Updated July 1, 2023

What are Accounting Transactions?

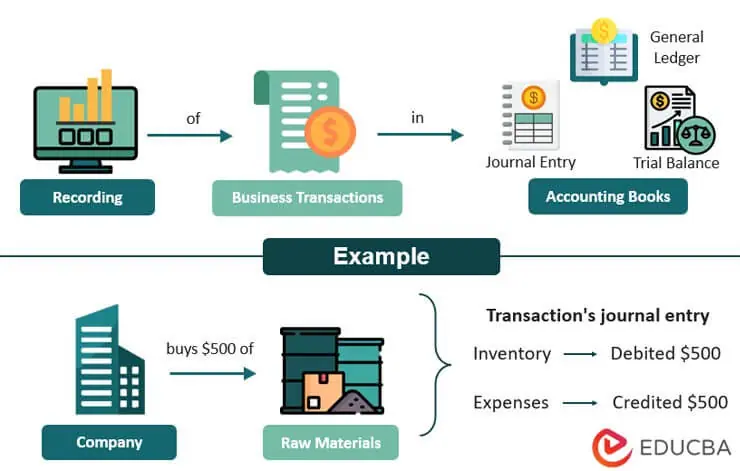

Accounting transaction refers to the process of recording, adjusting, and reporting businesses’ and individuals monetary transactions using accounting principles. It can include buying and selling goods/services, paying interest on loans, transferring money between accounts, and more.

These transactions can use cash, credit, or other non-cash payment methods. The article outlines some of the accounting transactions examples.

Whenever an accounting transaction occurs, the parties involved usually record it in two different accounts. Depending on the nature of the transaction, they might add money to one account (called debiting) and take away money from the other account (called crediting). Keeping accurate records of transactions is crucial for businesses to monitor their finances, create reports, and make informed decisions about the company’s future.

Accounting Transactions Examples List

Here are examples of accounting transactions that we encounter daily:

|

Example |

Description |

| Withdrawing cash from an ATM | Withdrawing money from a bank account decreases cash balance and increases bank fees (if applicable). |

| Making a credit card payment | Paying a credit card bill decreases cash or bank balance and reduces liabilities (the amount owed to the credit card company). |

| Purchasing gasoline for a car | Purchasing gasoline with cash, credit, or debit card resulting in a decrease in cash or bank balance and an increase in expenses. |

| Giving money to charity | Giving money to a charity decreases cash or bank balance and increases expenses (for tax purposes). |

| Selling items on an online marketplace | Selling things results in an increase in cash or bank balance as well as revenue. |

| Paycheck deposit | Depositing a paycheck into a bank account, which results in a decrease in cash and an increase in bank balance |

| Buying a movie ticket | Purchasing a movie ticket results in a decrease in cash or bank balance and an increase in expenses. |

| Ordering food from a restaurant | Purchasing food from a restaurant reduces your cash or bank balance and increases expenses. |

| Purchasing a train ticket | Buying a train ticket reduces your cash or bank balance and increases your expenses. |

| Paying a parking ticket | It entails paying a fine for a parking violation, which decreases cash or bank balance and increases expenses. |

Accounting Transactions Examples

Example #1

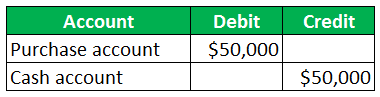

A shopkeeper, Anthony, wants to renovate their shop. Thus, he ordered fixtures and fittings worth $50,000 in cash consideration. Account for the transaction.

Solution:

Step 1:

The shopkeeper identifies the transaction type, accounts, and amount as:

Type: Purchase

Accounts: Purchase account and cash account

Amount: $50,000

Entry Format: Debit the purchase account and credit the cash account.

Step 2:

Anthony records the following journal entry after making the payment in cash:

Example #2

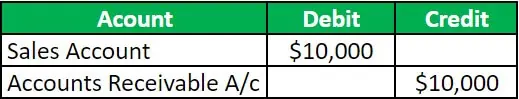

Sophia sells a car on credit for $10,000 and will receive the payment the following month. Make a journal entry for the transaction.

Solution:

Step 1:

Sophia identifies the transaction details as follows:

Type: Sale

Accounts: Sales account and Accounts Receivable account

Amount: $10,000

Entry Format: Debit the sales account and credit the accounts receivable account.

Step 2:

Sophia records the journal entry after selling the car as follows:

Example #3

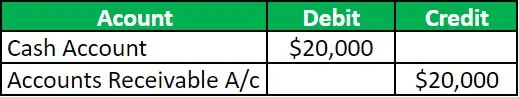

A business owner, Alex, invested $20,000 of his company Array Software’s money into a newly started restaurant business named Basil Pvt. Ltd. He also took a loan of $10,000 for the new venture. Record the transaction in the books of accounts.

Solution:

a) Money from Array Software Business:

Step 1: Alex identifies the following in the transaction:

Type: Business Transaction

Accounts: Cash account and accounts receivable account.

Amount: $20,000

Entry Format: Debit the capital account and credit the accounts receivable account.

Step 2:

Alex records the following journal entry for the Array Software business:

b) Borrowings from Bank for Basil Pvt. Ltd.

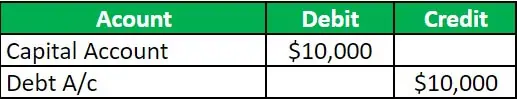

Step 1: Alex identifies the transaction as follows:

Type: Loan

Accounts: Debt account and capital account

Amount: $10,000

Entry Format: Debit the capital account and credit the debt account.

Step 2:

Alex records the following journal entry for Basil Pvt. Ltd:

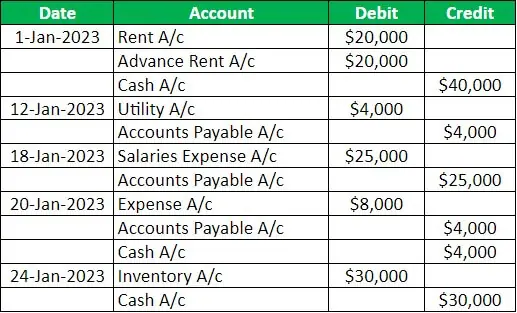

Example #4

A new business owner, Olivia, starts business operations in a new region. The business’s accounting team hands over the list of quarterly transactions. Account for the list of transactions.

Given,

|

Date |

Expenses | Amount |

Status |

| Jan 01, 2023 | Rental expenses | $20,000 | Advance payment for 1 month |

| Jan 12, 2023 | Electrical expenses | $4,000 | – |

| Jan 18, 2023 | Salaries of new employees | $25,000 | Wages to pay on the 1st of next month |

| Jan 20, 2023 | Marketing expenses | $8,000 | $4,000 paid in cash and $4,000 next month |

| Jan 24, 2023 | Purchase of Inventory | $30,000 | Paid in full |

Solution:

Step 1:

Olivia identifies all transactions as follows:

1. Record rental expenses:

Type: Expense

Accounts: Rent, advance rent, and cash account

Amount: $20,000 & $40,000

Date: 01-Jan-2023

Entry Format: Debit the rent and advance rent account while crediting the cash account.

2. Record electrical expenses:

Type: Expense

Accounts: Utility account and Accounts Payable account

Amount: $4,000

Date: 12-Jan-2023

Entry Format: Debit the utility account and credit the accounts payables account.

3. Keep track of new employee pay:

Type: Internal Expense

Accounts: Salaries expense and accounts payable account

Amount: $25,000

Date: 18-Jan-2023

Entry Format: Debit the salaries expense account and credit the accounts payable account.

4. Record marketing expenses:

Type: Expense

Accounts: Expense account, accounts payable, and cash account

Amount: $4,000 & $8,000

Date: 20-Jan-2023

Entry Format: Debit the expense account and credit the accounts payable & the cash account.

5. Purchase inventory:

Type: Purchase

Accounts: Inventory and cash account

Amount: $30,000

Date: 24-Jan-2023

Entry Format: Debit the inventory account and credit the cash account.

Step 2:

Olivia records the following journal entries:

Types

Types Based on Objective

1. Business Transactions

It includes all transactions that a company makes to run its operation, generate income, or make expenses.

Example: Company ABC produces a pen by incurring a production cost of $2 and sells it at $5 to make a profit of $3.

2. Non-business Transactions

Non-business interactions don’t involve making sales or purchases but charitable giving or other acts of civic duty.

Example: Company ABC gives $1 of its profits to a charity to educate young children.

3. Personal

Personal trades include actions taken for purely personal reasons, such as individual purchases.

Example: The CEO of the ABC Company buys a car for their family for $10,000.

Types Based on Exchange of Money

1. Cash:

The most frequent type of trade is a cash payment, which individuals or companies make using cash (paper money), cheques, or cards.

Example: Ana purchases groceries for $300 at a supermarket and pays using cash.

2. Non-Cash:

Any transaction that does not involve exchanging actual money comes under non-cash transactions.

Example: Ana buys a new house by borrowing $100,000 from the local bank and keeping the house as a mortgage, making no actual cash payments.

3. Credit:

In the case of credit transactions, the buyer promises to pay the balance at a future date rather than making the payment immediately after purchase.

Example: Ana purchases baking tools on credit to open a small business, promising to pay the owner after three months.

Types Based on Institutional Relationships

1. External:

It involves the exchange of products and services for cash between two parties, where one of the parties is external to the business.

Example: Company PQR purchases raw materials from R-M Pvt. Ltd. on credit. It is an external transaction as R-M Pvt. Ltd is external to Company PQR.

2. Internal:

Internal transactions refer to transactions within a company that does not involve sales, like estimating asset depreciation.

Example: Company PQR distributes bonuses to its employees on the company making a huge profit. As the transactions occur within the company, it is an internal transaction.

How to Record Accounting Transactions?

Companies can record accounting transactions in the following manner:

Step 1: Identify the Transaction

- First, companies must identify the type of transaction, like purchase, sale, payment, etc.

- They should then determine the accounts involved and decide which account to debit or credit.

- For example, in a sale, the accounts involved could be the sales revenue and accounts receivable, where they credit the sales account and debit the accounts receivable.

Step 2: Make a Journal Entry

- After identifying the transaction, companies record it in the journal, a chronological record of all trades.

- It includes the date, account names, and debit & credit amounts in the respective accounts.

Step 3: Post the Entry to the Ledger

- After recording the transaction in the journal, businesses post the details of the accounts to their respective ledgers.

- A general ledger records all accounts a business uses and details each account’s individual balance, activity log, and status.

- For instance, the accounts receivable log can help the firm acknowledge the value they are yet to receive from customers.

Step 4: Create an Unadjusted Trial Balance

- Businesses create a trial balance at the end of each accounting period.

- It ensures that their debits and credits are in proper balance and that they have recorded all transactions accurately.

- It also helps accountants discover any discrepancies or errors in the journal entries.

Step 5: Adjust the Journal Entries

- After preparing an unadjusted trial balance, companies can identify errors and correct and adjust the corresponding journal entries.

- Simultaneously, businesses that use an accrual accounting method make several journal entries at the end of the accounting period.

- Thus, they can consider these new entries to create an adjusted trial balance.

Step 6: Adjust the Trial Balance

- Firms make an adjusted trial balance after adjusting any incorrect journal entries.

- It ensures that the credits and debits balance without any fault.

Step 7: Prepare Financial Statements

- Finally, the business prepares financial statements, such as income statements, balance sheets, and cash flow statements.

- Accountants use the information in the adjusted trial balance for preparing the statements.

Step 8: Closing the Entries

- Firms close their entries after efficiently creating financial statements for the accounting year.

- It means they transfer all records from the temporary to the permanent account and start new books of accounts for the new financial year.

Things to Remember

- Accuracy: Record all accounting transactions accurately to avoid errors and misstatements.

- Timely: Record transactions on time to accurately present the organization’s financial position and performance.

- Consistency: Use consistent accounting methods and procedures to record transactions.

- Accounting Standards: Follow the accounting rules per accounting standards like IFRS and US GAAP – Generally Accepted Accounting Principles (United States).

- Completeness: Ensure all records in the financial books are complete and correct.

- Relevance: Determine a transaction’s importance or relevance before recording it in the books.

- Proper documentation: Maintain adequate documentation, such as invoices, receipts, and bank statements, to ensure the accuracy of the transactions.

- Internal controls: The business should have internal control over the transaction accounting’s recording, reporting, and authorizing.

Advantages & Disadvantages

|

Advantages |

Disadvantages |

| Financial Record-Keeping: It assists in maintaining a systematic and accurate record of all business activities. | Time-consuming: It can take up a lot of time, particularly for businesses with a high volume of transactions. |

| Financial Analysis: It enables companies to analyze their financial performance, identify areas of strength and weakness, and more. | Complex & Vulnerable to Errors: These accounting rules can be complex, necessitating specialized knowledge to ensure accuracy and compliance with accounting standards. |

| Better Decision Making: It helps businesses make informed decisions and avoid financial risks by accurately and reliably recording transactions. | Costly: Maintaining accurate accounting transactions necessitates substantial resources, such as personnel, software, and training, which can be prohibitively expensive for small businesses. |

Frequently Asked Questions (FAQs)

Q1. What are Basic Transactions?

Answer: Basic transactions are events where two or more parties exchange goods, services, or money. The parties involved in the transaction record it in their accounting systems to track the flow of funds.

For example, Mary purchases a handbag from Purses&Purses Ltd for $1,500 in cash. The company records this transaction for future references, such as calculating sales, revenue, etc.

Q2. What are five Accounting Transactions Examples?

Answer: Here are five examples of financial transactions:

- Using a credit card to purchase goods or services

- Depositing into a savings account

- Renting an apartment from a landlord

- Using an ATM to get cash

- Money transfer between bank accounts

Q3. What are the four Basic Steps of a Transaction?

Answer: The four steps of transactions are:

Steps:

#1 Record the transaction by identifying the involved parties, accounts affected, transaction’s date, amount, and description.

#2 Post the details to the appropriate general ledger accounts to ensure the financial statements are accurate and reflect the organization’s financial position.

#3 Prepare a list of general ledger accounts and their respective balances to ensure the total debits equal the credits. It can help detect any errors occurred during transaction recording or posting.

#4 Use information from the general ledger to make financial statements like the balance sheet, income statement, and statement of cash flows that summarize the organization’s financial performance.

Q4. What are the two Basics of Accounting?

Answer: The two accounting basics are accrual and cash accounting.

Accrual Accounting: It is when businesses record the transaction when they incur, regardless of when they make or receive the payment. For example, a company sells $450 on credit in March. Even if the customer pays the value in April, the company has to record the $450 in their accounting books for March.

Cash Accounting: It is when companies record financial transactions only after they receive or make the payment. For instance, a retail store sells a product for $2,500 in March but gets the final amount in May. So, the store owner will record this transaction in the books for May rather than March.

Q5. What is an Accounting Transactions Example in Everyday Life?

Answer: Buying groceries at a store is an example of an everyday accounting transaction. The two parties involved are the customer and the store. The store would record the transaction as a sale in their accounting system, and the customer would pay for the groceries with cash or a credit card.

Recommended Articles

This is a guide to Accounting Transactions Examples. Here we also explain the definition and examples of accounting transactions. You may also have a look at the following articles to learn more –