Updated November 17, 2023

Difference Between 10K vs 10Q

They say, and they are right, that the real treasure lies in the SEC filing. Indeed, the company’s SEC filings are a treasure when examined with the right precision and an eye for details often overlooked by data sites like Yahoo Finance and others. The importance of these fillings for having a diligent investing decision can’t be stressed enough, so to know them better, I will put forward some key differences between 10K and 10Q:

10K Fillings

- 10K Fillings are the detailed fillings done by the corporations to the SEC.

- Very important for equity and bond investors is the detailed analysis.

- 10K Fillings are annual due to filling after the last quarter.

- 10K Fillings must be Audited before submission.

- 10K Fillings has 5 different parts: Business Overview, Risk Factors, Selected Financial Data (historical data), Management Discussion and Analysis of Financial Conditions (MD&A), Results of Operations, and Financial Statements.

- Signed undertakings of the true nature of the submissions by the Chief Executive Officer and Chief Financial Officer, remuneration details of the key officers.

- Due 75 Days after the end of the fiscal year.

10Q Fillings

- The 10Q Fillings are less detailed than the 10K fillings.

- Quarterly 10Q filings are submitted in three quarters, with the fourth quarter being reserved for the corporation’s submission of the annual 10K filings.

- Corporations typically submit unaudited reports as required and may voluntarily choose to submit audited reports.

- Due every 40 Days after the end of the quarter.

- It is divided into 2 parts.

- Part 1: Financial statements, Management Discussion, and analysis of financial statements and changes in accounting principles.

- Part 2: Legal proceedings, Changes in internal controls, Defaults on Senior debts or coupons or dividend payment, material important disclosures.

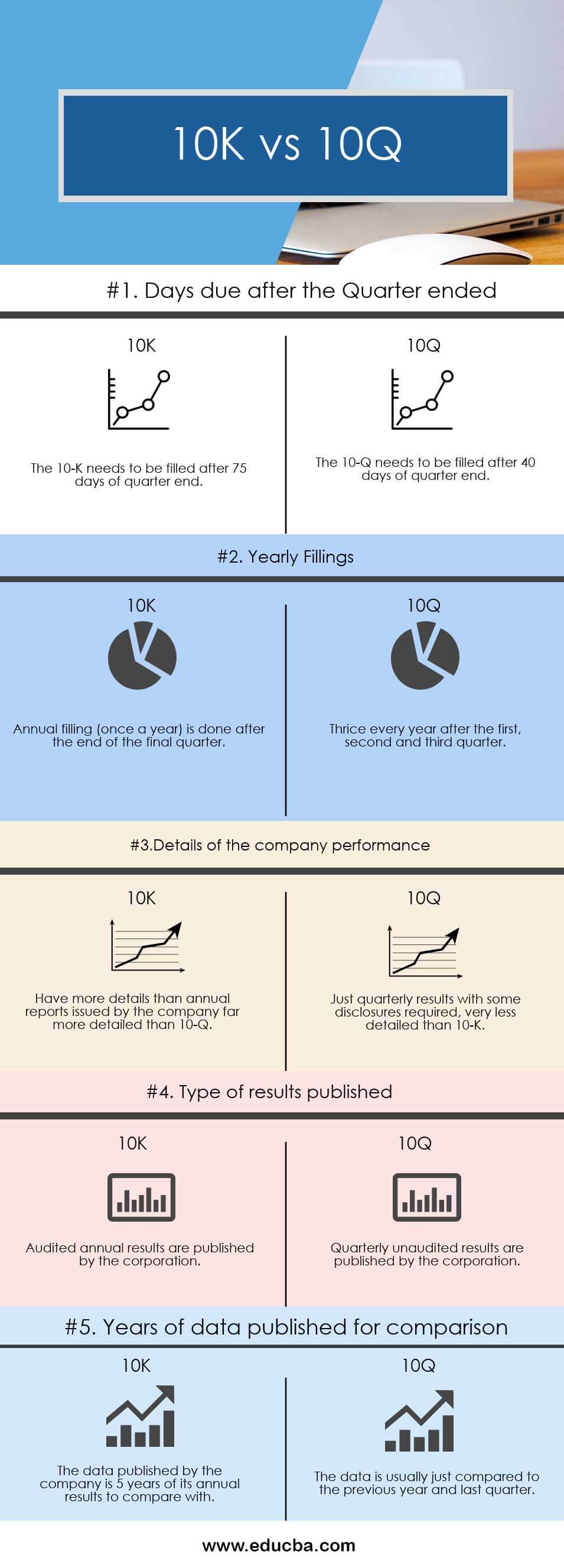

Head To Head Comparison Between 10K vs 10Q (Infographics)

Below is the top 5 difference between 10K vs 10Q :

Key Differences Between 10K vs 10Q

Although the importance and material information in filling the 10K vs 10Q is vital for all the market participants, equity investors, debt investors, traders, arbitrageurs, etc., generally, they all confuse their main differences. Here are some key differences between 10K vs 10Q.

- The 10K fillings are annual and due after the final quarter; 10q are filled for 3 first quarters.

- The company completes the 10K form within a maximum of 75 days and finalizes the 10Q form within 40 days after the fiscal quarter ends.

- Auditing by external auditors is necessary by the SEC for forms 10K & 10Q is acceptable without being audited, but generally, big firms submit it audited.

- A detailed version of events material information is present in 10K compared to 10Q.

- The 10K form contains annual data for the previous five years, while the 10Q form allows for a comparison with only the previous year, limiting the scope of analysis.

- Remuneration details of management and the business overview of current and international businesses in detail are present in 10K, and 10Q offers the changes we wish to see earlier than the annual disclosures, which are important to forecast the business decisions.

10K vs 10Q Comparison Table

Below is the topmost Comparison between 10K vs 10Q :

| The Basis Of Comparison |

10K |

10Q |

| Days due after the Quarter ended | You must complete the 10K within 75 days after the end of the quarter. | Fill out the 10Q within 40 days of the quarter’s end. |

| Yearly Fillings | After the final quarter ends, we complete the annual filing once a year. | Thrice every year after the first, second, and third quarters. |

| Details of the company’s performance | Have more details than annual reports issued by the company far more detailed than 10Q. | Just quarterly results with some disclosures required, very less detailed than 10K. |

| Type of results published | The corporation publishes audited annual results. | The corporation publishes its unaudited quarterly results. |

| Years of data published for comparison | The data published by the company is 5 years of its annual results to compare with. | Typically, organizations compare the data to the previous year and the last quarter. |

Conclusion

Although the company information is in bundles everywhere, be it the financial or media portals or the investor relations webpage on the company websites. Still, something raw, far better than sweet to digest annual reports and other media announcements, is 10K & 10Q filings done by the companies as mandated by the SEC.

Certainly! Please provide the information or topic you’d like me to convey in a more raw and active voice, and I’ll rephrase it accordingly. 10K is unarguably one of the best tools we have for accessing the company record published annually. It replaces the 10Q filling for the final quarter. It contains the annual results, which must be audited. Moreover, it contains peculiar business details even for international revenues of subsidiaries, new legal obligations, bond issues and maturing, and top management’s remuneration details. The 10K form thoroughly discusses the corporate and environmental effects on the business.

The 10K excels in making projections for future years and comparing them to the previous year, outperforming the 10Q in this regard. These also form the basis of how many brokerages view the future of the company’s stock price. The 10K provides detailed information on material matters and subjects presented for shareholder vote, disclosing significant information.

The 10Q filling is a different ball game when accessing a company as you use your accounting skills to check the inventory levels and cash flows for the last quarter to anticipate the results and project the future results. More importantly, focus on companies already on your radar and then develop your research based on the corporation’s unaudited quarterly filings. However, prioritize the 10Q, as it provides more frequent and detailed information with many disclosures and the latest results compared to the 10K in general.

Recommended Articles

Although this has guided the top difference between 10K vs 10Q, thus, we also discuss the 10K vs 10Q key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –