What are Intangible Assets?

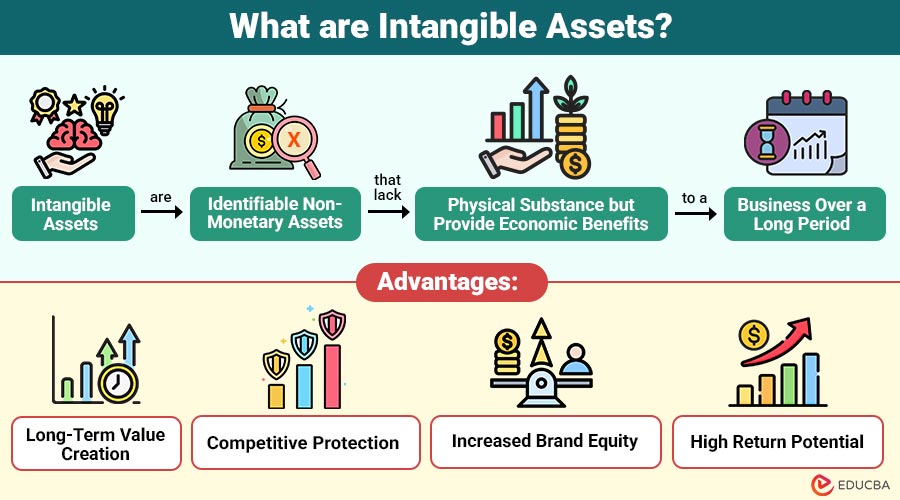

Intangible assets are identifiable non-monetary assets that lack physical substance but provide economic benefits to a business over a long period. Unlike tangible assets, they cannot be seen or touched, yet they contribute significantly to revenue generation and market positioning.

These assets are typically acquired through purchase, internal development, or business combinations and are recorded on the balance sheet if they meet specific recognition criteria under accounting standards.

Table of Contents:

- Meaning

- Key Characteristics

- Types

- Examples

- How are Intangible Assets Recorded in Accounting?

- Valuation

- Importance of Intangible Assets in Modern Business

- Advantages

- Disadvantages

- Role of Intangible Assets in Mergers and Acquistions

Key Takeaways:

- Intangible assets lack physical form yet generate long-term economic benefits and strategic value for businesses.

- Proper recognition, valuation, and amortization ensure accurate financial reporting and compliance.

- Brands, patents, software, and goodwill significantly influence competitiveness, innovation, and overall market valuation.

- Effective management is essential for sustainable growth, mergers, acquisitions, and investor confidence.

Key Characteristics of Intangible Assets

Here are the characteristics that define their nature, usage, and value within an organization:

1. Lack of Physical Form

Have no physical substance and exist as intellectual property, legal rights, or economic value within a business.

2. Identifiability

They can be clearly distinguished, separated, sold, licensed, or arise from enforceable contractual or legal rights owned by the entity.

3. Future Economic Benefits

These assets contribute to future revenue generation, cost reduction, operational efficiency, or long-term profitability for the organization.

4. Long-term Usage

The asset provides sustained benefits over multiple accounting periods rather than being consumed immediately.

5. Controlled by the Entity

The organization controls the asset, enabling benefit realization while preventing unauthorized use through legal or contractual protection.

Types of Intangible Assets

It falls into two primary types:

1. Identifiable

Identifiable intangible assets are non-physical assets that can be individually separated, sold, transferred, licensed, or exchanged, or arise from legal or contractual rights, allowing independent valuation and recognition on the balance sheet.

Examples:

- Patents

- Trademarks

- Copyrights

- Licenses

- Software

- Franchise agreements

2. Unidentifiable

Unidentifiable intangible assets, which represent excess purchase consideration over net identified assets and reflect brand reputation, customer loyalty, and overall business value, typically emerge during acquisitions and cannot be separated from the company as independent assets.

Example:

- Goodwill: Arises when one company acquires another for more than the fair value of the acquired company’s net assets.

Examples in Real Life

Below are real-world examples that illustrate how intangible assets create value and competitive advantage for organizations:

1. Software Company’s Source Code

Represents proprietary technology enabling unique features, product differentiation, competitive advantage, and recurring revenue through licensing and subscriptions.

2. Luxury Brand’s Trademark and Reputation

Builds brand identity, customer trust, premium pricing power, long-term loyalty, and strong global market positioning.

3. Pharmaceutical Company’s Patented Drug Formula

Grants exclusive production rights, protects research investment, prevents imitation, and ensures sustained revenue from regulated drug markets.

4. Media Company’s Copyrights for Films and Music

Secure creative ownership, control distribution rights, prevent piracy, and generate income via licensing, streaming, and royalties.

5. Customer Databases and Long-Term Contracts

Provide valuable customer insights, predictable cash flows, stronger relationships, and long-term business-recognized economic benefits.

How are Intangible Assets Recorded in Accounting?

In accounting, they are recorded differently depending on how they are acquired.

1. Purchased Intangible Assets

Intangible assets that are acquired are first recorded at acquisition cost, which includes the purchase price as well as any directly related costs required to get the asset ready for use.

2. Internally Generated Intangible Assets

Internally generated intangible assets are generally not capitalized, as their costs and future economic benefits cannot be reliably measured during the creation stage.

3. Amortization

Companies systematically amortize most intangible assets over their useful lives, while they do not amortize goodwill and instead test it annually for impairment.

Valuation of Intangible Assets

Valuing can be complex. Businesses typically use one of the following methods:

1. Cost Approach

This method values intangible assets based on the total costs incurred to develop, recreate, or replace them.

2. Market Approach

This approach determines asset value by comparing prices of similar intangible assets recently sold under comparable market conditions.

3. Income Approach

By discounting the anticipated future cash flows produced by the intangible asset, the income approach determines its value.

4. Importance of Proper Valuation

Accurate intangible asset valuation is essential for mergers, acquisitions, investment decisions, compliance, and transparent financial reporting.

Importance of Intangible Assets in Modern Business

Intangible assets play an important role in shaping long-term success, sustainability, and overall market value in today’s knowledge-driven economy.

1. Competitive Advantage

Patents and trademarks protect unique innovations, restricting imitation and enabling businesses to maintain strong, long-term competitive market positions.

2. Brand Loyalty

Strong brands create emotional connections, build trust, encourage repeat purchases, and improve customer retention in highly competitive markets.

3. Higher Market Valuation

Investors assign higher valuations to companies with valuable intellectual property, strong brands, and sustainable intangible-driven revenue potential.

4. Innovation and Growth

Continuous research and development drive innovation, enabling companies to launch advanced products and adapt to rapidly changing markets.

Advantages of Intangible Assets

Below are the key advantages that contribute to long-term business value, competitive strength, and sustainable profitability.

1. Long-Term Value Creation

Intangible assets, such as patents and trademarks, support sustainable business growth by generating continuous revenue and long-term competitive benefits.

2. Competitive Protection

Legal protections for intellectual property, including copyrights and patents, prevent competitors from copying innovations, thereby securing market position and business advantage.

3. Increased Brand Equity

Strong branding and trademarks enhance customer loyalty, market recognition, and pricing power, directly increasing company value and profitability over time.

4. High Return Potential

Innovation-focused intangible assets, such as proprietary technology, software, or patents, can deliver consistent, significant financial returns and high profit margins.

Disadvantages of Intangible Assets

Below are the major disadvantages that can affect valuation accuracy, financial stability, and long-term business performance.

1. Difficult Valuation

Valuing is complex because limited market data, subjective assumptions, and uncertain future benefits make precise monetary measurement difficult.

2. Risk of Obsolescence

Rapid technological change can render patents, software, or proprietary knowledge obsolete, quickly reducing usefulness, competitiveness, and expected future economic benefits.

3. Legal Challenges

Intellectual property ownership may face lawsuits, infringement claims, or regulatory disputes, resulting in high legal costs and management distractions globally.

4. Impairment Risk

When expected cash flows decline, accounting standards require impairment recognition, which negatively impacts reported earnings, asset values, and investor confidence.

Role of Intangible Assets in Mergers and Acquisitions

During acquisitions, it significantly influences purchase price allocation.

When one company acquires another, it records the excess purchase price over net identifiable assets as goodwill. This goodwill reflects:

- Brand reputation

- Skilled workforce

- Customer loyalty

- Strategic advantages

In many technology acquisitions, intangible assets account for a large portion of the transaction value.

Final Thoughts

Intangible assets are the foundation of modern businesses, driving innovation, brand strength, and long-term value. As economies increasingly rely on technology and digital transformation, assets like patents, trademarks, and goodwill shape competitiveness and market valuation. Understanding and managing assets is essential for accountants, investors, entrepreneurs, and business leaders seeking sustainable growth and strategic advantage.

Frequently Asked Questions (FAQs)

Q1. Are intangible assets depreciated?

Answer: They are amortized over their useful life, except goodwill, which is tested for impairment.

Q2. Do intangible assets have a useful life?

Answer: Intangible assets may have a finite or indefinite useful life. Finite-life assets are amortized, while indefinite-life assets are tested for impairment.

Q3. Can internally generated intangible assets be recorded?

Answer: Generally, they are not recorded unless they meet strict accounting criteria.

Q4. Why are intangible assets important for investors?

Answer: They indicate innovation strength, brand value, and long-term growth potential, helping investors assess a company’s true market value beyond physical assets.

Recommended Articles

We hope that this EDUCBA information on “Intangible Assets” was beneficial to you. You can view EDUCBA’s recommended articles for more information.