Updated August 1, 2023

Capitalization Rate Formula (Table of Contents)

- Capitalization Rate Formula

- Examples of Capitalization Rate Formula (With Excel Template)

- Capitalization Rate Formula Calculator

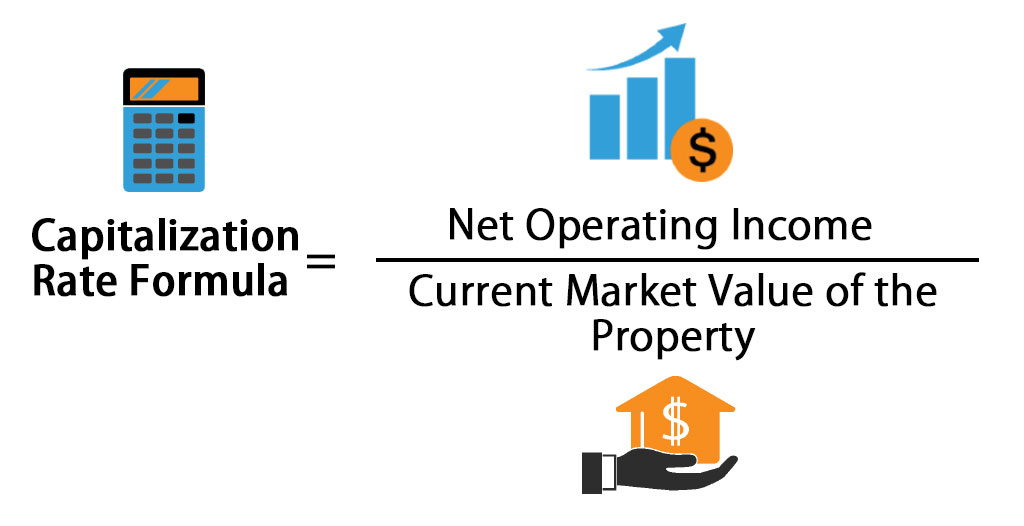

Capitalization Rate Formula

The Capitalization Rate defines the rate of return for an investor who invests money in real estate properties based on the Net Operating Income that the property generates.

Examples of Capitalization Rate Formula (With Excel Template)

Let’s take an example to understand the calculation of the Capitalization Rate formula in a better manner.

Example #1

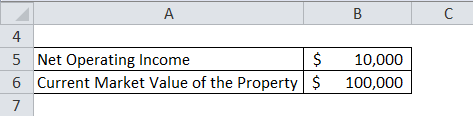

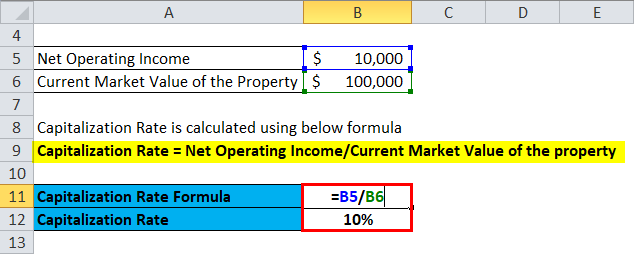

Let’s take an example of a commercial office property A where the Net Operating Income for a year is $10000, and the Property’s Current Market Value is $100000.

Solution:

Formula to calculate Capitalization Rate is as below:

- Capitalization Rate = $10000 / $100000

- Capitalization Rate= 10%

Example #2

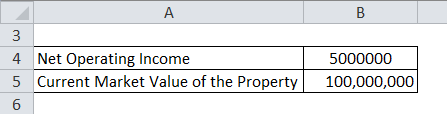

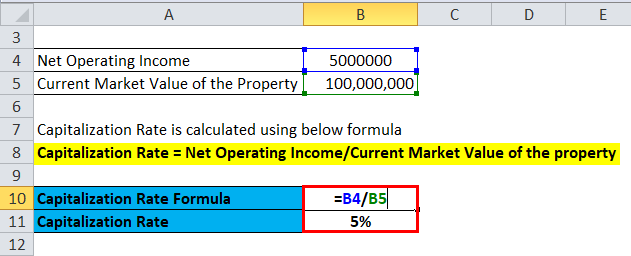

Let us take an example of the commercial property Ambience Mall in Delhi, whose Net Operating Income is Rs 50 lakhs, and the current Market Value of the property is Rs 10 Crore.

Solution:

Capitalization Rate is calculated using the below formula

Capitalization Rate = Net Operating Income / Current Market Value of the property

- Capitalization Rate = Rs 50 lakhs / Rs 10 Crore

- Capitalization Rate = 5%

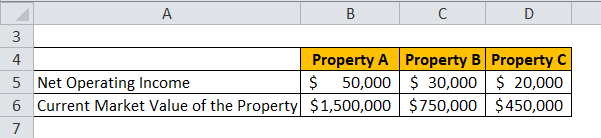

Example #3

Let us take an example where an investor has to decide in which property out of 3 properties he has to invest.

Solution:

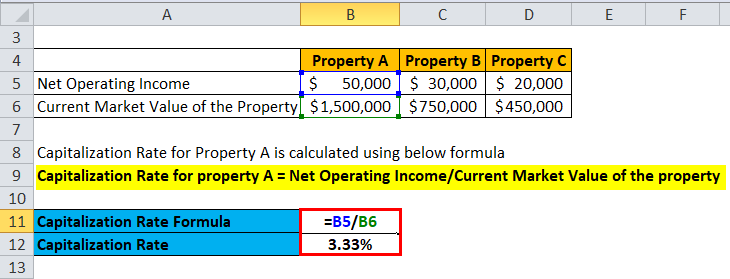

The capitalization Rate for property A is calculated using the below formula.

Capitalization Rate for property A = Net Operating Income / Current Market Value of property

- Capitalization Rate for property A = $50000 / $1500000

- Capitalization Rate for property A = 3.33%

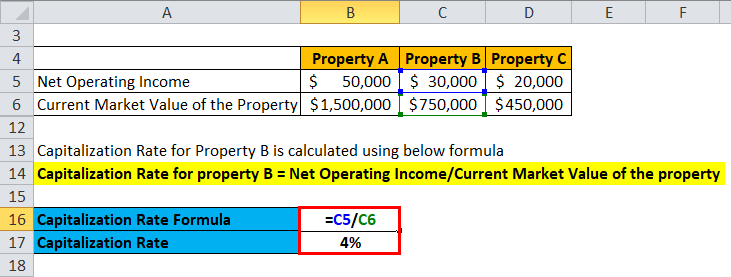

The capitalization Rate for property B is calculated using the below formula.

Capitalization Rate for property B = Net Operating Income / Current Market Value of property

- Capitalization Rate for property B = $30000 / $750000

- Capitalization Rate for property B = 4%

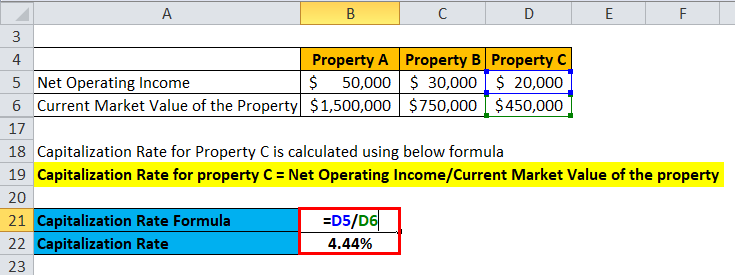

The capitalization Rate for property C is calculated using the below formula

Capitalization Rate for property C = Net Operating Income / Current Market Value of property

- Capitalization Rate for property C = $20000 / $450000

- Capitalization Rate for property C = 4.44%

Since Capitalization Rate for property C is the highest, hence the investor should invest in property C to gain the maximum return out of the 3 properties that can be invested in.

Explanation of Capitalization Rate Formula

Capitalization Rate can be defined as the rate of return for an investor investing money in real estate properties based on the Net Operating Income that the property generates.

Capitalization Rate = Net Operating Income / Current Market Value of the Property.

Net Operating Income is defined by deducting expenses from the total rental income generated by the property. The property’s current market value, as the name suggests, is the price in the current market that anyone would pay to buy the property.

The capitalization rate shows the investor his rate of return on the investment. A higher capitalization rate is worth more for the investor to invest in. While calculating Net Operating Income, depreciation is not included since only operating expenses are deducted.

Relevance and Uses of Capitalization Rate Formula

The capitalization rate is useful for investors to compare properties. If all things are equal and any two properties have capitalization rates of 10% and 5%, then the investor should choose the 10% return the property offers. It should be considered that the cap rate alone should not be a determinant of whether the property is worth investing in or not. A high capitalization rate means higher returns, but it also indicates higher risk. Hence investors should invest in properties based on their risk preferences.

For example, if there are two properties, all factors are equal except their geographic locations. One is located near the central part of the city, and the other is in the suburbs. Hence, the first property near the city center would garner more rental income. The costs of higher property taxes and maintenance would offset the rental income. Since it is located near the city center, the property’s current market value will be higher than the property in the suburbs. Hence, the property in the city center will have a lower capitalization rate than the property in the suburbs. A lower capitalization rate realizes a better valuation. This indicates property with a lower capitalization rate yields better returns with a lower level of risk. But the real-world scenarios are not that simple. One cannot look only at the capitalization rate as the decisive factor in choosing a property.

Capitalization Rate Formula Calculator

You can use the following Capitalization Rate Calculator.

| Net Operating Income | |

| Current Market Value of the Property | |

| Capitalization Rate Formula | |

| Capitalization Rate Formula | = |

|

|

Conclusion

The investor defines the capitalization rate as the rate of return sought while investing in real estate properties. Calculating the capitalization rate involves dividing the net operating income by the property’s market value. The net operating income is calculated by subtracting operating expenses from the rental income generated from the property. The operating expenses do not include depreciation. Capitalization rate should not be a single factor in estimating whether a property is worth investing in.

Recommended Articles

This has been a guide to the Capitalization Rate formula. Here we discuss How to Calculate the Capitalization Rate along with practical examples. We also provide a Capitalization Rate Calculator with a downloadable Excel template. You may also look at the following articles to learn more –