Updated June 29, 2023

Difference Between Corporation vs LLC

While one is trying to decide between business types that he wants to incorporate, most business owners will get perplexed between Corporation vs LLC. The latter will combine 2 kinds of business, a corporation and a partnership. On the other hand, the former would mean Incorporated (Inc), representing the form of a corporation, such as C Corp or S Corp. A Corporation and a limited liability company (i.e., LLC), are 2 different structures with unique tax requirements. It will not matter which entity type one chooses because being incorporated will add legitimacy to one’s business, specifically how it will be perceived in the market.

A limited liability company (i.e., LLC) is a business structure that offers protection via personal liability and a few tax benefits. The “LL,” or the limited liability, in the term LLC, will protect one’s personal assets if the judgment goes against one’s company. Traditional corporations further do offer limited liability, which should be noted well. On the other hand, Corporation is an artificial person that is a separate legal entity that is treated independently of its members (also called as shareholders), has its obligations and rights, perpetual succession, limited liability, and does hold property in its brand name.

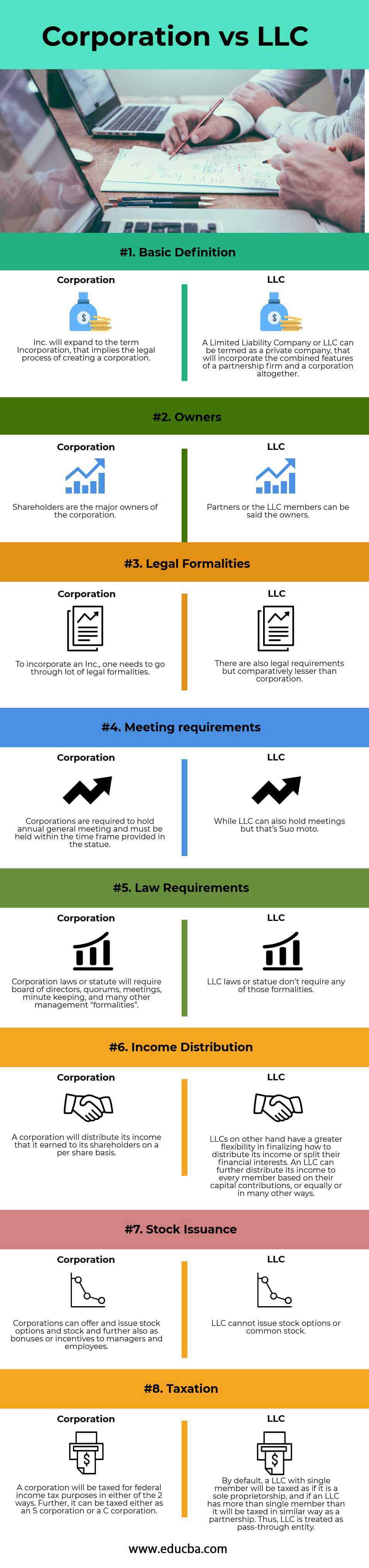

Head To Head Comparison Between Corporation vs LLC (Infographics)

Below is the top 8 difference between Corporation vs LLC :

Key Differences Between Corporation vs LLC

Both Corporation vs LLC are popular choices in the market.

Let us discuss some of the significant differences Between corporations vs LLC :

- A private company that will merge the combined features of a partnership firm or corporation is called a Limited Liability Company or LLC. On the other hand, Inc. is an acronym that will be used for the term “Incorporated” and as a suffix in the corporation’s brand name, which denotes a business entity registered under the statute of the law.

- An LLC can be termed as a privately held corporation, but a corporation, on the other hand, is a publicly-traded corporation.

- The Limited Liability Company owners are the members, whereas the shareholders are the corporation’s ultimate owners.

- LLCs will offer more flexibility than a corporation. There is no bar or limit on the maximum number of members in a Limited Liability Company. On the other hand, an S Corp., a type of corporation, can have only a hundred members.

- A corporation is subject to stringent record-keeping and legal formalities. However, regarding a Limited Liability Company, the record-keeping and the legal formalities are lenient.

- The best and key feature of an LLC is pass-through taxation; as stated earlier, the LLC’s income will be taxable in the hands of its owners post-distribution. On the contrary, a corporation will have to face double taxation. First, it will be taxed at the corporate level and then at an individual level, when the income or the profit is distributed to shareholders of the corporation as a dividend.

- The annual reports of a corporation should be submitted timely to the appropriate authority as per the law’s requirements. Unlike a corporation, LLC, wherein filing annual reports or financial statements with the appropriate authority is not required.

- The Annual General Meeting (i.e., AGM) should compulsorily and mandatorily be held by a Corporation that is Incorporated. As against this, holding an AGM is not mandatory for an LLC or Limited Liability Company.

Corporation vs LLC Comparison Table

Let’s look at the top Comparison between Corporation vs LLC:

| Basis of Comparison |

Corporation |

LLC |

| Basic Definition | Inc. will expand to Incorporation, which implies the legal process of creating a corporation. | A Limited Liability Company or LLC can be termed a private company that will incorporate the combined features of a partnership firm and a corporation. |

| Owners | Shareholders are the major owners of the corporation. | Partners or LLC members can be said to the owners. |

| Legal Formalities | To incorporate an Inc., one needs to go through many legal formalities. | There are also legal requirements but comparatively lesser than a corporation. |

| Meeting Requirements | Corporations must hold an annual general meeting and must be held within the time frame provided in the statute. | While LLC can also hold meetings, that’s Suo Moto. |

| Law Requirements | Corporation laws or statutes will require a board of directors, quorums, meetings, minute keeping, and many other management “formalities.” | LLC laws or statue don’t require any of those formalities. |

| Income Distribution | A corporation will distribute its income to its shareholders on a per-share basis. | On the other hand, LLCs have greater flexibility in finalizing how to distribute their income or split their financial interests. An LLC can further distribute its income to every member based on their capital contributions, or equally or in many other ways. |

| Stock Issuance | Corporations can offer and issue stock options and stock and bonuses or incentives to managers and employees. | LLC cannot issue stock options or common stock. |

| Taxation | A corporation will be taxed for federal income tax purposes in either of the 2 ways. Further, it can be taxed as an S corporation or a C corporation. | By default, an LLC with a single member will be taxed as a sole proprietorship, and if an LLC has more than a single member, it will be taxed similarly as a partnership. Thus, LLC is treated as a pass-through entity. |

Conclusion

Corporation vs LLC both offers their unique benefits and certain similarities. Both Corporation vs LLC provide limited liability protection as every coin has 2 sides, including corporation and LLC. In an LLC, there is no limit on the count of members; the business income or profit will pass through the member’s personal income tax return. Further, it cannot issue common stock to raise the required funds from the marketplace. On the contrary, corporations will be authorized to make the public issue (i.e. IPO) and split corporate income that lessens overall tax liability. Still, the cascading effect is present in the taxation of such legal entities.

Recommended Articles

This has been a guide to the top difference between Corporation vs LLC. Here we also discuss the Corporation vs LLC key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –