Updated July 6, 2023

Definition of Double Taxation

Double taxation occurs when the same income is subject to tax twice– either in the hands of two different taxable parties in the same country (called Economic Double Taxation) or in the hands of the same taxable party across two taxable jurisdictions or countries (called Juridical Double Taxation).

Explanation

With increasing globalization, it is common for an entity or individual to earn money in a country different from its country of residence. A country’s tax laws mandate the taxation of income earned within its jurisdiction and income earned by its residents outside the country. This can result in double taxation, as the income may be taxed both in the country of origin (where it was generated) and in the country of residence.

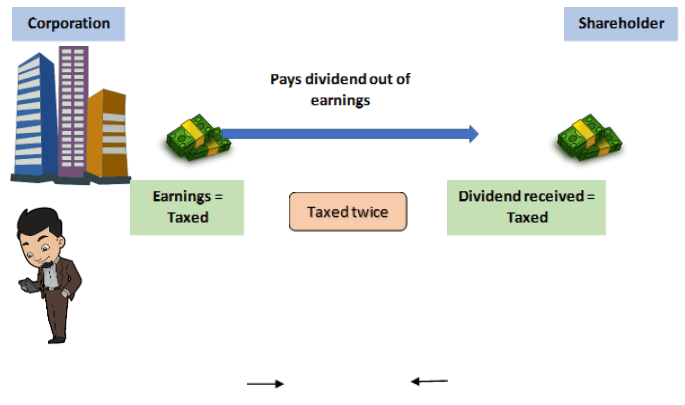

Corporations may be obligated to pay taxes on their profits, and a portion of those profits can also be subject to taxation for shareholders as dividend income.

How Does It Work?

- Economic Double Taxation: Corporations must pay taxes based on their earnings for the period. Entities often distribute a portion of their profits to their shareholders as dividends. Shareholders must pay personal income tax on compensation from their investments in such corporations. Consequently, the company and the individual shareholder end up paying taxes on the same amount, as the company’s earnings are distributed as dividends.

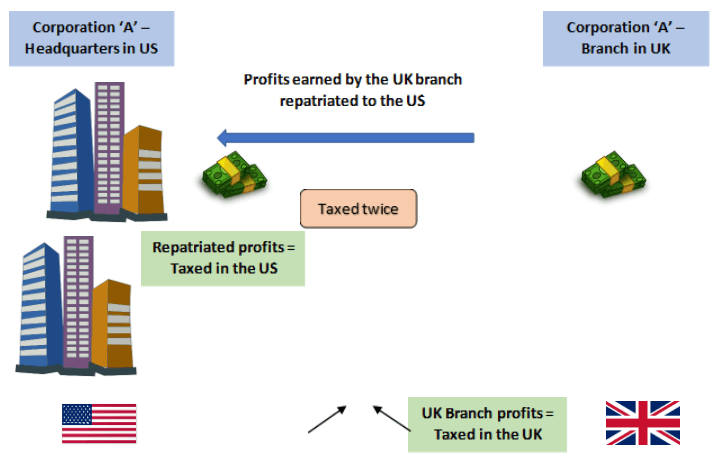

- Juridical Double Taxation: This kind of taxation occurs when the country of origin and residence are taxable entities. In the case of a company headquartered in the United States of America with its operations spread across the United Kingdom, for example, the company’s arm in the UK would be earning profits in the UK, which would be repatriated to the company’s home country – the USA. As a result, the UK arm would be required to pay taxes on its earnings in the UK. While the profits repatriated to the USA might also be taxed as per US taxation laws, leading to the profits being taxed twice – in the UK and the USA.

Example of Double Taxation

Different examples are mentioned below:

Economic Double Taxation

Juridical Double Taxation

In the above example, considering Corporation ‘A’ paid the dollar equivalent of $200,000 as taxes in the UK and is liable to pay taxes of $250,000 in the US on the repatriated profits (without considering any double taxation benefits), tax regulations or DTA between the two nations may provide for either of the following options (indicative only; not reflective of actual tax provisions) –

- Income Exempt: Repatriated profits may be exempt from tax in the US. Accordingly, the corporation would have no tax liability on the profits repatriated to the US.

- Tax Credit: Corporation ‘A’ may be allowed a tax credit of $200,000 (the amount of tax paid in the UK on the same profits). As a result, the company’s tax liability on the repatriated profits may reduce to $50,000 as opposed to $250,000 had the income been fully taxed without the benefit of a tax credit.

- Concessional Tax Rate: Repatriated profits may be taxed lower than the rate applicable to other corporation earnings, resulting in tax liability lower than $250,000.

Double Taxation Agreement

To avoid Juridical Double Taxation, various countries have entered into treaties to prevent it, often based on guidance provided by the Organization for Economic Cooperation and Development. Double Taxation Agreements (DTAs) are structures to avoid double taxation on international earnings of taxable entities, facilitate a better exchange of information between countries, promote improved trade relations, and prevent tax evasion.

Some of the common ways in which DTAs may provide relief from it are as follows –

- The country of residence allows for income exemption from another country if the tax is paid in the country of origin.

- They are taxing the income in both countries and providing tax credits in the country of residence to the extent of taxes paid in the country of origin.

- We are allowing for lower or concessional rates of taxes in either of the taxing countries.

DTAs may contain different methods of claiming tax relief for different types of income.

How to Avoid Double Taxation?

Tax laws usually prevent double economic taxation through lower tax rates or tax credits. For example, individual taxpayers benefit from lower tax rates on qualified dividends in the US compared to the rates applicable to their regular income.

Under Juridical Double Taxation, the country of origin may exempt income if it has been taxed in the foreign country, or the country of residence may provide tax credits for international income or apply concessional tax rates, as per the DTA between the countries.

Advantages

Some of the advantages are mentioned below:

Benefits to the Tax Payers

DTAs help reduce the tax burden that they would otherwise incur on account of double taxation by any of the following means (as provided for in the DTA) on their international income:

- Foreign-source income is exempt

- Foreign-source income is taxed at concessional rates

- Tax credits or refunds of tax paid in the other country

Benefits to the nations involved in the DTA

- Promotes better trade and investment relations between the nations

- Allows for more transparency in the flow of transactions between the nations

- Better information sharing between nations can help prevent or detect tax evasion.

Conclusion

It refers to the taxation of the same income twice, leading to higher-than-normal taxes levied on the same income on a macro level. Tax regulations and DTA allow for lower tax rates and tax credits to provide for double taxation. Thus, DTAs help relieve Juridical Double Taxation and allow for better trade relations and information sharing between countries.

Recommended Articles

This is a guide to the definition, how it works, its advantages, and an example. You may also have a look at the following articles to learn more –