Updated July 15, 2023

What are Diluted Shares?

Diluted shares are a company’s total number of tradable shares left after the dilution of the convertible assets (employee stock options, bond conversions, etc.). It is an important measure to calculate a company’s diluted earnings per share (EPS).

Explanation

Earnings per share is a metric that helps understand how profitable a company is and how valuable its shares are. For instance, if a company’s EPS increases, the value of its shares also increases. However, if a company has diluted shares (which means more shares are available due to conversions), its EPS value may decrease.

Let’s understand this with an example:

David and his friends own a printing shop valued at $1,000. David decides to sell 100 shares at $10 per share to raise more money. So, he now has 100 outstanding shares, and each is worth $10.

David also promises his employees that they can buy 10 shares at a discounted price of $5 per share. Now, there are 110 shares outstanding (100 original shares + 10 employee shares), but the total value of the printing shop remains at $1,000. So, each share is now worth $9.09 (calculated by dividing $1,000 by 110 shares).

| Original | Diluted | |

| No. of Shares | 100 | 110 |

| Price per Share | $10 | $9.09 |

This example shows that when David sold additional shares to his employees, the total outstanding shares increased from 100 to 110. It led to a decrease in the price per share from $10 to $9.09. It illustrates how diluted shares can impact the value of each share.

How do you Calculate Fully Diluted Shares?

Calculate the number of diluted shares as follows:

1. Download the company’s annual reports from its websites. You will find annual reports in the investor relation section.

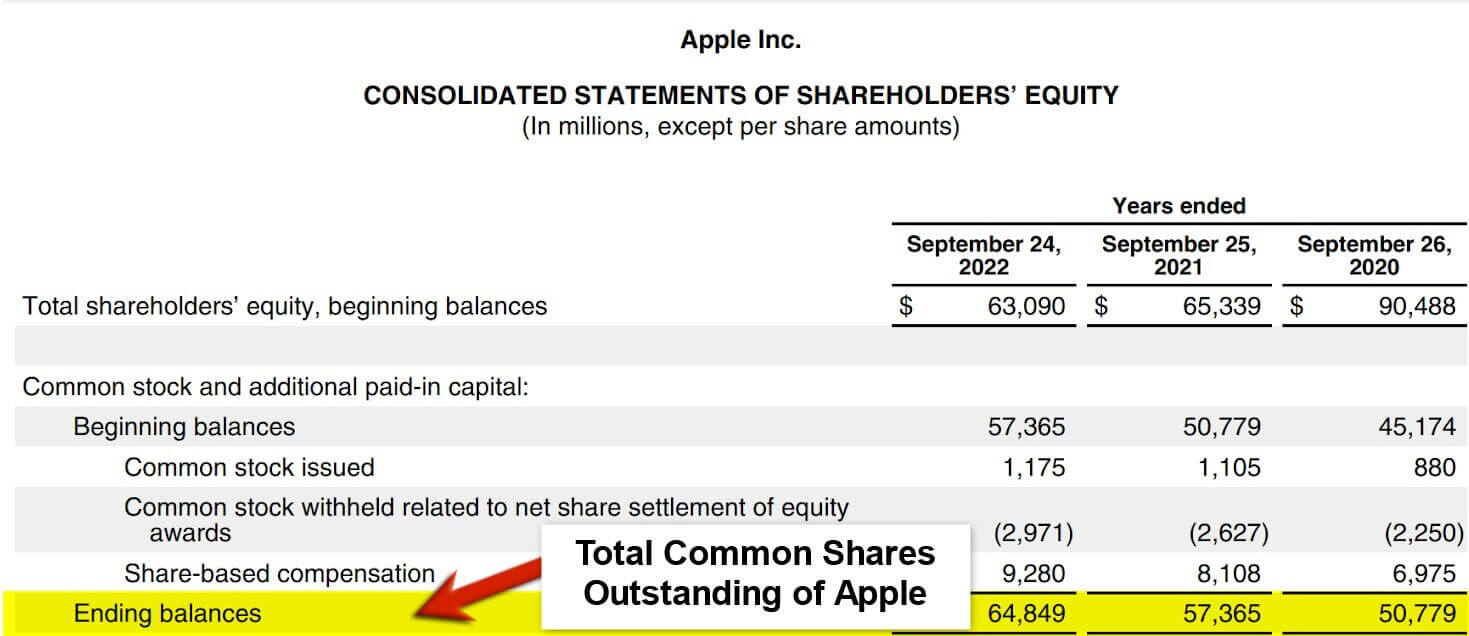

2. Refer to the company’s consolidated balance sheet in the annual report.

3. Open the stockholders’ equity section of the balance sheet to identify the number of common shares outstanding by the company.

(Source: Annual report of Apple Inc. for FY22)

4. If the company has issued employee stock options, check the footnotes in the balance sheet to find the number of options, strike price, or exercise price. Subtract the exercise price from the current stock price and divide the result by the current stock price. Multiply this number by the number of options outstanding.

5. Determine the number of warrants issued and multiply it by the number of shares of each convertible warrant.

6. For convertible bonds, multiply the number of bonds by their conversion ratio to arrive at the diluted portion of convertible bonds.

7. Add the results from steps 4, 5, and 6 to the number of outstanding shares to obtain the total number of diluted shares.

8. Add the results of steps 4, 5, and 6 to the number of outstanding shares to arrive at the diluted share figure.

Diluted Shares Examples

Example #1

Let’s say Slice & Co. holds 100,000 common shares of outstanding along with 10,000 employee stock options outstanding. According to the company finances, the strike or exercise price of the options is $50, and the current underlying stock price is worth $100. The convertible stock bonds are worth 5,000, and the conversion ratio for these bonds is 1:1. Calculate the company’s diluted shares.

Solution:

Follow the below step-by-step process to calculate the diluted shares:

Step 1: Calculate shares from the Employee Stock Options Exercise:

- Subtract the exercise price (50) from the current stock price (100) = $100 – $50 = 50

- Divide $50 by the current stock price (100) = 50/100 = 5

- Multiply 0.5 by the number of options outstanding (10,000) = 0.5*10,000 = 5,000

Step 2: Calculating shares from Convertible Bond conversion:

- Multiply the number of convertible bonds outstanding (5,000) by the conversion ratio (1:1) = 5,000

Step 3: Add resultant Outstanding shares (from Step 1 and Step 2) to Common Shares Outstanding:

Total diluted shares = Common shares outstanding + shares from employee stock options + shares from convertible bonds

= 100,000 + 5,000 + 5,000

= 110,000

Here’s the summary of the entire calculation:

|

Number of shares |

Amount |

| Common shares outstanding | 1,00,000 |

| Shares resulting from employee stock options | 5,000 |

| Shares resulting from convertible bonds | 5,000 |

| Total diluted shares | 1,10,000 |

Example #2

Suppose EST Limited has 50,000 common shares outstanding and 5,000 as warrants having a strike price of 25. Every warrant is convertible into 5 shares with a current stock price of 30. The diluted shares calculations will be as follows:

Step 1: Calculate the number of shares from warrants:

= 5,000 x 5

= 25,000

Step 2: Calculate the total number of diluted shares:

= 50,000 + 25,000

= 75,000

The table for the calculation of diluted shares is below

|

Number of Common Shares Outstanding |

Warrants | Conversion Ratio | Exercise Price | Current Stock Price |

Number of Diluted Shares |

| 50,000 | 5,000 | 5 | 25 | 30 | 25,000 |

| Total | 75,000 |

Example #3

Let’s say Smith & Co. is a company based in the USA holding shares outstanding worth 50 million dollars. The employee stock options also benefit the company. According to their accounts & finance book, the number of the options outstanding is 3 million with an exercise price of 10. Calculate the diluted share assuming the company’s current stock price is 20.

|

Particulars |

Value |

| Number of shares outstanding by the company (A) | 50 million |

| Number of employee options outstanding (B) | 3 million |

| Exercise price | $10.00 |

| Current stock price | $20.00 |

| Desired price($20-$10) | $10.00 |

| Current stock value ($10/$20) © | 0.5 |

| Total number of outstanding shares(0.5*3 million) (D =C*B) | 1.5 million |

| Total number of dilutes shares ( 50 million+1.5 million) (A + D) | 51.5 |

What Happens When Companies Dilute Shares?

1. Increase in capital: Share dilution helps raise a company’s capital. Let’s say a company holds a certain percentage of capital in a company. After the share dilution, their capital will increase, but the number of shares will remain the same.

2. New shares issuance: The dilution of shares results in the issuance of new shares by the company, which lessens the company’s ownership percentage. Not only the percentage holdings, but shareholders have to face a decrease in the value of their shares too.

3. Decrease in value: Each share’s value decreases due to dilution. Also, the shareholder earns less as compared to earlier holding before dilution.

4. Beneficial for new ventures: A company can significantly benefit from the share dilution if it wants to increase its capital or start a new venture. Also, it can help in raising more funds in the next investor rounds.

Impact of Diluted Shares

Below are the impacts of Dilutes shares:

- Dilutive shares impact the earning of the individual share as the company’s capital increases with the issuance of new shares while the individual holding percentage decreases. Hence, the EPS of the individual gets adversely affected.

- Along with EPS, the Price-earnings ratio is affected as the P/E ratio with the earnings per share.

- Sometimes dilutive shares can be beneficial too. For example, if a company has to launch a new large line of business, it must increase capital and revenues. In this case, share dilution positively impacts shares in the long run.

Diluted vs Non-diluted Shares

|

Parameters |

Diluted Shares |

Non-Diluted Shares |

| Meaning | It is the available stock or shares to a company after undergoing all the sources of conversions are exercised like employee stock option plans, convertible bond conversions, etc. | The shares or share stock will be available even before the other options of conversions are yet to be exercised.

|

| Formula | Dilutive EPS = (Net income-Preferred dividend +Paid out dilutive securities)/ (Weighted average number of common shares outstanding conversion of dilutive securities) | Non-Diluted EPS = Net Earnings/Number of shares. |

| Purpose | It helps in assessing the profitability of a company. | It also helps in assessing the profitability along with the convertible stocks. |

| Investors POV | It is less significant to the investors as it doesn’t accounts for a company’s convertible stocks. | It is significantly more important for investors. |

| Ease Factor | It is easier to comprehend and understand. | It is relatively more complex than the former. |

Advantages of Share Dilution

- Diluted shares help find the potential effect of converting dilutive stock bonds. Thus, it helps assess the EPS.

- It is beneficial in determining a company’s financial position in the market and helps in finding its potential.

- There is a very minimal or low chance of manipulation as all the securities or stocks get captured and are in the convertible stage.

Final Thoughts

From a company’s point of view, dilution of shares is beneficial as it gives a better presentation of its capital to investors. On the other hand, from an individual point of view, it is not as beneficial as it decreases the shareholder’s share value in the company’s total capital. However, suppose the shareholder has long-term investment plans in the company. In that case, dilution of shares can benefit the shareholder, too, as it allows the company to expand its business, ultimately benefiting the shareholder.

Frequently Asked Questions (FAQs)

Q1. What happens if shares are dilutive?

Answer: Share dilution is a significant reduction in the ownership percentage when a new investor invests in a company and becomes liable for shareholding. However, the dilution should always be in an optimum manner. Also, many companies tend to issue new shares to get extra capital from investors for growth purposes or to pay off debts.

Q2. What is the difference between basic and diluted shares?

Answer: Basic and diluted shares are two typical ways of measuring the total outstanding shares of a company. Basic shares are the total number of stocks investors hold in a company. On the other hand, diluted shares consider the potential dilution that could occur if all of a company’s outstanding securities were convertible into common stock.

Q3. Why there’s a need to dilute shares?

Answer: Companies may need to dilute their shares for various reasons, such as to raise capital, acquire other companies, pay off the employees, or reduce debt. Distributing shares may have many benefits, but it can also have some drawbacks. Therefore, companies should assess their ability to dilute stock before doing so.

Q4. Is share dilution good?

Answer: Share dilution can be good or bad, depending on the circumstances. While share dilution can provide much-needed capital to a company for its growth, simultaneously, it can also have negative consequences for the existing shareholders.

Recommended Articles

This is a guide to Diluted Shares. Here we also discuss the definition and how to calculate diluted shares, along with an example and advantages. You may also have a look at the following articles to learn more –