Updated July 27, 2023

Difference Between Bank Rate vs Repo Rate

Bank Rate vs Repo rate is the two most important rates that are used for calculating borrowing and lending activities. While both these rates are used to control inflation and maintain liquidity in the market they are often considered to be the same. However, as discussed below there are many vital differences between the two. Before we turn to the comparison directly let’s first understand what these rates really mean.

Bank Rate

It is the Rate that central banks charge for a loan that they provide to a commercial bank and does not involve any collateral. Whenever any commercial bank has a shortage of funds they can borrow from the central bank. The bank rate is one of the important factors which is used by policymakers to regulate the economy. The economy is stimulated by decreasing the bank rate. This makes borrowing cheaper and encourages the same which increases spending. When the policymakers think that the rate of inflation is going up they increase the bank rate. it is used in determining the monetary policy of the economy

Repo Rate

In our daily life when we fall short of funds we go to the bank to borrow some money. In a similar fashion when a bank falls short of money it goes to the central banks to borrow money. Repo rate is the rate at which central banks lend money to commercial banks at the time of financial needs. This loan is given by keeping some securities, bonds as collateral. For example, a bank borrows $20000 from the central bank and the rate of interest is 10%, then the commercial bank will pay the central bank $2000 as the total amount of interest.

It is used to maintain liquidity in the banking sector. If the central bank of the country is looking to increase liquidity in the banking system then it will decrease the repo rate on the other hand if it wants to curb borrowing and control the liquidity it will increase the repo rate. An increase in rate means the Central bank will get a higher amount of interest

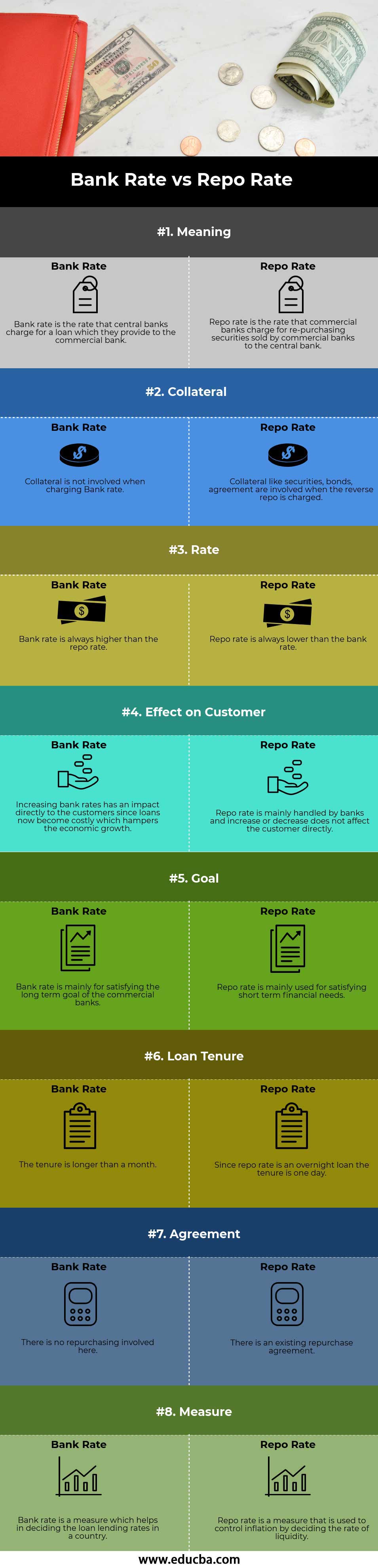

Head to Head Comparison Between Bank Rate vs Repo Rate (Infographics)

Below is the Top 8 Comparison between Bank Rate vs Repo Rate.

Key Differences between Bank Rate vs Repo Rate

Let us see some major differences between Bank Rate vs Repo Rate.

Loan charge on- Bank Rate is the rate that central banks charges for a loan which they provide to a commercial bank, on the other hand, the repo rate is the rate that commercial banks charge for re-purchasing securities sold by commercial to the central bank

Definition – Bank Rate is the rate at which a Central bank lends loans to financial institutions and other commercial banks. Repo rate is a short term rate at which commercial banks lends loan to central banks in case they face any shortages

Goals – Bank Rates are used to fulfill long term goals while repo rate fulfill short term goals

Agreement – When the Central bank lends money at the bank rate, there is no agreement involved. The loan is given at a fixed rate to the commercial bank. On the other hand, in the case of the repo rate, there is a repurchase agreement made between the banks. This agreement consists of a predominant rate at which the bank will return the loan

Collateral – When dealing with bank rates no collateral is required to be provided. When dealing with Repo rates, on the other hand, the loan is granted only when collateral is provided

Rate – The Bank Rate is always almost higher than the repo rate. The repo rate is always lower than the bank rate

Effect on Changes in the Rate – When the bank rate is increased or decreased it has a direct impact on the consumers and the economy. For example, if bank rates are increased, the loans become expensive as the interest rate increases. This curbs lending and slows economic growth. If rates are decreased the interest rate decreases and loans become cheaper. This increases lending and borrowing and increases economic growth. Reverse repo does not have this kind of impact on the economy.

Bank Rate vs Repo Rate Comparision Table

Let us discuss the topmost comparisons between Bank Rate vs Repo Rate.

| Particular | Bank rate | Repo rate |

| Meaning | Bank rate is the rate that central banks charge for a loan which they provide to the commercial bank | Repo rate is the rate that commercial banks charge for re-purchasing securities sold by commercial banks to the central bank |

| Collateral | Collateral is not involved when charging Bank rate | Collateral like securities, bonds, an agreement is involved when the reverse repo is charged |

| Rate | The bank rate is always higher than the repo rate | Repo rate is always lower than the bank rate |

| Effect on Customer | Increasing bank rates has an impact directly to the customers since loans now become costly which hampers the economic growth | Repo rate is mainly handled by banks and increase or decrease does not affect the customer directly |

| Goal | Bank rate is mainly for satisfying the long term goal of the commercial banks | Repo rate is mainly used for satisfying short term financial needs |

| Loan Tenure | The tenure is longer than a month | Since the repo rate is an overnight loan the tenure is one day |

| Agreement | There is no repurchasing involved here | There is an existing repurchase agreement |

| Measure | Bank rate is a measure that helps in deciding the loan lending rates in a country | Repo rate is a measure that is used to control inflation by deciding the rate of liquidity |

Conclusion

Bank and Repo Rate are both used in determining the monetary policy of the country which is deciding by the Central bank of the country to have control on the liquidity, pace, and money supply in the country. Mainly borrowing from the central bank is the last resort when no other means of borrowing is available. Hence Bank rate is thus become a theoretical concept.

Repo Rate is used by the banks as the topmost policy rate used by the central bank of the country to set as an anchor for determining the interest rate of the country

Recommended Articles

This has been a guide to the difference between Bank Rate vs Repo Rate. Here we also discuss the Bank Rate vs Repo Rate key differences with infographics and comparison table. You may also have a look at the following articles to learn more –