Updated July 13, 2023

Net Asset Formula (Table of Contents)

What is Net Asset Formula?

Net Assets are the difference between the total assets of a company and its total liabilities, giving the shareholders’ equity or net worth of the company. The net Assets Formula is the formula used to calculate a company’s net assets or net worth.

Example of Net Asset Formula (With Excel Template)

Let’s take an example to understand the calculation of the Net Asset in a better manner.

Net Asset Formula – Example #1

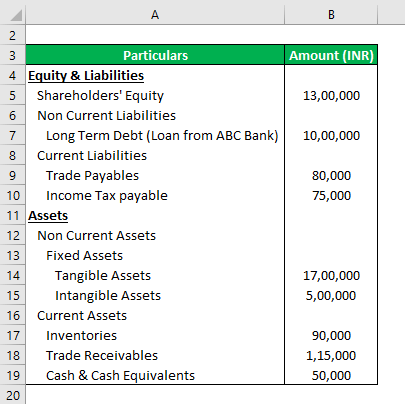

Let’s calculate the net assets of A Ltd. as of 31st March 2020.

Solution:

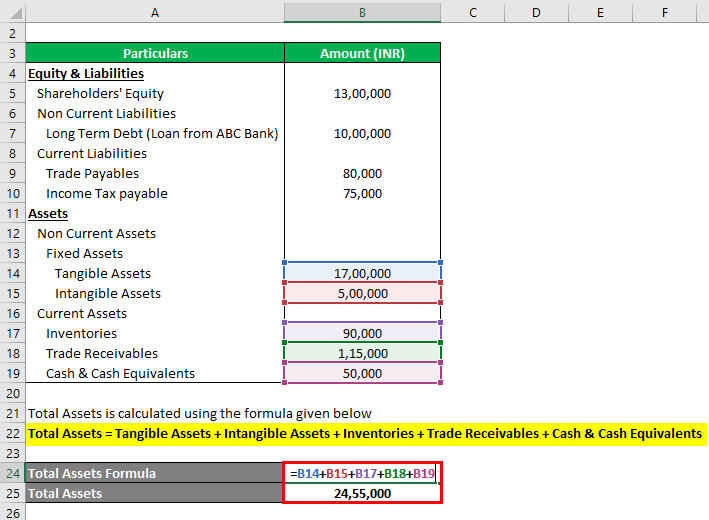

Total Assets is calculated using the formula given below

Total Assets = Tangible Assets + Intangible Assets + Inventories + Trade Receivables + Cash & Cash Equivalents

- Total Assets = 17,00,000 + 5,00,000 + 90,000 + 1,15,000 + 50,000

- Total Assets = 24,55,000

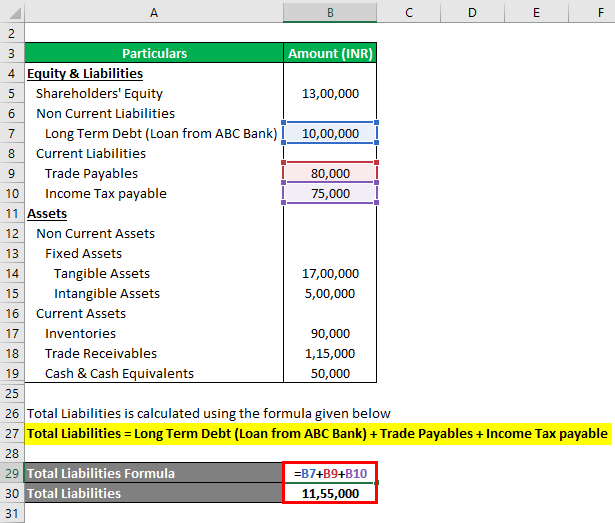

Total Liabilities are calculated using the formula given below

Total Liabilities = Long Term Debt (Loan from ABC Bank) + Trade Payables + Income Tax payable

- Total Liabilities = 10,00,000 + 80,000 + 75,000

- Total Liabilities = 11,55,000

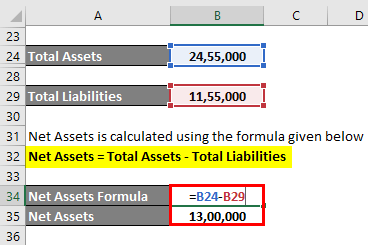

Net Assets are calculated using the formula given below

Net Assets = Total Assets – Total Liabilities

- Net Assets = 24,55,000 – 11,55,000

- Net Assets = 13,00,000

This would always equal the Shareholders’ Equity in the company’s balance sheet.

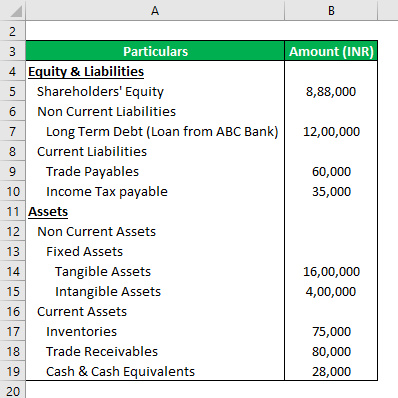

Net Asset Formula – Example #2

Let’s calculate the net assets of A Ltd. as of 31st March 2019.

Solution:

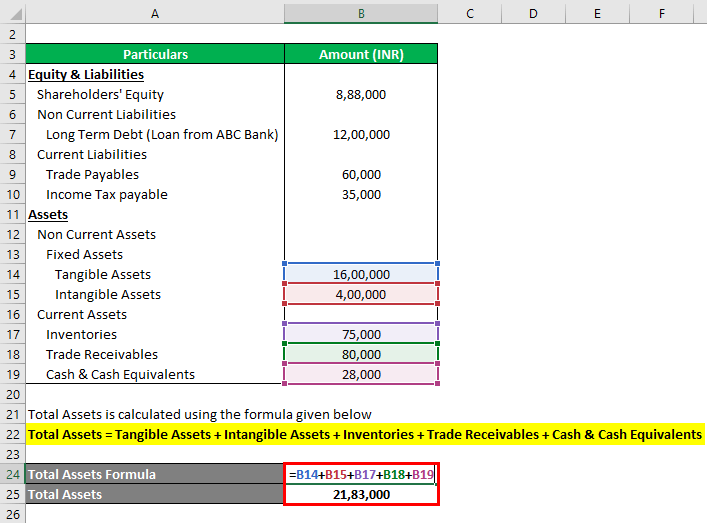

Total Assets is calculated using the formula given below

Total Assets = Tangible Assets + Intangible Assets + Inventories + Trade Receivables + Cash & Cash Equivalents

- Total Assets = 16,00,000 + 4,00,000 + 75,000 + 80,000 + 28,000

- Total Assets = 21,83,000

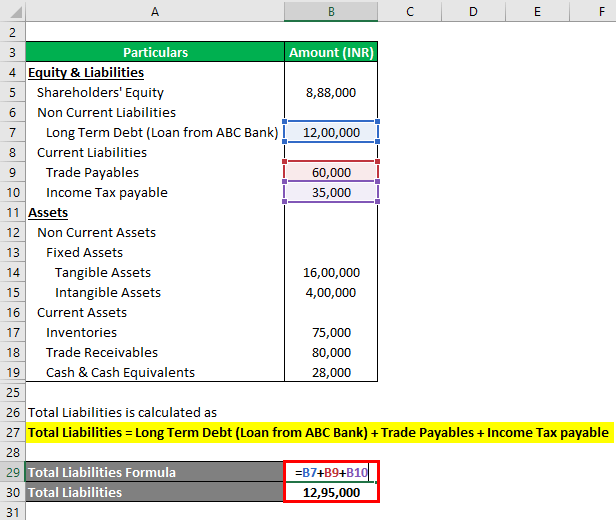

Total Liabilities are calculated using the formula given below

Total Liabilities = Long Term Debt (Loan from ABC Bank) + Trade Payables + Income Tax payable

- Total Liabilities = 12,00,000 + 60,000 + 35,000

- Total Liabilities = 12,95,000

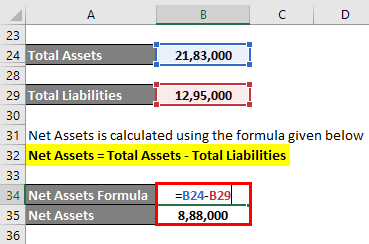

Net Assets are calculated using the formula given below

Net Assets = Total Assets – Total Liabilities

- Net Assets = 21,83,000 – 12,95,000

- Net Assets = 8,88,000

Now, the calculation of the net assets of A Ltd. for 2 years can help us compare the company’s net worth over the 2 years and get to know the company’s overall performance over the periods. The company’s net assets increased by INR 4,12,000 (13,00,000 in March 2020 versus 8,88,000 in March 2019), indicating overall growth in the business and the company’s net worth.

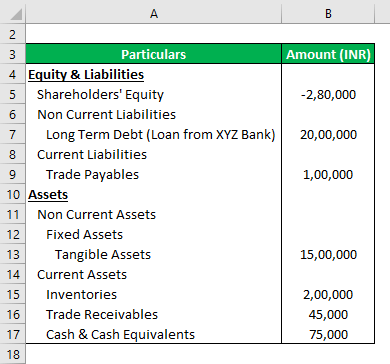

Net Asset Formula – Example #3

Consider B Ltd. and calculate its net assets as of 31st March 2020.

Solution:

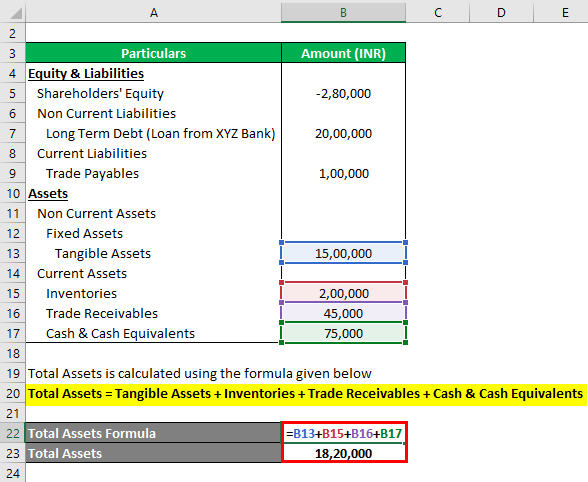

Total Assets is calculated using the formula given below

Total Assets = Tangible Assets + Inventories + Trade Receivables + Cash & Cash Equivalents

- Total Assets = 15,00,000 + 2,00,000 + 45,000 + 75,000

- Total Assets = 18,20,000

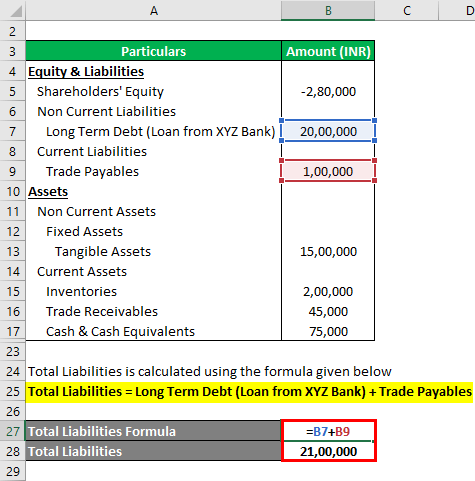

Total Liabilities are calculated using the formula given below

Total Liabilities = Long-Term Debt (Loan from XYZ Bank) + Trade Payables

- Total Liabilities = 20,00,000 + 1,00,000

- Total Liabilities = 21,00,000

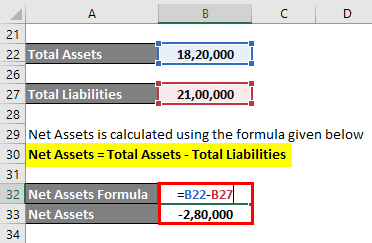

Net Assets are calculated using the formula given below

Net Assets = Total Assets – Total Liabilities

- Net Assets = 18,20,000 – 21,00,000

- Net Assets = -2,80,000

Here, the net assets of B Ltd. are negative 2,80,000, indicating that the company’s net worth is nothing, and in fact, the company owes around 2,80,000, moreover, all its assets. Therefore, the negative net worth might be due to capital erosion due to losses accumulated over the years.

Explanation

A company’s total assets denote the full value of the company’s assets that are valuable to the company, like Fixed Assets (such as Land, Plant & Machinery, Furniture, Vehicles, etc.), Current Assets (such as Inventory, Trade Receivables/ Debtors, Cash & Cash Equivalents, etc.) and other assets.

A company’s total liabilities denote the total value of money that a company owes to other persons or entities. It includes long-term debt (loans from banks, financial institutions, and other parties), current liabilities (such as Trade Payables/ Creditors, Employees’ dues of less than a year, etc.)

The difference between the total assets and the total liabilities gives the actual net value or net worth of the company, which is of utmost significance to a lot of parties like the company’s shareholders, its employees, the government, banks & financial institutions, and other stakeholders which might be interested in the company’s working directly or indirectly.

Relevance and Use of Net Asset Formula

- Provides insight into a company’s financial health: Net assets calculation gives an important insight into the overall financial health of an organization. The higher the net assets of a company, the better the financial position of its business.

- Helps make investment decisions: An organization’s net assets or net worth helps the current and potential investors make investment decisions in the future. A company with a negative or decreasing net worth might not draw interest from investors.

- Helps banks and financial institutions make lending decisions: An organization’s net assets also help the banks and financial institutions evaluate their lending decision and consider whether to lend (or further lend) to that organization. For example, Banks have certain criteria for a borrower to fulfill before they are given loans. A company with decreasing net worth might reflect the piling up of losses, and banks might be unable to lend to that company.

Net Asset Formula Calculator

You can use the following Net Asset Formula Calculator

| Total Assets | |

| Total Liabilities | |

| Net Assets | |

| Net Assets = | Total Assets – Total Liabilities |

| = | 0 – 0 |

| = | 0 |

Conclusion

The net assets formula is crucial in calculating an organization’s net assets or net worth, which helps its various stakeholders evaluate its overall growth and financial position.

Recommended Articles

This is a guide to Net Asset Formula. Here we discuss how to calculate the Net Asset along with practical examples. We also provide a Net Asset Formula calculator with a downloadable Excel template. You may also look at the following articles to learn more –