Updated July 31, 2023

Average Total Cost Formula (Table of Contents)

- Average Total Cost Formula

- Examples of Average Total Cost Formula (With Excel Template)

- Average Total Cost Formula Calculator

Average Total Cost Formula

Average total cost is a cost measure per unit of output produced by the firm. Sometimes, it is also per unit total cost because it is calculated by dividing the total cost of production by the number of units produced.

Here’s the Average Total Cost Formula :

Here Total cost includes all the costs required to produce the goods. It includes both Fixed cost (one time cost which is required to produce the goods but does not change with the output) and Variable cost (per unit cost to produce the goods, which changes as per the output)

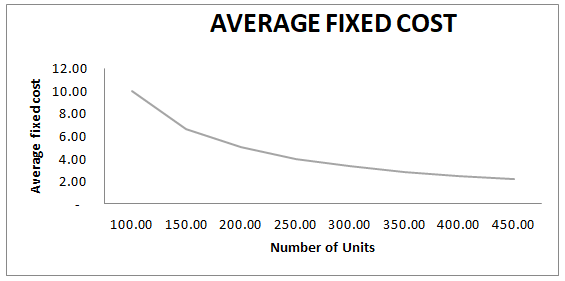

During the initial stages of production, the average total cost will be higher and will go down as we increase the number of units produced. This is because when a business starts its production, it has to incur certain fixed costs like buying machinery, equipment, etc. This cost is not related to how many units businesses will produce. So as the unit produced keeps increasing, per unit fixed cost will drop, as will the average total cost.

Examples of Average Total Cost Formula (With Excel Template)

Let’s take an example to understand the calculation of the Average Total Cost formula in a better manner.

Example #1

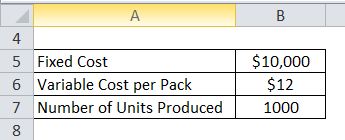

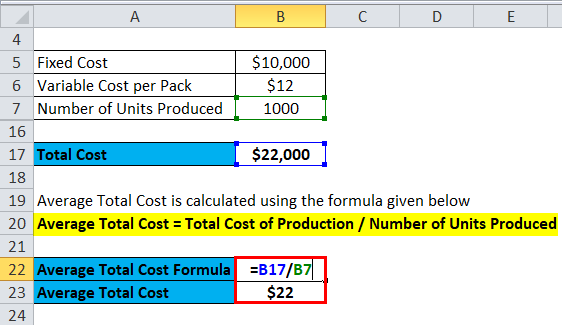

Suppose there is an FMCG company which is producing candy for kids. The fixed cost they have invested in equipment etc. is $10,000. The variable cost per pack of candy is $12. The company is producing 1000 on average.

Total Variable Cost is calculated using the formula given below

Total Variable Cost = Variable Cost per Pack * Number of Packs

- Total Variable Cost = $12 * 1000

- Total Variable Cost = $12000

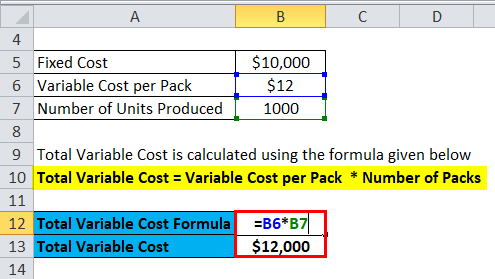

Total Cost is calculated using the formula given below

Total Cost = Fixed cost + Total Variable Cost

- Total Cost = $10000 + $12000

- Total Cost = $22000

Average Total Cost is calculated using the formula given below

Average Total Cost = Total Cost of Production / Number of Units Produced

- Average Total Cost = $22000 / 1000

- Average Total Cost = $22

Example #2

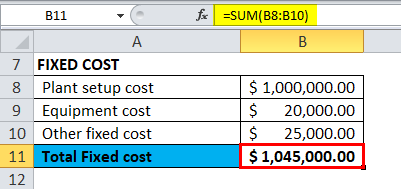

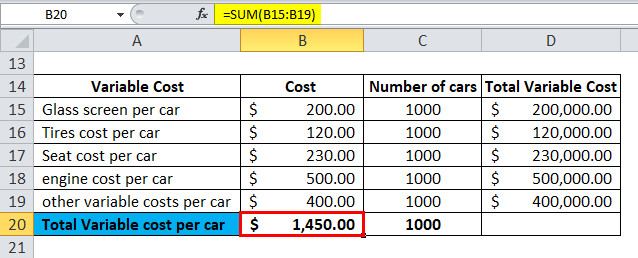

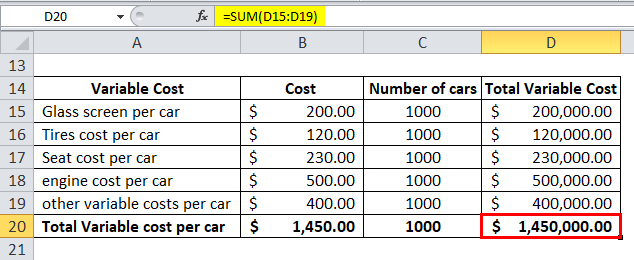

Company ABC Inc. is working in the manufacturing/assembling of Cars. So for them, costs like Steel, glass screens, number of tires, car seats, engines, etc., are all variable because they will vary as per the number of cars the company produces. But costs like plant, assembly line, equipment, R&D, etc., are all fixed since these costs do not directly link with the unit produced.

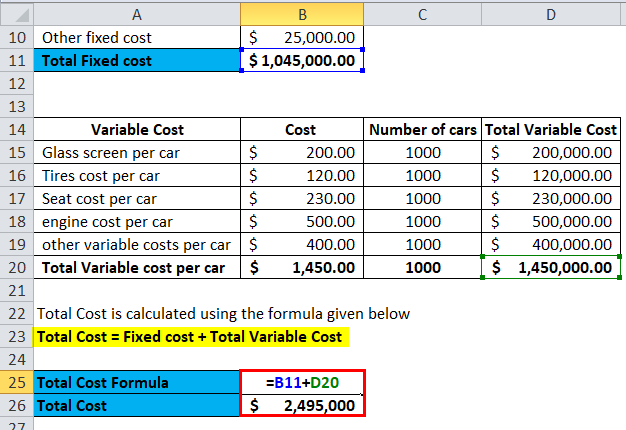

We calculate Total Fixed Cost as follows:

Total fixed cost = $1,045,000

We calculate Total Fixed Cost as follows:

Total variable cost per car = $1450

Total variable cost is calculated as:

Total variable cost = $1,450,000

We calculate Total Cost using the formula given below.

Total Cost = Fixed cost + Total Variable Cost

- Total Cost = $1,045,000 + $1,450,000

- Total Cost = $2,495,000

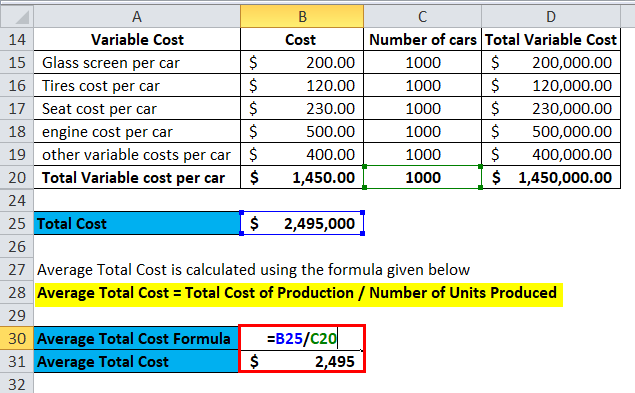

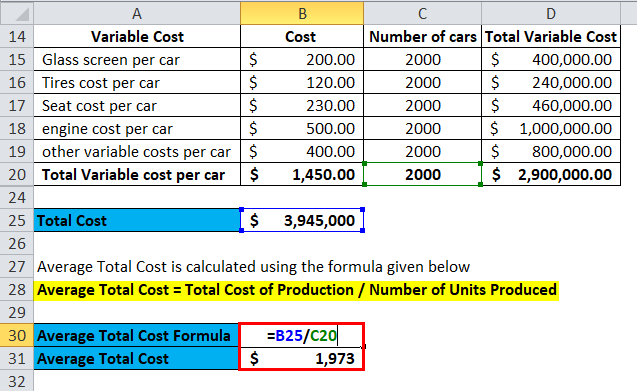

We calculate Total Cost using the formula given below.

Average Total Cost = Total Cost of Production / Number of Units Produced

- Average Total Cost = $2,495,000 / 1000

- Average Total Cost = $2495

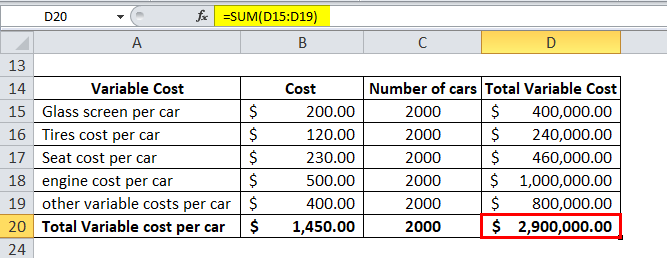

If we increase the number of cars, fixed costs will not change, and only variation will happen in the variable cost.

We calculate Total Cost using the formula given below.

Total variable cost = $2,900,000

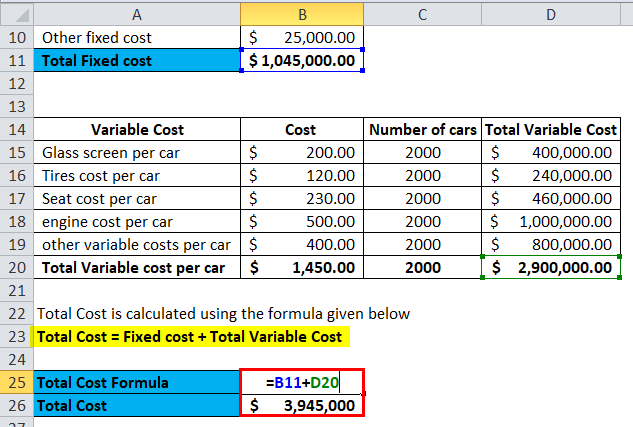

We calculate Total Cost using the formula given below.

Total Cost = Fixed cost + Total Variable Cost

- Total Cost = $1,045,000 + $2,900,000

- Total Cost = $3,945,000

We calculate Total Cost using the formula given below.

Average Total Cost = Total Cost of Production / Number of Units Produced

Average Total Cost = $3,945,000 / 2000

Average Total Cost= $1973

So as you see here, as we increase the number of cars, the average total cost per car drops. The company has spread the fixed cost over 2000 units, resulting in a lower per-unit fixed cost than the earlier scenario.

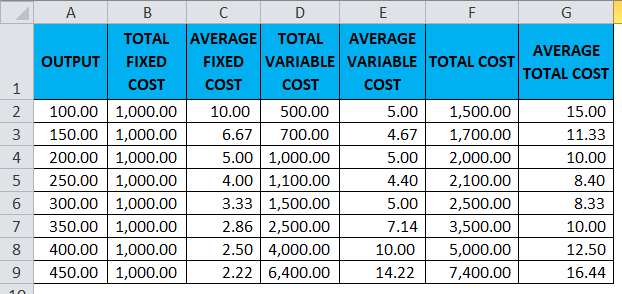

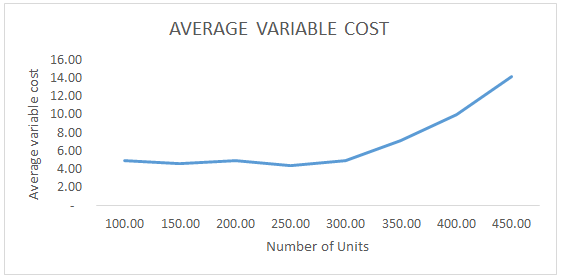

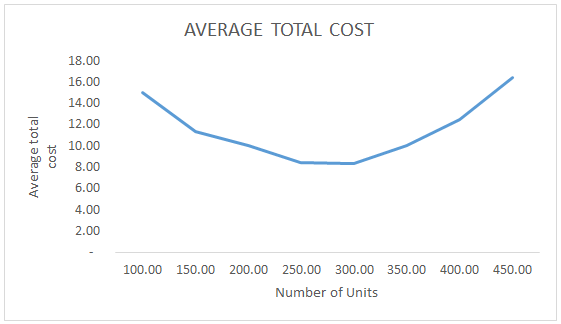

Average Total Cost Curve

As explained earlier, the total cost is higher for a small quantity of output. But as we keep increasing the quantity, average costs start declining. But now the catch is that this decline will not continue forever, and after a certain level, the average cost starts to increase. This is because of the concept of diminishing marginal return, which states that after some point, adding an additional factor of production will result in a smaller increase in output. The reason for the U-shaped curve of the Average Total Cost is that it reflects the changing relationship between average total cost and the quantity of output produced. I will elaborate will the help of an example:

Example #3

Relevance and Uses

As explained above, the average total cost gives us an idea of the per unit cost that a company will incur to produce a stipulated number of units of goods. Also, we have seen that as production increases, the total cost will drop because of the spreading of the same fixed cost over more units now. But due to diminishing marginal return, the variable cost after a particular point will start increasing. This is because of a decrease in margin productivity and a return of the additional resource we add.

The company can use this concept of the average total cost to analyze various aspects of its production and utilize its resources more efficiently. A few relevant uses of the average total cost formula are :

- Companies can see what is the optimal point of production for them and what is the level of production which minimize their cost

- If they need additional fixed costs due to an increase in demand etc., companies can analyze what should be production quantity so that the fixed cost addition will not shoot up their average total cost.

- Companies can use this concept to plan and increase production capacity to utilize their resource well.

Average Total Cost Formula Calculator

You can use the following Average Total Cost Calculator.

| Total Cost of Production | |

| Number of Units Produced | |

| Average Total Cost Formula | |

| Average Total Cost Formula | = |

|

|

Recommended Articles

This has been a guide to the Average Total Cost formula. Here we discuss How to Calculate the Average Total Cost and practical examples. We also provide Average Total Cost Calculator with a downloadable Excel template. You may also look at the following articles to learn more –