What is Risk Control?

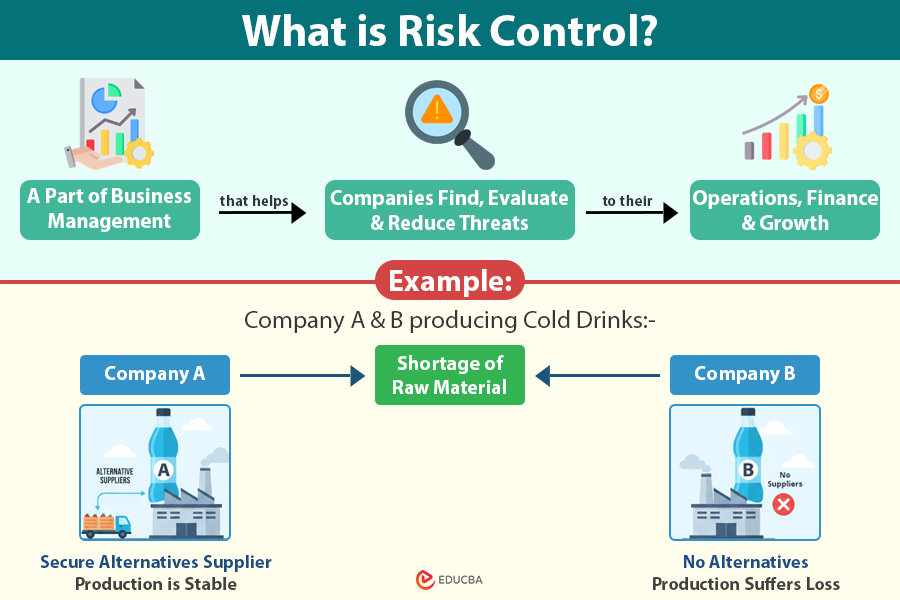

Risk control is a critical part of business management, helping companies identify, assess, and mitigate potential threats to operations, finances, and growth. By implementing effective risk control strategies, organizations can minimize losses, protect assets, and maximize shareholder value.

Imagine two manufacturing companies, Company A and Company B, producing the same product. Company A has a risk-control team that monitors supply-chain disruptions. When they anticipate a potential shortage of raw materials, they promptly engage alternative suppliers to avoid production delays. Company B, without such a system, unexpectedly experiences a shortage, resulting in a one-month halt and a $2 million loss.

This example shows how proactive risk control can prevent losses and keep a business running smoothly.

Table of Contents

- What is Risk Control?

- How Does it Work?

- Real World Examples

- Types

- Techniques

- Frameworks and Standards

- How Does Risk Control Help the Firm?

- Emerging Trends

How Does Risk Control Work?

Risk control works by identifying, assessing, and managing potential threats to a business before they cause significant damage. It is a structured process that helps organizations minimize losses and maintain smooth operations. The typical steps include:

- Identify risks: Examine business activities, operations, and processes to detect potential risks. These could be financial, operational, technical, or regulatory.

- Assess risks: Evaluate the likelihood of each risk and the potential damage it could cause. Prioritize risks by their potential to severely affect the business.

- Implement control measures: Take actions to reduce, eliminate, or manage the risks. This can include preventive measures, contingency plans, or insurance coverage.

- Monitor and reassess: Continuously monitor business operations to detect new risks or changes in existing risks. Adjust control measures as necessary to maintain effectiveness.

- Review and improve: After risk events or near-misses, evaluate the effectiveness of controls. Learn from these events to inform future risk-control strategies.

Real World Examples

1. JPMorgan Chase Enhances Cybersecurity Controls

JPMorgan Chase has implemented advanced risk controls to protect against cyber threats through threat detection systems and regular vulnerability assessments. These proactive controls help safeguard sensitive financial data and maintain customer trust.

2. General Motors Manages Supply Chain Risks Using IoT

General Motors (GM) uses IoT sensors and predictive maintenance to track equipment health in real time, helping prevent unexpected breakdowns. GM also diversified its supplier base and established contingency plans to ensure continuous production and minimize the risk of disruption.

3. Walmart’s Data Analytics for Inventory and Supply Chain Control

Retail giant Walmart employs data analytics and AI‑powered forecasting tools to anticipate supply chain disruptions arising from weather, supplier delays, or demand fluctuations. These measures help optimize inventory and reduce supply‑related losses.

4. Australian Retailer Tackles Cybersecurity Breach

A local retail chain in Townsville (Australia) experienced a cybersecurity breach. However, it implemented risk control measures, including a forensic investigation, a system overhaul, staff cybersecurity training, and customer communication, to recover and rebuild trust.

5. Tourism Operator Survives Cyclone with Emergency Planning

A Great Barrier Reef tour operator prepared effective risk controls, including emergency response planning, asset relocation, insurance coverage, and communication strategies, allowing the business to reopen quickly after a cyclone and retain staff.

6. Continental AG Strengthens Internal Risk Controls

Continental AG continued to improve its internal control systems (ICS) and risk management processes in 2024 to address new regulatory challenges, bolstering cybersecurity, data compliance, and cross‑functional oversight to mitigate operational and governance risks.

7. Extreme Weather Risk Controls in Corporate Supply Chains

In 2024, Hurricane Helene disrupted production of high‑purity quartz in North Carolina, underscoring how environmental risks can unexpectedly affect global tech supply chains. Companies are increasingly identifying such climate risks and building risk visibility and adaptation strategies to prevent future losses.

Types of Risk Control

There are three major types. They are detective, preventative, and corrective.

- Detective risk control: This control measure is applied only after the discretionary event has been detected. Examples of detective risk control include internal audits of financial reporting, reviews of financial statements, and reconciliations of physical inventories.

- Preventive risk control: These control measures are implemented to prevent a potential risk event from occurring. For instance, all financial models include a built-in balance sheet check to prevent a mismatch between total assets and total liabilities.

- Corrective risk control: These control measures are implemented after a problem is identified through detective risk control. The aim is to avoid repeating the same mistake. Examples of corrective risk control measures include disciplinary action, software patches, and the filing of reports.

Techniques

Six main techniques can be used. They are avoidance, loss prevention, reduction, separation, duplication, and diversification.

- Avoidance: This control technique is used to eliminate a risk entirely; if implemented successfully, there is almost zero chance of incurring losses from that risk.

- Loss prevention: This control technique doesn’t eliminate the risk but prevents expected losses. In other words, this technique accepts the risk rather than avoiding it entirely and then attempts to mitigate the resulting losses.

- Loss reduction: This technique accepts both the risk and the potential loss that may result from it. It seeks to minimize losses in the event of the risk.

- Separation: This control technique involves the spreading of key assets. This ensures that not all assets will be affected simultaneously if a catastrophic event occurs at a single location.

- Duplication: This technique entails creating a backup plan. Technology-based firms primarily practice it.

- Diversification: This control technique involves allocating available resources across multiple lines of business. In such a scenario, a calamitous event in one business segment does not affect the firm’s overall operations.

Risk Control Frameworks and Standards

To systematically manage and control risks, many organizations adopt established risk control frameworks and standards. These frameworks provide structured approaches for identifying, assessing, and mitigating risks, ensuring consistency, compliance, and effective risk management.

1. ISO 31000: Risk Management Standard

ISO 31000 offers clear principles and guidelines to help organizations manage risks effectively. It emphasizes the integration of risk management across all aspects of business, including strategy, operations, and decision-making.

Key Features:

- Risk identification, assessment, and treatment

- Continuous monitoring and review

- Customizable to fit any industry or organization, regardless of size.

Example: Large multinational corporations, such as Shell, use ISO 31000 to systematically manage operational and financial risks.

2. COSO Enterprise Risk Management (ERM) Framework

The COSO ERM framework helps organizations manage risks while staying aligned with their goals. It focuses on governance, risk assessment, control activities, information, and communication.

Key Features:

- Emphasizes linking risk management with strategy

- Provides a structured approach to internal controls

- Helps identify emerging risks proactively.

Example: Financial institutions such as JPMorgan Chase implement COSO ERM to manage credit, market, and operational risks.

3. NIST Risk Management Framework (RMF)

The National Institute of Standards and Technology (NIST) uses the RMF to manage IT and cybersecurity risks. It guides organizations in securing information systems while addressing threats and vulnerabilities.

Key Features:

- Systematic risk assessment and mitigation for IT systems

- Aligns with federal standards and regulations

- Focuses on continuous monitoring and improvement.

Example: US federal agencies and tech companies like Microsoft use NIST RMF to strengthen cybersecurity controls and protect sensitive data.

4. OHSAS/ISO 45001 for Occupational Health and Safety Risks

ISO 45001 (formerly OHSAS 18001) focuses on identifying and controlling workplace hazards to ensure employee safety.

Key Features:

- Risk-based approach to workplace safety

- Promotes a culture of continuous improvement

- Integrates health and safety with overall business processes.

Example: Manufacturing companies like Toyota implement ISO 45001 to reduce workplace accidents and improve operational safety.

How Does Risk Control Help the Firm?

Effective risk control allows a company to anticipate, manage, and minimize potential losses before they become serious problems. By identifying risks early and implementing the right measures, firms can:

- Reduce financial losses: Proper risk control helps prevent unexpected costs from operational, financial, or market disruptions.

- Protect business assets: Companies can safeguard critical resources, technology, and intellectual property.

- Ensure business continuity: It prepares firms to continue operations even during crises, like supply chain disruptions or equipment failures.

- Maximizing shareholder value: Limiting losses and managing risks effectively builds investor confidence and enhances long-term profitability.

- Support strategic decision-making: Knowing potential risks helps leaders make smart, proactive decisions rather than react later.

Emerging Trends in Risk Control

Risk control is evolving rapidly as businesses adapt to new technologies, global challenges, and changing regulatory environments. Here are some key emerging trends:

- AI and machine learning integration: More companies are now using AI and machine learning to spot risks before they happen. These technologies quickly analyze large datasets to identify patterns and potential threats more efficiently than traditional methods.

- Real-time risk monitoring: With IoT devices and advanced sensors, businesses can now monitor operations in real time. This allows immediate action to prevent or reduce losses, especially in manufacturing, logistics, and energy sectors.

- Cybersecurity focus: As digital transformation accelerates, protecting against cyber threats has become a major component of risk control. Organizations are implementing advanced firewalls, encryption, and AI-based threat detection systems.

- Regulatory compliance automation: Automated systems are helping organizations remain compliant with rapidly evolving regulations. This helps reduce the risk of penalties and ensures that safety measures comply with industry standards.

- Scenario planning and stress testing: Firms are increasingly conducting simulations and stress tests to prepare for extreme events, including natural disasters, supply chain disruptions, and financial crises. This proactive approach improves resilience.

- Sustainability and ESG risks: Environmental, social, and governance (ESG) factors are increasingly incorporated into risk management strategies. Companies are assessing risks related to climate change, labor practices, and corporate governance to protect long-term value.

- Remote and hybrid work considerations: The rise of remote and hybrid work has introduced new risks, including data breaches and operational disruptions. It now includes securing virtual environments and effectively managing distributed teams.

Final Thoughts

Effective risk control is more than a defensive strategy; it is a proactive approach that enables organizations to anticipate challenges, protect assets, and thrive in a competitive, uncertain environment. By identifying potential threats, implementing control measures, and continuously monitoring outcomes, businesses can minimize financial losses, ensure operational continuity, and enhance long-term growth.

In the rapidly evolving world, risk control also supports strategic decision-making, boosts stakeholder confidence, and enables firms to adapt to technological, environmental, and regulatory changes. Companies that integrate risk control into their core operations not only survive crises but also capitalize on opportunities, creating sustainable value for shareholders and society alike.

Frequently Asked Questions (FAQs)

Q1. How often should a company review its risk control measures?

Answer: Companies should review risk control measures at least annually, and more frequently during major business changes, regulatory updates, or after experiencing a risk event. Dynamic or high-risk industries should continuously monitor their risk control measures.

Q2. Can small businesses benefit from risk control frameworks like ISO 31000 or COSO ERM?

Answer: Yes. While large corporations often lead in implementing these frameworks, small businesses can adapt the principles to fit their scale. Even simple risk assessments and preventive measures can significantly reduce losses.

Q3. What role does leadership play in risk control?

Answer: Leadership sets the tone for risk awareness and accountability. Effective leaders prioritize risk management, allocate resources to mitigation, and foster a culture in which employees actively identify and report risks.

Q4. How does risk control differ from risk management?

Answer: Risk management is the broader process of identifying, analyzing, and responding to risks. Risk control is a key component of this process, focusing specifically on implementing measures to reduce or eliminate the impact of those risks.

Q5. How can technology improve risk control effectiveness?

Answer: Technologies like AI, IoT, and predictive analytics allow real-time monitoring, early detection of threats, and data-driven decision-making. This enables faster responses and reduces potential losses relative to manual risk-control methods.

Recommended Articles

This is a guide to Risk Control. Here, we also discuss the introduction and the operation of risk control. Along with types and examples. You may also have a look at the following articles to learn more –