Updated July 29, 2023

Difference Between Equity vs Asset

The equity of the Company or Business is money that the company’s owner invests. It can be said that Equity is the Capital of business. We should know who are owners of Business Forms. For a Company, Shareholders are the owner; for Partnership Firm, the partner is an owner; for a Proprietorship individual is an owner. All the money invested by the owner is called Equity of Business. As per the dictionary, Assets means “a useful and valuable thing”. Assets are things bought or generated by the Company and benefit the business economically. Assets are reflected on the right side of the Balance sheet.

Assets can be classified as fixed and current assets according to the Life of Assets. Assets are also classified according to their physical existence: Tangible and Intangible Assets. Fixed Assets are the assets the business uses for the long term—for example, Land and Building, Plant and Machinery, Vehicles, office equipment, etc. Current Assets are those assets whose life is less than a year.

Equity

In Equation form, Equity can be represented as

The interpretation of the above equation is “Assets which are created by the company after paying off all the debts”. We can also say that Shareholder’s Equity in the Net Assets of the Company, it is also called the Company’s Net worth. Positive Shareholder’s Equity is a Good Sign of the Company’s Financial Condition, which means that the company has sufficient Assets to Pay off its all due, i.e., Liabilities. Along the same line, negative Equity reflects that Company doesn’t have sufficient assets to pay it due. This has a negative impact on the Company. Utilization of Equity is done mainly for two purposes:

- Creation of Assets or

- Paying off Liabilities

Equity is a source of funds for the business. Hence it is always reflected as the Liability side of the Balance sheet.

Meaning of Assets

Example of Current Assets is Accounts Receivable, Short term Loans and Advance, Prepaid Expenses, Cash and Bank Balance, etc. Tangible Assets are those that have a physical existence, like Plants and Machinery. Intangible assets are those that cannot be seen or are invisible, like Goodwill, trademarks, patents, etc. Assets are Applications of Funds of Business. Hence, it has a debit balance.

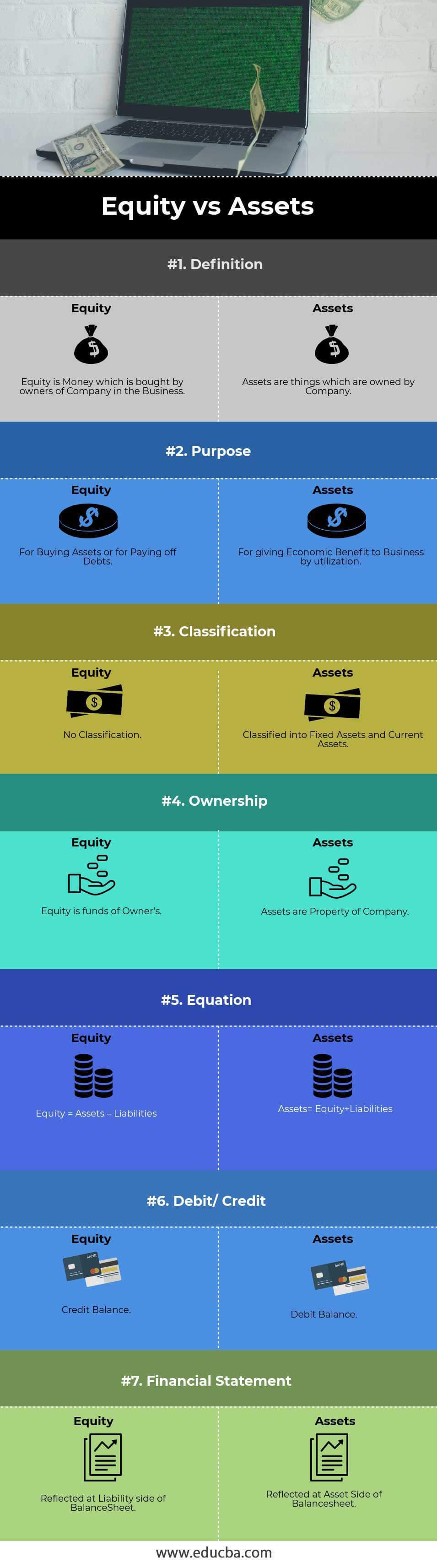

Head To Head Comparison Between Equity vs Asset (Infographics)

Below is the top 7 difference between Equity vs Asset:

Key Differences Between Equity vs Asset

Let us discuss some of the significant differences Between Equity vs Asset :

- Equity is money that the Owners of the Company buy for running the business, whereas Assets are things bought by the company and have a value attached to them.

- Equity is always represented as the Net worth of a Company, whereas Assets of the Company are valuable things or Property.

- There is always a credit balance in equity, which means the corporation has a repayment obligation. In contrast, assets always carry a debit balance, meaning that valuable things are the property of the Company.

- Equity is the Source of Funds, whereas Assets are the application of that Fund.

- There is no Equity Classification, whereas Assets are classified into Fixed Assets, Current Assets, Tangible Assets, and Intangible Assets.

- It is reflected on the Left Side of the Balance sheet, and Assets are reflected on the Right Side.

Below is the Balance sheet of the Company; this is how both Equity and Assets are represented:

|

Balance sheet |

|||

| Liabilities | Amount | Assets | Amount |

| Shareholder’s Equity | Current assets | ||

| Equity | $1,00,000 | Cash | $50,000 |

| Reserves | $20,000 | Petty cash | $500 |

| Current/short-term liabilities | Inventory | $10,000 | |

| Accounts payable | $6,000 | Pre-paid expenses | $100 |

| Interest payable | $200 | Fixed assets | |

| Accrued wages | $300 | Leasehold | $0 |

| Income tax | $500 | Property & land | $20,000 |

| Long-term liabilities | Furniture & fitout | $50,000 | |

| Loans | $7,600 | Vehicles | $4,000 |

| Total liabilities | $1,34,600 | Total assets | $1,34,600 |

Equity vs Asset Comparison Table

Let’s look at the top 7 Comparison between Equity vs Asset

| The Basis of Comparison |

Equity |

Assets |

| Meaning | Equity is Money that owners of a Company in the Business buy | Assets are things which are owned by Company |

| Purpose | For Buying Assets or for Paying off Debts | Forgiving Economic Benefits to Businesses by utilization |

| Classification | No Classification | Classified into Fixed Assets and Current Assets |

| Ownership | Equity is funds of Owner’s | Assets are Property of the Company |

| Equation | Equity = Assets – Liabilities | Assets= Equity+Liabilities |

| Debit/ Credit | Credit Balance | Debit Balance |

| Financial Statement | Reflected at the Liability side of the balance sheet | Reflected at Asset Side of Balance sheet |

Conclusion – Equity vs Asset

Equity vs Assets are different terms, but both are related. We can say that one is the Source of Funds, and the Other is the Application or Utilization of Funds. One is Liability, and the Other is Asset.

Recommended Articles

This has been a guide to the top difference between Equity vs Assets. Here we also discuss the Equity vs Asset key differences with infographics and comparison tables. You may also have a look at the following articles to learn more-