Overview of Liabilities Examples

The business’s liability reflects its obligation to transfer future economic benefits, usually in the form of a sum of money, to other entities, such as suppliers and lenders, due to past transactions.

In other words, the business’s financial records show the sum of money that the business owes to other persons/entities due to purchasing goods, receiving services, or borrowing money. This topic will explore various examples of liabilities in detail.

Explanation of Liabilities Examples

The company owes liabilities to another party, including suppliers of goods and services, lenders of money, or any other party to whom the company must pay in the future. The company mostly settles these liabilities by paying cash or transferring other economic benefits to the concerned party.

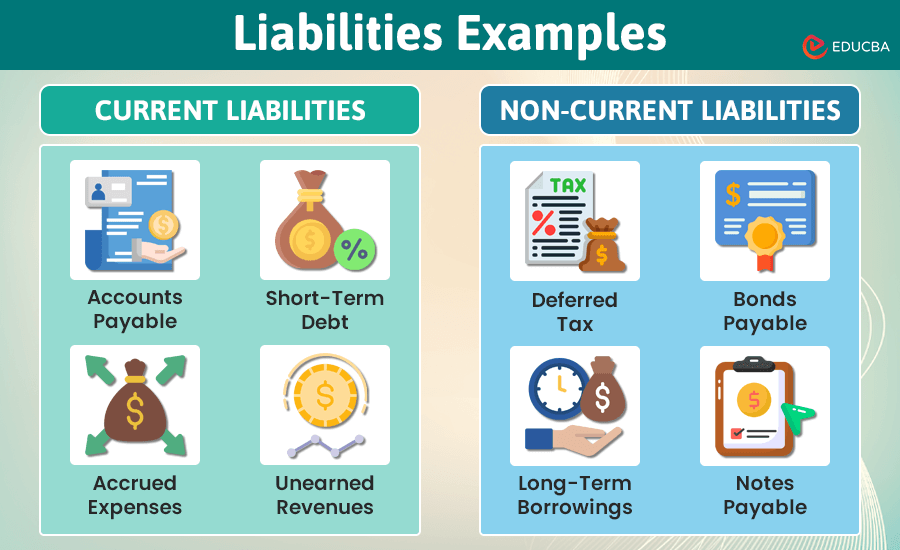

The liabilities of the business are primarily divided into two categories:

- Current liabilities: The business expects to settle current liabilities within one year from the reporting date. Current liabilities include accounts payable, short-term debts, notes payable, customer advances, and other similar obligations.

- Non-current liabilities: The business expects to settle non-current liabilities over longer periods, typically exceeding one year from the reporting date. Examples of non-current liabilities include long-term loans repayable after a year and debentures issued by the company.

Examples of Liability

The examples of liability are as follows:

Current Liabilities

- Accounts payable: The company owes a short-term obligation to its creditors who have provided goods and services on credit, and the company is yet to pay them within a year.

- Bank overdrafts: The bank allows customers to overdraw amounts exceeding their available bank account balance.

- Short-term debts: The company has borrowed funds from banks and other institutions, which must be repaid within one year.

- Accrued expenses: The company has unpaid expenses, such as rent and salaries payable, that it needs to pay within a year.

- Unearned revenues: The company has received customer advances for goods or services that are yet to be supplied. For example, a customer paid $50 in advance while ordering goods delivered after one month. Therefore, we will report the $50 as unearned revenue until the goods are delivered.

- Current portion of long-term debt: The company has a portion of long-term debt payable within one year. For instance, the company has taken a term loan of $6,000, of which $1,000 is due for repayment within one year of the reporting period. Therefore, $1,000 is reported as a current liability.

Non-Current Liabilities

Following are some examples of non-current liabilities:

- Long-term borrowings: The company raises funds to meet its capital expenditure by implementing strategic decisions that improve operational functions. The company borrows these funds for a period greater than 1 year, so they appear as non-current liabilities in the company’s balance sheet.

- Notes payable: Sometimes, the company buys goods or receives services, but it will pay after one year. In such cases, the company records the liability as notes payable under the non-current liabilities category, as the payment is due after one year.

- Bonds payable: Organizations such as hospital corporations and government entities issue bonds as long-term debts for more than one year. The bond issuer enters into a formal agreement regarding the future payment of interest, tenure, and maturity amount.

- Deferred tax liability: The company incurs this liability due to timing differences between tax calculations based on Income Tax rules and the tax on the company’s book profits. When a company has a deferred tax liability, it indicates that the disclosed income amount in the current year is lower than the amount in the books of account. The company sets off these liabilities in the future, making them non-current liabilities.

- Other non-current liabilities: Any other liabilities that arise after one year in the company are categorized as non-current liabilities. Examples include deferred compensation products related to warranty and pension liabilities.

Conclusion

Liabilities are future payments owed by a company to external parties. We categorize these liabilities into current or short-term and non-current or long-term liabilities based on the timeframe for settling the debt. Suppose the liability is payable within one year. In that case, we classify it as a current liability, whereas if the liability is payable after one year, we designate it as a non-current liability.

Recommended Articles

This is a guide to Liabilities Examples. Here we also discuss the definition and examples of liabilities and an explanation. You may also have a look at the following articles to learn more –