How to Manage Your Money?

Indeed, money can’t buy happiness, but it instills a sense of security if managed correctly. So now the question is – “what is the right way to manage money?” Well, it is certainly much more than just making ends meet. However, you don’t have to be a finance expert to be able to manage your own money; you just need to understand some of the basics of how money works.

Undoubtedly, life becomes much easier if you have the required financial skills, as it helps you maintain a healthy credit score and ensures that you don’t end up with debt beyond your capacity to repay. However, suppose you are bad with money management and live paycheck to paycheck despite earning a decent amount of money. In that case, you are at the right place, as this article will provide more useful tips to improve your money management skills.

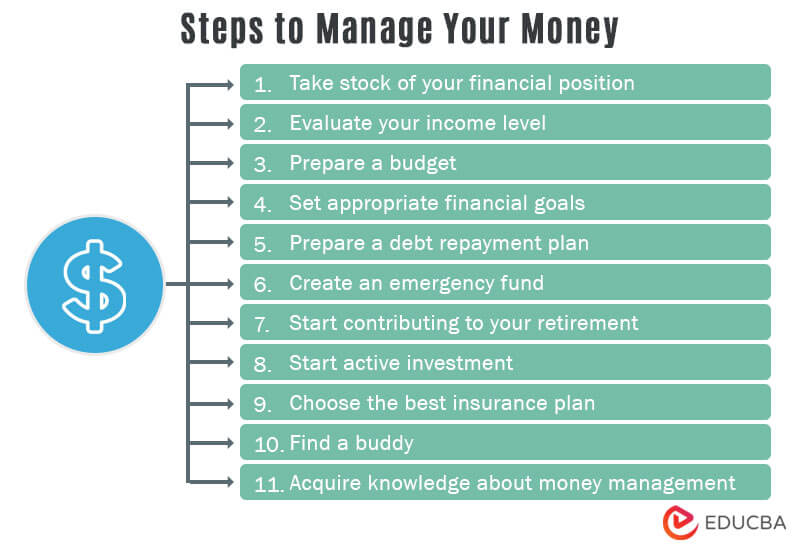

Steps to Manage Your Money

You can manage your money efficiently by following the below-mentioned steps one after the other.

1. Take Stock of your Financial Position

Before hopping onto any money management strategy, taking stock of your present-day financial position is very important. So, you need to consider all outstanding obligations, large expenses, available assets, etc., to understand your financial position accurately.

2. Evaluate your Income Level

You must look at your after-tax income (not gross income) to determine if it aligns with your expectations. This is because your income level forms a crucial part of the budget. If you are satisfied with your current income level, you can pick up a side hustle that fits your daily schedule. such as creating an online course and selling digital products, etc.

3. Prepare a Budget

Without a definite plan, you often overspend and, eventually, find yourself short on money. Hence, it is necessary to build a budget, stick to it and say “no” to avoidable expenses so that your savings aren’t hurt. So, take out some time and prepare a budget.

4. Set Appropriate Financial Goals

Setting the right set of financial goals is one of the most important steps in the process of money management. These are like milestones that help you stay focused and keep you motivated towards achieving them. So, you should determine the role of money in your life and set clear and precise financial goals based on that.

5. Prepare a Debt Repayment Plan

Debt is the biggest financial burden that potentially dents your ability to accumulate and build wealth for the future. So, you should take debt seriously, prioritize its repayment, and close it as soon as possible. Hence, choose a repayment plan that suits your financial position and repayment ability. It will ensure that debt doesn’t stand between you and your financial goals.

6. Create an Emergency Fund

An emergency fund is the best way to prepare yourself for any unexpected future expenses. Many experts advocate 3 to 6 months of expenses to be maintained in an emergency fund. However, the amount of money to be maintained in an emergency fund depends on your ability to absorb risk. Nevertheless, you should set up a separate bank account for the emergency fund.

7. Start Contributing to your Retirement

You may think that contributing to a retirement fund is an unnecessary tip if you are at the start of your career. However, it is best to start putting money into a retirement fund as early as possible. Early starters enjoy the power of compounding that ensures that the small amount of money that you contribute today will grow to become huge and boost your retirement fund significantly in the future.

8. Start Active Investment

Your money management takes a leap and goes to the next level if you can make your money work for you. In other words, start investing your money with the objective of building long-term wealth. Investments made over a long period of time help your money grow gradually every year, often resulting in outstanding returns. So, start investing actively in mutual funds, equity, etc.

9. Choose the Best Insurance Plan

Insurance can be a tad bit expensive case you are adequately insured. So, evaluating the insurance plans at least once a year is advisable to check out for relatively economical options. You must consider a few insurance service providers to get the best deal. However, while looking for cheaper options, please don’t compromise on insurance coverage.

10. Find a Buddy

If you can find someone with similar financial goals, it is best for you, as this buddy can help keep you on track. Frequent discussions with this buddy keep you focused and compel you to track your progress toward your financial goals.

11. Acquire Knowledge about Money Management

You should continue gaining more and more knowledge about personal finance management, which will never hurt you. You can employ the new information to adjust your money management strategies. Basically, you learn and earn – it is as simple as that.

Conclusion

So, there is no doubt that personal finance is a tricky business without the knowledge of money management. However, money management itself isn’t that difficult, but getting started is the most difficult part. Hence, it is crucial to start managing your money seriously before things get out of control. The small steps taken today can potentially shield you from any major financial catastrophe in the future.

Recommended Articles

This is a guide to How to Manage Your Money. Here we also discuss the definition and 11 simple Steps for Managing Money and an explanation. You may also have a look at the following articles to learn more –