Updated August 29, 2023

Accrued Revenue Explanation

Businesses record accrued revenue in accordance with the principles of revenue recognition and matching. The revenue recognition principle states that revenue must be recognized when it is earned or when goods or services are provided, irrespective of whether payment has been received. This principle ensures that revenue is accurately recorded in the relevant accounting period.

The concept is more relevant to service industries where the project continues for more than one accounting period. In such cases, income is recorded when performance obligations set out in the agreement between the parties are completed. The same is as for the accounting treatment specified as per GAAP. As soon as all the obligations are completed, billing is done, and actual trade receivables are booked against accrued revenue.

Recording Accrued Revenue

Companies record accrued revenue as an adjusting entry in the financial statements. It is credited and shown on the credit side of the income statement, and accrued income receivables are debited, which is shown on the asset side of the balance sheet.

Let’s consider an example of a construction project where a builder is tasked with constructing a commercial property consisting of three floors. In this scenario, each floor represents a separate performance obligation. As each floor is completed, the construction company can recognize the proportionate revenue for that specific floor as accrued revenue. This reflects the performance obligation fulfilled for each floor.

The total contract amount for the building is $9,00,000. It will be booked by $3,00,000 when the first floor is completed.

As per the example, the journal entry for accrued revenue shall be as follows:

| Dr. Accrued Revenue Receivables | $3,00,000 |

| Cr. Accrued Revenue Income | $3,00,000 |

Examples of Accounts Receivables

Following are the examples.

Example #1: Accrual of Interest on Loan

Alan Ltd is a loan-providing company that provided a loan of $100,000 to Sam. As per the terms of the agreement, the tenure of the loan is of 5 years with an interest rate of 12% per annum. As per the policy of Alan Ltd, interest receivable on loan will be accrued every month, but the billing will be done at the end of the year only. In this case, what will the journal entry be recorded in the books of account of Alan Ltd every month for the first year concerning the interest and entry for billing of the interest?

Solution:

Interest accrued per month is calculated as

Yearly Interest = Loan Amount * Interest Per Annum

- Yearly Interest = $100000 * 12%

- Yearly Interest = $12,000

Monthly Interest is calculated as

Monthly Interest = Yearly Interest / Number of Months in a Year

Monthly Interest = $1,000

| Date |

Particulars |

Debit |

Credit |

| Month-end | Accrued revenue A/c | $1,000 | |

| To Interest Revenue A/c | $1,000 | ||

| (Entry to record accrual of the interest revenue at the end of each month) | |||

Entry is to be passed at the end of every year for billing interest

|

Date |

Particulars |

Debit |

Credit |

| 01.05.2020 | Account receivable (S) A/c | $ 12,000 | |

| To Accrued revenue A/c | $ 12,000 | ||

| (Entry to record billing of interest revenue) | |||

Example #2: Continuous Legal Service

Alan Ltd received the contract from B Ltd to provide continuous legal service for a period of three months for a particular project. As per the agreement, B Ltd will owe $ 25,000 at the end of each month to Alan Ltd, amounting to $75,000, but the invoice will be raised only after the completion of the project, i.e., at the end of the third month. Pass the necessary journal entries in the books of Alan Ltd at the end of each of the three months.

Solution:

Entry in books of Alan Ltd

|

Date |

Particulars | Debit |

Credit |

| End of 1st Month | Accrued revenue A/c | $25,000 | |

| To Revenue from legal services A/c | $25,000 | ||

| (Entry to record accrual of the revenue at the end of the first month) | |||

|

Date |

Particulars | Debit |

Credit |

| End of 2nd Month | Accrued revenue A/c | $25,000 | |

| To Revenue from legal services A/c | $25,000 | ||

| (Entry to record accrual of the revenue at the end of the second month) | |||

Example #3: Maintenance Services

A company, Alan Ltd, is involved in providing repairs and maintenance services to the plants and machinery of the cloth manufacturing industry. An Ltd provided services worth $ 10,000 on the last day of the month of April -2020 to B Ltd but raised the invoices for the same after two days, i.e., in 02-May-2020. The company is following the accrual method of accounting. How will these transactions be recorded in the company’s books of accounts?

In this case, the revenue is accrued when the services are provided to the customer, i.e., at the end of April-2020. However, the billing is done in the next month, and the payment is received only in the next month. So, the following will be the journal entries in the books of Alan Ltd.

|

Date |

Particulars | Debit |

Credit |

|

| Apr-20 | Accrued revenue A/c | $10,000 | ||

| To Service Revenue A/c | $10,000 | |||

| (Entry to record accrual of the revenue at the end of April month) | ||||

|

Date |

Particulars | Debit |

Credit |

|

| May-20 | Service Revenue A/c | $10,000 | ||

| To Accrued revenue A/c | $10,000 | |||

| (Entry to record reversal of accrual of the revenue in the previous month) | ||||

|

Date |

Particulars | Debit |

Credit |

|

| May-20 | B ltd. A/c | $10,000 | ||

| To Service Revenue A/c | $10,000 | |||

| (Entry to record issuance of an invoice in the May month) | ||||

|

Date |

Particulars | Debit |

Credit |

|

| May-20 | Cash A/c | $10,000 | ||

| To B Ltd. A/c | $10,000 | |||

| (Entry to record receipt of payment in the May month) | ||||

Example #4: Rental Services

Y took the premises of X on rent. Rent for the particular month will be paid on the 2nd of the following month. The monthly rental amount is $ 7,000. What will be the year-end entry for recording the accrual of the rent revenue in the books of X?

At the end of the year, only one month’s rent, i.e., last month’s rent, will accrue. Journal entry records the same as follows:

| Date | Particulars | Debit | Credit |

| Year-End | Accrued revenue A/c | $7,000 | |

| To Rent Revenue A/c | $7,000 | ||

| (Entry to record accrual of the rent revenue at the end of the year) | |||

Accrued Revenue in Balance Sheet

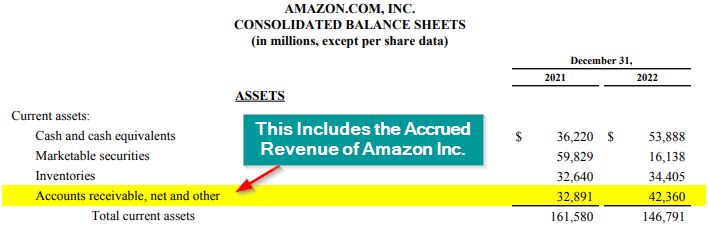

Accrued revenue is shown in the balance sheet as an asset. They are recorded as receivables and form part of the assets in the balance sheet.

For example, for Amazon Inc. they record the accrued revenue that they are yet to receive with the “Accounts receivable, net and other” as customer receivables.

Here is the accrued revenue receivables on their balance sheet.

Difference Between Accrued Revenue and Accounts Receivable

Here is how the accounts receivables are different from accrued revenue.

| Aspect | Accrued Revenue | Accounts Receivable |

| Purpose | Ensures accurate income recognition in the proper accounting period. | Tracks outstanding payments and customer obligations. |

| When does it Occur? | Recognized before actual billing or receipt of payment. | Arises the customer is invoiced for the delivered goods and services . |

| Example | Services provided in the current month but not yet billed to the customer. | Amount pending from customer who received the purchased goods with bill. |

| Payment Received Timing | Payment is received after the company recognizes the revenue. | Company receives payment first, and then they recognize it as revenue. |

Advantages & Disadvantages

| Advantages | Disadvantages |

| It follows the accrual basis of accounting and records the income as and when it is earned. This gives a fair view of the profitability of the company. | Accrued receivables are not liquid, as it takes time to convert them into cash. This is why a large amount of accrued revenue negatively impacts the working capital. |

| It is listed as an asset on the company’s balance sheet, providing transparency into the company’s accounts, making management aware of the anticipated future receipts. | The real amount received later might be different because accrued revenue is recorded based on an estimated amount to be received. |