Updated July 29, 2023

Table of Content

Difference Between Above the Line vs Below the Line

ATL activities, such as advertising, encompass broader territories and do not target specific customers. The main focus behind adopting ATL activity is to make people aware of the product. In this case, the people buying the product weigh less than the awareness raised. Below the Line or BTL advertising consists of activities that create a real emotional connection with the targeted customer. In this case, it is imperative to convert the target segment into a buyer instead of building a brand. Sometimes these activities are also called direct marketing activities.

Different Ways in Which Companies Use ATL

- Television: As per a statistic, there were around 197 million TV-owning households in India as of 2018. This exhibits the power of advertising the product through this channel. The impact of advertising via TV is huge. It has a reach right from the local to the national level. Sometimes it may also reach the international level. Also, advertising via TV has an added advantage of a video that gives the users a real-life-like experience.

- Radio: Forgetting is a human instinct. Hence to leave a long-lasting image in the customers’ minds, it is imperative to expose people to the product several times. But since mediums such as TV are very expensive, hence Radios come to the rescue here. Also, the reachability of the radio ranges from the local to the national level.

- Printing (Newspapers and Magazines): Newspapers are also a mode of advertising. In this case, the marketers go for images or text. And this mode has very high reachability as compared to others. Also, this is a relatively less expensive mode as compared to TV. The person retains the added advantage of having the image as long as they keep the newspaper, enabling them to check the advertisement diligently. Similar is the case with magazines. Through magazines, marketers can reach out to the specific niche of the masses.

Advantages of Above the Line marketing

- It has got a wider reach.

- An easy and effective way to connect with people since it involves either images or videos that convey the message well.

- It helps marketers to build brand value by reaching out to the masses and raising awareness about the product.

Below are Some of the Below the Line Activities

- Out-of-home (OOH) advertising: The main rationale behind this advertising method is to target customers outside their homes. This can be seen anywhere outside your home, maybe on a large wall, on buses, billboards, etc. This attracts a lot of attention partly because of the huge size of the advertising and the long time it is displayed.

- Marketing via mail is more personal, where marketers go for one-on-one communication with the customer. For instance, we get emails from e-commerce websites such as Amazon and Myntra related to ‘coupons especially for you’, or customers also bought ‘this’ are some examples.

- Sponsorships: This is also a method that companies adopt. This can be seen in the case of sports such as cricket, Football, etc. In football, for instance, there is always a cut-throat competition between Pepsi and Coke.

- Brand Activation: The main objective of this method is to create a long-lasting relationship with the customer by interacting and providing a soothing experience. For instance, companies introduce products by reaching the target groups in an exhibition.

Advantages of Below the Line

- This mode of advertisement is extremely target oriented

- The returns on the initial investment are better, and the leads can track better than the ATL activities.

- In this type of advertising, the companies can Customize as per the requirement of the target segment.

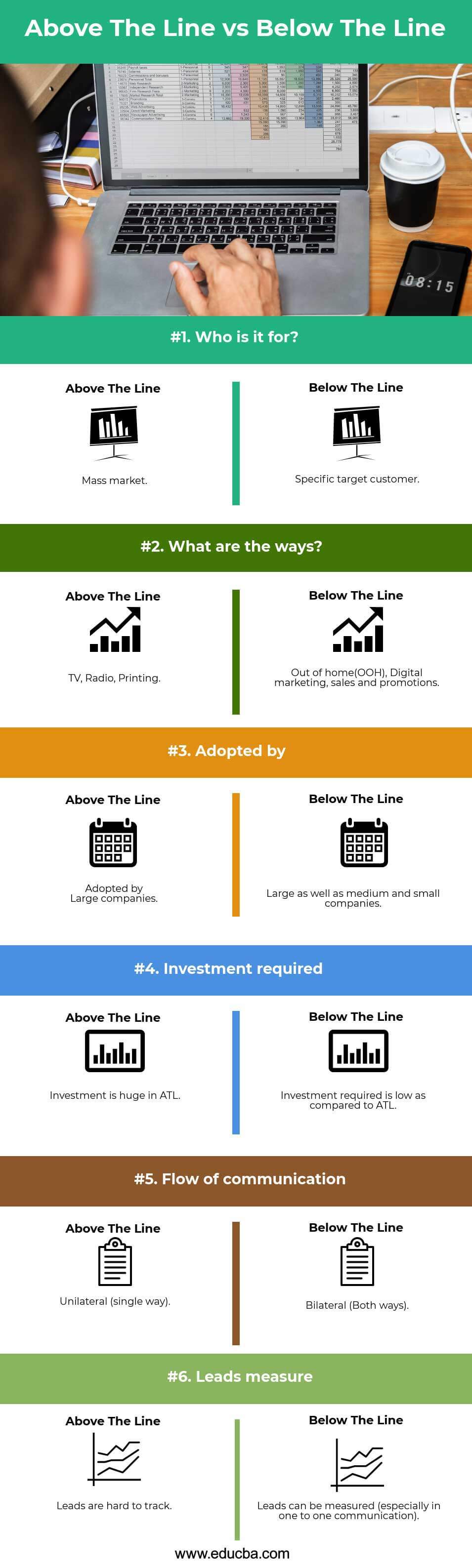

Head-to-Head Comparison Between Above the Line vs Below the Line (Infographics)

Below is the top 6 difference between Above the Line vs Below the Line

Key Differences Between Above the Line vs Below the Line

Let us discuss some of the major differences between Above the Line vs Below the Line:

- ATL is an activity with no specific target, whereas BTL consists of activities targeting a specific target group.

- The modes used in the case of ATL are TV, radio, and print(Newspapers and magazines), whereas in the case of BTL, we operate out of home (OOH), digital marketing, sales, and promotions.

- Large companies generally adopt ATL, whereas BTL is adopted both by large and small companies.

- The investment required by ATL is high as compared to BTL activities

- A flow of communication is unilateral in the case of ATL, but in the case of BTL, the communication is bilateral

Above the Line vs Below the Line Comparison Table

Let’s look at the top 6 Comparisons between Above the Line vs Below the Line.

| The Basis of Comparison |

Above the Line |

Below the Line |

| Who is it for? | Mass market | Specific target customer |

| What are the ways? | TV, Radio, Printing | Out-of-home (OOH), Digital marketing, sales, and promotions |

| Adopted by | Large companies | Large as well as medium, and small companies |

| Investment required | Investment is huge in ATL | The investment required is low compared to ATL |

| Flow of communication | Unilateral (single-way) | Bilateral (Both ways) |

| Leads measure | The Leads are hard to track | Leads can be measured (especially in one-to-one communication) |

Conclusion

Based on the requirements of the business, either of the advertising methods can be used by the companies. If the companies have to go just for raising awareness about the product or service at a huge mass level, then the company can go for Above line advertising; otherwise, if the requirement is targeting the specific customer and converting the leads, then go for Below line advertising.

Recommended Articles

This has been a guide to Above the line vs below-the-line. Here we also discuss the Above line vs Below the line key differences with infographics and comparison table. You may also have a look at the following articles to learn more –