Introduction to Digital Wallets

Digital wallets have changed the way we manage money. They have simplified transactions for millions of people worldwide. Gone are the days when you had to carry cash or juggle multiple apps just to pay bills or transfer money. With just a few taps on your smartphone, digital wallets allow you to pay bills, shop online, transfer money, and much more.

So, let’s understand the basics of digital wallets, how to set one up, and how to use them effectively.

What is a Digital Wallet?

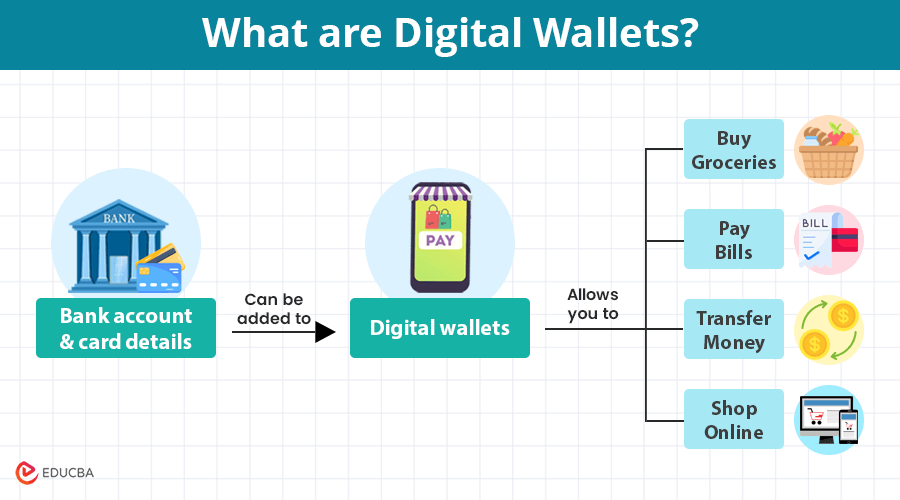

A digital wallet or e-wallet is an app or a software system that securely stores your payment information, such as debit cards, bank accounts, etc. It allows you to make payments electronically.

In simple terms, a digital wallet replaces the need for you to carry physical cards and cash, making it an all-in-one solution for managing your finances.

With a digital wallet, you can:

- Buy groceries

- Pay utility bills

- Transfer money to others

- Shop online

Benefits of Using a Digital Wallet

There are several advantages to adopting a digital wallet for your everyday transactions:

- Convenience: You can use your smartphone to make payments quickly. No more rummaging for the right card or change.

- Security: Digital wallets encrypt your data, offering a more secure option than carrying around physical cards or cash.

- Faster transactions: Paying bills, shopping online, and transferring money is faster and can often be done in a few seconds.

- Expense tracking: Most digital wallets provide transaction histories, making it easier to manage and track your spending.

- Rewards and offers: Many digital wallets, including Bajaj Pay, offer exclusive discounts, rewards, and cashback for regular users.

How to Set Up a Digital Wallet? (Step-by-Step Guide)

Now that you understand what a digital wallet is and why it is beneficial let us dive into how to set one up.

1. Choose the Right Digital Wallet

There are many digital wallet options available, such as:

- Bajaj Pay

- Google Pay

- Paytm

- PhonePe

When selecting a wallet, consider what features you need:

- Bill payments: Do you need a wallet that facilitates easy utility bill payments (electricity, water, gas)?

- Security: Is the app secure, with robust encryption protocols and two-factor authentication?

- Rewards: Does it offer cashback, discounts, or loyalty rewards on transactions?

Apps like Bajaj Pay and PhonePe, for instance, are particularly user-friendly for managing a wide range of transactions, from paying utility bills to UPI payments and even offering rewards for frequent users.

2. Download and Install the App

Once you have chosen your digital wallet, follow these steps to install it:

- Search for the app (e.g., “Bajaj Pay”) in the Google Play Store (for Android) or App Store (for iOS).

- Tap “Install” to download the app.

- Open the app to begin the setup process.

3. Register or Sign in

Once you open the app, you must either register or log in:

- New Users (must register): Provide your mobile number or email, and you will receive an OTP to verify your identity. You will likely need to provide some personal details, such as:

- Name

- Date of birth

- Home address

- Existing Users (can log in): Simply sign in with your registered information.

4. Link Your Bank Account or Cards

Some digital wallets will ask you to link your bank account or cards. This step allows you to:

- Pay bills

- Make purchases

- Transfer money

5. Secure Your Wallet

Most digital wallets offer several ways to secure your account:

- Password or PIN: Lock your wallet using a strong password or PIN.

- Biometric authentication: If your smartphone has fingerprint or facial recognition, you can enable this feature for added security.

- Two-factor authentication: Many digital wallets offer this extra security layer. Apps like Bajaj Pay provide biometric and PIN protection, ensuring your funds and payment information are secure from unauthorized access.

6. Add Money to Your Wallet

Now that your wallet is set up, you need to add funds. Most wallets offer multiple ways to add money:

- Bank transfer: Link your bank account and money to your digital wallet.

- Credit/Debit Card: Add funds by linking your cards.

- UPI: Use UPI to transfer funds from your bank account as many digital wallets, such as Bajaj Pay, support UPI.

Ways to Use Your Digital Wallet

Below are some common ways people use their digital wallets:

1. Paying Bills

Digital wallets make it easy to pay utility bills like electricity, water, and gas.

Here’s how it works:

- Open the app.

- Select the “Bill Payment” option.

- Choose the type of bill (like water or gas) and input your bill details.

- Complete the payment.

2. Shopping Online or In-store

Many online retailers accept digital wallet payments, and you can even use them in physical stores equipped with QR code scanners.

3. Transferring Money

Need to send money to a friend or family member? Digital wallets make this simple and quick. Apps like Bajaj Pay allow you to use UPI for instant transfers, making it a seamless experience.

4. Rewards and Cashback

Some digital wallets offer exciting rewards like cashback, loyalty points, or discounts on regular transactions. Keep an eye out for these offers to save money while using your wallet.

Best Practices for Using a Digital Wallet

Here are a few tips to ensure you are getting the most out of your digital wallet:

- Keep your app updated: Always update your digital wallet app to the latest version to benefit from the latest security enhancements and features.

- Monitor transactions: Remember to monitor your transactions regularly to track your spending and catch any suspicious activity.

- Use promotions and cashback offers: Always look out for promotional offers, especially when paying utility bills or shopping online.

Final Thoughts

Setting up and using a digital wallet is not only simple but also incredibly beneficial in today’s digital world. By following these steps, you can streamline your financial transactions, enjoy faster payments, and even take advantage of rewards and offers.

Whether you are paying bills, shopping, or transferring money, platforms like Bajaj Finserv make the process secure, efficient, and rewarding. With a few taps, you can manage your finances and enjoy the ease of a cashless experience.

Recommended Articles

If you found this article on “Digital Wallets” helpful, consider reading the following recommendations.