Updated July 24, 2023

Bond Yield Formula (Table of Contents)

What is the Bond Yield Formula?

The term “bond yield” refers to the expected rate of return from a bond investment. The bond yield is primarily of two types-

- Yield to Maturity (YTM)

- Current Yield

The term “yield to maturity” or YTM refers to the return expected from a bond over its entire investment period until maturity. YTM is used in the calculation of bond price wherein all probable future cash flows (periodic coupon payments and par value on maturity) are discounted to present value on the basis of YTM. Mathematically, the formula for bond price using YTM is represented as,

Where t: No. of Years to Maturity

On the other hand, the term “current yield” means the current return rate of the bond investment computed on the basis of the coupon payment expected in the next year and the current market price. The formula for current yield is expressed as expected coupon payment of the bond in the next one year divided by its current market price. Mathematically, it is represented as,

Example of Bond Yield Formula (With Excel Template)

Let’s take an example to understand the calculation of the Bond Yield in a better manner.

Bond Yield Formula – Example #1

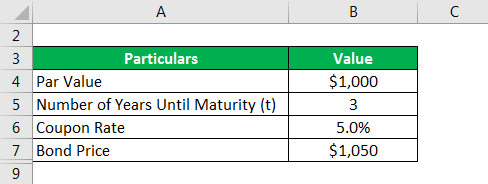

Let us take the example of a 3-year $1,000 bond that will pay annual coupons at a rate of 5%. Calculate the YTM of the bond if its current market price is $1,050.

Solution:

Annual Coupon Payment is calculated using the formula given below

Annual Coupon Payment = Coupon Rate * Par Value

- Annual Coupon Payment = 5% * $1,000

- Annual Coupon Payment = $50

The other cash flow to be received at the end of three years in the form of par value is $1,000.

YTM is calculated using the formula given below

Bond Price = ∑ [Cash flowt / (1+YTM)t]

- $1,050 = $50 / (1 + YTM)1 + $50 / (1 + YTM)2 + ($50 + $1,050) / (1 + YTM)3

- YTM = 3.2% (to be computed through trial and error method)

Therefore, for the given coupon rate and market price, the YTM of the bond is 3.2%.

Bond Yield Formula – Example #2

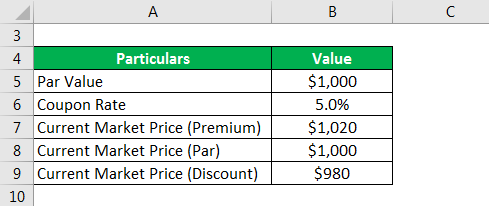

Let us take the example of a 5-year $1,000 bond that pays a coupon rate of 5%. Calculate the bond’s current yield if the bond trades at a premium price of $1,020, The bond trades at par, and The bond trades at a discounted price of $980.

Solution:

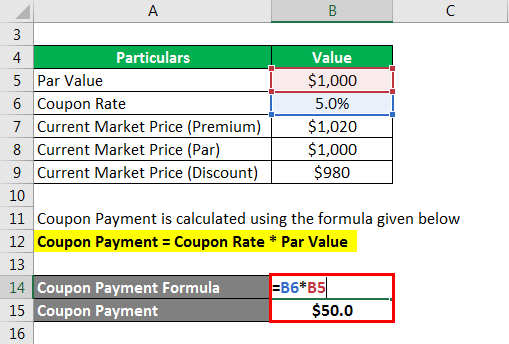

Coupon Payment = Coupon Rate * Par Value

- Coupon Payment = 5% * $1,000

- Coupon Payment = $50.0

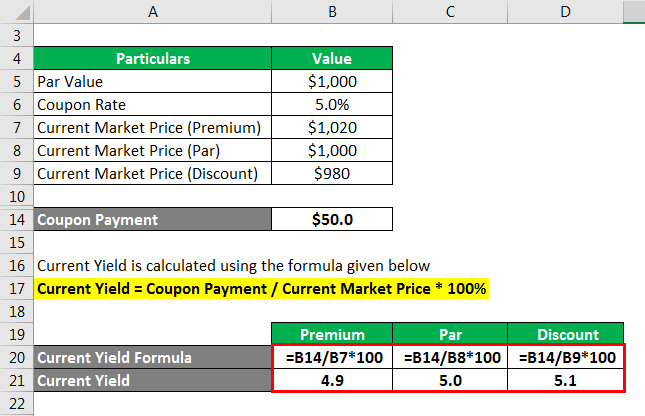

Current Yield is calculated using the formula given below

Current Yield = Coupon Payment / Current Market Price * 100%

For Current Market Price (Premium)

- Current Market Price = $50 / $1,020 * 100%

- Current Market Price = 4.9%

For Current Market Price (Par)

- Current Market Price = $50 / $1,000 * 100%

- Current Market Price = 5.0%

For Current Market Price (Discount)

- Current Market Price = $50 / $980 * 100%

- Current Market Price = 5.1%

Explanation

The formula for Bond Yield can be calculated by using the following steps:

Step 1: Firstly, determine the bond’s par value be received at maturity and then determine coupon payments to be received periodically. Both par value and periodic coupon payments constitute the potential future cash flows.

Step 2: Next, determine the investment horizon of the bond, which is the number of years until its maturity denoted by t.

Step 3: Next, figure out the current market price of the bond.

Step 4: Finally, the formula for the bond price can be used to determine the YTM of the bond by using the expected cash flows (step 1), number of years until maturity (step 2) and bond price (step 3) as shown below.

Bond Price = ∑ [Cash flowt / (1+YTM)t]

The formula for a bond’s current yield can be derived by using the following steps:

Step 1: Firstly, determine the potential coupon payment to be generated in the next one year.

Step 2: Next, figure out the current market price of the bond.

Step 3: Finally, the formula for current yield can be derived by dividing the bond’s coupon payment expected in the next one year (step 1) by its current market price (step 2), as shown below.

Current Yield = Coupon Payment in Next One Year / Current Market Price * 100%

Relevance and Use of Bond Yield Formula

The concept of bond yield is very important to understand as it is used in the assessment of its expected performance. The formula is based on the principle that despite the constant coupon rate until maturity, the expected return rate of the bond investment varies based on its market price, which reflects how favourable the market for the bond is. As such, bond yield is relevant for managing the portfolio of a bond investment.

Bond Yield Formula Calculator

You can use the following Bond Yield Formula Calculator

| Coupon Payment in Next One Year | |

| Current Market Price | |

| Current Yield | |

| Current Yield = |

|

||||||||||

|

Recommended Articles

This is a guide to Bond Yield Formula. Here we discuss how to calculate the Bond Yield along with practical examples. We also provide a Bond Yield calculator with a downloadable excel template. You may also look at the following articles to learn more –