What is Payroll Management?

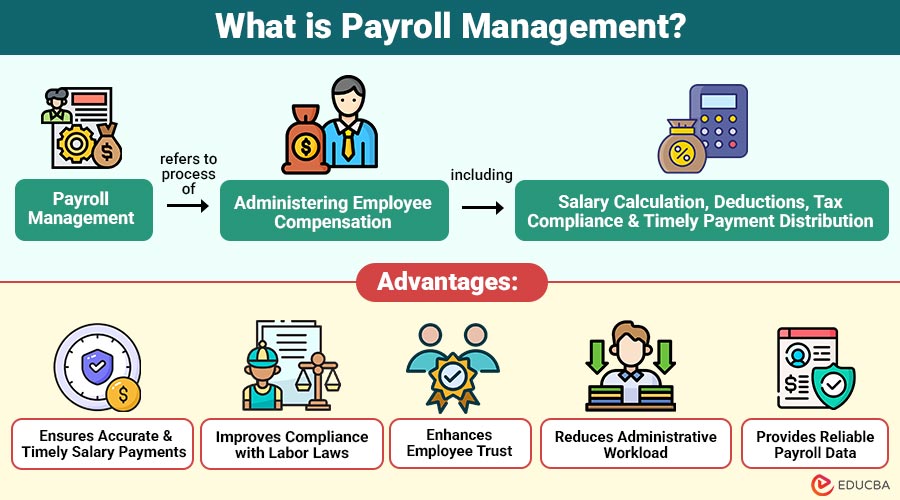

Payroll management refers to process of administering employee compensation, including salary calculation, deductions, tax compliance, and timely payment distribution.

It covers everything from collecting employee attendance data to generating payslips and filing payroll-related statutory reports with government authorities. Effective payroll management guarantees that employees are compensated correctly while organizations remain compliant with labor laws and taxation requirements.

Table of Contents:

Key Takeaways:

- Payroll management ensures accurate employee compensation, statutory compliance, timely payments, and organizational trust through processes.

- Effective payroll systems reduce errors, support legal compliance, improve efficiency, and enhance overall employee satisfaction.

- Automation and technology simplify payroll operations, strengthen data security, support scalability, and enable strategic decisions.

- Well-managed payroll builds credibility, supports financial planning, minimizes risks, and allows organizations to focus on growth.

Importance of Payroll Management

Effective payroll management plays a vital role in organizational success:

1. Ensures Employee Satisfaction

Timely and accurate salary payments build employee trust, boost morale, reduce dissatisfaction, and consistently improve productivity across the organization.

2. Legal and Tax Compliance

Payroll management reduces the risk of fines, penalties, audits, and legal issues by ensuring compliance with tax and labor laws.

3. Financial Accuracy

Accurate payroll calculations help organizations control costs, forecast budgets effectively, ensure correct reporting, and maintain long-term financial stability.

4. Enhances Organizational Credibility

Reliable payroll processes strengthen organizational reputation among employees, government authorities, auditors, investors, and other key stakeholders.

Key Components of Payroll Management

Payroll management consists of several interconnected components that work together to ensure smooth operations:

1. Employee Information Management

This includes maintaining accurate employee records such as:

- Personal details

- Employment type (full-time, part-time, contract)

- Salary structure

- Bank account details

- Tax declarations

Accurate data forms the foundation of error-free payroll processing.

2. Salary Structure and Compensation Planning

Organizations define salary components such as:

- Basic pay

- Allowances (HRA, conveyance, special allowance)

- Bonuses and incentives

- Overtime payments

A clearly structured salary ensures transparency for employees and simplifies payroll calculations.

3. Attendance and Leave Tracking

Payroll calculations depend heavily on:

- Working days

- Paid and unpaid leaves

- Overtime hours

- Holidays and absences

Integration with attendance or leave management systems ensures accurate salary computation.

4. Payroll Processing

This is the core function of payroll management, which includes:

- Gross salary calculation

- Deduction of taxes and statutory contributions

- Net salary computation

- Payslip generation

Payroll processing must be precise to avoid employee dissatisfaction and compliance issues.

5. Statutory Compliance

Payroll management must adhere to labor laws and tax regulations, such as:

- Income tax deduction and filing

- Provident fund (PF) contributions

- Employee state insurance (ESI)

- Professional tax

- Minimum wage laws

There may be fines, audits, and legal action for noncompliance.

6. Payroll Reporting and Record Keeping

Organizations must maintain payroll records for:

- Audits

- Tax filings

- Financial reporting

- Legal documentation

Payroll reports help management analyze labor costs and make informed decisions.

Payroll Management Process

A typical payroll management process follows these steps:

1. Collect Employee Data

Gather accurate employee salary structures, attendance records, leave details, reimbursements, and personal information required for payroll processing.

2. Validate Inputs

Review and verify attendance data, salary revisions, new joiners, exits, and employee changes to avoid payroll errors.

3. Calculate Gross Pay

Compute total earnings, including basic salary, allowances, bonuses, overtime, and performance-based incentives, before deductions.

4. Apply Deductions

Deduct applicable income tax, provident fund, ESI, professional tax, loan repayments, and other statutory or voluntary deductions.

5. Compute Net Pay

Determine each employee’s final payable salary by subtracting all deductions from gross earnings.

6. Disburse Salaries

Transfer net salaries to employee bank accounts through secure electronic payment systems or approved payment methods.

7. Generate Payslips

Create detailed digital or physical payslips showing earnings, deductions, and net pay for employee reference.

8. File Statutory Returns

Submit payroll-related tax filings, compliance reports, and statutory returns to government authorities within prescribed deadlines.

Advantages of Payroll Management

Here are the key advantages of effective payroll management in organizations:

1. Ensures Accurate and Timely Salary Payments

Payroll management guarantees correct salary calculations and on-time payments, preventing errors, delays, and employee dissatisfaction.

2. Improves Compliance with Labor Laws

Structured payroll processes help organizations follow labor laws, tax regulations, and statutory requirements, reducing compliance risks.

3. Enhances Employee Trust

Consistent and transparent payroll practices build employee confidence, trust, and long-term engagement within the organization.

4. Reduces Administrative Workload

Automated payroll systems save time and increase operational efficiency by reducing manual labor, paperwork, and repetitive operations.

5. Provides Reliable Payroll Data

Accurate payroll records support financial planning, budgeting, audits, and informed strategic decision-making by management.

Challenges in Payroll Management

Despite automation, payroll management faces several challenges:

1. Regulatory Changes

Regular modifications to labor rules and tax laws necessitate ongoing system updates, payroll process modifications, and monitoring.

2. Data Accuracy

Inaccurate employee information, attendance errors, or missing records can result in incorrect salary calculations and compliance issues.

3. Scalability Issues

Organizational growth increases payroll complexity due to multiple pay structures, locations, employee categories, and regulatory requirements.

4. Confidentiality and Data Security

Payroll systems must protect sensitive employee data from unauthorized access, cyber threats, and potential data breaches.

Best Practices for Effective Payroll Management

To ensure smooth payroll operations, organizations should follow these best practices:

1. Automate Payroll Processes

Implement payroll software to streamline calculations, reduce manual effort, minimize errors, and improve overall processing efficiency.

2. Maintain Accurate Employee Records

Regularly update employee personal, salary, attendance, and tax information to prevent payroll discrepancies and delays.

3. Stay Updated with Compliance

Continuously monitor labor law changes and tax regulations to ensure payroll processes remain legally compliant.

4. Conduct Regular Payroll Audits

Perform periodic payroll audits to detect errors, improve accuracy, prevent fraud, and ensure regulatory compliance.

5. Provide Employee Transparency

Offer clear payslips and employee self-service portals to build trust and reduce payroll-related queries.

Future Trends in Payroll Management

Payroll management is rapidly evolving with technology advancements:

1. Cloud-Based Payroll Systems

Cloud payroll solutions enable remote access, real-time updates, scalability, and secure payroll processing across multiple locations.

2. AI and Automation

Artificial intelligence automates calculations, detects payroll errors, monitors compliance, and improves accuracy while reducing manual intervention.

3. Integration with HR Analytics

Payroll systems integrated with HR analytics provide insights into workforce costs, productivity trends, and strategic decision-making.

4. Employee Self-Service Platforms

Self-service payroll platforms empower employees to access payslips, tax details, and salary information, improving transparency and efficiency.

Final Thoughts

Payroll management is critical business function that ensures accurate salary processing, legal compliance, and employee satisfaction. It covers wage calculation, statutory deductions, reporting, and record-keeping. As organizations expand and regulations evolve, automated payroll systems and best practices help reduce errors, save time, improve transparency, minimize risks, and allow businesses to focus on strategic growth.

Frequently Asked Questions (FAQs)

Q1. Can small businesses use payroll software?

Answer: Yes, payroll software is highly beneficial for small businesses to reduce errors and ensure compliance.

Q2. What happens if payroll compliance is not followed?

Answer: Non-compliance can lead to penalties, legal action, and reputational damage.

Q3. Can payroll be outsourced?

Answer: Yes, many organizations outsource payroll to reduce costs and compliance risks.

Q4. How often is payroll processed?

Answer: Payroll is usually processed monthly, but some organizations follow weekly or bi-weekly cycles.

Recommended Articles

We hope that this EDUCBA information on “Payroll Management” was beneficial to you. You can view EDUCBA’s recommended articles for more information.