Updated July 13, 2023

Difference Between Right Issue vs Bonus Issue

Rights Issue is a right issued to its existing shareholders to subscribe to the shares at a discounted price within a specified time period. A bonus issue is an issue of shares by the Company to its existing shareholders free of cost. It is issued in relation to no. of shares held by the shareholders. We will learn more about the Right Issue vs Bonus Issue in this topic.

What is the Right Issue?

The Company offers its existing shareholders the choice to purchase additional fresh shares through a Rights issue. Existing shareholders are given the right to buy additional shares at a discounted price compared to the market price. They can exercise the right within a stipulated time frame. Any shareholder who exercises the rights can buy the shares and increase their shareholding in the Company. In the post-rights issue, the number of shares increases, diluting the share value and, in turn, affecting the share price in the market.

A rights issue mainly offers to raise additional capital. The raised capital can use for any business needs or settlement of existing debts.

Rights given to shareholders can also use in three ways (1) Use the rights and purchase additional shares, (2) Ignore the rights, or (3) Sell the rights to other parties.

Example:

ABC Corp has decided to make rights issue. It declared a rights issue of 1:2 at $1000 per share, where the market price is $1300. The company is willing to issue one rights share for every two shares held by the existing shareholder.

So now shareholders can use the rights completely or renounce their rights partially or fully.

What is Bonus Issue?

A bonus issue is additional shares offered to the existing shareholders at no cost (i.e.) free shares. Instead of paying dividends to the shareholders, the Company can issue bonus shares. Bonus shares are issued in proportion to no. shares already held by the existing shareholders. (Eg.) One bonus share will be issued for every five shares held (1:5). Shareholders’ equity does not dilute concerning bonus shares as shares are issued in the same proportion, and the equity% will remain the same.

A bonus issue considers when the Company cannot payout to the shareholders due to a financial crunch or to restrict cash outflow while meeting the shareholders’ expectations. The bonus issue does not involve cash outflow, only increasing the company’s share capital. Post Bonus issue, the company’s share price will reduce as the number of shares increases. It will create more liquidity for the shareholders as they can sell the shares in the market and get cash. Additionally, shares have become more affordable in terms of price to retail investors.

Example:

X Corp has decided to make a bonus issue in the ratio of 1:2. It means for every two shares held by existing shareholders; additionally, one share issue is free of cost. This will increase the liquidity in the market and restrict the company’s cash outflow to the existing shareholders.

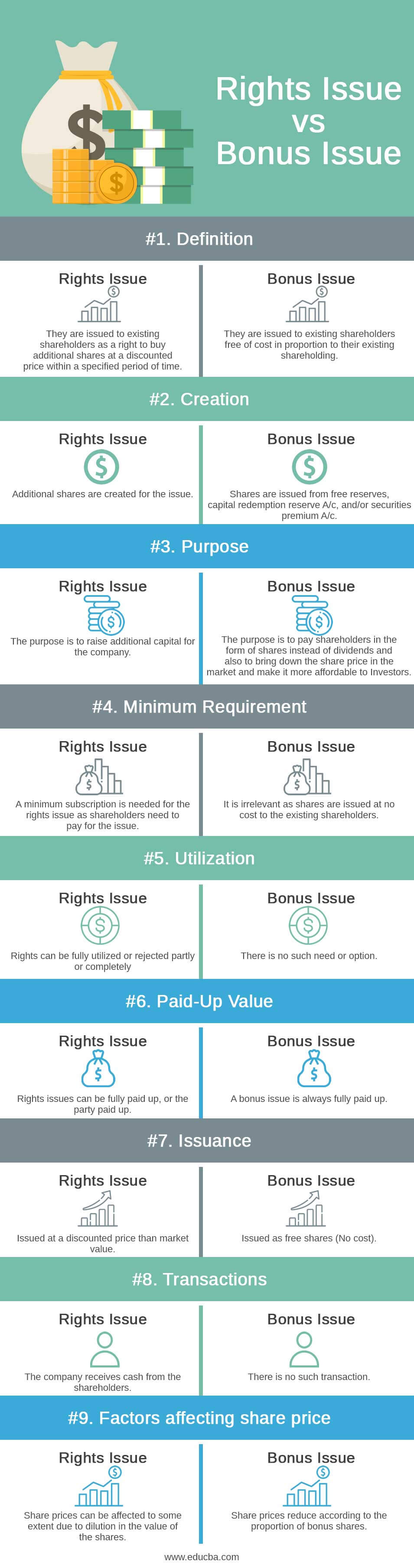

Head To Head Comparison Between Right Issue vs Bonus Issue (Infographics)

Below is the top 9 difference between Right Issue vs Bonus Issue:

Similarities Between Right Issue vs Bonus Issue

- Both Rights Issues and Bonus Issues are made to the existing Shareholders.

- Both issues increase the no. of outstanding shares and the Company’s Share capital.

- Both are Ordinary classes of Shares.

- Both issues increase the liquidity in the market for the shareholders to transact easily.

- Shareholders are benefitted from both issues as one comes at a discounted price, and one comes free of cost.

Key Summary

The company issues rights issues and bonus issues for different purposes. On a macro level, both issues increase the no. of outstanding shares in the market and enhance shareholder value. Rights issue comes at a discounted price, whereas bonus issue is free. The company’s management uses the right strategy based on the business’s and shareholders’ needs.

A rights issue prefer when the company needs funds for business activities and debt repayment. In contrast, a bonus issue considers an alternative to dividend outflow to restrict the cash outflow.

Right Issue vs Bonus Issue Comparison Table

Below is the 9 topmost comparison between Right Issue vs Bonus Issue:

|

Rights Issue |

Bonus Issue |

| They are issued to existing shareholders as a right to buy additional shares at a discounted price within a specified period of time. | They are issued to existing shareholders free of cost in proportion to their shareholding. |

| Additional shares are created for the issue. | Shares are issued from free reserves, capital redemption reserve A/c, and securities premium A/c. |

| The purpose is to raise additional capital for the company. | The purpose is to pay shareholders in the form of shares instead of dividends and also to bring down the share price in the market and make it more affordable to Investors. |

| A minimum subscription is needed for the rights issue as shareholders need to pay for the issue. | It is irrelevant as shares are issued to the existing shareholders at no cost. |

| Rights can be fully utilized or rejected partly or completely | There is no such need or option. |

| Rights issues can be fully paid up, or the party paid up. | A bonus issue is always fully paid up. |

| Issued at a discounted price than market value | Issued as free shares (No cost) |

| The company receives cash from the shareholders. | There is no such transaction. |

| Share price can be affected to some extent due to dilution in the value of the shares. | Share prices reduce according to the proportion of bonus shares. |

Recommended Articles

This has been a guide to the top difference between Right Issue and vs Bonus Issue. We also discuss the Right Issue vs Bonus Issue key summary with infographics and a comparison table. You may also have a look at the following articles to learn more.