Difference Between CFO vs CEO

Both positions in an organization play a vital role in the organization’s growth. Any titles are given to a person to show their duties and responsibilities in the organization. This both CFO vs CEO term exists because of corporate governance. Incorporate the world many workplace titles which differ from organization to organization. To look after the interest of shareholders, many organizations follow or adopt two-tier corporate hierarchies. The first tier is the board of directors.

The second tier is the organization’s upper management (COO, CEO, and CFO). Some large companies use titles such as CEO, CFO, CTO, and so on, whereas smaller organizations may use president, vice-president, director, etc. These top executives make decisions that achieve the organization’s financial and non-financial goals. All top executive positions require leadership skills and the ability to develop and implement a strategic vision to support organizational goals. The most common and top positions across all industries are CFO vs CEO. These two positions and people associated with this position are the organization’s most powerful and influential people.

Let’s discuss this two CFO vs CEO positions in detail.

Chief Executive Officer (CEO)

CEO is the highest or topmost position in an entire organization. The CEO is a leader of the organization and plays an important role between the organization’s board of directors and various organization levels. The CEO is responsible for the success and failure of the organization. The board of directors appoints the organization’s CEO and reports to them. One of the CEO’s major duties is implementing the corporate policy directed by the organization’s board. The CEO provides a vision and sets the organization’s culture. CEO’s exact duty can vary based on a number of factors, including the size of the organization and whether it’s a public or private organization.

Chief Financial Officer (CFO)

CFO is the highest ranking in financial position. So as the name suggests, the main role of the CFO is to manage the company’s finance. CFO is an important part of organizational leadership. CFO helps leadership in making financial decisions and executing those decisions. CFO’s Job is to make an organization financially strong and profitable. CFO reports directly to the CEO and has substantial inputs into organization investment, capital structure, and money management. CFO’s main responsibility is maintaining and improving the organization’s financial health. CFO is the organization’s economist, responding to macro and micro parameters. CFO spends the most time looking forward to what will next quarter or year looks like. The role of the CFO is to raise funds, understand capital markets, profit planning, Distribution of funds and profit, etc. Fractional CFO companies provide similar expertise on a part-time or project basis, allowing smaller companies to benefit from high-level financial strategy without the cost of a full-time CFO.

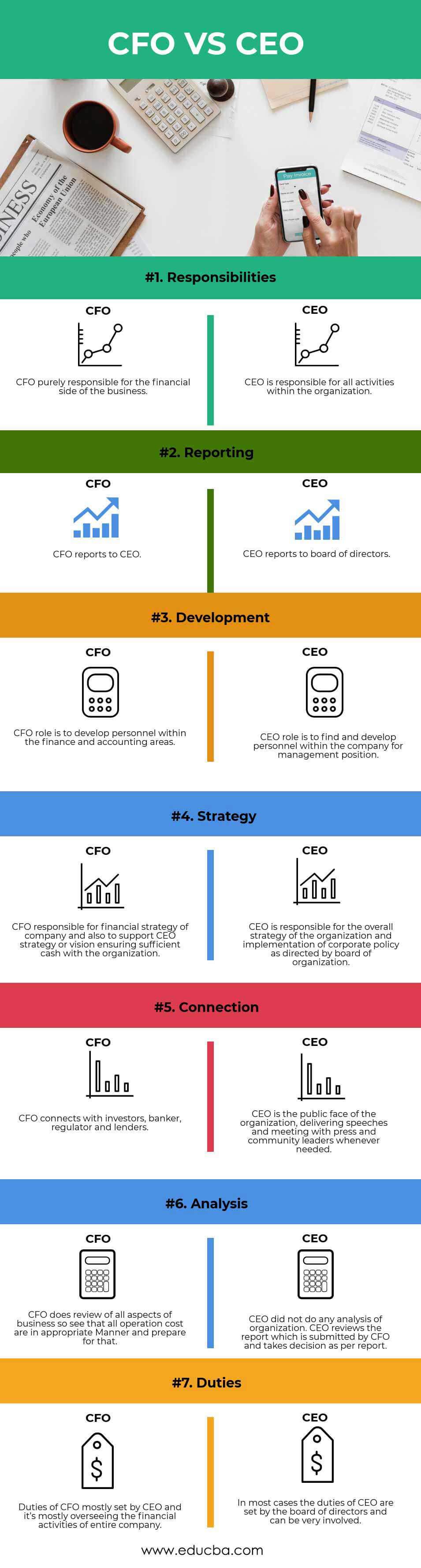

Head To Head Comparison Between CFO vs CEO (Infographics)

Below is the top 7 difference between CFO vs CEO

Key Differences Between CFO vs CEO

Both CFO Vs CEO is the topmost and most important position in the organization. Let us discuss some of the major differences :

- The CEO is responsible for all organization’s activities, whereas CFO is responsible only for the organization’s financial activities or side.

- CEO reports directly to the board of an organization, whereas CFO reports directly to an organization’s CEO.

- CEO drives the organization towards its goal by implementing the corporate policy, which is directed by the company board, whereas the CFO’s job or role is to maintain and improve a company’s financial health

- The CEO usually has more equity in the organization, whereas CFO not always has equity.

- The CEO defined the strategy, and CFO figured out how to fund it.

- CFO is responsible for reviewing all aspects of the business and reports all his findings to the CEO, who makes decisions based on that report.

CFO vs CEO Comparison Table

Let’s look at the top 7 Comparisons between CFO vs CEO.

| The Basis of Comparison | CFO | CEO |

| Responsibilities | CFO is purely responsible for the financial side of the business. | The CEO is responsible for all activities within the organization. |

| Reporting | CFO reports to the CEO. | CEO reports to the board of directors. |

| Development | CFO’s role is to develop personnel within the finance and accounting areas. | The CEO’s role is to find and develop personnel within the company for the management position. |

| Strategy | CFO is responsible for a company’s financial strategy and supporting CEO’s strategy or vision, ensuring sufficient cash within the organization. | CEO is responsible for the organization’s overall strategy and implementation of corporate policy as directed by the board of an organization. |

| Connection | CFO connects with investors, bankers, regulators, and lenders. | CEO is the organization’s public face, delivering speeches and meeting with press and community leaders whenever needed. |

| Analysis | CFO reviews all aspects of the business, so see that all operating costs are appropriate and prepare for that. | CEO did not do any analysis of the organization. CEO reviews the report submitted by CFO and decides as per the report. |

| Duties | The CEO mostly sets the CFO’s duties and oversees the entire company’s financial activities. | In most cases, the board of directors sets the CEO’s duties and can be very involved. |

Conclusion

- So from above, it is clear that CFO vs CEO is unequal. CEO Drives an organization towards its goal by keeping in mind its corporate mission and values, and CFO provides funding and planning to achieve this goal.

- While a CFO has a role in making the financial decision, the CEO ultimately moves the financial needle in business. The CFO is nothing but a treasurer or controller of an organization.

- Good corporate governance usually recommends the separation of duties between both CFO vs CEO.

- The CFO’s responsible for maintaining the organization’s financial health and working closely with the CEO to achieve this; the CFO is the organization’s economist.

- CFO is the CEO’s right hand and maintains a deep relationship with key external stakeholders.

- Companies fail because they run out of cash; in that case, the CFO role comes into the picture, and it’s essential for any organization.

Recommended Articles

This has been a guide to the top difference between CFO vs CEO. Here, we also discuss the CFO vs CEO key differences with infographics and comparison tables. You may also have a look at the following articles to learn more.