What is the Underground Economy?

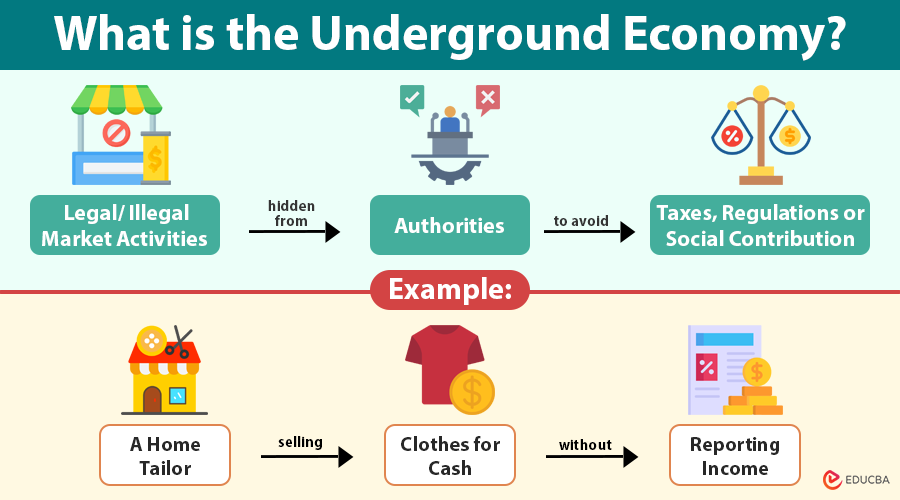

The underground economy refers to all market-based legal or illegal economic activities that are deliberately concealed from authorities to avoid taxes, labor standards, social security contributions, or compliance with administrative procedures.

For example, imagine a person who sews clothes at home and sells them directly to customers in cash without a business license or tax registration. While the tailoring service is legal, the income is not reported to tax authorities, placing it squarely within the underground economy.

From 1991 to 2015, the shadow economy accounted for an average of around 32% of the global GDP, based on data from 158 countries.

Table of Contents

- Meaning

- Key Features

- Examples

- Causes

- Impact

- Developing vs. Developed Nations

- Role of Technology

- How do Governments Address it?

- Is it Always Bad?

Key Takeaways

- The underground economy encompasses both legal and illegal activities that are intentionally concealed from authorities to evade taxes, labor laws, and regulations.

- High tax rates, complex bureaucracy, unemployment, and weak law enforcement are major factors contributing to its decline.

- While it provides livelihood and flexibility, it leads to tax revenue loss, labor exploitation, unfair competition, and data distortion.

- Digital payments and analytics help detect underground activity, but cryptocurrency and gig platforms can also fuel it.

- Effective responses include simplified tax regimes, awareness campaigns, incentives for formalization, and enhanced enforcement.

Key Features of the Underground Economy

- Cash-based transactions: Most deals happen in cash to avoid electronic records, making detection difficult.

- No official records: Receipts, invoices, and ledgers are often absent or intentionally falsified.

- Avoidance of taxes and regulations: Individuals or businesses evade income tax, value-added tax (VAT), labor laws, or safety norms.

- Lack of worker protections: Workers often do not receive minimum wages, benefits, or legal protections for their safety.

- Existence across all sectors: The shadow economy appears in construction, domestic work, agriculture, digital freelancing, and even professional services.

Examples of Underground Economy Activities

The underground economy touches multiple sectors, both legal and illegal. Common examples include:

- Unreported labor: A household paying a cook or nanny in cash, without contracts or benefits.

- Tax evasion by professionals: A dentist offering a discount for cash payments and not declaring the income.

- Unlicensed businesses: Home bakers or street vendors selling goods without health permits or business licenses.

- Online income: Freelancers working for foreign clients and not reporting earnings to tax departments.

- Black markets: The sale of counterfeit clothes, electronics, drugs, or illegal wildlife trade.

Causes of the Underground Economy

Several structural, economic, and behavioral factors drive the existence of shadow economies:

- High tax burdens: People and businesses often try to pay less or avoid taxes when they feel income tax, GST/VAT, or corporate taxes are too high.

- Bureaucratic complexity: Long procedures, expensive licenses, and excessive paperwork deter compliance. People prefer to operate informally to save time and cost.

- Limited formal employment opportunities: In many countries, especially developing ones, the formal sector is unable to absorb all job seekers. As a result, people turn to informal jobs for survival.

- Weak law enforcement: If regulatory authorities cannot effectively monitor or penalize violators, individuals may feel safe operating outside the system.

- Cultural and social acceptance: In some societies, cash deals and unreported services are the norm, especially among small businesses or within local communities.

Impact of the Underground Economy

The underground economy brings a mix of benefits and drawbacks, depending on the perspective:

A. Impact on Government

- Revenue loss: Unpaid taxes shrink national budgets, impacting public services such as healthcare, education, and infrastructure.

- Data distortion: Governments rely on GDP, employment, and consumption figures for planning. If a significant portion goes unrecorded, policies become less effective.

- Reduced creditworthiness: Lower tax revenue can lead to higher deficits or increased borrowing.

B. Impact on Businesses

- Unfair competition: Informal businesses undercut formal ones by avoiding taxes and regulations.

- Barrier to growth: Unregistered businesses are unable to access loans, insurance, or government grants.

C. Impact on Workers

- No formal contracts or job security.

- Lack of benefits like sick leave, maternity leave, or retirement plans.

- Exposure to unsafe or exploitative work conditions.

D. Impact on Society

- Increased inequality as informal workers remain excluded from financial systems.

- Encouragement of illegal networks and corruption.

- Erosion of public trust in law and governance occurs when rule-breaking becomes widespread and prevalent.

Underground Economy in Developing vs. Developed Nations

The underground economy exists globally, but its form and intensity vary.

| Factor | Developing Countries | Developed Countries |

| Size | Can account for 30–60% of GDP | Typically 5–15% of GDP |

| Key Drivers | Unemployment, poverty, limited regulation | Tax evasion, regulatory avoidance |

| Common Sectors | Agriculture, street vending, domestic work | Freelancing, construction, personal services |

| Technology Use | Mostly cash-based | Gig platforms, crypto, underreported online income |

| Government Response | Informal job formalization efforts | Tax audits, digital surveillance, penalties |

In developing countries, the shadow economy often acts as a safety net. In developed economies, it is more about optimizing income or bypassing bureaucracy.

Role of Technology in the Shadow Economy

Technology has both good and bad effects on the underground economy.

Positive Effects

- Digital payments (e.g., UPI, mobile wallets) make money movement traceable and reduce reliance on cash.

- Data analytics help tax authorities detect patterns of underreporting or fraudulent activity.

Negative Effects

People use cryptocurrency to make anonymous transactions, which can support tax evasion, smuggling, or online scams.

- Dark web marketplaces allow the buying and selling of banned items.

- Freelance platforms sometimes encourage income that goes unreported or unregulated.

Governments must adapt quickly to these evolving digital risks while promoting transparency through digital inclusion.

How Governments Address the Underground Economy?

Governments worldwide are implementing strategies to reduce informal activities and encourage compliance:

- Simplified tax systems: Flat-rate schemes for small businesses, easier filings, and digital returns reduce friction.

- Incentives for formalization: Access to loans, training, or government schemes can motivate businesses to formalize their operations.

- Awareness campaigns: Educating the public about the advantages of participating in the formal economy.

- Enforcement mechanisms: Increased audits, penalties, and collaboration with financial institutions to detect undeclared income.

- Digital tracking: Promoting electronic payments and mandating digital records to trace transactions.

A combination of reward and enforcement is essential for sustainable success.

Is the Underground Economy Always Bad?

Not entirely. In many low-income regions, the informal sector serves as a vital lifeline, providing employment where none exists. It fosters entrepreneurial spirit and provides essential goods and services to marginalized communities.

However, overdependence on this sector limits access to formal credit, social protection, and upward mobility. It also weakens institutions and reduces the government’s ability to invest in long-term development.

The ideal approach is not total elimination, but rather the gradual integration of informal activities into the formal economy.

Final Thoughts

The underground economy is a complex and deeply rooted part of every country’s economic landscape. While it helps millions earn a living, it also challenges tax systems, weakens labor rights, and undermines public trust. Recognizing its role—both positive and negative—is the first step toward effective solutions.

Governments must work toward simplifying systems, offering incentives to formalize, and using technology wisely to detect and manage underground activities. With balanced reform, economies can become more transparent, inclusive, and resilient.

Frequently Asked Questions (FAQs)

Q1. Can digital platforms like Uber or Fiverr be part of the underground economy?

Answer: Yes, individuals often fail to declare the income they earn through these platforms for tax purposes or violate local labor or licensing laws. In that case, they contribute to the underground economy, even if the platform itself operates legally.

Q2. Is cash always a sign of underground activity?

Answer: Not always. Cash is a preferred medium in the underground economy due to its untraceability, but not all cash transactions are illegal or hidden. Many legal businesses and individuals still prefer cash for convenience or cultural reasons.

Q3. Can the underground economy help during economic downturns?

Answer: Yes, to an extent. During times of recession or crisis, informal work serves as a safety net for individuals who are unemployed. However, its long-term impact can hinder formal job creation and economic recovery if not transitioned properly into the formal sector.

Q4. Can the formalization of the underground economy lead to job losses?

Answer: Sometimes. When regulations increase, some micro-businesses or informal setups may struggle with compliance costs and shut down. That is why gradual transition policies, subsidies, and education are essential for formalization efforts to succeed.

Recommended Articles

We hope this article has provided you with a clear understanding of the underground economy and its impact on various areas. Check out these recommended articles to learn more about informal jobs, tax issues, and how economies work around the world.