Updated July 18, 2023

Definition of Bonds Payable

Bonds payable are defined to be type debt which are generally for a long term and are issued by corporates, governments, secured institution, etc. i.e. in this agreement the issuer of the bonds makes a formal agreement to pay interest to the bond holder semi-annually and to make the payment of principal or the matured amount on a specified future date.

Explanation

Bond payable is a promise set to pay the bond holder with some interest along with the principal amount on its maturity on a fixed date in the future. These bonds are generally issued by the government or corporates to generate cash. A bond issuer or the company is the borrower. When a bond is issued it creates a liability and therefore bonds payable appear on the liability side of the balance sheet of the company. Bonds payable is thus categorized under long term class of liabilities. Bonds are generally issued at par, premium, and discount. This depends on the difference between the coupon rate it is offering, and the market yield it will generate on issuance.

When a bond is issued the issuer will record the face value of the bond as the bond payable. The issuer will receive the cash for the fair value of the bond and the positive (premium) or negative(discount) is recorded on bonds payable. Generally, interest on bonds will be paid on a semi-annual basis.

How to Record Bonds Payable Accounting?

There are three different kinds of scenarios when it comes to accounting for bond payable and those are as follows:

- Par Scenario

- Premium Scenario

- Discount Scenario

1. Par Scenario

Suppose XYZ Ltd. is a public limited company and is in a phase to issue corporate bonds to raise capital for expansion. We assume the market rate existing is 10% and the company also issues a 10% rate bond. Accounting for the same will be as follows:

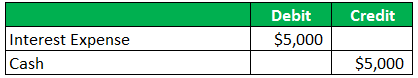

Period interest will be given at 10% rate semi-annually which is recorded as:

Payment of face value on maturity:

2. Premium Scenario

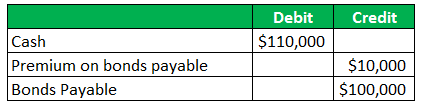

Suppose XYZ Ltd. is a public limited company and is in a phase to issue corporate bonds to raise capital for expansion. We assume the market rate existing is 8% and the company is issuing a premium rate of 10% rate bond. The accounting for the same will be as follows:

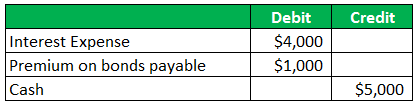

Period interest will be given semi-annually which is recorded as:

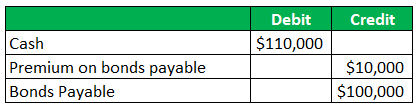

Payment of face value on maturity:

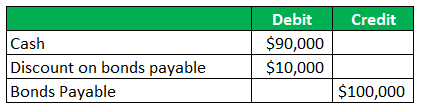

3. Discount Scenario

Suppose XYZ Ltd. is a public limited company and is in a phase to issue corporate bonds to raise capital for expansion. We assume the market rate existing is 10% and the company is issuing a discount at a rate of 8% rate bond. The accounting for the same will be as follows:

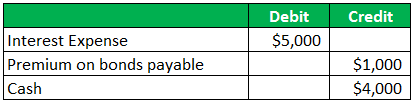

Period interest will be given semi-annually which is recorded as:

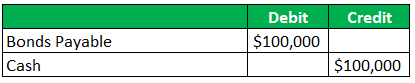

Payment of face value on maturity:

Example of Bonds Payable Accounting

Bonds are generally priced or denominated as $1000s. Suppose a company to raise capital has issued bonds in open market. The face value of each is $1000 and now if the bonds gets sold at a market price of 100 only it means the bond has got sold at par and 100% of its face value at which it was issued. The other circumstances can be the bond getting sold at a market price of 105 which will generate $1050 of cash i.e. 1050-1000 = $50 which we call as premium and, in these cases,we say the bond has got sold in premium.

Lastly, one more scenario can prevail which we say bond getting sold at discount i.e. the same bond is getting sold at a discount market rate of 9, which will provide $950 cash to the company. The differentiating factor here is the interest rates. The interest rate offered in cases of bond issued at part is same as the prevailing market rate and the interest rate applicable in bond issued at the premium is generally more than the market rate. Lastly, in cases of bind issued at a discount the interest rate offered is less than what the market offers, and therefore the bond is issued at a discount to compensate the interest rate factor.

Amortizing Bonds Payable Accounting

The amortization formula which is applicable in terms of bond payable accounting is as follows:

There are generally two ways to calculate the bond’s cost amortization which are as straight-line method and the effective interest rate method. As the interest rates changes in the market, the interest which a corporation is supposed to give on a bond is at times higher or lower than the interest rate it actually gives to the investors. Bond discount is a condition when an investor pays less than the face value of the bond which represents a higher interest rate than what for the bond was issued for.

The bond premium is a scenario when investors pay more for the bond which represents a lower interest rate than what for the bond was issued for. In the cases of bonds issued at discount the difference between the face value and the interest rate being given to the bond holders proves to be an added n expense for the company. This is why it is then called an amortized cost.

Advantages of Bonds Payable Accounting

Some of the advantages are given below:

- Tax benefits can be enjoyed when bonds payable are issued.

- It helps in raising emergency funds required for expansion or capital enhancement.

- Bonds are safer instrument backed up by the government or corporates.

- Bonds are also rate by credit agencies based on their risk profile.

- Bonds are generally less volatile and less risky than stocks.

Conclusion

As discussed above we have seen how bonds payable are advantageous to both bond issuer and bond holder. Also, we have discussed the various scenarios of how bond payable gets issued, and also the accounting for the same has been considered.

Recommended Articles

This is a guide to Bonds Payable. Here we also discuss the definition and how to record bonds payable accounting along with an example and advantages. You may also have a look at the following articles to learn more –