Updated July 11, 2023

What is Paid in Capital?

Paid in Capital refers to the amount of money paid in or the amount of capital contributed by the investors in exchange for the shares of a company purchased by them in other words paid in capital (PIC) reflects the aggregate sum of money received by the company from its shareholders in exchange of its shares.

Explanation

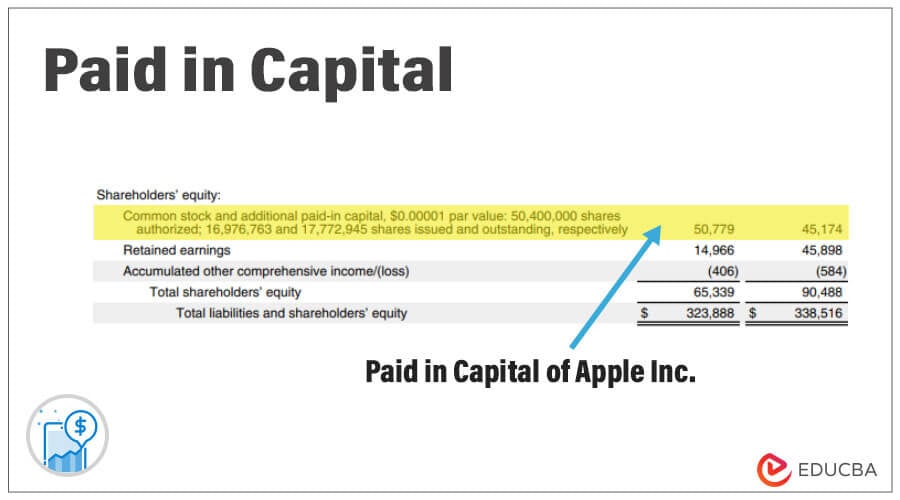

Shareholders contribute capital to the company, which receive only in the primary market when the shares are issued for the first time. It can divide further into two other lines: the first item is common stock (share capital reported at par value), and the other is additionally p.i. Capital is the amount the company receives more than its nominal or par value of the share. The PIC is reported on the company’s balance sheet on the equity and liabilities side under the head shareholders’/owner’s equity.

Features

The following are the main features of PIC:

- The PIC reported in the balance sheet shows the investors’ capital contribution in total and not of the individual investors.

- The PIC only shows the investors’ capital contribution at the time of initial issuance of the share. It does not consider the amount financed by investors on a later date to purchase the shares from the open market.

- There are two categories in which the PIC is bifurcated: common stock, representing the par value of issued shares, and additional financed capital, which signifies any amount received in excess of par value when shares are issued at a premium.

- The company reports it on the balance sheet under the equity head.

- When the company buybacks its own shares then, it reduces the paid-up capital of the company.

- The shareholders pay the PIC, which represents a portion of the called-up capital of the company, while the called-up capital is the sum of money requested by the company from the investors.

- The paid-up capital of the company cannot exceed its authorized share capital.

- The company declares a percentage of dividends to finance the shareholders, which applies to the PIC to calculate the dividend amount.

The Formula for Paid Capital

The formula for calculating the PIC is,

Or

Where,

In the first formula,

The total number of shares issued is the total capital issued by the company to its shareholders. Issue price is the amount at which the shares are issued to the shareholder.

In the second formula,

Common stock is issued as the number of shares multiplied by the par value of the share. Additional PIC is the issued number of shares *(Issue price – face value of share)

Example

Suppose a company Happy Inc. is engaged in the business related to the manufacturing of furniture. The balance sheet of the company shows the following data as of 31.03.2020.

|

Particulars |

Amount |

| Authorized share capital | $2,000,000 |

| Common stock | $1,200,000 |

| Additional PIC | $60,000 |

| Retained earnings | $750,000 |

| Issue price of the share | 21 per share |

| Face value of the share | $20 per share |

| Total number of outstanding shares | 60,000 |

From the above data, calculate the financed capital of the company.

Solution:

Method 1

The formula to calculate the PIC is as follows-

Paid in capital = Total no of shares issued * Issue price

Calculation of PIC

Method 2

The formula to calculate the p.i. capital is as follows-

Paid-in Capital = Common Stock + Additional Working Capital

Calculation of p.i. capital

|

Particulars |

Amount |

| Common stock(A) | $1,200,000 |

| Additional Working Capital(B) | $60,000 |

| P.I. capital(A+B) | $1,260,000 |

Paid in Capital vs Paid up Capital

The PIC is the amount of money the shareholders receive in exchange for the shares allotted to them, and the PIC is also known as paid-up or contributed capital.

Advantages

- Paid-up capital is not the borrowed capital of the company, so the company is not bound to pay the fixed cost of such capital.

- The high paid-up capital indicates its financial position because it shows that the company has lower debt burdens.

- The value of PIC is used to calculate various financial ratios, such as the debt-equity ratio (debt/equity). The lower debt ratio indicates that the burden of debts is lower and vice versa.

- The funds raised can be used for any purpose as there is no restriction on the company related to the usage of funds.

Disadvantages

- Although the cost of financing is high in debt funding, the investor, while contributing, expects a return in the form of dividends and capital appreciation which may result in a high cost of equity.

- From the investor’s point of view, the return is very uncertain as the PIC does not guarantee them any gains, dividends, growth, etc.

- The issuance of common stock dilutes the ownership and management control, as the shareholders are given the right to participate and vote in the company’s affairs.

Conclusion

Thus, p.i. Capital is the capital contributed by the shareholders in the company. It is shown in the equity section of the balance sheet. P. I capital includes both common stocks as well as the additional p.i. Capital and the value paid in the capital are used to measure financial ratios such as solvency ratios.

Recommended Articles

This is a guide to Paid in Capital. Here we also discuss the definition, features of paid-in capital, and advantages and disadvantages. You may also have a look at the following articles to learn more –