Updated July 19, 2023

What is the Full Form of GST?

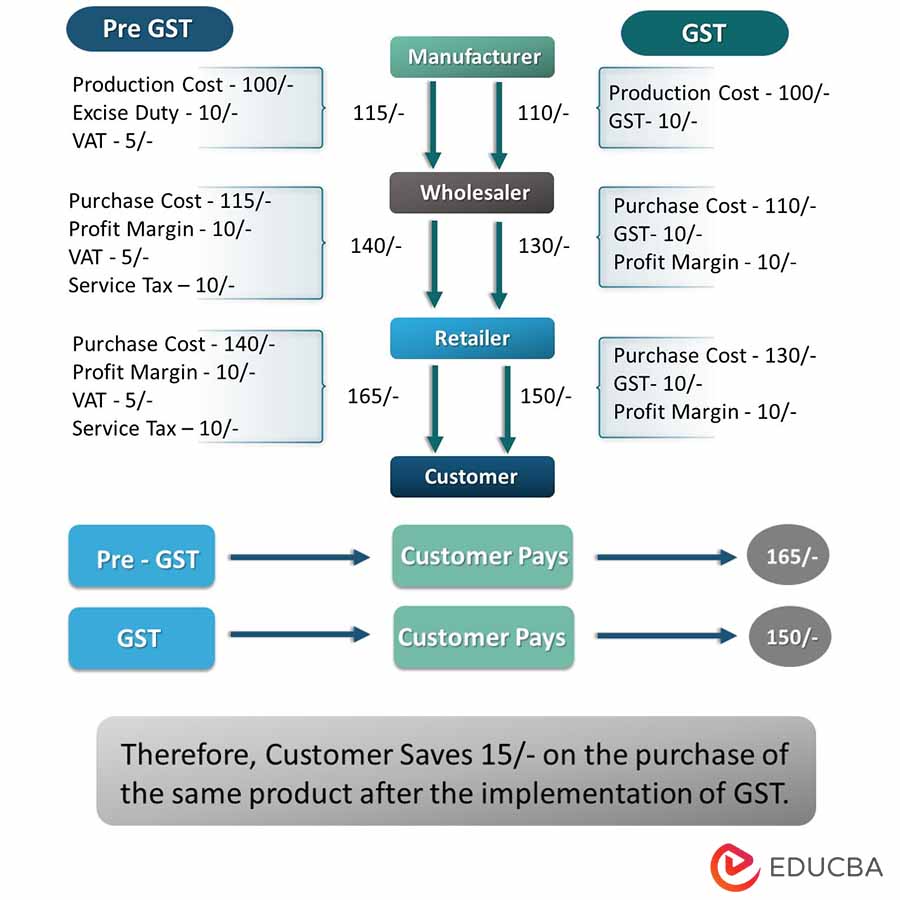

The Goods and Services Tax (GST) is an indirect multistage tax collected from consumers on the supply of goods and services. The government levies this tax indirectly on the final consumer by adding the sum of tax in all stages to the final product.

Taxation occurs in different stages like production, wholesale, retail, and consumption. GST was introduced to replace a range of existing indirect taxes with a single, unified tax.

Key Highlights

- GST is a comprehensive tax system that applies to goods and services across India, making it easier to comply with taxation laws.

- It is of four types – Central (CGST), State (SGST), Integrated (IGST), and Union territory (UGST).

- It has four different rates: 5%, 12%, 18%, and 28%, which are subject to change as per government rules.

- Depending on the business’s turnover, they can file the return quarterly or monthly.

- It has benefited businesses, reducing the overall tax burden and improving compliance with tax laws.

History

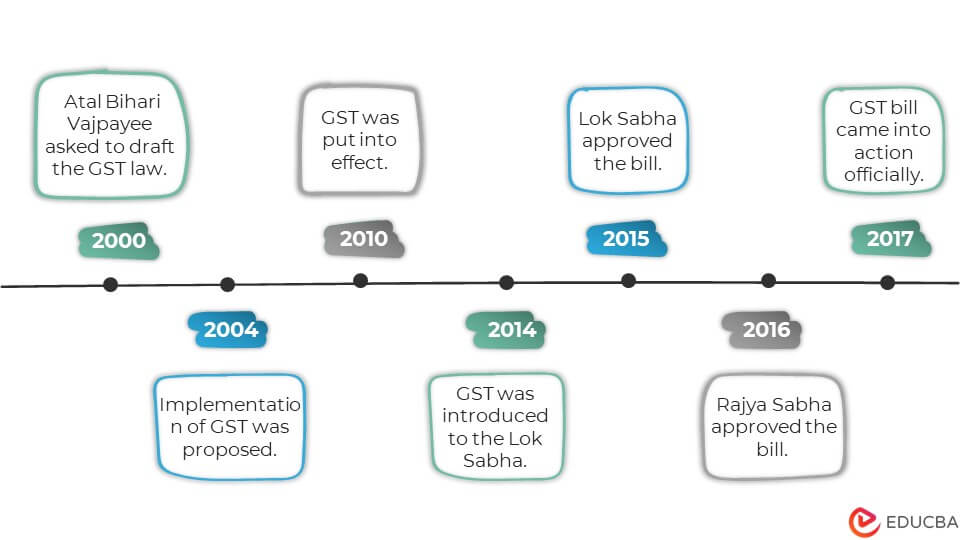

- 2000- Prime minister Atal Bihari Vajpayee set up a committee led by Ashim Dasgupta (former finance minister of West Bengal) to draft this tax law.

- 2004- The Fiscal Responsibility and Budget Management Committee came into action and proposed to implement this tax system.

- 2010- According to the Union Finance Minister P Chidambaram’s budget speech, it was put in effect by 1st April 2010.

- 2014- The 122nd Constitution Amendment Bill introduced Goods and Services Tax to the Lok Sabha after a failure in 2011.

- 2015- Lok Sabha approved the bill.

- 2016- Rajya Sabha approved the bill. The Goods and Services Tax Council came into existence.

- 2017- On 1st July, the bill came into action officially.

Types of GST in India

CGST (Central Goods and Services Tax)

- The Central Government levies it on the intra-state supply of goods and services.

- It includes all the taxes which were previously known as central indirect taxes.

SGST (State Goods and Services Tax)

- Each state imposes a tax on the intra-state supply of goods and services.

- State taxes like luxury, entry, entertainment, and value-added tax (VAT) falls under this category.

IGST (Integrated Goods and Services Tax)

- It is applicable for inter-state transactions, and the rate is the sum of Central and state tax rates.

- The Centre and the state (where the consumption occurs) government share the revenue.

UGST (Union Territory Goods and Services Tax)

- It applies to Union Territories without a Legislative Assembly, such as Chandigarh, Dadra and Nagar Haveli, Daman & Diu, and Lakshadweep.

- The central government levies this tax and shares the revenue with the respective Union Territory.

How Does GST Work?

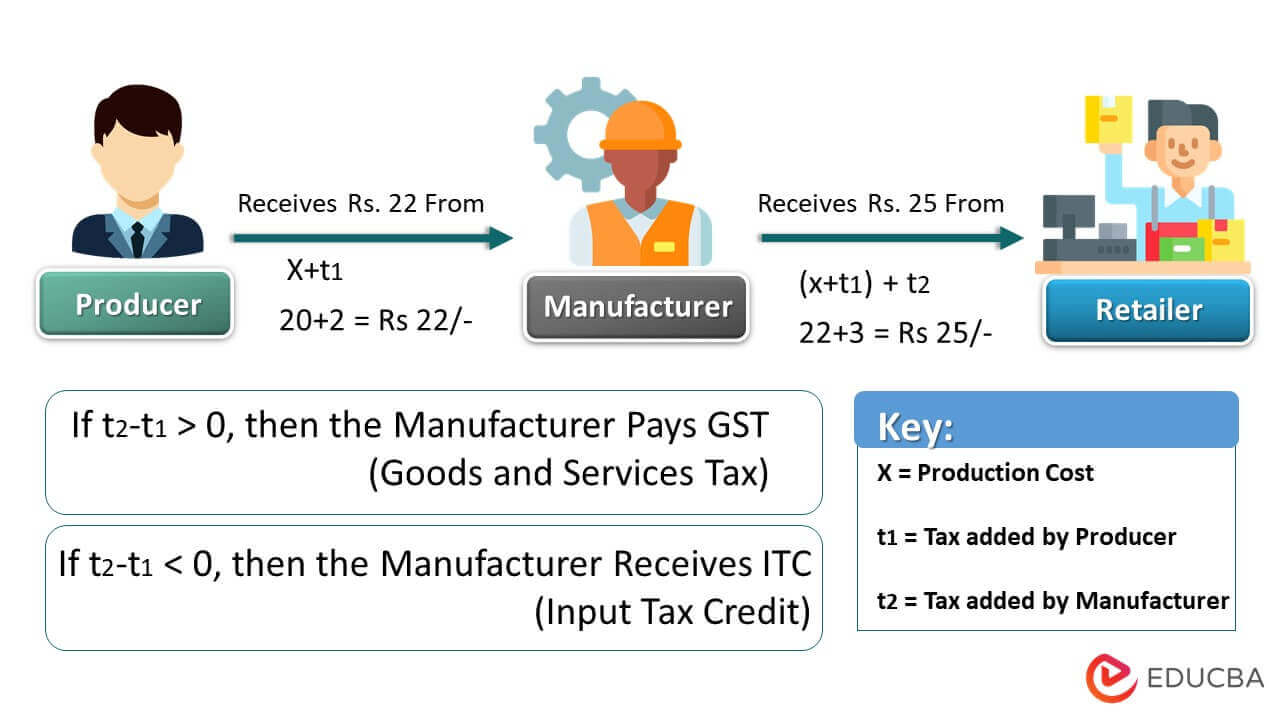

Assume a manufacturer buys a product from the producer and pays the tax-inclusive price. Let the producing cost be INR 20 (x) and the tax amount be INR 2 (t1). Thus, the manufacturer pays the producer INR 22 (x+t1).

Suppose the manufacturer then imposes a tax of INR 3 (t2) on the product and sells it to the retailer. Therefore, retailers will have to pay the manufacturer INR 25 ((x+t1)+t2).

Now, if the tax t2 is greater than the initial tax t1, the manufacturer should pay the difference to the government as GST, i.e., t2 – t1 >0, GST = (3-2)= INR 1.

However, if the initial tax t1 is higher than the tax t2, it is the ITC (input tax credit), i.e., t2 – t1 <0 = ICT. The manufacturer receives from the government that gets adjusted in his next transactions.

Simply put, if the difference between tax t2 and t1 is positive, the manufacturer should pay the difference to the government as GST.

However, if the difference is negative, i.e., it is considered ITC (input tax credit) that the manufacturer can recover on their next sale of the product.

How is GST Calculated Using Formula?

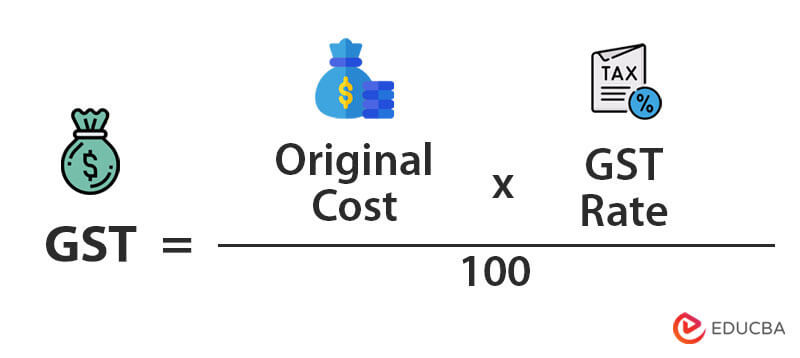

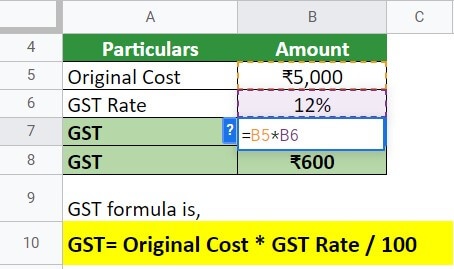

The formula for calculating GST is,

- The original cost is the initial price of an article.

- The rate stands for the tax rate specified by the government.

Examples of GST

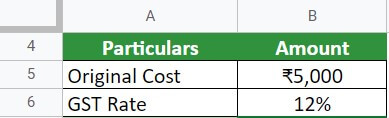

Example #1

Preet has brought a gown for herself. The marked price of the gown is

INR 5,000. The GST rate on apparel is 12%. Calculate the GST amount.

Given,

Solution:

Implementing the formula,

The GST amount is INR 600. So, Preet will have to pay INR 5,600 (5,000+600) to the seller.

Example #2

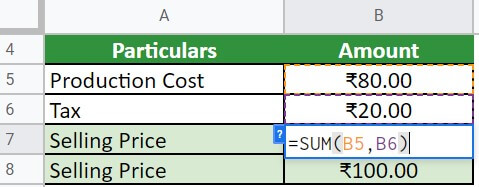

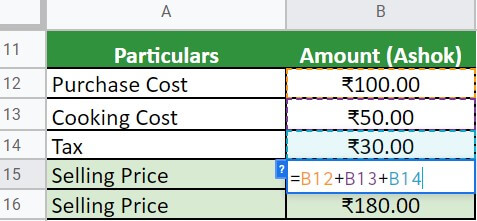

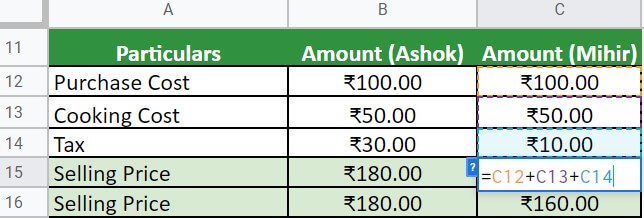

A farmer produces crops and sells them for INR 80 while adding a GST of INR 20. Ashok, a restaurant owner, buys raw materials from the farmer at INR 100. He adds INR 50 as cooking costs and INR 30 as taxes while selling food to his customers. Mihir, another restaurant owner, buys the same raw materials but adds a tax of INR 10 only. Their cooking costs are the same. Calculate each owner’s selling prices.

Solution:

a. We calculate the Selling Price of the farmer as follows:

b. We calculate the Selling Price of owner Ashok as follows:

c. We calculate the Selling Price for owner Mihir in column C, as seen below:

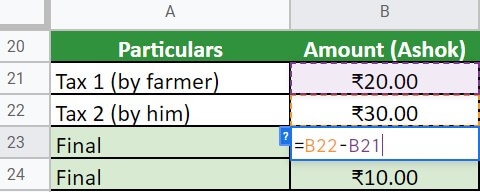

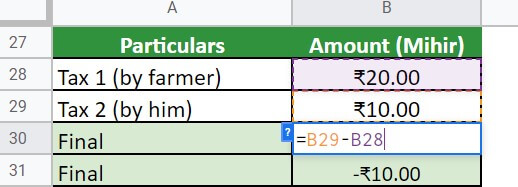

d. The difference in taxation for both the owners (Ashok and Mihir) is as follows:

As Tax 2 – Tax 1 > 0 for Ashok, he’ll pay the difference amount (INR 10) to the government as GST. Moreover, as Tax 2 – Tax 1 < 0 for Mihir, he’ll collect the difference amount (INR 10) from the customer as ITC.

Registration

Under the GST Act, all businesses and professionals with an annual turnover of over Rs 20 lakh (10 lakh rupees for North Eastern states) must register for it.

Steps to Register

Step #1: Log in to the Government Portal and click “Register Now” under “Taxpayers.”

Step #2: Choose “a taxpayer” from the “I am a” dropdown menu. Then, enter the State/UT, District, Business Name, PAN, mail id, and mobile number.

Step #3: After you click on “Proceed,” enter the OTPs you receive on your mobile number and mail.

Step #4: After OTP verification, the portal will generate a TRN (temporary reference number). Again, click on “Proceed.”

Step #5: Choose “New Registration” from the “Services” menu and enter the TRN.

Step #6: Enter the captcha verification and the OTP you receive on your mobile number.

Step #7: A “saved application” page will appear on the screen. Click on “Action.”

Step #8: In the following pages, enter details of your business, partnership, authorized signatory, authorized representative, places of business, goods & services, state-specific information, and Aadhar.

Step #9: Click “Save and Continue” after filling in each page.

Step #10: You will receive an Application Reference Number (ARN) by mail and SMS as a confirmation of your registration.

Step #11: After successful registration, the portal will generate a unique 15-digit Goods and Services Tax Identification Number (GSTIN). This number is necessary for all future filing and compliance requirements.

GST Returns

- They are documents that businesses must submit before the 10th of every month.

- The documents must contain every detail of purchases, sales, collected and paid taxes, and the total amount of tax.

- They must enter all invoices into their accounting software correctly to generate accurate filing reports.

- Businesses must also fill out the GSTR 1, 2, 3B, and 9 forms while filing returns.

- Every business with an annual turnover exceeding 20 lakhs should file returns.

- Filing correct returns helps businesses to keep track of their financial obligations and avoid penalties or additional taxes.

India GST Rates

- GST rates in India vary from 0% to 28%.

- It has three slabs: 0%, 5%, and 28% for goods, and four slabs: 0%, 5%, 12%, and 18% for services.

- However, it is an exception for commonly used items, such as grains, fruits, vegetables, edible alcohol, and even petroleum products.

- Moreover, the Council reviews the rates from time to time, and businesses should stay updated with the latest changes.

These are the rates for goods according to the Central Board of Indirect Taxes and Customs:

|

Goods |

|

| Commodity | Rate |

| Milk & Eggs | 0% |

| Education & Health Services | 0% |

| Gold | 3% |

| Marble | 5% |

| Vaccines | 5% |

| Sugar & Tea | 5% |

| Domestic LPG & Kerosene | 5% |

| Almonds & Fruit Juice | 12% |

| Apparel & Shoes | 12% |

| Computers & Mobiles | 12% |

| Soap & Toothpaste | 18% |

| Pasta & Corn Flakes | 18% |

| Cars & High-End Motorcycles | 28% |

| Cigarettes | 28% |

| AC & Fridge | 28% |

(Source: Central Board of Indirect Taxes and Customs)

These are the rates for services according to the Central Board of Indirect Taxes and Customs:

|

Services |

|

| Commodity | Rate |

| Education & Health | 0% |

| Rail Transport (except sleeper class) | 5% |

| Building Construction | 12% |

| Food/Drinks Catering | 18% |

| Residential Hotels, Inns, Guest Houses | 18% |

| Entertainment: Park, Movie, Rides, Games | 28% |

(Source: Central Board of Indirect Taxes and Customs)

Benefits of GST

- GST has replaced the need for multiple state-level taxes with one central tax.

- It has simplified filing returns, payments, and tax collection processes, which increase efficiency and save businesses time and money.

- With transparent pricing, customers know exactly how much they pay for goods or services.

- This registration allows claiming Input Tax Credit (ITC), an essential tax-saving benefit that can help save your business money.

- It has made it easier for businesses to expand across multiple states in India, leading to economic growth and development.

- It reduces business costs and encourages obedience to the law.

Frequently Asked Questions (FAQs)

Q1. What is GST?

Answer: GST is a single cumulative tax on goods and services in the Indian economy. It is an indirect tax and gets calculated at every transaction stage from manufacturer to consumer.

Q2. Who is the Father of GST?

Answer: Atal Bihari Vajpayee is the Father of GST. In 2000, under his command, Ashim Dasgupta, the then finance minister of West Bengal, set up a committee to discuss the scopes and aspects of the tax system.

Q3. Which state passed GST first?

Answer: Assam was India’s first state to pass the GST bill. The state government passed the bill on 12th April 2016.

Q4. When was GST implemented, and why?

Answer: PM Narendra Modi implemented GST in India on 1st July 2017 so that all businesses can run under one single tax rule rather than many. Also, it made filing returns easy for them.

Q5. What are the features of GST?

Answer: The features of GST are- a comprehensive tax base, multiple tax rates, input tax credit, e-way bill system, self-assessment, reduced tax burden, improved compliance, transparent administration, boost to the economy, and connectivity.

Recommended Articles

This was an EDUCBA guide to GST. For more detailed information, please refer to EDUCBA’s Recommended Articles.