Updated July 15, 2023

Definition of Unearned Revenue

Unearned revenue refers to the amount of money received by an entity against which the goods or services have yet to be provided. It represents the advance amount that an entity receives from its customers against the goods or services to be provided in the future. It treats as a liability in the books of accounts.

Explanation

The accounting principles suggest that an income recognize only when earned. Revenue earns only when the performance obligation for providing goods or rendering services completes. If any consideration receives from the customer before the performance obligation is met, the amount received is known as unearned revenue and represents a liability for the entity. Once the entity delivers goods or renders services per the contract, the unearned revenue is reversed, and revenue recognizes.

Example of Unearned Revenue

Suppose a buyer contracted with the seller to deliver goods in 5 lots, each containing 100 units, on 01.01.2020. The price per lot is $2,000. The seller had delivered 2 lots as of 01.02.2020. The buyer paid $10,000 to the seller on 01.02.2020. What shall be the amount of unearned revenue in this case as of 01.02.2020?

Solution:

In this case, 3 lots are yet to deliver as of 01.02.2020. However, the payment for these 3 lots has already been made by the buyer to the seller, along with the payment for the initial 2 lots. Since payment has been made in advance for the 3 lots, unearned income must be booked for these 3 lots.

- Unearned Income = 3 × $2,000

- Unearned Income = $6,000

Accounting for Unearned Revenue

It is classified as a current liability in the books of accounts. The advance amount received represents a liability, indicating an incomplete performance obligation. Upon fulfilling the performance obligation by providing goods or services, the enterprise books the actual revenue and reduces the amount of unearned revenue. The accounting entries shall be as follows:

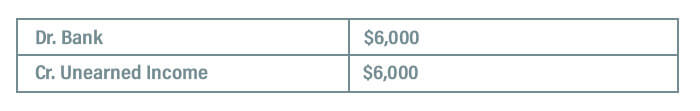

When an advance is received from the customer:

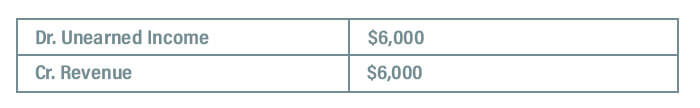

When performance obligation is met, and revenue is earned:

Importance of Unearned Revenue

- It is an important term in accountancy. If income is booked instead of unearned revenue, revenues, and profits will overstate and mislead the users of the financial statements. Further, the revenues and profits would understate for the next periods.

- This concept helps to maintain the matching principle of accountancy, which states that revenues should be matched with the related expenses. If revenues are booked when consideration receives, and expenses are booked later when incurred, it would defeat the matching principle.

- For these reasons, unearned revenue is booked as a liability and reversed only when the actual delivery of goods or provision of services occurs.

Unearned Revenue vs Deferred Revenue

It is also known as deferred revenue, and both terms convey the same meaning. They reflect an amount received in advance by the company for the goods or services that must be provided in the future. Since revenue is not earned, its recognition as an income has to be deferred until it is earned. The amount of advance forms part of the current liabilities of the entity and is reversed when revenue is earned.

Benefits

- It is an advance received from the seller and increases the cash flows of the seller, thereby assisting in carrying out more business activities.

- The amount received as an advance increases the liquidity of the entity.

- Recording unearned revenue gives a true and fair view of the seller’s revenues, thereby eliminating any confusion.

- It helps to maintain the matching principle of accountancy.

Disadvantages

- It represents the current liability of the company.

- The goods or services have yet to be provided, creating a burden for the seller to fasten the process since the amount has already been received.

Conclusion

It is a common accounting term that can be found in the financial statements of any entity. This is relevant for both trading as well as service industries. It is in the nature of advance and reversed later when revenue is earned.

Recommended Articles

This is a guide to Unearned Revenue. Here we discuss the definition, Accounting for Unearned Revenue and its benefits and disadvantages. You may also have a look at the following articles to learn more –