Updated July 7, 2023

What is a Standby Letter of Credit?

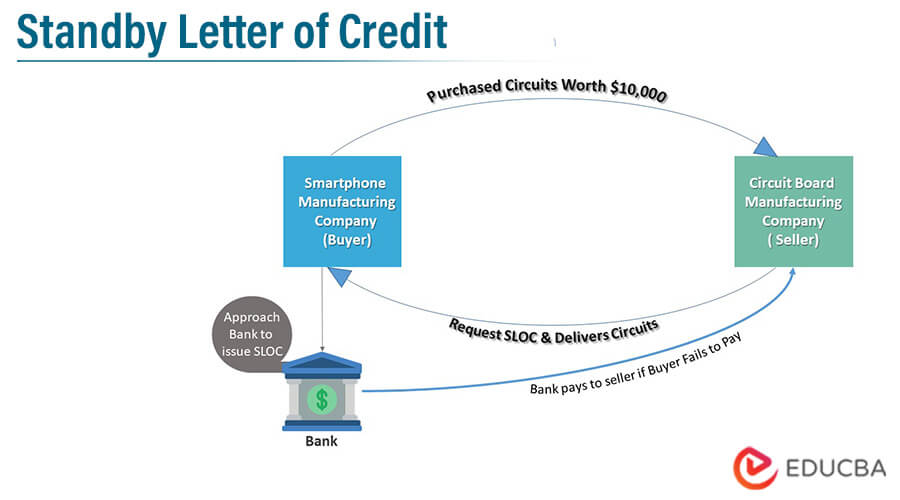

The term “standby letter of credit” refers to the legal, financial instrument that promises timely payment to the seller if the buyer defaults. In other words, it acts as a safety net for international market exporters, ensuring on-time payment for various business transactions, especially shipment of goods.

Typically, a bank issues it to mitigate the risks associated with overseas payments in international trade.

Key Takeaways

Some of the key takeaways of the article are:

- Banks issued a legal financial document to protect sellers against buyers’ default risk.

- Although businesses utilize these credit instruments in both domestic and international trade, their prevalence is higher in international trade transactions.

- There are mainly two types – financial and performance.

How Does a Standby Letter of Credit Work?

The seller is assured and remains uninvoked unless an undesirable incident occurs, such as the buyer defaulting on the payment or going bankrupt. In other words, the bank has to honor the price if the buyer defaults on it. Like any other credit facility, the bank charges a fee for the approved credit limit, which usually falls from 1% to 10%.

As far as the approval is concerned, it is akin to any other credit instrument. The issuing bank evaluates the applicant’s creditworthiness and then extends a standby letter of credit as a payment guarantee assuming full responsibility for the on-time payment to the seller. Nevertheless, both seller and buyer must fulfill the terms and conditions specified in the trade agreement to avail of the guarantee.

Example

Let us look at the following example to understand the concept of it.

XYZ Inc. is a smartphone manufacturing company that purchased printed circuit boards worth $5,000,000 from ASD Inc., a circuit board manufacturing company. Since they had never had any business transactions, ASD Inc. wanted to protect itself and asked XYZ Inc. to furnish a standby letter of credit equivalent to the shipment value. Accordingly, XYZ Inc. went to its bank and got a standby letter of credit issued.

Later, ASD Inc. delivered the printed circuit boards to XYZ Inc. and offered them 30 days to make the entire payment. However, XYZ Inc. failed to make the payment on time. ASD Inc. contacted the issuing bank and asserted that it had not received payment for the shipment. Finally, ASD Inc. submitted all the necessary documents per the standby letter of credit agreement, and the bank paid the owed money. This is how it works in a real business scenario.

Types of Standby Letters of Credit

Based on the features requested by the buyer, it can take several different forms, as mentioned below.

1. Financial Standby Letter of Credit

This type assures a seller of the financial capabilities of a buyer. A valuable credit instrument is utilized in the case of large trade contracts, where buyers and sellers typically lack familiarity with each other. In addition, it is one the most commonly used form of secondary guarantees that help mitigate the risk of default in the case of large trade agreements, which otherwise carry significant financial risks.

2. Performance Standby Letter of Credit

This type usually secures a buyer’s interests. The buyer can incorporate specific performance clauses in terms of the agreement, such as shipping by a particular date. In such a scenario, the issuing bank will only release the standby letter of credit if the performance clause is adequately fulfilled.

How to Get a Standby Letter of Credit?

To get it, an applicant must follow the below-mentioned step-by-step guidance.

- The buyer must request a bank or similar financial institution to issue a standby letter of credit in the seller’s favor.

- The bank will then evaluate the buyer’s creditworthiness and decide whether to extend the guarantee.

- It may ask the buyer to furnish a CIBIL rating and other details about their credit history. The bank may also ask the applicant to provide collateral in case of a significant transaction value.

- If the bank is satisfied with the applicant’s credibility and the furnished documents, it may issue the letter in the seller’s favor. Conversely, if the bank is unsatisfied with the applicant’s financial position and doubts its capability to pay the money, it may reject the request.

Advantages

- It helps ensure that the buyer will pay the seller once it receives the shipped goods.

- It adds credibility to the bids of small businesses and often helps them evade the need for upfront payment to the sellers.

- If the buyer fails to pay within the stated timeline, the seller can request the issuing bank to pay on the buyer’s behalf.

Disadvantages

- The flow of documentation is very complicated

- It is a reasonably new credit instrument, so its rules and regulations may not be specific and just.

Conclusion

So, there are many benefits of using a standby letter of credit and a few disadvantages. But, the most critical aspect is that it protects sellers against the risk of default by the buyers.

Recommended Articles

This is a guide to a Standby Letter of Credit. Here we also discuss the definition, working, examples, types, how to get it, and advantages & disadvantages. You may also have a look at the following articles to learn more –