Updated August 1, 2023

Consumer Surplus Formula (Table of Contents)

- Consumer Surplus Formula

- Examples of Consumer Surplus Formula (With Excel Template)

- Consumer Surplus Calculator

Consumer Surplus Formula

Consumer surplus is the difference in amount between the actual price and the price willing to pay a consumer for goods or services. Actual price is the initial price of goods or services, whereas the price willing to pay a consumer is decided by a consumer based on market testing, surveys, etc.

Price of the product is finalized by a company after market research and depends on demand and supply of product and service. The consumer surplus formula can be written as the maximum amount willing to pay by the consumer minus the actual price of goods and services or the initial price. The formula for consumer surplus can be expressed as:-

Examples of Consumer Surplus Formula (With Excel Template)

Now, let us see an example of the Consumer Surplus Formula.

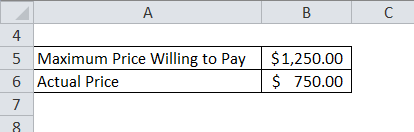

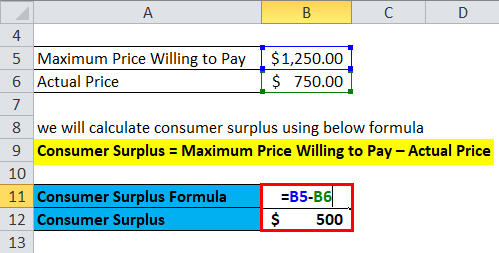

Example #1

A company came up with a new product, which is auto dish cleaner. The company had conducted various market research and finalized its maximum price, willing to pay $1,250, whereas the actual price of the product is $750.

Now, we will calculate consumer surplus using the below formula

Consumer Surplus = Maximum Price Willing to Pay – Actual Price

Put the values in the above formula.

- Consumer Surplus = 1,250 – 750

- Consumer Surplus = $500

So, the consumer surplus of auto dish cleaners is $500.

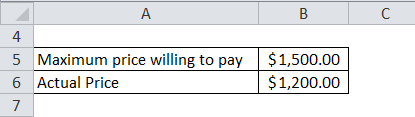

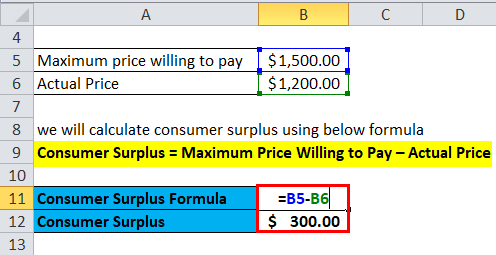

Example #2

Suppose a consumer wants a television with 44 inches LED TV with HD quality and is willing to pay $1,500 for it. He went to an electronics store and found that the television with the features he wanted was for a price of $1,200.

As we know,

Consumer Surplus = Maximum Price Willing to Pay – Actual Price

Put the value in the above formula.

- Consumer Surplus = $1,500 – $1,200

- Consumer Surplus = $300

Consumer surplus value is $300. Here consumer has saved the same.

Explanation of the Consumer Surplus Formula

The formula for consumer surplus can be calculated by first checking the consumer base and the highest price the consumer is willing to pay. The company already has the initial price, and their subtraction will result in a consumer surplus.

Now, let us see the extended consumer surplus formula.

Extended Consumer Surplus Formula

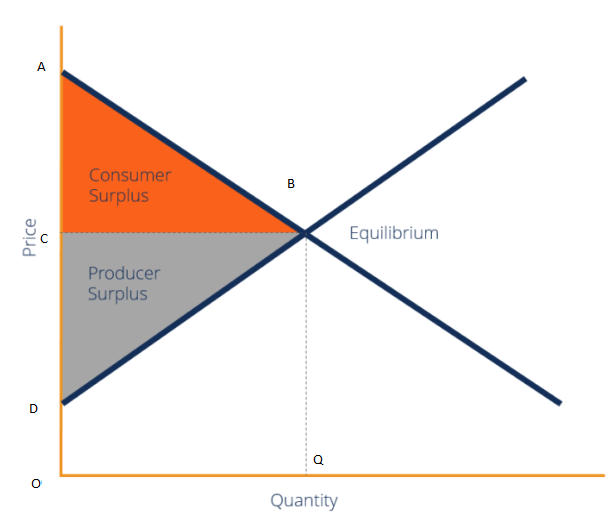

In the below image of consumer and producer surplus in perfect competition, triangle ABC is consumer surplus, and another triangle ABC BCD reflects producer surplus. Here, point A and C represent the maximum price the consumer is willing to pay the market price, respectively. Points B and Q correspond to the quantity demand at equilibrium. Extended consumer surplus can be written as half of BC multiplied by AC or half of OQ multiplied by AC, as OQ and CB are parallel.

Consumer and Producer Surplus in Perfect Competition

Formula for Extended Consumer Surplus can be expressed as:-

Consumer Surplus = ½ * BC * AC

Or,

Consumer Surplus = ½ * OQ * AC

Hence,

Explanation of the Extended Consumer Surplus Formula

Extended consumer surplus can be calculated this way. Firstly we need to draw a supply and demand curve with quantity on the horizontal axis and price on the vertical axis.

Now, put the market price in the equilibrium price. As per the law of supply and demand, the market price is a point of intersection between the demand and supply curves. Now a line must be created between the market equilibrium price and ordinate.

As we know, triangle ![]() ABC is consumer surplus, and area of the triangle that is Consumer Surplus:-

ABC is consumer surplus, and area of the triangle that is Consumer Surplus:-

Area of Triangle = ½ * Base * Height

Base = CB = OQ

Height = AC

Put a value in the above equation.

Consumer Surplus = ½ * CB * AC

And

Consumer Surplus = ½ * OQ * AC

Now, let us give an example to understand the same.

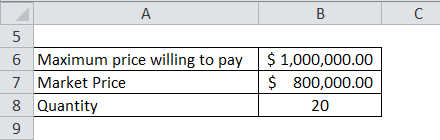

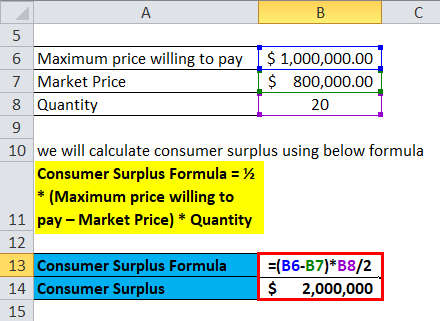

Example #3

A consumer wants to buy a high-tech car with all advanced features, and he is ready to pay $1,000,000, which is the highest price among the customers, and other customers are willing to pay only $800,000. Market price as per demand supply meet is $800,000. As per this price, car demand is 20 in equilibrium demand.

Let us find consumer surplus for the same.

As we know,

Put values in the above formula.

- Consumer Surplus = ½ * ($1,000,000 – $800,000) * 20

- Consumer Surplus = $2,000,000

So, the consumer surplus is $2,000,000.

Example #4

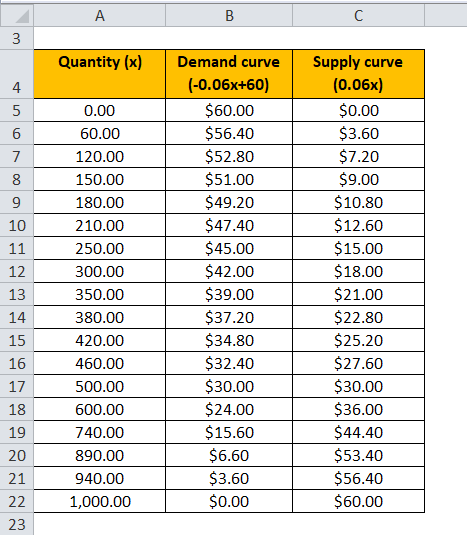

Suppose a company wants to calculate consumer surplus with the demand function i.e. QD, which is (-0.06x + 60), and supply function QS is 0.06x.

Here, x is quantity.

Below is the function with the change in quantity.

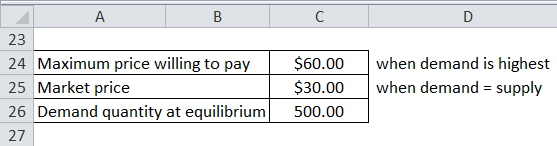

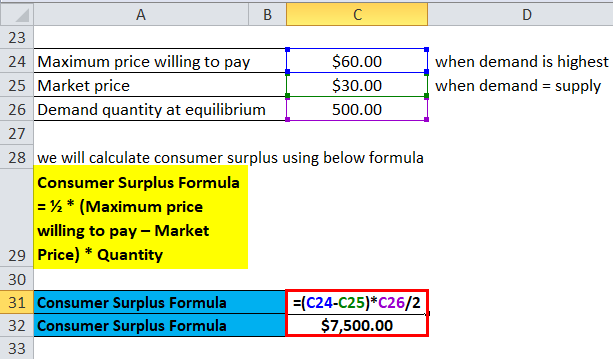

By the above table, we got the below values:-

Now, let us calculate Consumer Surplus,

Put value in the above formula.

- Consumer Surplus = ½ * (60 -30) * 500

- Consumer Surplus = $7,500

So, the consumer Surplus is $7,500.

Significance and Uses

There are multiple uses of the consumer surplus equation, which are as follows:-

- Consumer surplus equation helps make business pricing-related decisions like pricing of selling goods and services and the value of pricing.

- Consumer surplus equation helps generate maximum revenue as this company can get the best selling price with maximum revenue generation.

Consumer surplus is a very important element in business, especially when re-pricing is done, or a new product needs to be launched. The consumer surplus is based on an economic theory of marginal utility.

Consumer Surplus Calculator

You can use the following Consumer Surplus Calculator

| Maximum Price Willing to Pay | |

| Actual Price | |

| Consumer Surplus Formula | |

| Consumer Surplus Formula = | Maximum Price Willing to Pay – Actual Price |

| = | 0 – 0 |

| = | 0 |

Recommended Articles

This has been a guide to a Consumer Surplus formula. Here we discuss How to Calculate Consumer Surplus along with practical examples. We also provide Consumer Surplus Calculator with a downloadable Excel template. You may also look at the following articles to learn more –