Updated October 11, 2023

Net Operating Income Meaning

Net operating income (NOI) subtracts the total operating expenses (COGS, SG&A) from the total operating revenue to measure profitability, i.e., the amount of money an organization earns from its core business operations.

Table of Contents

- What is Net Operating Income?

- Formula

- How to Interpret It?

- Examples

- How to Calculate It?

- Calculator

- Importance

- Net Operating Income Vs. EBITDA Vs. Net Income

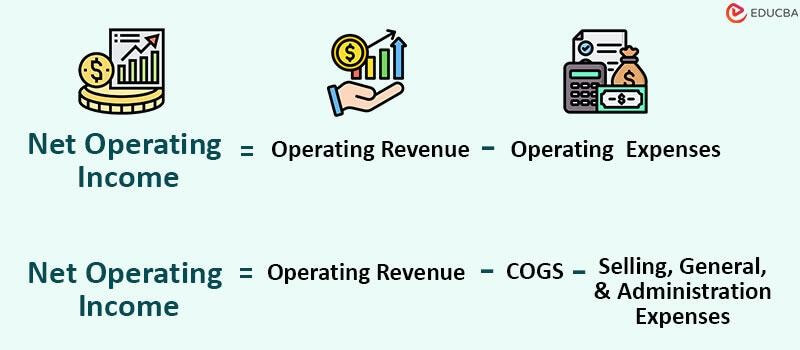

Net Operating Income Formula

The formulas to calculate the net operating income are as follows.

Where,

- Operating Revenue: Income from business’s day-to-day operations or rental property.

- Operating Expenses: Costs required to run the business’s day-to-day operation and property maintenance.

Where,

- COGS: Total expenses for producing or purchasing the goods.

- Selling, General, & Administrative Expenses: Company’s day-to-day operational costs, excluding the production costs.

How to Interpret Net Operating Income?

The net operating income formula is commonly used in the real estate industry. Interpreting it is very simple.

- The higher the NOI, the more the profitability of the asset.

- A consistent decline in NOI can mean that the profitability is decreasing.

To improve NOI, the firm can increase revenue sources, reduce operating costs, or, in extreme cases, sell the property.

Examples

Let’s understand how to use the net operating income formula from the following examples.

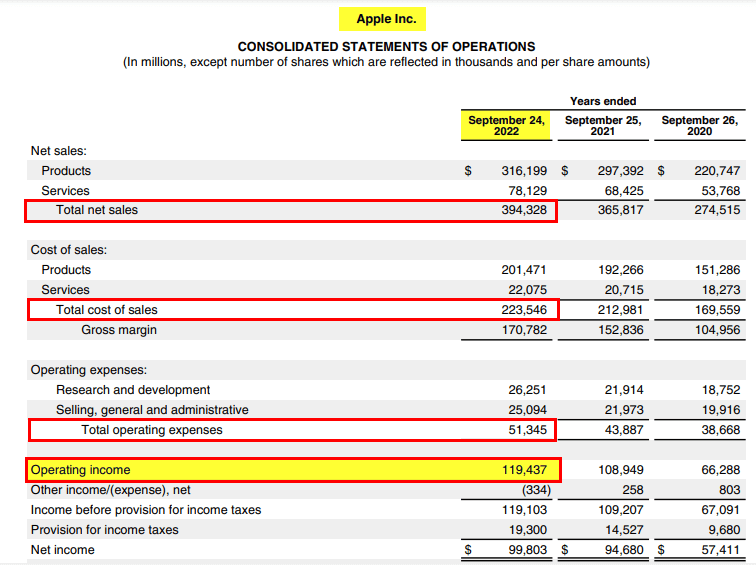

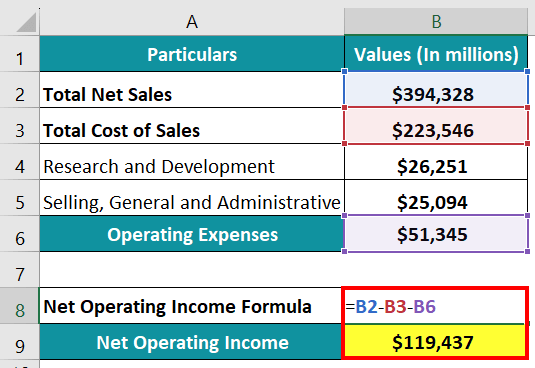

Example #1: Apple Inc.

Let’s consider Apple Inc.’s financial data from its 2022 annual report to calculate its net operating income.

(Image Source: Annual Report 2022)

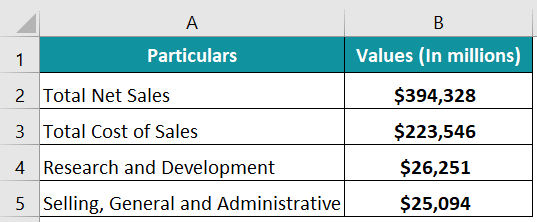

Given:

Solution:

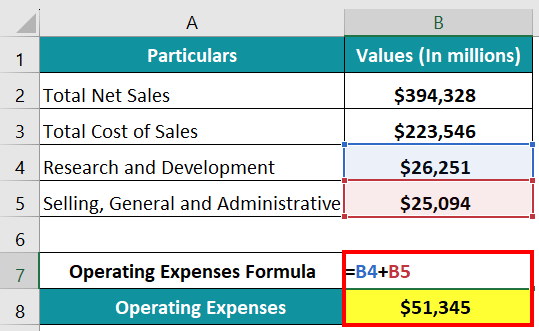

Step 1: Let’s use the below formula to calculate the operating expenses.

Operating Expense = Research and Development + Selling, General and Administrative

= $26,251M + $25,094M = $51,345M

Step 2: Now, we will calculate the net operating income using the formula below

Net Operating Income Formula = Total Net Sales – Total Cost of Sales – Operating Expenses

= $394,328M – $223,546M – $51,345M = $119,437M

Therefore, Apple Inc. generated a net operating income of $119,437M in 2022.

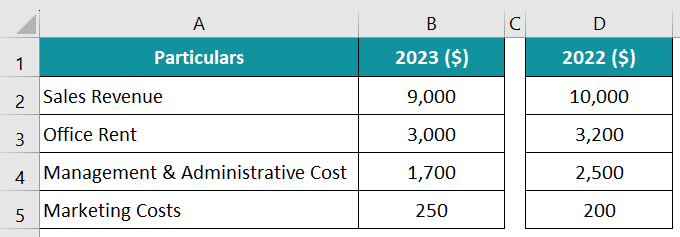

Example #2

Consider UrbanEstates, a real estate company that builds luxury homes in urban areas. The company wants to calculate its net operating income for 2023 and 2022. The data from the income statement for the two years 2023 and 2022 is as follows.

Solution:

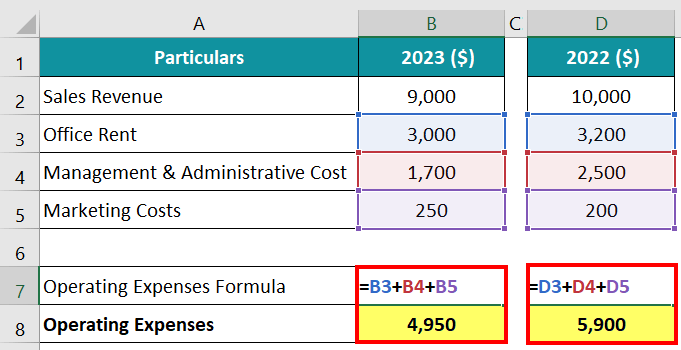

Step 1: Let us first calculate the total operating expenses of UrbanEstates for the last two years with the following formula:

Operating Expenses = Office Rent Management & Admin Cost + Marketing Cost

For 2023:

Operating expenses= $3,000 + $1,500 + $250 = $4,950

For 2022:

Operating expenses = $3,200 + $2,500 +$200= $5,900

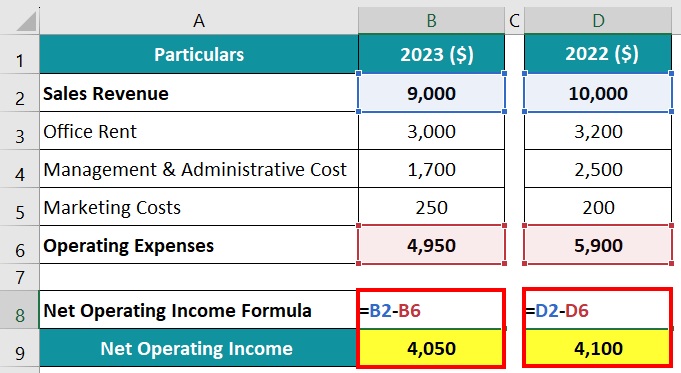

Step 2: Now, we will find the net operating income using the below formula:

Net Operating Income Formula = Operating Revenue – Operating Expenses

For 2023 = $9,000- $4,950 = $4,050

For 2022 = $10,000- $5,900= $4,100

Result:

The net operating income of UrbanEstates in 2023 was $4,050, and in 2022 it was $4,100. However, if we analyze closely, we can see a decrease in sales revenue in 2023 ($9,000) as compared to 2022 ($10,000). Despite this $1,000 fall in revenue, the company’s NOI only decreased by $50. This happened because the company managed to lower its rent and administrative costs. This suggests that the cost-cutting strategies implemented by the company were effective.

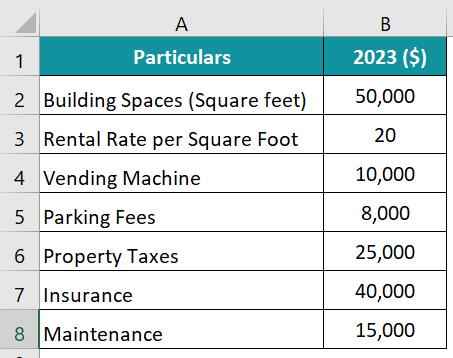

Example #3

Consider a businesswoman who owns a commercial building named Tech Plaza. She wants to know the net operating income generated from her building property in 2023. The following are the details of financial transactions in 2023.

Solution:

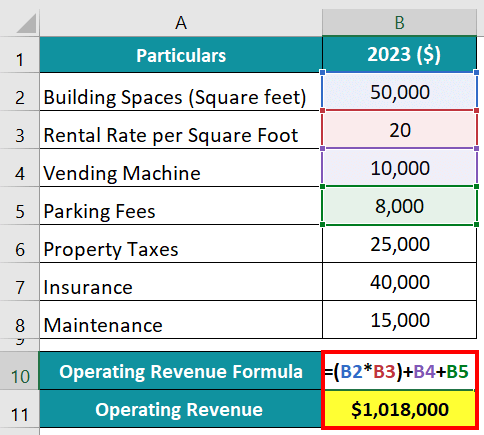

Step 1: Let’s first calculate the operating revenue.

The formula to calculate operating revenue is as follows.

Operating Revenue = Rental Income + Vending Machine + Parking Fees

So,

Operating Revenue = (Rental rate per Sq. ft. x Building Spaces) + Vending Machine + Parking Fees

= ($50,000 x 20) + 10,000 + 8,000 = $1,018,000

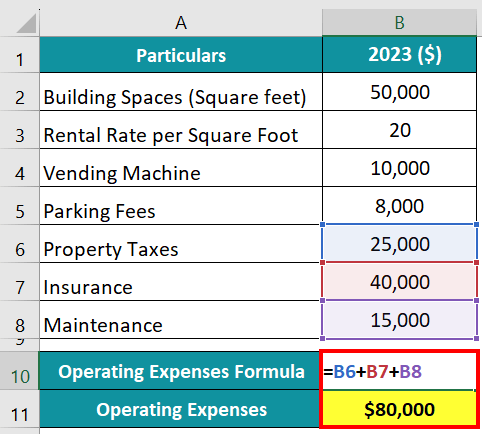

Step 2: Now, let’s calculate the total operating expenses from the following formula.

Operating Expenses = Property Taxes + Insurance + Maintenance

= $25,000 + $40,000 + $15,000 = $80,000

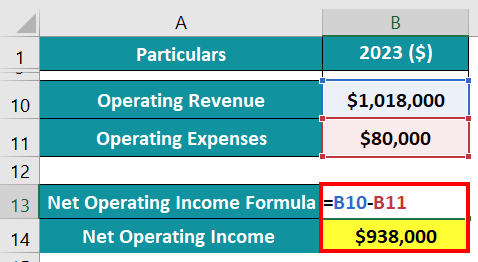

Step 3: Finally, let’s calculate NOI with the following formula.

Net Operating Income Formula = Operating Revenue – Operating Expenses

= $1,018,000 – $80,000 = $938,000

Result: The net operating income from Tech Plaza in 2023 is $938,000

Example #4

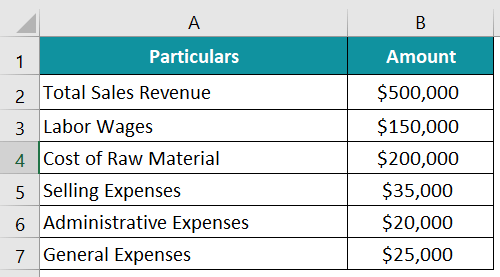

Suppose a company, DFG Ltd., which manufactures automobiles and exports worldwide, wants to calculate the net operating income for the fiscal year 2023. The following are the data extracted from the income statements.

Solution:

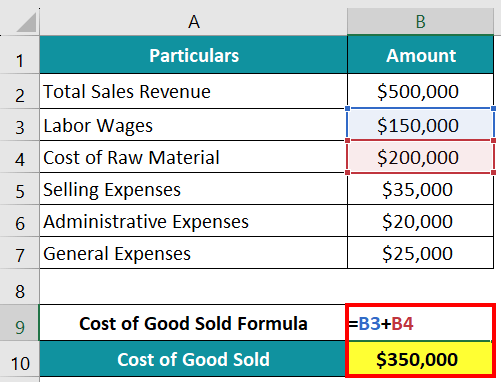

Step 1: Let us first calculate the cost of goods sold (COGS) using the formula given below:

Cost of Goods Sold = Labor Wage + Cost of Raw Material

= $150,000 + $200,000 = $350,000

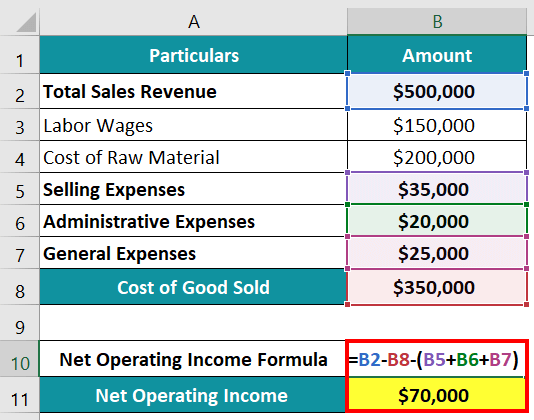

Step 2: We will use the formula below to calculate the net operating income:

Net Operating Income Formula = Operating Revenue – COGS – Selling, General, & Administrative Expenses

=$500,000 – $350,000 – ($35,000 + $25,000 + $20,000) = $70,000

Therefore, the net operating income of DFG Ltd in 2023 is $70,000.

How to Calculate NOI?

Follow the below steps to calculate the net operating income.

Step 1: Firstly, find the total revenue of the company in the income statement or compute it using the following formula:

Total Revenue = Number of Units Sold * Average Selling Price Per Unit

Step 2: Next, you can easily find the cost of goods sold in the income statement. You can also calculate it using the following formula:

Cost of Goods Sold = Cost of Raw Material + Direct Labor expense

Step 3: Next, determine the operating expenses. Typically, selling expenses and administrative expenses are the major part of the operating expenses of a company.

Step 4: Finally, substitute the values in the formula,

Net Operating Income = Total Revenue – Cost of Goods Sold – Selling, General, & Administrative Expenses

Calculator

You can use the following Net Operating Income Calculator.

| Operating Revenue | |

| Cost of Goods Sold | |

| Selling, General, & Administrative Expenses | |

| Net Operating Income | |

| Net Operating Income = | Operating Revenue - Cost of Goods Sold - Selling, General, & Administrative Expenses | |

| 0 - 0 - 0 = | 0 |

Importance

The net operating income formula is important for the following reasons.

- Profit check: It lets us know how much money we have after paying all the expenses, indirectly revealing the profit.

- Investment health: It helps us understand which properties are more profitable. If NOI is positive, it’s a sign of good investment, indicating that earnings are more than costs. But if it’s negative, it means expenses are more than earnings or profit, indicating financial loss.

- Decision making: It guides investors in making informed decisions. For instance, if the expenses are higher, one can increase the charge for rent or other sources to cover the extra costs.

- Loan approval: When applying for loans from banks or financial institutions, it is important. Lenders will check the company’s net income to know the financial health and to ensure they can repay the loan amount.

Net Operating Income Vs. EBITDA Vs. Net Income

| Aspects | Net Operating Income | EBITDA | Net Income |

| Definition | Net Operating Income is the profit a business or property generates from its core operations. | EBITDA is a financial metric that measures a company’s profitability. | Net Income provides the company’s total profit after deducting all expenses, i.e., financial performance. |

| Formula | Revenues−Operating Expenses. | Revenues−Operating Expenses+Depreciation & Amortization | Revenues−Total Expenses. |

| Includes | Depreciation and amortization. | – | Interest, taxes, depreciation, and amortization. |

| Excludes | Interest expense and taxes. | Interest, taxes, depreciation, and amortization expenses. | – |

| Uses | Useful in evaluating operational profitability in real estate and specific business areas. | Comparing companies in capital-intensive sectors and is useful in assessing operational performance. | Provides a comprehensive view of the company’s overall profitability, like key metrics in income statements. |

Frequently Asked Questions (FAQs)

Q1. What is the purpose of NOI in real estate?

Answer: In real estate, the NOI is generally useful for determining how much a property or other entity can profit from its core business activities. For example, you can evaluate a property’s financial health and potential profit by deducting all related operating expenses from its revenue. In addition, creditors, investors, and other stakeholders use this calculation to evaluate the business’s operational efficiency and make informed financial decisions.

Q2. Is the net operating income formula the same as EBIT?

Answer: Net Operating Income formula and EBIT are not the same. Net operating income is useful in real estate and measures property profit. It deducts all operating expenses (except interest and taxes) from operating revenues. In contrast, EBIT is a broader financial metric used across various industries to understand a company’s earrings. It shows a company’s profitability by including interest, taxes, and other non-operating income.

Q3. What is the difference between net operating income and profit?

Answer: The key difference between profit and NOI is as follows.

- NOI summarizes income from operations, while profit represents net earnings.

- NOI considers only operational costs, while profit considers all costs, including operating expenses, debts, and loan interest.

- NOI does not include financial burdens like loan interest, but they are integral to profit calculation and include all financial expenses and taxes.

- NOI is useful in real estate to examine property performance, while profit is used universally to evaluate a company’s financial standing.

Recommended Articles

This article provides an overview of the net operating income formula, including practical, real-life examples. You can refer to our other articles to learn more.