Updated July 29, 2023

Market Capitalization Formula (Table of Contents)

- Market Capitalization Formula

- Examples of Market Capitalization Formula (With Excel Template)

- Market Capitalization Formula Calculator

Market Capitalization Formula

The term market capitalization means the total value of a particular company if it sells all its shares in the stock market at the current market price. The formula of market capitalization is as follows:

Examples of Market Capitalization Formula (With Excel Template)

Let’s take an example to understand the calculation of the Market Capitalization formula in a better manner.

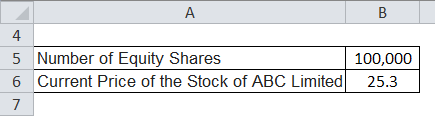

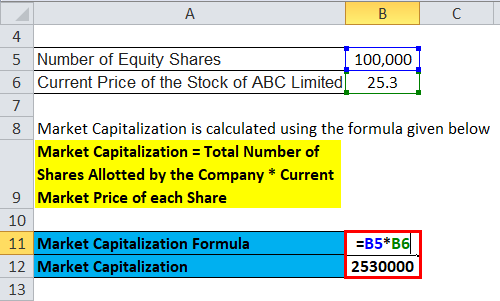

Example #1

ABC Limited has equity shares of 1, 00,000 which are listed in the stock exchange. The current market price of each share is INR 25.30. Calculate the Market Capitalization of the Company.

Solution:

The formula to calculate Market Capitalization is as below:

Market Capitalization = Total Number of Shares Allotted by the Company * Current Market Price of each Share

- Market Capitalization of ABC Limited = 1,00,000 * 25.30

- Market Capitalization of ABC Limited = INR 25, 30,000

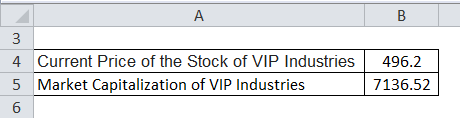

Example #2

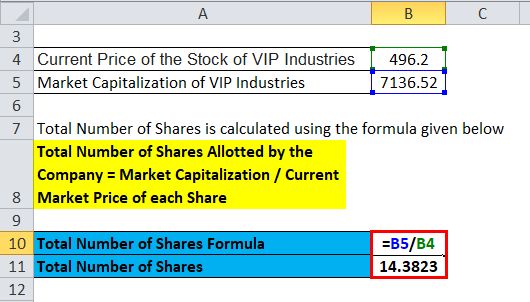

Market Capitalization of VIP Industries is INR 7136.52 Cr. Find out the Number of Shares trading in the Stock exchange if the Current Market price of each share is INR 496.2.

Solution:

As per the formula, we know that,

Market Capitalization = Total Number of Shares Allotted by the Company * Current Market Price of each Share

The formula to calculate the Total Number of Shares is as below:

Total Number of Shares Allotted by the Company = Market Capitalization / Current Market Price of each Share

- Total Number of Shares Allotted by the Company = INR 7136.52 Cr / 496.2.

- Total Number of Shares Allotted by the Company = 14.3823 shares

The total outstanding share of VIP industries is 14.3823

Example #3

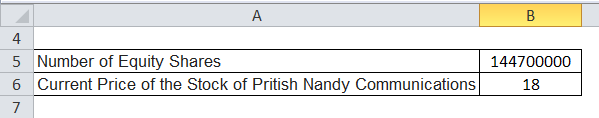

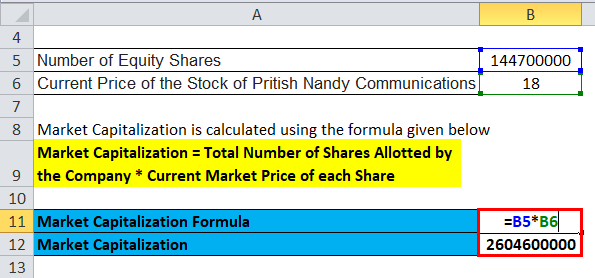

Pritish Nandy Communications has equity shares of 14, 47,00,000 which is listed in the NSE and BSE stock exchanges. The current market price of each share is INR 18. Calculate the Market Capitalization of the Company.

Solution:

The formula to calculate Market Capitalization is as below:

Market Capitalization = Total Number of Shares Allotted by the Company * Current Market Price of each Share

- Market Capitalization of Pritish Nandy Communications = 14,47,00,000 * 18

- Market Capitalization of Pritish Nandy Communications = INR 2604600000

Explanation

Market capitalization indicates the value of money if all the shareholders want to liquidate their position after selling the stock holding at a particular time.

One of the characteristics of the market capitalization formula is that it indicates the company’s financial power.

The company’s business has proven strong as the stock price is quoted at INR 90, 9 times higher than its base price of INR 10. This indicates that a company’s business is ever-growing, and the reserves and profitability have grown.

Suppose a company is growing at a steady pace. In this case, we assume that the equity share of the particular company will grow at a pace that is either equal to or approximately equivalent to the growth of the company’s profitability. Thus if a company’s share price constantly grows, it indicates healthy business activity. On the other hand, if a company’s share price is declining, it is more or less assumed that its growth has been handed or it is making losses in current quarters.

The company’s profitability is directly linked with the market capitalization of that particular company.

Earnings per share EPS is obtained by dividing the company’s total profitability within a particular tenure by the total number of outstanding shares trading in the stock market. So if the total profitability increases or decreases, the EPS will increase or decrease accordingly.

Again in most of the profitable companies, we see that the total profit is way less than the market capitalization of the particular stock. This is because the market tends to discount shares with few multiples of the EPS when they are traded in the market. So EPS * Price to Earnings multiple is equivalent to the current stock price.

The PE multiple is a request to the current price of the stock / EPS.

Relevance and Uses

- When a particular business is valued, the common base which is being taken is the market capitalization of the particular company as it is the value given by the traders and the investors depending upon the meter of business and quality of business of the particular stock.

- Over 10 to 20 years, a good business has always generated higher market capitalization as its profit-making ability with its P/E multiple has always been up-trending. With the increase of market participants, the P/E multiple gets higher, indicating that more investors are willing to invest in that particular Company.

- The reverse is also true. This means that if a business is not profitable and the dynamics are negative, the market will not give a higher multiple, and the stock price will fall with time. Again, if the company’s growth is shrinking, then it will relatively affect the stock price as the PE multiple will decrease along with the stock price.

- When a particular company thinks of an acquisition of a particular company, be it in the same segment or for the purpose of diversification, the Analysts tend to compare its profitability with the market capitalization to get the P/E multiple and hence the value of the business. The higher P/E multiple suggests a higher valuation for the particular business, and the lowers P/E multiple denotes lower business growth.

Market Capitalization Formula Calculator

You can use the following Market Capitalization Calculator.

| Total Number of Shares Alloted by the Company | |

| Current Market Price of each Share | |

| Market Capitalization Formula | |

| Market Capitalization Formula = | Total Number of Shares Alloted by the Company x Current Market Price of each Share |

| = | 0 x 0 = 0 |

Recommended Articles

This has been a guide to the Market Capitalization formula. Here we discuss How to Calculate Market Capitalization along with practical examples. We also provide Market Capitalization Calculator with a downloadable Excel template. You may also look at the following articles to learn more –