Updated November 27, 2023

Difference Between Present Value vs Net Present Value

Present Value

Present Value is basically the discounted value of future cash flow at a specific discounting rate. If the future cash flows are spread over multiple years, then the present value is some of the discounted value of future cash flows.

The formula for calculation of Present value:

FV is cash flow in future years, and r is the discounting rate.

N= represents the year of the cash flow

Demonstration for Calculation of Present Value

The present value of USD 100 in a year timeline with a discount rate of 8% is as below:

- Present Value (PV) = Future Value (FV)/ (1+r) ^n

- Present Value = 100/ (1+8%)^2

- Present Value = 100/1.1664

- Present Value = USD 85.73

So, the present value of USD 100, expected to be received after 2 years, is USD 85.73. Therefore, the present value of future cash flow is always less than the actual cash flow in that specific year because of the concept of the time value of money.

Present Value is useful in real-world applications in estimating future requirements’ present value, such as house EMI for a house loan and education loan for children. The present Value concept is widely used in bond pricing and valuation in Corporate Finance.

Net Present Value

Net present value is very similar to the present value except for considering capital investments made in the initial year while calculating net present value. Therefore, Net Present Value is the sum of a discounted value of future cash flows less initial investments.

The formula for calculation of Net Present value:

FV is cash flow in future years, and r is the discounting rate.

N= represents the year of the cash flow

Demonstration for Calculation of Net Present Value

A Company XYZ Corporation invests USD 100 million in a Project. The estimated cash flows from the project in the next 5 years for the company are as below:

| Year | 0 | 1 | 2 | 3 | 4 | 5 |

| Cash Flow | -100 | 20 | 25 | 30 | 35 | 40 |

Let’s calculate the NPV of the investment for the project at a discount rate of 8%.

- Net Present Value= Present Value of Future Cash Flows- Initial Investment

- Net Present Value = 20/ (1+8%)+ 25/ (1+8%)^2 + 30/ (1+8%)^3 +35/ (1+8%)^4+40/ (1+8%)^5-100

- Net Present Value = 116.72-100

- Net Present Value = 16.72

Net Present Value = USD 16.72 million

Applications

NPV is widely used in capital budgeting, making investment decisions, selecting between multiple projects for investment considerations, comparing two investments, etc., by finance professionals and investment bankers.

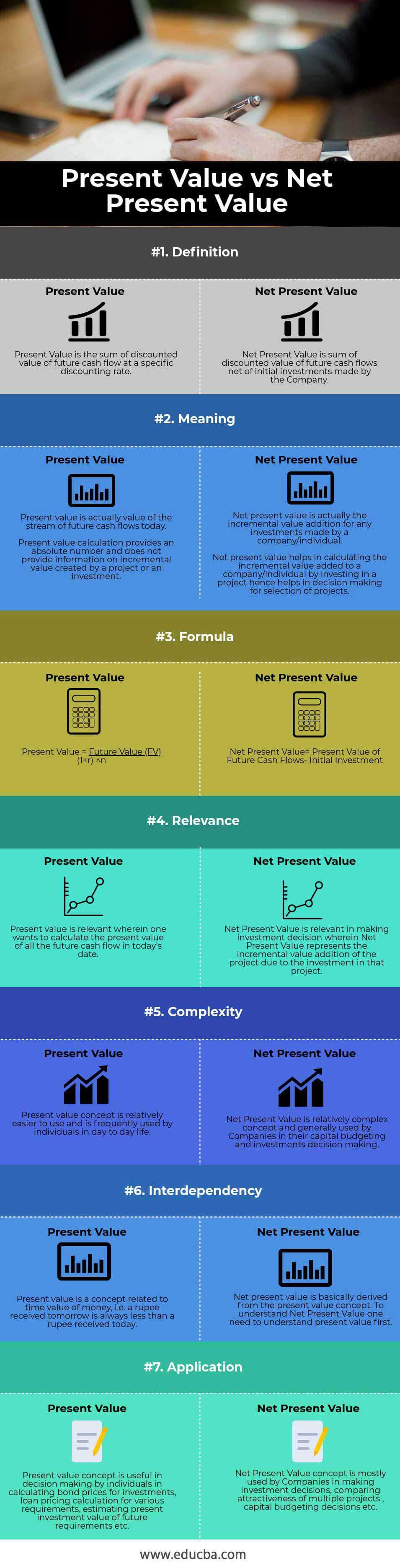

Head To Head Comparison Between Present Value vs Net Present Value (Infographics)

Below is the top 7 difference between Present Value vs Net Present Value

Key Differences Between Present Value vs Net Present Value

Both Present Values vs Net Present Value are popular choices in the market; let us discuss some of the major differences between Present Value vs Net Present Value

- Present Value is the sum of the discounted value of future cash flow. However, net present value is the sum of the discounted value of future cash flows minus initial investments.

- Net Present Value considers the initial investment and future cash flows to calculate the incremental value addition. However, Present Value only considers the discounting of future cash flows.

- Present value basically provides an absolute value, the discounted value of future cash flows. However, Net Present value measures incremental value created due to an investment decision, such as net value addition to a Company due to investment in a specific project.

- Net present value finds much more relevance for Companies and is relatively more complex than Present Value. Present value is used by individuals in day-to-day decision-making and is relatively easier.

- Net Present Value helps discount the amounts of future cash flows at different time periods with incoming and outgoing cash flows. Therefore, it is relatively complex but much more helpful in decision-making than at present value.

- A brief understanding of the concept of Present value is required to understand and calculate the Net present value, and both are related to the concept of the time value of money.

- The present value concept is useful in decision-making by individuals in calculating bond prices for investments, loan pricing calculation for various requirements, estimating the present investment value of future requirements, etc. However, the Net Present Value concept is mostly used by companies in making investment decisions, comparing the attractiveness of multiple projects, making capital budgeting decisions, etc.

Present Value vs Net Present Value Comparison Table

Below is the 7 topmost comparison between Present Value vs Net Present Value

| The basis of Comparison | Present Value | Net Present Value |

| Definition | Present Value is the sum of the discounted value of future cash flow at a specific discounting rate. | Net Present Value is the sum of the discounted value of future cash flows net of initial investments made by the Company. |

| Meaning | Present value is the actual value of the stream of future cash flows today.

Present value calculation provides an absolute number and does not provide information on incremental value created by a project or an investment. |

Net present value is the incremental value addition for any investments made by a company/individual.

Net present value helps calculate the incremental value added to a company/individual by investing in a project, hence helping in decision-making for the selection of projects. |

| Formula | Present Value = Future Value (FV)/ (1+r) ^n | Net Present Value= Present Value of Future Cash Flows- Initial Investment |

| Relevance | Present value is relevant wherein one wants to calculate the present value of all the future cash flow in today’s date. | Net Present Value is relevant in making investment decisions wherein Net Present Value represents the incremental value addition of the project due to the investment in that project. |

| Complexity | The present value concept is relatively easier to use and frequently used by individuals daily. | Net Present Value is a relatively complex concept companies generally use in capital budgeting and investment decision-making. |

| Interdependency | Present value is a concept related to the time value of money, i.e. a rupee received tomorrow is always less than one received today. | Net present value is derived from the present value concept. To understand Net Present Value, one needs to understand present value first. |

| Application | The present value concept is useful in decision-making by individuals in calculating bond prices for investments, loan pricing calculation for various requirements, estimating the present investment value of future requirements, etc. | The Net Present Value concept is mostly used by companies in making investment decisions, comparing the attractiveness of multiple projects, making capital budgeting decisions, etc. |

Conclusion

Both Present Value and Net Present Value are tools to make investment decisions, future planning, purchases, borrowings, etc., for Companies and individuals. Net Present Value provides more effective information in decision-making for Companies than Present Value, which is more effective and helpful for individuals.

Recommended Articles

This has guided the top difference between Present Value and Net Present Value. Here, we also discuss the Present Value vs Net Present Value key differences with infographics and a comparison table. You may also have a look at the following articles to learn more.