Updated July 24, 2023

What is Trade Deficit?

The negative difference between a country’s Exports and Imports of goods and services in money terms is known as the trade deficit, and it is a part of the trade balance component of the balance of payments of the country for a period of time. As it is measured over a period of time, it is termed a flow variable in the study of Economics.

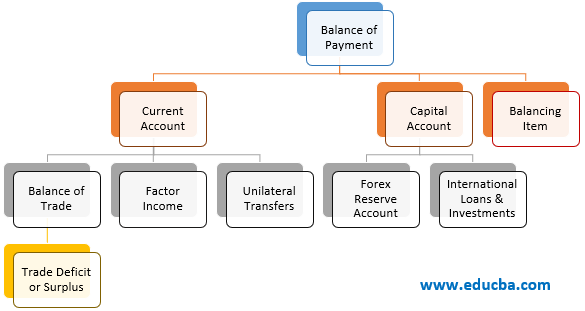

Understanding the Balance of Payments

To understand the balance of trade and trade deficit and surplus, we first need to understand the balance of payments, which has the following components and sub-components:

a) Current Account

It is the net of the country’s income or payments and has the following components.

- Balance of Trade: The difference between receipts’ monetary value from exports and payments for imports. In the Aggregate output equation used in Economic theory, it is symbolized by ‘NX’. If Exports value more, then we have a trade surplus; otherwise, we have a trade deficit.

- Factor Income: The difference between interest and dividends received from foreign investments of the country and that paid to the foreign investors who have invested in the country.

- Transfer Payments: This is the money sent back home by the country’s population working abroad. These are unilateral or one-directional, i.e. there are no goods or services provided in return for the same.

b) Capital Account

- Change in Forex Reserve: When the country imports goods from abroad, it needs to make payments in foreign currency or an exchange currency such as USD. For this purpose, the country needs to exchange domestic currency for foreign which leads to a decrease in Forex reserve, and the opposite transaction takes place when the country exports, leading to an increase in the Forex Reserve. The difference between the two is calculated here.

- Investments in Assets: In the current account, we record the income from and to the foreign asset investments while the actual investment is recorded under the capital account, for example, the purchase of foreign company’s stock or bonds or Greenfield investments, and the reverse of the same made by foreign investors in the domestic assets.

The current account surplus leads to a capital account deficit and vice versa because of the double-entry system of recording transactions. This leads to the sum of the two accounts being zero; however, as there is a possibility of statistical errors, the balancing item component of the BoP takes care of that.

How Does Trade Deficit Work?

We need to understand the factors affecting the balance of trade:

1. Cost of Factor Inputs

Factor inputs such as raw material, labor, land rents, taxes, etc., affect the cost of production of the goods and services produced in the country. A higher cost of production leads to making the goods less competitive in the international market, leading to a reduction in exports. All things remaining the same will increase the deficit or reduce the surplus.

2. Exchange Rates

In international trade, if a domestic currency is depreciated, it is a plus because the foreign consumer’s purchasing power increases as one unit of foreign currency is capable of buying more units of foreign goods. Therefore the exports get a boost leading to a contraction of deficit or widening of surplus.

3. Taxes, Sanctions, Tariffs, Quotas

All of these policies restrict the flow of goods between two countries, and if these are imposed, they lead to a deficit for the exporting country and a surplus for the importing country. One of the reasons for such impositions is to boost the domestic economy.

4. Quantum of Forex Available

For importing countries, the amount of Forex it possesses becomes significant because it cannot import goods unless and until it is in a position to pay for those goods. At times countries enter into a deal of making the exchange in domestic currency instead of using a third party exchange currency such as USD. It is easier to import in such cases because a country has greater flexibility over the amount of its own currency available in circulation. Recently, in 2018, India got into a deal to purchase Iranian oil and pay for it in Indian National Rupee; later on, the US imposed sanctions; however, such contracts are quite prevalent.

5. Business Cycle

In the economic boom or expansion phase, the exporting countries show a surplus or a contraction of the deficit, while importing countries show a deficit or contraction of the surplus. The vice versa is true during the recession.

Example of Trade Deficit

In the US, the Bureau of Economic Analysis (BEA), in collaboration with the United States census bureau and the US Department of Commerce, publishes the monthly data, lagged by 2 months, on the balance of trade. According to their data, the deficit in August 2019 was $55 billion while that in September 2019 is $52.5 billion, and therefore it showed a decrease in one month period.

The imports in September fell by $4.4 billion while exports fell by $1.8 billion. One of the major contributors to this decrease was the Auto industry, where the import of parts and export of parts, vehicles, and engines decreased by approximately $1 billion each. That is concurrent with the current slowdown in the auto sector as a whole. Apart from this, the decline in consumer goods imports was significant at $2.5 billion. This deficit has widened by approximately 24.8 billion, i.e. about 5.4% from the last year’s deficit of the same period. The next release is scheduled for December 5th for the month of October 2019.

Advantages and Disadvantages of Trade Deficit

Below are the advantages and disadvantages:

Advantages of Trade Deficit

- Comparative Advantage: According to the theory of Comparative advantage, any country should specialize its limited resources in the production of those goods and services in which it has a comparative advantage over other countries and import all other goods. Therefore, if the country incurs a deficit in achieving a comparative advantage, its resources are optimally utilized.

- Greater Investments: FDI and FPI are part of the capital account, and if the current account has a deficit, the capital account shows a surplus; therefore, the countries with greater trade deficit may experience a greater inflow of investments as interest rates increase in such an environment. This is sometimes referred to as the self-correcting nature of the Trade deficit. However, it is more of a theoretical concept than a real phenomenon.

Disadvantages of Trade Deficit

- Negatively Impacts GDP: As per Economic theory, the GDP = C + I + G + NX, where C stands for consumption, I for investments, G for government expenditure, and NX for Net exports or the balance of trade. If NX is positive, it will increase the GDP, while if negative; it will decrease the GDP.

- Domestic Unemployment: Greater imports imply that foreign-produced goods are cheaper as compared to domestically produced ones. This would lead to a reduction in domestic production and, therefore, greater unemployment.

- Currency Depreciation: To import more, the country needs to sell its own currency in exchange for foreign currency to be able to pay for the imports. This increases the supply of domestic currency in the international market and increases the demand for foreign currency, leading to an appreciation of the foreign currency and the simultaneous depreciation of the domestic currency. This can also lead to inflationary pressures for the domestic population as the currency declines its purchasing power of the currency.

- Dutch Disease: In simple terms, if the resources of a country are concentrated on one sector where it has a comparative example, only that sector grows, and others don’t, so the dependency on one product becomes very high. An example is Middle-east countries’ dependency on oil exports.

Conclusion

A trade deficit can be beneficial under certain circumstances; however, most countries prefer to curtail it at advisable limits. The US has had a deficit for most of the past years; however, its currency has not been affected much; this is because the USD is the most popular exchange currency for most international transactions and therefore is always in great demand, and it is also an SDR currency and therefore acts as a reserve currency. The above is not true for most of the countries of the world for whom the trade deficit is a bigger problem.

Recommended Articles

This is a guide to the Trade Deficit. Here we discuss how Trade Deficit works. along with advantages and disadvantages. You may also look at the following articles to learn more –