What is the Evolution of Money?

Money has not always been as simple as tapping a phone or swiping a card. Long before digital wallets and online transfers, people struggled with basic trade, exchanging goods directly, carrying heavy metals, or relying on fragile paper notes. Each limitation pushed societies to innovate, leading to the gradual evolution of money. From bartering and commodity money to coins, banknotes, cards, and digital payments, money has evolved to suit changing economic needs and lifestyles. Understanding the evolution of money helps us see why modern currency exists in its current form and how economic progress has shaped the way we exchange value today.

In this blog, we will explain the evolution of money in detail, along with some lesser-known and interesting facts about each stage.

Table of Contents

- Introduction

- Characteristics of Money

- Stages of Money Evolution

- Infographic: Timeline + Examples

- Interesting Facts

Characteristics of Money

Money has evolved to better fulfill certain essential characteristics. Each new form of money emerged to overcome the limitations of earlier systems and improve efficiency in trade and transactions.

- Durability: Money should retain its value over time, even with physical damage. This is why societies moved from perishable commodities to metal coins, paper notes, and digital money.

- Divisibility: Money must be easily divisible into smaller units to allow payments of different values. Coins, notes, and digital balances solved the problem of indivisible goods in barter systems.

- Portability: Money should be easy to carry and move from one person to another. Heavy commodities and metal bars led to the introduction of lighter coins, paper currency, and eventually electronic money.

- Acceptability: People must widely accept money as a medium of exchange. Government-backed currencies and regulated digital payment systems increased public trust and acceptance.

- Uniformity: Each unit of money should be identical in value and appearance. Standardized coins, printed banknotes, and digital balances ensure fairness in transactions.

- Limited Supply: Money should have a controlled supply to maintain its value. Modern monetary systems regulate supply through central banks, while cryptocurrencies use predefined limits.

Stages of Money Evolution

The table below outlines the various stages in the history of money.

| Evolution Stage | When, Where & Why Did It Start? | Examples |

| Barter System | When?: Around 6,000 BC Where?: Mesopotamia; later adopted by the Phoenicians. Why?: In early societies, people often had more of some goods and less of others. To get what they needed, they traded their extra goods for what others had. |

Food, spices, weapons. |

| Commodity | When?: Around 2,500 BC Where?: Mesopotamia Why?: Issues were arising in the barter system. For instance, one person might have milk and need grains, but the person with grains doesn’t need milk. It also became hard for businesses to get the resources they needed. So, people started using specific items as money. |

Barley, wheat, livestock, cocoa beans, tea, tobacco, salt, and seashells. |

| Metal Coins | When?: Around 1,000 BC Where?: China Why?: People found that commodities were hard to store & transport, perished quickly, and had different trade values. So, they started using metals like gold and silver to make coins. These coins were long-lasting and easier to carry and trade than commodities. |

Electrum coins (gold-silver alloy), gold coins, silver coins, Bronze coins, Nickel coins. |

| Paper Money | When?: 806 AD Where?: China Why?: Trading large amounts of money with coins became a problem. So, during the Tang dynasty, people used paper bills (promissory notes) as a promise to pay the amount stated. True paper money didn’t come into use until the 11th century, during the Song dynasty. |

Promissory notes, Exchange certificates, Banknotes. |

| Credit | When?: Early 1750s Where?: England Why?: Working on the promissory note system, people started using checks, which were handwritten notes known as drawn notes. It was to streamline payment procedures and reduce risks. |

DD, Cheques. |

| Plastic Money | When?: 1958 (Credit Card), 1966 (Debit Card) Where?: Fresno, California (Credit Card), Delaware (Debit Card) Why?: Instead of carrying paper money around, Bank of America introduced the first credit card, working on a similar concept of credit that had already been in use. Later, as an alternative to carrying cash or a checkbook, the Bank of Delaware started a pilot program for debit cards. |

Credit cards, Debit cards. |

| Electronic Transfer | When?: 1872 (Telegraph), 2011 (GPay) Where?: Denver, Colorado, by Western Union Why?: Western Union started the first telegraph transfer to make it easier to send money across borders or to distant places. It allowed people to send money using the telegraph. By the 1990s, banks introduced Internet banking, allowing customers to manage their accounts and transactions online. Then, in 1998, Peter Thiel, Max Levchin, Luke Nosek, Ken Howery, and Yu Pan started PayPal, making digital payments simpler. |

Telegraph wire transfer, ecash, PayPal, Google Pay, PhonePe, Bhim. |

| Digital Money | When?: 2009 (Bitcoin) Where?: Unknown Why?: Satoshi Nakamoto, whose true identity is still unknown, created the first cryptocurrency, Bitcoin, in 2009. Seeing people frustrated with online transactions and worried about the global economy, Nakamoto wanted to give individuals more control over their money. Using a consensus-based approach, the idea was to create a system where no third party had exclusive control over money. |

Bitcoin, Ripple, Ethereum, Dogecoin. |

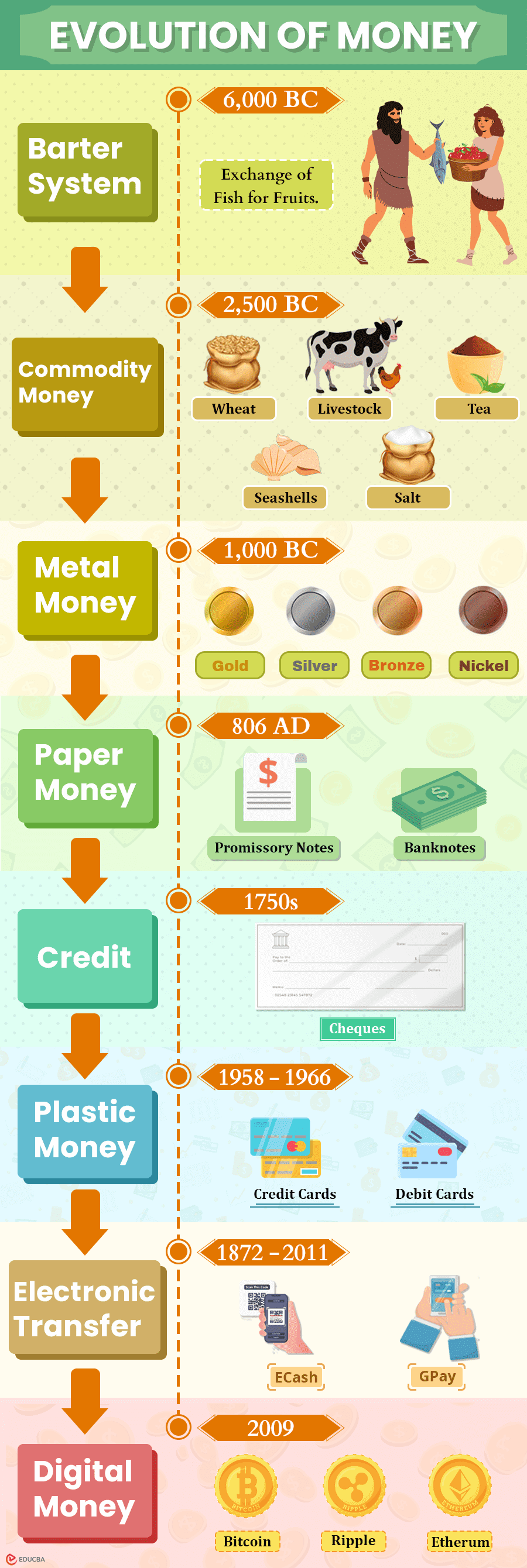

Evolution of Money Infographic: Timeline + Examples

Here is an image illustrating the history of money timeline.

Interesting Facts About the History of Money

#1. Barter System

- Bartering, which originated with money, still exists today, especially in informal economies and among traders who exchange goods or services without money. For instance, people in East India (Assamese and Meghalayan) participate in Jonbeel Mela, a three-day festival where they exchange goods, keeping the money exchange history and system alive.

- The barter system has reemerged during financial crises, such as:

- The Great Depression in the US (1929-1939)

- Hyperinflation in Bolivia (1985)

- Global Recession (2008) – Citizens from many countries, including Argentina and North Carolina, turned to bartering.

- If COVID-19 had caused a severe recession, bartering likely would have become common again.

#3: Metal

- Before metal coins became official currency, metal objects like ingots, unmarked bars, and silver bullion were used as commodity money.

- The first official coinage was the “Lydian Lion” coins, made of electrum (an alloy of gold and silver). These coins featured a royal lion symbol, marking the beginning of stamping coins with rulers’ faces or cultural symbols to verify authenticity.

- Coins came in various shapes and sizes; their weight determined their amount, not their legal value.

#4. Paper Money

- As managing large amounts of coins became difficult because they were heavy, in the 13th century, both China and parts of Europe began exploring the use of paper money. By the 13th century, the Chinese were already using paper notes extensively.

- In the 13th century, travelers like Marco Polo and William of Rubruck introduced Europeans to the concept of paper money, but Europe was not ready for paper notes. It took another 300 years for them to gain popularity.

- In the 17th century, due to high gold inflation, Sweden became the first European country to adopt paper money.

#5. Credit

- The credit system existed long before it became official with the invention of checks. Most kingdoms used promises to pay back in the future to buy goods in the present, which inspired the modern credit system.

- In the 1st century AD, Persian banks gave out credit, calling it “sakk.” Later, the spelling “check” became common in the US and worldwide. In 1828, “cheque” by the French became the common spelling around most parts of the world.

- Although checks might seem like a common payment method, their use has declined significantly as people shift to digital payments.

- Banks began issuing demand drafts as a more secure form of payment than checks. Unlike checks, where the amount is deducted from the bank once it processes the check at the receiver’s end, in a DD, the bank deducts the amount as soon as it issues it, making it a prepaid, safer instrument.

#6. Plastic Money

- In 1950, Frank McNamara was dining at a diner in NYC when he found he didn’t have his wallet. After promising to pay for his meal the next day, he came up with the idea for the first credit card. He created the “Diners Club” card from cardboard that he could use to pay for expenses and, at the end of the month, would clear the balances. Around 27 restaurants in New York accepted payments from the initial Diners Club.

- In 1966, the Bank of Delaware tried debit cards as an alternative to cash and checks. This early system struggled due to a lack of technology to connect merchants with banks, especially across state lines. Debit cards gained widespread acceptance after the introduction of ATMs in 1969.

#7. Electronic Transfer

The evolution of electronic looks as follows:

-

SWIFT

- Full form: Society for Worldwide Interbank Financial Telecommunication

- A network that all financial institutions use to send and receive information about financial transactions.

-

ACH

- Full form: Automated Clearing House

- Started in the US, it was a network that enabled financial institutions to make electronic payments to one another.

-

EFT

- Full form: Electronic Funds Transfer

- EFT broadened electronic payments to cover direct deposits, electronic bill payments, and point-of-sale transactions.

-

ATM

- Full form: Automated Teller Machine

- Introduced in the 1980s along with debit cards,

- are machines you can use for basic banking tasks like withdrawing cash, depositing money, and checking your balance.

-

RTGS

- Full form: Real-Time Gross Settlement

- Starting from the 20th century, banks and financial institutions have used RTGS to make instant money transfers.

-

UPI

- Full form: Unified Payments Interface

- Developed by NPCI in India, UPI allows people to send money to others using their smartphones.

Final Thoughts

The evolution of money reflects humanity’s constant effort to make trade simpler, safer, and more efficient. Each stage, from barter to digital currencies, emerged to address the limitations of the previous system, such as a lack of convenience, security, portability, or trust. As societies grew more complex, money evolved to support larger economies, faster transactions, and global connectivity.

Today, money is no longer just physical cash; it exists as data, code, and secure digital records. While new forms like digital payments and cryptocurrencies continue to reshape how we exchange value, the core purpose of money remains unchanged: to act as a trusted medium of exchange, a unit of value, and a store of wealth. Understanding the evolution of money helps us appreciate modern financial systems and prepares us for the future of currency and payments.

Recommended Articles

We hope you enjoyed this article on the history and evolution of money. Here are a few recommendations for similar blogs.