Updated July 27, 2023

Alpha Formula (Table of Contents)

What is Alpha Formula?

The term “alpha” refers to the measure of the highest return possible from a minimum amount of investment risk. In other words, alpha is the assessment tool to gauge the ability of a portfolio manager to generate a higher return on a risk-adjusted basis.

The formula for alpha can be derived by subtracting the expected return of the portfolio from its actual return. Mathematically, it is represented as,

The expected rate of return of the portfolio can be calculated using the risk-free rate of return, market risk premium and beta of the portfolio as shown below.

Therefore, the formula for alpha can be expanded as,

Examples of Alpha Formula (With Excel Template)

Let’s take an example to understand the calculation of the Alpha in a better manner.

Alpha Formula – Example #1

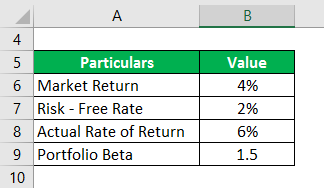

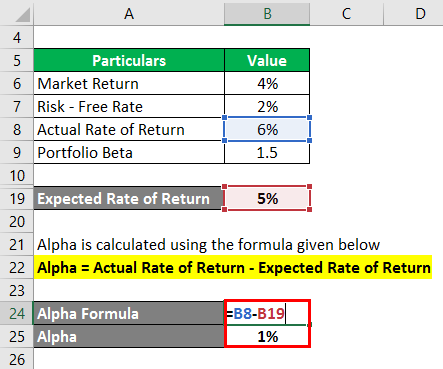

Let us take the example of a Portfolio with a Beta of 1.5 that generated an Actual Return of 6% during last year. If the current Market Return is 4% and the Risk-Free Rate is 2%, then calculate the Alpha of the Portfolio.

Solution:

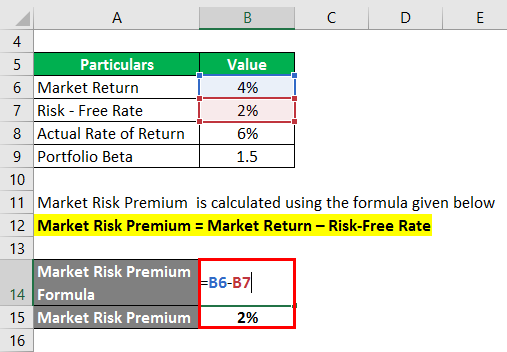

Market Risk Premium is calculated using the formula given below

Market Risk Premium = Market Return – Risk-Free Rate

- Market Risk Premium = 4% – 2%

- Market Risk Premium = 2%

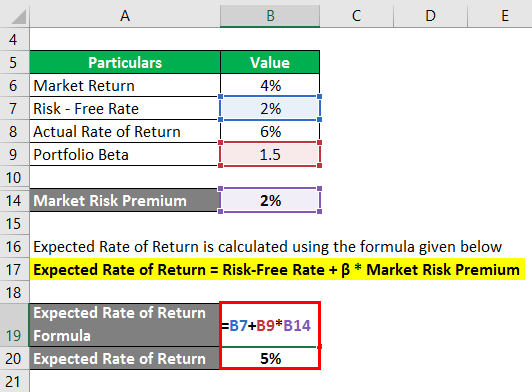

Expected Rate of Return is calculated using the formula given below

Expected Rate of Return = Risk-Free Rate + β * Market Risk Premium

- Expected Rate of Return = 2% + 1.5 * 2%

- Expected Rate of Return = 5%

Alpha is calculated using the formula given below

Alpha = Actual Rate of Return – Expected Rate of Return

- Alpha = 6% – 5%

- Alpha = 1%

Therefore, the Alpha of the Portfolio is 1%.

Alpha Formula – Example #2

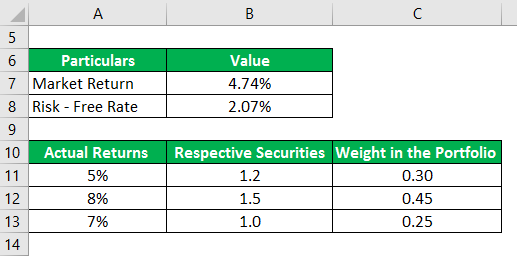

Let us take another example of a Portfolio of three securities yielding Actual Returns of 5%, 8% and 7% during last year. The beta of the Respective Securities are 1.2, 1.5 and 1.0 and their Weight in the Portfolio is 0.30, 0.45 and 0.25. S&P 500 is the suitable benchmark index for the Portfolio and it Realized a Return of 4.74% during the last one year. The 10-year treasury bill currently offers a Return of 2.07%. Based on the given information, determine whether the Portfolio Manager could generate any Alpha.

Solution:

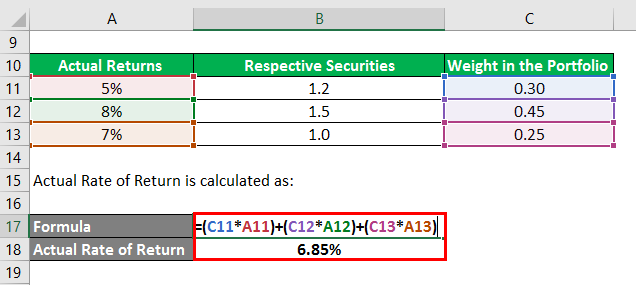

Actual Rate of Return is calculated as:

- Actual Rate of Return = (0.30 * 5%) + (0.45 * 8%) + (0.25 * 7%)

- Actual Rate of Return = 6.85%

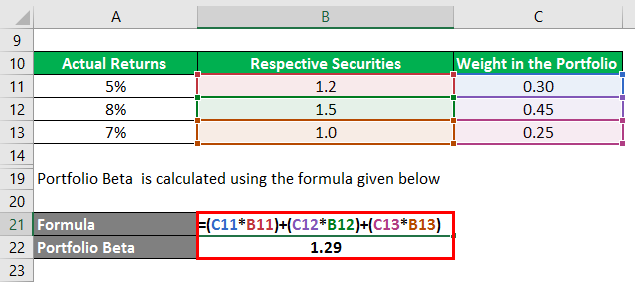

Portfolio Beta is calculated using the formula given below

- Portfolio Beta = (0.30 * 1.2) + (0.45 * 1.5) + (0.25 * 1.0)

- Portfolio Beta = 1.29

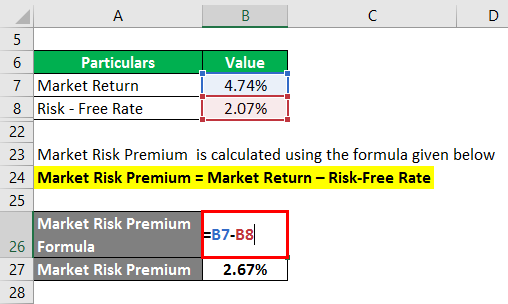

Market Risk Premium is calculated using the formula given below

Market Risk Premium = Market Return – Risk-Free Rate

- Market Risk Premium = 4.74% – 2.07%

- Market Risk Premium = 2.67%

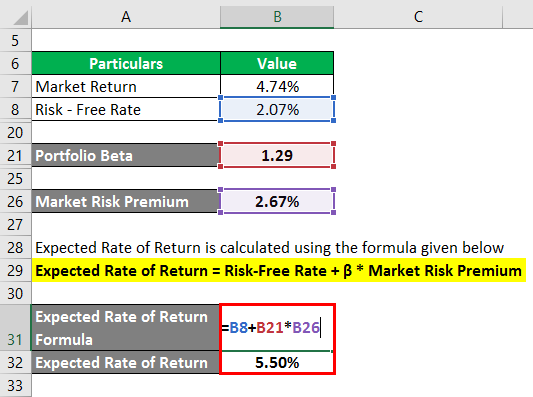

Expected Rate of Return is calculated using the formula given below

Expected Rate of Return = Risk-Free Rate + β * Market Risk Premium

- Expected Rate of Return = 2.07% + 1.29 * 2.67%

- Expected Rate of Return = 5.50%

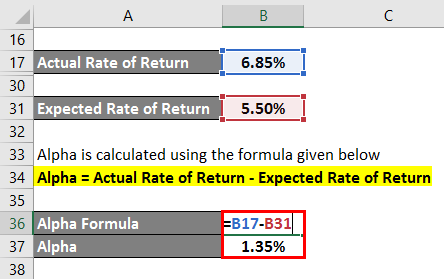

Alpha is calculated using the formula given below

Alpha = Actual Rate of Return – Expected Rate of Return

- Alpha = 6.85% – 5.50%

- Alpha = 1.35%

Therefore, the Portfolio Manager has been Skillful enough to Generate a Portfolio Alpha of 1.35%.

Explanation of Alpha Formula

The formula for alpha can be derived by using the following steps:

Step 1:

Firstly, determine the risk-free rate of return for the case. Typically, the annual yield of government bonds or treasury bills are considered to be risk-free and as such is used as the risk-free rate of return.

Step 2:

Next, determine the market return and usually, the return of the major stock market index is taken as the proxy for market return. For instance, the annual return of S&P500 can be used as the market return. Now, calculate the market risk premium by subtracting the risk-free rate from the market return.

Step 3:

Next, determine the beta of each security based on their relative price movement as compared to the benchmark index. Then, calculate the beta of the portfolio using a weighted average of all the securities. The portfolio beta is denoted by β.

Step 4:

Next, calculate the expected rate of return by using risk-free rate (step 1), market risk premium (step 2) and portfolio beta (step 3) as shown below.

Step 5:

Next, determine the actual rate of return of the portfolio.

Step 6:

Finally, the formula for alpha can be derived by subtracting the expected rate of return of the portfolio (step 4) from its actual rate of return (step 5) as shown below.

Relevance and Uses

From the perspective of a portfolio analyst, the concept of alpha is very important as it is used to assess the ability of a portfolio manager to generate a risk-adjusted return. Alpha is the excess return generated vis-à-vis the risk of the portfolio and it is purely seen as the portfolio manager’s credit. Portfolio managers who are able to beat the benchmark and generate alpha are known as active portfolio managers.

However, one of the major limitations of alpha is that the formula is very much dependent on the choice of an appropriate benchmark index. As such, the selection of a wrong benchmark index for market return can lead to misrepresentation to the prospective investors.

Alpha Formula Calculator

You can use the following Alpha Formula Calculator

| Actual Rate of Return | |

| Expected Rate of Return | |

| Alpha Formula | |

| Alpha Formula = | Actual Rate of Return – Expected Rate of Return |

| = | 0 – 0 |

| = | 0 |

Recommended Articles

This is a guide to the Alpha Formula. Here we discuss how to calculate the Alpha along with practical examples. We also provide an Alpha Formula calculator with a downloadable Excel template. You may also look at the following articles to learn more –