What is Behavioral Finance?

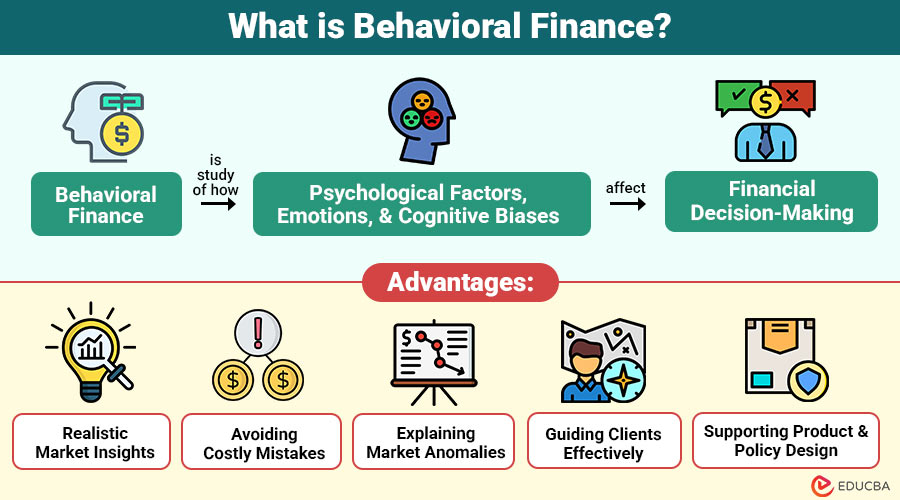

Behavioral Finance is study of how psychological factors, emotions, and cognitive biases affect financial decision-making. It challenges the traditional concept of rational investors and efficient markets, introducing a more realistic perspective that humans often deviate from logic due to biases, heuristics, and social influences.

Table of Contents:

- Meaning

- Importance

- Key Principles

- Applications

- Advantages and Disadvantages

- Real World Examples

- Strategies

Key Takeaways:

- Behavioral Finance reveals how cognitive biases and emotions influence financial decisions, often causing irrational investment behaviors.

- Recognizing psychological patterns helps investors, advisors, and policymakers make informed, disciplined, and more effective financial decisions.

- Through the prism of behavioral biases and herd behavior, market anomalies like bubbles and collapses can be better understood.

- Applying behavioral insights through strategies, automation, and education mitigates the impact of bias, promoting long-term, rational investment outcomes.

Importance of Behavioral Finance

Behavioral Finance is essential for:

1. Individual Investors

Behavioral Finance helps investors recognize cognitive biases, emotional influences, and irrational tendencies, leading to more informed, rational financial decisions.

2. Financial Advisors

Advisors can guide clients more effectively by understanding behavioral biases, managing unrealistic expectations, and improving investment strategies and outcomes.

3. Policymakers & Regulators

Behavioral insights enable regulators to prevent financial crises, mitigate market bubbles, and design policies that foster stable, efficient, and equitable markets.

4. Organizations

Companies use behavioral principles to structure retirement plans, investment products, and employee benefits that align with human decision-making tendencies.

Key Principles of Behavioral Finance

Several psychological principles form the foundation of Behavioral Finance:

1. Heuristics

In order to make judgments quickly, investors frequently employ mental shortcuts, but these simplifications can result in cognitive biases and recurring errors.

2. Prospect Theory

People tend to perceive losses more intensely than equivalent gains, which influences risk-taking behavior and leads to inconsistent investment decisions in various scenarios.

3. Overconfidence Bias

Investors often overrate their knowledge or forecasting ability, trading excessively or taking unnecessary risks, which can harm long-term portfolio performance.

4. Herd Behavior

Investors often follow crowd behavior rather than conducting independent analysis, which can contribute to market bubbles, rapid price increases, or sudden crashes.

5. Anchoring

Initial information, such as stock prices or past performance, overly influences decisions, preventing investors from adjusting their judgments with new data.

6. Loss Aversion

The fear of losses outweighs the pleasure of gains, causing investors to hold losing positions longer than rationally justified.

7. Mental Accounting

People mentally categorize money into different categories, leading to biased budgeting, spending, or investing decisions that may not maximize returns.

Applications of Behavioral Finance

Here are some key practical applications of Behavioral Finance in different areas:

1. Investment Strategies

Understanding behavioral biases can help design strategies that counter irrational decisions. For instance, setting automatic stop-loss orders prevents investors from holding onto losing stocks due to loss aversion.

2. Financial Planning

Advisors can use behavioral insights to manage client expectations, helping them stay disciplined during volatile markets.

3. Corporate Finance

Executives often exhibit biases, such as overconfidence, when making mergers and acquisitions. Behavioral finance helps companies assess risks more realistically.

4. Public Policy

Governments use “nudge theory” (a concept in behavioral economics) to encourage better financial habits, such as automatic enrollment in retirement savings plans.

5. Personal Finance

Individuals can recognize their own cognitive biases—such as impulse buying or mental accounting—and adopt disciplined saving and investing strategies.

Advantages and Disadvantages of Behavioral Finance

Here are the key advantages and disadvantages of Behavioral Finance

Advantages:

- Realistic Market Insights: Behavioral Finance considers emotions, psychology, and cognitive biases, providing practical insights into market behavior that traditional finance models often overlook.

- Avoiding Costly Mistakes: Recognizing irrational behaviors and emotional reactions helps investors reduce mistakes and make more disciplined, rational decisions during market fluctuations.

- Explaining Market Anomalies: Behavioral Finance explains phenomena like bubbles, overreactions, and inefficiencies that traditional models cannot, offering a deeper understanding of financial trends.

- Guiding Clients Effectively: Financial advisors utilize behavioral insights to develop personalized strategies, aligning client guidance with individual behavioral tendencies and long-term investment objectives.

- Supporting Product and Policy Design: Organizations can design investment products, retirement plans, and regulations that take into account human behavior to achieve more effective financial outcomes.

Disadvantages:

- Difficulty Quantifying Emotions: Human emotions are difficult to measure, making it challenging to create precise models that predict investor decisions or market movements.

- Individual and Cultural Variation: Biases vary across individuals and cultures, limiting the universal applicability of behavioral finance insights in diverse populations and contexts.

- Evolving Field: Behavioral Finance is still developing and lacks universal acceptance, so traditional finance principles dominate academic and professional practice.

- Limited Market Prediction: Human behavior is unpredictable and influenced by complex psychological and social factors, making precise forecasts of market movements difficult.

- Oversimplification Risk: Simplifying complex psychological processes may overlook subtle behavioral patterns, thereby reducing the accuracy of modeling real-world financial decision-making.

Real-World Examples

To see Behavioral Finance in action, consider these well-known market events:

1. Dot-Com Bubble (1997–2000)

Investors rushed into internet stocks, driven by herd behavior and overconfidence. When reality set in, markets collapsed, wiping out trillions in value.

2. 2008 Financial Crisis

Overconfidence in housing markets and blind faith in mortgage-backed securities created a massive bubble, ultimately leading to a global recession.

3. GameStop Saga (2021)

A classic case of herd behavior, where retail investors coordinated on social media platforms like Reddit, driving stock prices to irrational levels.

Strategies to Overcome Behavioral Biases

While biases can not be eliminated, investors can adopt strategies to reduce their influence:

1. Education & Awareness

Investors should study common behavioral biases, recognize them in their own decisions, and understand how emotions influence financial choices.

2. Diversification

Spreading investments across various assets and sectors reduces the impact of individual mistakes, mitigating losses caused by biased decision-making.

3. Long-Term Focus

Maintaining a long-term investment perspective helps prevent emotional reactions to short-term market changes and promotes disciplined, rational financial behavior.

4. Professional Guidance

Financial advisors offer impartial advice, helping investors overcome personal biases, make informed decisions, and achieve long-term financial objectives.

5. Automation Tools

Using systematic investment plans or robo-advisors reduces emotional trading, enforces discipline, and ensures consistent, bias-free investment strategies.

Frequently Asked Questions (FAQs)

Q1. Why is loss aversion important in investing?

Answer: Loss aversion is crucial because investors weigh potential losses more heavily than gains, often holding losing assets too long, which can hinder portfolio growth.

Q2. Can Behavioral Finance predict market crashes?

Answer: It cannot precisely predict crashes, but helps explain why irrational behaviors lead to bubbles and collapses.

Q3. What role do emotions play in investing?

Answer: Emotions like fear, greed, and excitement drive short-term decisions, often leading to suboptimal outcomes.

Q4. How can advisors apply Behavioral Finance?

Answer: By recognizing client biases, managing expectations, and designing investment strategies that protect clients from irrational choices.

Final Thoughts

Behavioral Finance examines how psychology influences financial decisions, explaining market inefficiencies and irrational investor behavior driven by fear, greed, and biases. For individuals, it promotes self-awareness, discipline, and strategic thinking. For professionals and policymakers, it guides the design of financial systems aligned with human behavior. By combining psychology with finance, it helps make smarter, informed decisions for the future.

Recommended Articles

We hope that this EDUCBA information on “Behavioral Finance” was beneficial to you. You can view EDUCBA’s recommended articles for more information.