Updated June 27, 2023

Difference Between 401(K) vs Roth IRA

Can you think of the tax-saving vehicles available for employees so that they can save on taxes? Well, let me give you a hint. Based on the point in time that the people want a tax to be deducted from a portion of their savings. I am positive you might have come across two vehicles: 401(K) vs Roth IRA.

401(K) is a deferred income plan offered by the employer. While contributing for 401(K), an employee assigns an amount to be paid towards this plan. The income channelized for this plan is before taxes are deducted from the paycheck. On the contrary, a Roth IRA is set up between an employee and an investment firm. In this case, the employer of the employee is not involved. As opposed to 401(K), here, money used is after tax deductions.

401(K)

Choosing 401(K) boils down to the question, ‘When do you want to pay your taxes? Based on whether you will be in a higher tax bracket today than when you will give you a hint about choosing this plan. If you think the tax rate when you retire will be lower than the present, then you should go for a 401(K) plan. In this way, you will not have to pay higher taxes today when you are in a higher tax bracket.

The name comes from where this plan has been defined, i.e. 401(K) section of IRS code. There are many schemes to choose from by the employee. But none of the gains from these schemes is taxed by the IRS. Taxation only occurs once the employee has reached retirement age. As of 2019, the limit for annual 401(k) contributions for those under 50 rises to $19,000 from $18,500, the 2018 limit. Those aged 50 and older can contribute an additional $6,000 per year in catch-up contributions.

Benefits of 401(K)

- Your contributions might result in tax savings during each year of contribution.

- Using this plan, you can contribute much more each calendar year.

- You may get an employer match, i.e. contributing additional money to the employee’s account, which is usually a percentage of the employee’s contribution.

- The money you contribute to the 401(k) plan can be taken directly from your paycheck.

Roth IRA

From the traditional route, Roth IRA does not involve the employer in the picture. It is just about the individual or the employee and the investment firm. Moreover, the contributions made by the individual are after-tax deductions. Roth IRA is more flexible than 401(k) for employees as they have more to choose from. This gives employees a greater degree of investment freedom. Since after-tax money is used to fund the Roth IRA scheme, hence no income tax is levied at the time of retirement when the money is withdrawn.

In 2019, the maximum annual contribution for those under 50 was $6,000, up from $5,500 in 2018. Those aged 50 and up can contribute an additional $1,000 for a total of $7,000/$6,500 per year. Individuals who earn more than $137,000 per year in 2019 ($135,000 for 2018) – or $203,000/$199,000 for those married filing jointly – are ineligible to contribute. Below those limits is a phase-out income group for whom partial contributions are possible. The range for 2019 is $122,000 to $137,000 ($120,000-$135,000 in 2018) for individuals and $193,000-$203,000 ($189,000-$199,000 in 2018) for those married filing jointly.

This scheme for the employers of the individuals makes sense if they feel that the income tax bracket they will fall in at retirement will be higher than they are currently in. Usually, the Roth IRA contributions must be made in cash. But there are various investment options within the Roth IRA once the funds are contributed, including bonds, stocks, mutual funds, ETFs, etcetera.

Benefits of Roth IRA

- Your withdrawals at the age of retirement will be tax-free since you have already made after-tax contributions.

- You can withdraw your money at any time without penalty (you cannot withdraw before age 59 without incurring a penalty).

- This scheme gives you the freedom to choose the brokerage firm and also the investment options as opposed to 401(K).

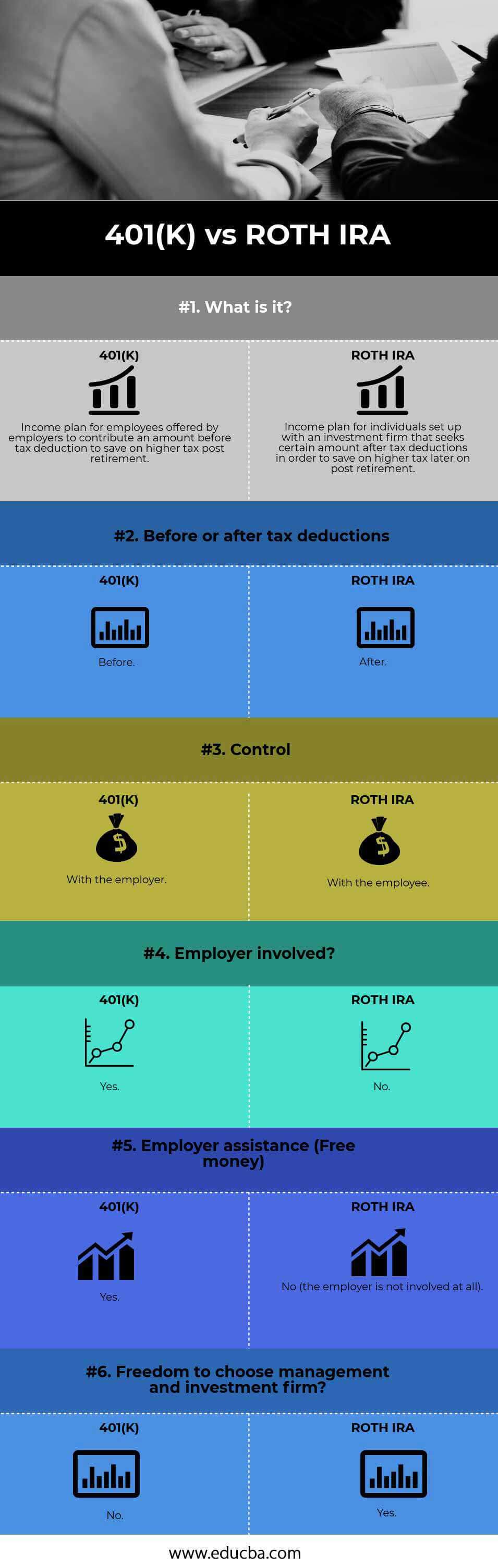

Head To Head Comparison Between 401(K) vs Roth IRA (Infographics)

Below is the top 6 difference between 401(K) vs Roth IRA:

Key Differences Between 401(K) vs Roth IRA

401(K) vs Roth IRA are popular choices in the market.

- Contributions by the employer: In 401(K), the employer might fund up to a certain percentage of your contribution. When an employer gives such an incentive (free money), it must be used. This is not the case with Roth IRAs, in which after-tax deductions result in a pure contribution by an individual.

- Investment options: Although you benefit from a contribution by an employer in 401(K), this might not be sufficient as the investment options’ power vests with the employer. This narrows down your choices. On the other hand, in Roth IRA, the individual is free to choose from the investment firm and many investment options. The person can choose the investment manager.

- Tax: There is also a difference between 401(K) vs Roth IRA schemes regarding how the schemes are funded. In 401(K), the funds are contributed to the pre-tax income, while for Roth IRA, the funds are contributed to the after-tax income. It means that when you withdraw the money at retirement, for 401(K), you must pay taxes that were not paid earlier. But in Roth IRA, since taxes were already paid up hence no need to pay taxes at the time of withdrawal.

Head To Head Comparison Between 401(K) vs Roth IRA

Below is the 6 topmost comparison between 401(K) vs Roth IRA:

|

Basis of Comparison |

401(K) |

ROTH IRA |

| What is it? | Income plan for employees offered by employers to contribute an amount before tax deduction to save on higher tax post-retirement. | Income plan for individuals set up with an investment firm that seeks a certain amount of after-tax deductions to save on higher tax later post-retirement. |

| Before or after-tax deductions | Before | After |

| Control | With the employer. | With the employee. |

| Employer involved? | Yes | No |

| Employer assistance (Free money) | Yes | No (the employer is not involved at all) |

| Freedom to choose management and investment firms? | No | Yes |

Conclusion – 401(K) vs Roth IRA

So we looked at two of the income plans that could help an individual at the time of retirement based on the income tax brackets they are currently in. We saw 401(K) vs Roth IRA. 401(K) should be your first choice if you think the income tax rate when you retire will be higher than today’s rate. Otherwise, Roth IRA is better if you feel that the tax bracket under which you fall at retirement will be higher than the one you are today. So it depends from person to person.

Recommended Articles

This has been a guide to the top difference between 401(K) vs Roth IRA. Here we also discuss the 401(K) vs Roth IRA key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –