Updated July 27, 2023

Coverage Ratio Formula (Table of Contents)

- Coverage Ratio Formula

- Examples of Coverage Ratio Formula

- Coverage Ratio Formula in Excel (With Excel Template)

Coverage Ratio Formula

A Coverage ratio is a group of measurement to find out the capability of a specific company to serve its debt and financial commitment such as interest payments and liabilities to pay back at a particular time. High ratio value indicates high ability whereas low value indicates less ability. Many factors are considered to examine this such as Net income, interest, total assets, Liabilities unpaid, etc. The low ratio does not always mean less capacity. Other financial conditions are as applicable such as liquidity, solvency capacity. Though there are multiple types of coverage ratio, three ratios are commonly used by investors in the market.

#1 – Interest Coverage Ratio

This is also known as the time’s interest earned ratio. It is the ability of a company to pay back the interest within the given time on a particular debt.

#2 – Debt Service Coverage Ratio

This is the capacity to pay the complete debt service by a company. While calculating this, the principal + interest are considered for the upcoming term also from the income statement. It can be calculated by the following formula.

#3 – Asset Coverage Ratio

This is the capacity to pay the complete debt service for owing the assets by a company. The assets are tangible assets such as land, machinery, infrastructures, houses, etc. which comes in the balance sheet. It can be calculated by the following formula.

Examples of Coverage Ratio Formula

Coverage Ratio Formula – Example #1

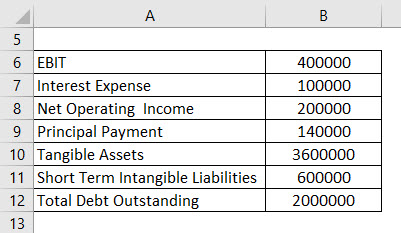

ABC is a small beauty Products Company. Its EBIT is Rs.400000 and respective Interest Payments of 100000. The same Company generates a profit of Rs.200000 quarterly and its quarterly principal payment is 140000. Company ABC has tangible assets of RS.3600000 and it has tax payments for 600000 worth and the company’s total debt equals 2000000. Calculate Coverage Ratio using the following information.

Solution:

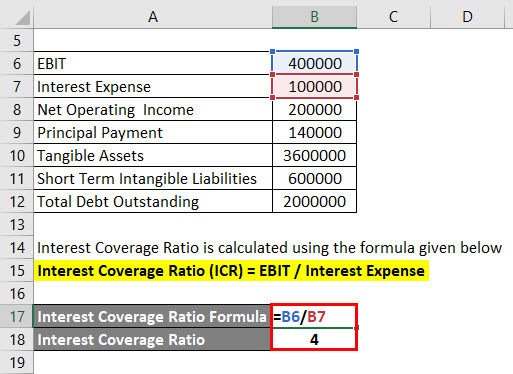

Interest Coverage Ratio is calculated using the formula given below

Interest Coverage Ratio (ICR) = EBIT / Interest Expense

- Interest Coverage Ratio = 400000 / 100000

- Interest Coverage Ratio = 4

Which shows Good capacity of Debt coverage by ABC.

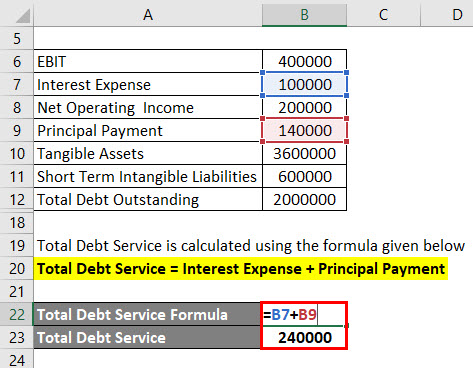

Total Debt Service is calculated using the formula given below

Total Debt Service = Interest Expense + Principal Payment

- Total Debt Service = 100000 + 140000

- Total Debt Service = 240000

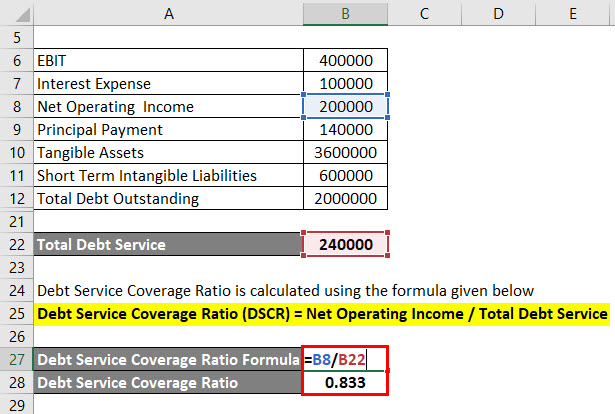

Debt Service Coverage Ratio is calculated using the formula given below

Debt Service Coverage Ratio (DSCR) = Net Operating Income / Total Debt Service

- Debt Service Coverage Ratio = 200000 / 240000

- Debt Service Coverage Ratio = 0.833

Which shows less capacity of Debt coverage by ABC.

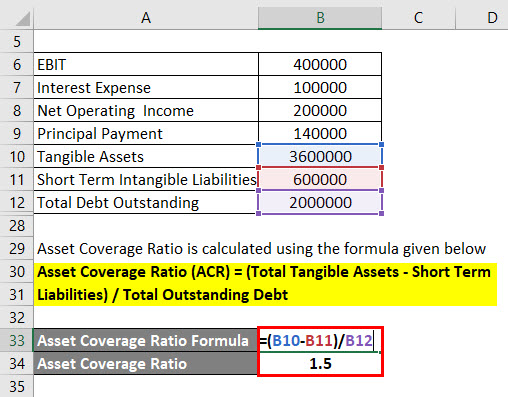

Asset Coverage Ratio is calculated using the formula given below

Asset Coverage Ratio (ACR) = (Total Tangible Assets – Short Term Liabilities) / Total Outstanding Debt

- Asset Coverage Ratio = (3600000 – 600000) / 2000000

- Asset Coverage Ratio = 1.5

Which shows the Optimum capacity of Asset coverage by ABC.

Coverage Ratio Formula – Example #2

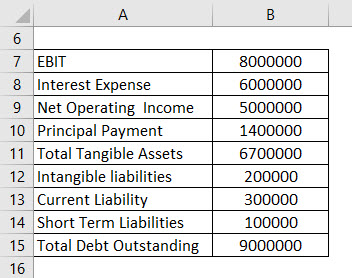

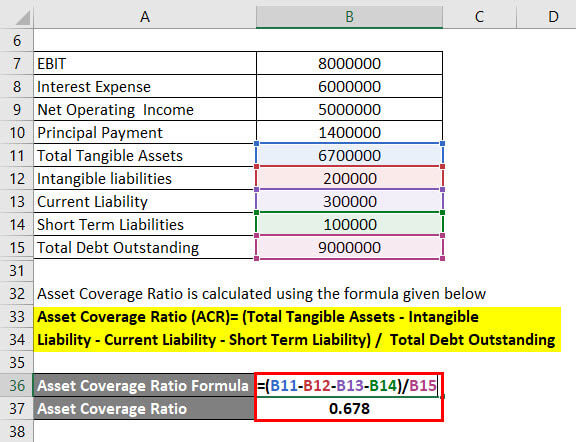

Let’s assume Dyeing Company Camex makes a profit of RS.5000000 semi-annually and its EBIT is Rs.8000000. It has total tangible assets of 6700000 and respective Interest Payments of 6000000 and Intangible assets such as logo, trademark worth RS.200000 and Current Liabilities of Rs.300000, short term liability of Rs.100000.Its Quarterly principal payment is 1400000. Total Debt Equals 9000000. Calculate Coverage Ratio using the following information.

Solution:

Interest Coverage Ratio is calculated using the formula given below

Interest Coverage Ratio (ICR) = EBIT / Interest Expense

- Interest Coverage Ratio = 8000000 / 6000000

- Interest Coverage Ratio = 1.333

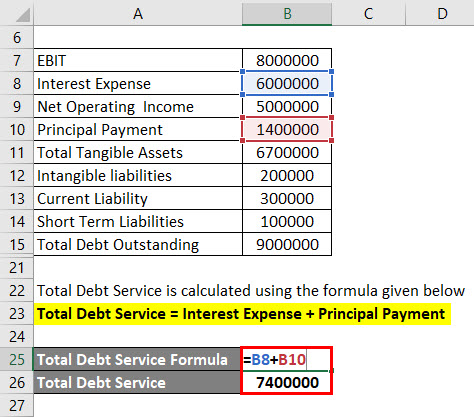

Total Debt Service is calculated using the formula given below

Total Debt Service = Interest Expense + Principal Payment

- Total Debt Service = 6000000 + 1400000

- Total Debt Service = 7400000

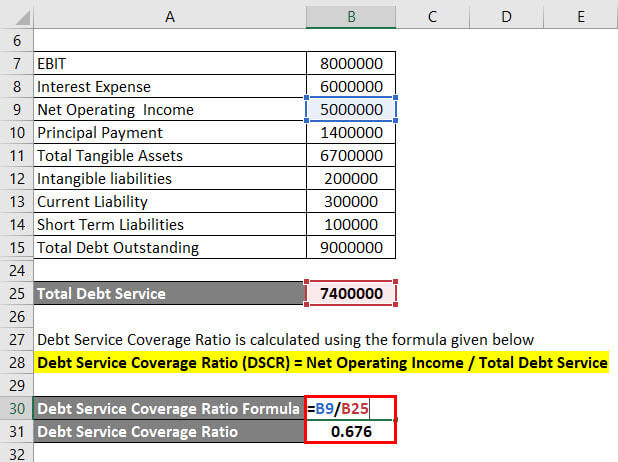

Debt Service Coverage Ratio is calculated using the formula given below

Debt Service Coverage Ratio (DSCR) = Net Operating Income / Total Debt Service

- Debt Service Coverage Ratio = 5000000 / 7400000

- Debt Service Coverage Ratio = 0.676

Asset Coverage Ratio is calculated using the formula given below

Asset Coverage Ratio (ACR) = (Total Tangible Assets – Short Term Liabilities) / Total Outstanding Debt

- Asset Coverage Ratio = (6700000 – 200000 – 300000 – 100000) / 9000000

- Asset Coverage Ratio = 0.678

Explanation

Here is the step by step approach for calculating all 3 coverage Ratios.

- Interest Coverage Ratio:

Step 1: EBIT Value is noted. EBIT is the Earnings before Interests and taxes value.

Step 2: Interest Expense value is noted. This is the regular interest payments by a company.

Step 3: The values are applied in the below to get the Interest coverage ratios calculated.

Interest Coverage Ratio (ICR) = EBIT/ Interest Expense

2 or higher Interest Coverage ratio is generally considered for good capacity. It can be calculated using the below formula.

- Debt Service Coverage Ratio:

Step 1: Net Operating Income Value is noted. As the variable name says, it is the net income when a company is operational.

Step 2: Total Debt Service value is noted. This is the value of the debt a company owes.

Step 3: The values are applied in the below formula to get the Debt Service coverage ratios calculated.

Debt Service Coverage Ratio (DSCR) = Net Operating Income/ Total Debt Service

1 or higher the ratio value says a company has good earnings to remunerate its entire debt obligations

- Asset Coverage Ratio:

Step 1: Total Tangible Assets Value is noted. This includes tangible assets such as buildings, vehicles, machinery, land, houses, etc.

Step 2: Total Short term liabilities value is noted. This includes such as dividends payables, taxes payables, customer deposits, etc.

Step 3: Total Outstanding Debt value is noted. This is unpaid remaining total debt amount including the near term payments.

Step 4: The values are applied in the below formula to get the Asset coverage ratios calculated.

Asset Coverage Ratio (DSCR) = (Total Tangible Assets- Short term liabilities)/ Total Outstanding Debt

1.5 is considered as a good value in normal whereas for companies like industries 2 is considered satisfactory.

Relevance and Use of Coverage Ratio Formula

Coverage Ratio helps to identify the ability of a company when it is in potentially troubled financial Situations. It can help in 2 situations. For Company situation over time, we can track the changes. We need Debt History in this case. This is the ideal key to find the relationship between a company and its competitors. But each field has different key factors to be compared with and it is riskier too. So Business comparison and evaluation in different fields are not that easy. Hence using ICR, DSCR and ACR one can easily compare between companies in the same field as it gives depth insights.

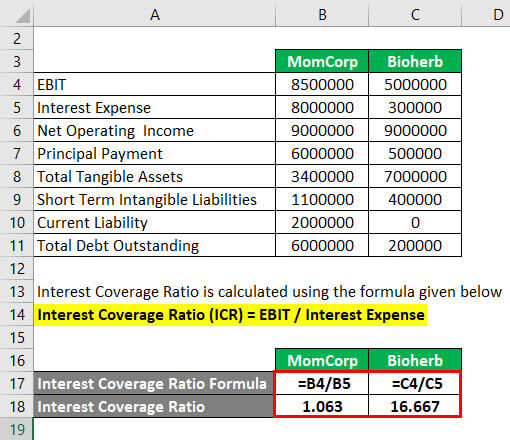

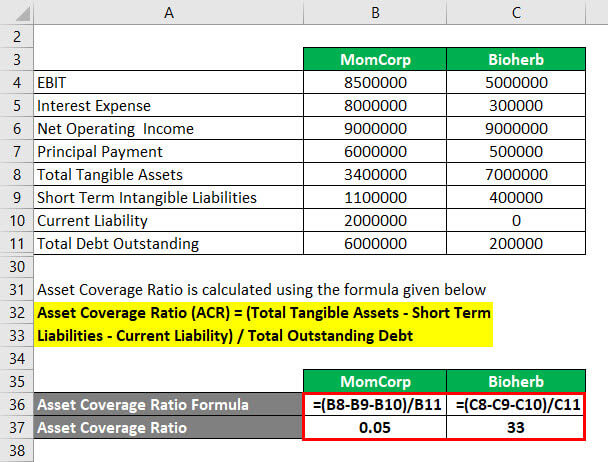

Coverage Ratio Formula in Excel (With Excel Template)

Here we will do the example of the Coverage Ratio formula. It is very easy and simple.

Now let us take the real-life example below to calculate Coverage Ratios with 2 sets of Different Values of different companies.

Interest Coverage Ratio is calculated using the formula given below

Interest Coverage Ratio (ICR) = EBIT / Interest Expense

For MomCorp

- Interest Coverage Ratio = 8500000 / 8000000

- Interest Coverage Ratio = 1.063

For Bioherb

- Interest Coverage Ratio = 5000000 / 300000

- Interest Coverage Ratio = 16.667

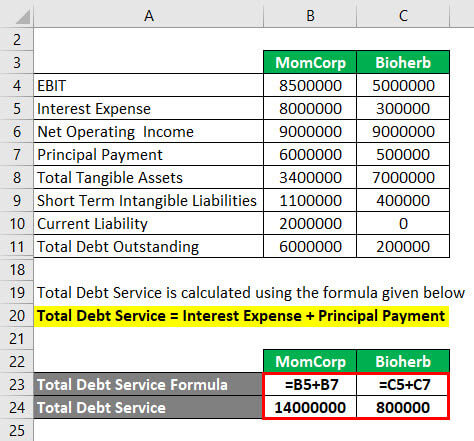

Total Debt Service is calculated using the formula given below

Total Debt Service = Interest Expense + Principal Payment

For MomCorp

- Total Debt Service = 8000000 + 6000000

- Total Debt Service = 14000000

For Bioherb

- Total Debt Service = 300000 + 500000

- Total Debt Service = 800000

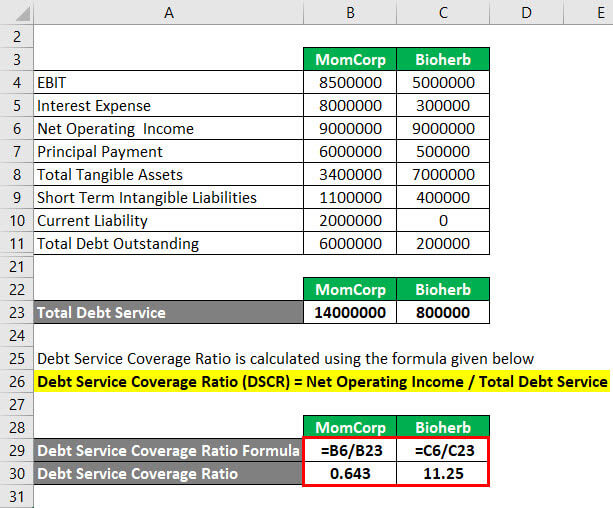

Debt Service Coverage Ratio is calculated using the formula given below

Debt Service Coverage Ratio (DSCR) = Net Operating Income / Total Debt Service

For MomCorp

- Debt Service Coverage Ratio = 9000000 / 14000000

- Debt Service Coverage Ratio = 0.643

For Bioherb

- Debt Service Coverage Ratio = 9000000 / 800000

- Debt Service Coverage Ratio = 11.25

Asset Coverage Ratio is calculated using the formula given below

Asset Coverage Ratio (ACR) = (Total Tangible Assets – Short Term Liabilities – Current Liability) / Total Outstanding Debt

For MomCorp

- Asset Coverage Ratio = (3400000 – 1100000 – 2000000) / 6000000

- Asset Coverage Ratio = 0.05

For Bioherb

- Asset Coverage Ratio = (7000000 – 400000 – 0) / 200000

- Asset Coverage Ratio = 33

Here if you take Bioherb, it has better coverage ratios in all aspects when compared with MomCorp. But as it is said earlier, we cannot compare companies which are in different fields.

Recommended Articles

This has been a guide to Coverage Ratio formula. Here we discuss how to calculate Coverage Ratio along with practical examples and downloadable excel template. You may also look at the following articles to learn more –