Updated July 26, 2023

Indexation Formula (Table of Contents)

What is the Indexation Formula?

The term “indexation” refers to the technique of adjusting various values across a period of time based on the value in a particular year identified as the base year. In other words, the indexation techniques allow easier comparison of the changes in the value in any given year vis-à-vis the base year.

The formula for indexation can be simply derived by dividing the value of any subject good in any given year by the value of the same good in the base year, and then the result is multiplied by 100.

Mathematically, it is represented as,

Examples of Indexation Formula (With Excel Template)

Let’s take an example to understand the calculation of Indexation in a better manner.

Indexation Formula – Example #1

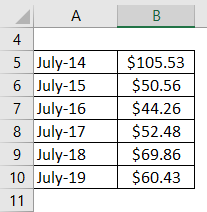

Let us take the example of Crude Oil Price per barrel over the last five years as shown below:

- July 2014: $105.53

- July 2015: $50.56

- July 2016: $44.26

- July 2017: $52.48

- July 2018: $69.86

- July 2019: $60.43

Based on the above-given information, prepare the tables for the crude oil price index if the base year is 2014 and 2015.

Solution:

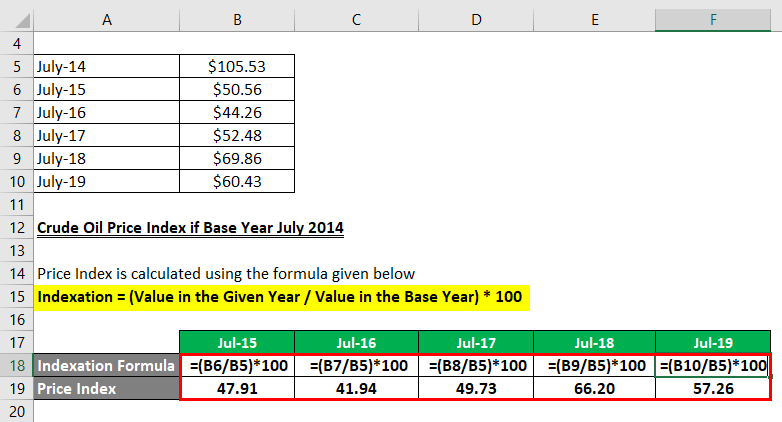

Crude Oil Price Index if Base Year July 2014

Price Index is calculated using the formula given below

Indexation = (Value in the Given Year / Value in the Base Year) * 100

For July 2015

- Price Index = ($50.56 / $105.53) * 100

- Price Index = 47.91

For July 2016

- Price Index = ($44.26 / $105.53) * 100

- Price Index = 41.94

For July 2017

- Price Index for= ($52.48 / $105.53) * 100

- Price Index for= 49.73

For July 2018

- Price Index = ($69.86 / $105.53) * 100

- Price Index = 66.20

For July 2019

- Price Index = ($60.43 / $105.53) * 100

- Price Index = 57.26

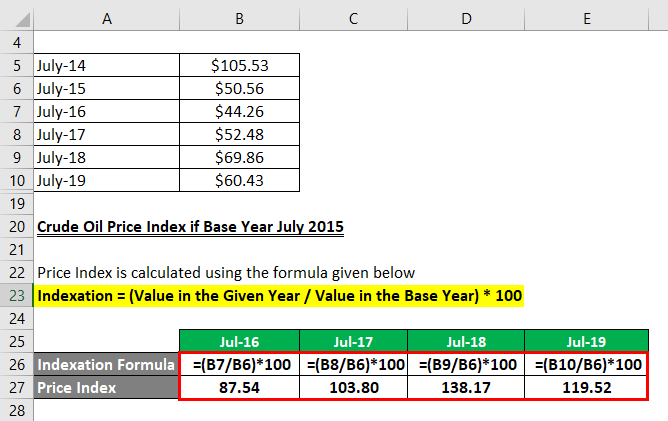

Crude Oil Price Index if Base Year July 2015

Price Index is calculated using the formula given below

Indexation = (Value in the Given Year / Value in the Base Year) * 100

For July 2016

- Price Index =($44.26 / $50.56) * 100

- Price Index = 87.54

For July 2017

- Price Index = ($52.48 / $50.56) * 100

- Price Index = 103.80

For July 2018

- Price Index = ($69.86 / $50.56) * 100

- Price Index = 138.17

For July 2019

- Price Index = ($60.43 / $50.56) * 100

- Price Index = 119.52

Therefore, the above two tables show the value of indexation changes with the change of the base year. Further, indexation makes the computation of inflation much easier.

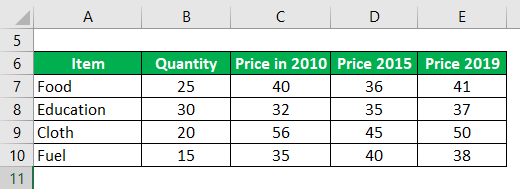

Indexation Formula – Example #2

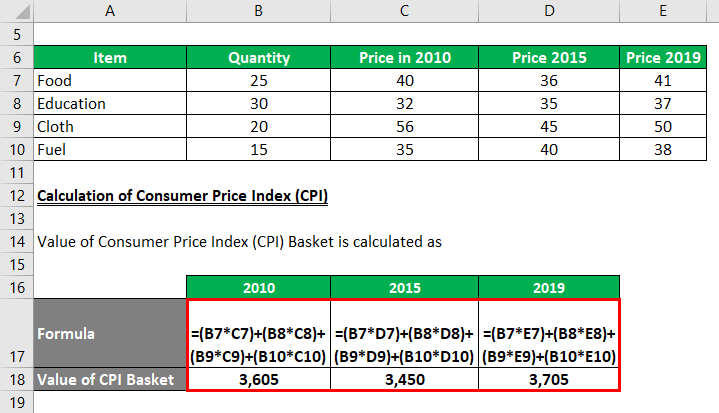

Let us take the example of a consumer price index (CPI) which is most the common form of indexation. Let us assume that the CPI basket of a country covers only four items, food, education, cloth, and fuel. The country has decided 2010 to be the base year for measuring CPI. Prepare the CPI for the following items.

Solution:

Calculation of Consumer Price Index (CPI)

Value of Consumer Price Index (CPI) Basket is calculated as

For 2010

- Value of CPI Basket = (25 * 40) + (30 * 32) + (20 * 56) + (15 * 35)

- Value of CPI Basket = 3,605

For 2015

- Value of CPI Basket = (25 * 36) + (30 * 35) + (20 * 45) + (15 * 40)

- Value of CPI Basket = 3,450

For 2019

- Value of CPI Basket = (25 * 41) + (30 * 37) + (20 * 50) + (15 * 38)

- Value of CPI Basket = 3,705

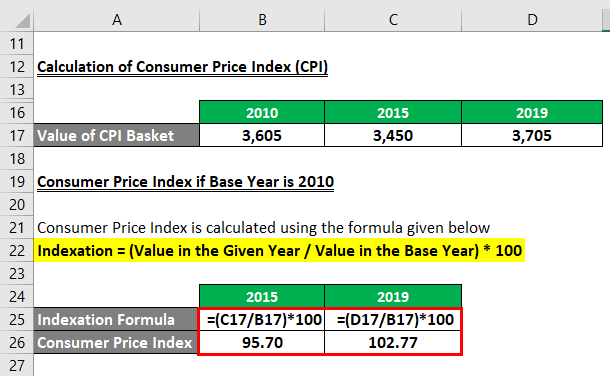

Consumer Price Index if Base Year is 2010

Consumer Price Index is calculated using the formula given below

Indexation = (Value in the Given Year / Value in the Base Year) * 100

For 2015

- Consumer Price Index = (3,450 / 3,605) * 100

- Consumer Price Index = 95.70

For 2019

- Consumer Price Index = (3,705 / 3,605) * 100

- Consumer Price Index = 102.77

Therefore, the CPI for the years 2015 and 2019 stood at 95.70 and 102.77, respectively.

Explanation

The formula for indexation can be calculated d by using the following steps:

Step 1: Firstly, identifying and fixing the base year is very important. The base year is selected by an authorized body based on various social and economic factors. Now, determine the value of the good or a basket of goods under consideration in the base year.

Step 2: Next, determine the value of the same good or basket of goods in any given year.

Step 3: Finally, the formula for indexation can be derived by dividing the value of any subject good in any given year (step 2) by the value of the same good in the base year (step 1), and then the result is multiplied by 100 as shown below.

Indexation = (Value in the Given Year / Value in the Base Year) * 100

Relevance and Uses of Indexation Formula

The concept of indexation is very important because organizations or governments usually use it to assess the impact of inflation on prices and asset values. Indexation finds application in wage comparison in a high-inflation environment. Some common examples of indexation include consumer price index, raw material price index, consumer confidence index, business confidence index, etc.

Indexation Formula Calculator

You can use the following Indexation Formula Calculator

| Value in the Given Year | |

| Value in the Base Year | |

| Indexation | |

| Indexation | = |

|

||||||||

| = |

|

Recommended Articles

This is a guide to Indexation Formula. Here we discuss how to calculate Indexation along with practical examples. We also provide an Indexation Formula calculator with a downloadable Excel template. You may also look at the following articles to learn more –