What is Professional Risk Manager (PRM)?

A Professional Risk Manager (PRM) manages the risks that could affect an organization or project. They usually possess a background in finance, economics, accounting, or a related field and are knowledgeable about risk management tools and methods.

Further, they have a good understanding of the organization’s industry, operations, products, and services. Professional Risk Managers use various tools and techniques to detect, assess, and monitor risks, and they are assigned to develop and implement risk-mitigation strategies.

Role of Professional Risk Manager

The primary duties of a Professional Risk Manager involve analyzing financial statements, creating risk reports, and overseeing the organization’s activities and investments to identify potential sources of risk.

PRMs play a crucial role in helping organizations navigate the uncertainties and challenges of the business environment by developing risk management policies and procedures, communicating risk assessments to senior management, and implementing strategies to mitigate risks. They work closely in sync with other departments in the organization, such as legal, compliance, and audit, to ensure that risks are properly addressed.

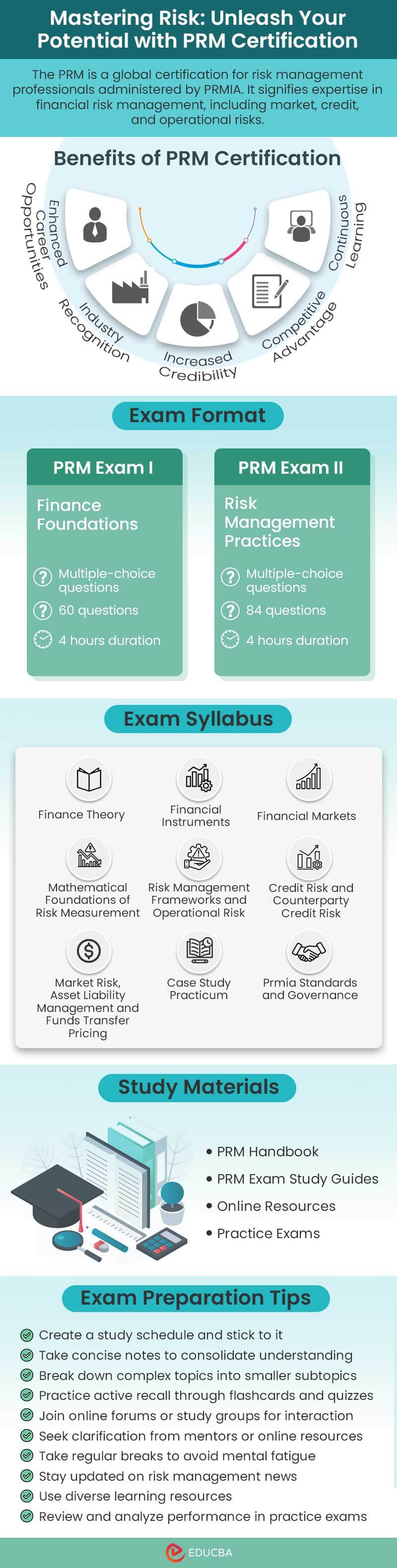

PRM Exam Infographic

How to Become a Professional Risk Manager?

Here are some suggestions in order to become a professional risk manager:

1. Education: Various organizations and institutions offer certification programs in risk management, such as the Professional Risk Manager (PRM) designation, awarded by the Professional Risk Managers’ International Association (PRMIA). This certification can help you exhibit your risk management expertise, enhancing your job prospects.

2. Skill Development: It is important to develop the required skills, such as analytical, communication, and problem-solving abilities.

3. Experience Building: One can acquire experience in the field of risk management by working in positions such as risk analyst, risk consultant, or internal auditor.

4. Staying Updated: Furthermore, one must also stay up-to-date with regard to the latest developments and best practices involved in risk management.

++++

Professional Risk Managers’ International Association (PRMIA) offers a PRM certification program, which can be registered via the following steps:

Step 1: Go to the PRMIA website and click on “Join” to create an account.

Step 2: Once you have created an account, you can select the PRM program from the list of available certifications.

PRMIA offers various study packages, e.g., self-study, online instructor-led, and classroom courses.

Step 3: Choose the package that suits you best.

The registration fee varies depending on the study package you choose.

Step 4: Pay the fee online using a credit card or other accepted payment methods.

You will now gain access to the PRM study materials, which include textbooks, practice exams, and other resources.

Step 5: You can schedule the PRM exam at a testing center nearby at your convenience.

To earn the PRM certification, you must pass a series of four exams that cover topics such as risk management theory, financial instruments, and operational risk.

PRM Exam Overview

The PRM exam is an internationally recognized risk management certification program covering financial instruments, risk measurement, and risk management frameworks. It is divided into four levels that gradually increase knowledge and abilities through multiple-choice questions and a case study test.

|

Exam Title |

Test Length (number of test questions) |

Testing Time Limit |

| Exam 1 | 60 questions | 4 hours |

| Exam 2 | 84 questions | 4 hours |

(Source: PRM Guidebook)

Eligibility & Requirements

- Having a current sustaining membership with PRMIA is necessary.

- The candidate must have completed graduate school (i.e., MBA, MSF, MQF, etc.) or be a current CFA charter holder.

- The following are the requirements concerning experience in the absence of a Master’s degree:

- Two years of full-time work experience along with a bachelor’s degree

- Four years of full-time work experience

- The work experience must be related to finance or risk management departments.

- Candidates must pay the required fees to opt for the exam.

- The program must be concluded within three years of enrollment. One must pass the exams within a period of two years, although exemptions can apply.

Exemptions

- Individuals who have designations of (CFA) Chartered Financial Analyst or Certified International Investment Analyst (CIIA) can get an exemption from Exam 1. CFA holders are also exempted from any experience requirement.

- New PRM applicants can apply for an exemption in the application form. Although there is no extra exemption fee, the total program fee must still be paid.

- Current PRM candidates who want to apply for an exemption should upload the required paperwork to the “PRMIA Certification Profile” tab in their member profile.

Exam Dates

*Scheduling Window – the time frame in which you may contact Pearson VUE and fix the date you will sit for the exam (testing window).

**Testing Window – days you can sit for your exam.

|

Scheduling Window* |

Testing Window** |

| January 1 – March 10, 2023 | February 13 – March 10, 2023 |

| March 11 – June 16, 2023 | May 22 – June 16, 2023 |

| June 17 – September 8, 2023 | August 14 – September 8, 2023 |

| September 9 – December 15, 2023 | November 13 – December 15, 2023 |

| January 1 – March 8, 2024 | February 12 – March 8, 2024 |

| March 9 – June 14, 2024 | May 20 – June 14, 2024 |

| June 15 – September 6, 2024 | August 12 – September 6, 2024 |

| September 7 – December 13, 2024 | November 11 – December 13, 2024 |

| January 1 – March 7, 2025 | February 10 – March 7, 2025 |

| March 8 – June 13, 2025 | May 19 – June 13, 2025 |

| June 14 – September 5, 2025 | August 11 – September 5, 2025 |

| September 6 – December 12, 2025 | November 10 – December 12, 2025 |

Syllabus and Structure

|

No. |

Subject |

Topics |

| 1. | Finance Theory |

|

| 2. | Financial Instruments |

|

| 3. | Financial Markets |

|

| 4. | Mathematical Foundations of Risk Measurement |

|

| 5. | Risk Management Frameworks and Operational Risk |

|

| 6. | Credit Risk and Counterparty Credit Risk |

|

| 7. | Market Risk, Asset Liability Management and Funds Transfer Pricing |

|

| 8. | Case Study Practicum |

|

| 9. | Prmia Standards and Governance |

|

| No. | Domains Assessed | Number of Stand-Alone Test Questions [1] | Number of Practicum-Based Test Questions [2] | Proportion Across Both Exams |

| PRM Exam 1 | PRM Exam 2 | |||

| I. | Finance Theory |

17 |

0-2 |

12% |

| II. | Financial Instruments |

14 |

0-2 |

10% |

| III. | Financial Markets |

16 |

0-2 |

11% |

| IV. | Mathematical Foundations of Risk Measurement |

13 |

0-2 |

9% |

| V. | Risk Management Frameworks and Operational Risk |

23 |

4-7 |

16% |

| VI. | Credit Risk and Counterparty Credit Risk |

20 |

4-7 |

15% |

| VII. | Market Risk, Asset Liability Management and Funds Transfer Pricing |

17 |

4-7 |

13% |

| VIII. | Case Study Practicum [3] |

0 |

20 [4] |

12% |

| IX. | PRMIA Standards and Governance |

4 |

0 |

2% |

| Total |

60 |

84 |

100% |

[1] Stand-alone test questions are questions intended to be answered based on the information provided in the question’s stem or prompt. The answer to the question will refer only to the content provided in that specific question.

[2] Practicum-based test questions are questions intended to be answered based on the information provided in the scenario that precedes the question. The question’s stem or prompt may require additional information to be identified from the provided scenario in order to answer the question.

[3] The Case Study Practicum portion of PRM exam 2 includes test questions that assess the application of knowledge from domains I through VII. Due to the nature of the practical application of the lessons learned from the case studies, different skill sets and knowledge will be assessed with each practicum. As a result, each exam form may contain different sets of test questions assessing these areas.

[4] The Case Study Practicum includes 4 sets of 5 test questions, to make up the 20 total test questions that assess the application of the lessons learned from the PRMIA Case Studies. Each set of test questions may include between 0-2 questions related to domains I-IV and will include between 4–7 questions related to domains V-VII.

Fees

- To commence the enrollment process for the PRM Program, an Application Fee of US$150 must be paid.

- Upon the approval of the application, the person must pay a PRM Program fee of US$1080.

- In addition, a Sustaining Membership is mandatory, which amounts to US$225.

- Please note that there can be an extra charge for retaking exams, expired exam authorizations, or if a scheduled exam was missed without prior notice.

Study Resources

- PRM Handbooks and Study Guides: The PRM Handbook covers the syllabus for the PRM exams and provides detailed information on risk management-related concepts, principles, and practices. Likewise, PRM study guides are particularly designed for PRM exam preparation. They outline the key concepts and provide practice questions and exercises to reinforce the content learned.

- Practice Exams: Practice exams are crucial for exam preparation, as it introduces the exam format, time constraints, and types of questions. PRMIA offers official practice exams that simulate the actual exam experience for the students.

- Online Courses: Several online platforms offer PRM exam preparation courses. These courses comprise video lectures, study materials, practice questions, and mock exams. They provide structured learning and allow you to study at your own pace.

- Reference Books: Several books on risk management can be used as reference materials for the PRM exam. Some recommended books are “Financial Risk Management: A Practitioner’s Guide to Managing Market and “Risk Management and Financial Institutions” by John C. Hull.

- Online Forums: Engaging in online forums and discussion groups dedicated to PRM exam preparation can be quite useful. One can connect and correspond with other candidates, exchange study materials, ask queries, and obtain insights from their experiences.

PRM Results and Passing Rates

PRM results are posted on the candidate’s profile within 15 days of the test. The result will be informed to the candidates via an email alongside the instructions to access it.

The PRM passing rates are estimated to be around 65%. Moreover, the pass rates for individual exams range from 59% (Exams I and III) to 78% (Exam IV).

Career Prospects

There are various career prospects available for individuals with Professional Risk Manager designation, such as:

- Risk Analysts or Consultants

- Compliance Officer

- Portfolio Manager

- Risk Modeler

- Quantitative Analyst

Salary

Here is a graph outlining the average salaries pertaining to the domain of professional risk management:

(Source: Payscale)

Frequently Asked Questions(FAQs)

Q1. Is the PRM certification recognized globally?

Answer: Yes, the PRM certification is globally recognized in the domain of risk management. Financial institutions, organizations, and risk management specialists hold value for it across the world.

Q2. What are the prerequisites for taking the PRM Exam?

Answer: There are no prerequisites for the PRM Exam. Nonetheless, a good foundation in statistics, mathematics, finance, and economics can be quite useful for comprehending the concepts in the exam. Please check out the eligibility criteria in the sections mentioned earlier in the article.

Q3. Can we retake a failed PRM Exam?

Answer: Yes, if you do not attain a passing score, you can retake the exam. The number of times you can retake an exam is unlimited. However, the exam fee must be paid every time.