Updated July 21, 2023

What is Working Capital?

Working capital refers to the liquid funds available to a company for its daily operations. It is the difference between the company’s current assets and current liabilities and can either be in the form of cash or bank deposits.

Working capital has crucial importance because it helps a company meet its short-term financial obligations, such as rent, payroll, and utilities, thereby maintaining smooth business operations.

Positive working capital exists when a company’s current assets exceed its current liabilities. It signifies that it has sufficient finances to meet its short-term obligations. If a company’s current liabilities are exceeding its current assets, it has a negative working capital, indicating financial trouble.

Formula for Working Capital

To calculate the working capital or liquid funds of a business, one can use the below-mentioned formula:

Components of Working Capital

Working Capital components can be bifurcated into two major categories: Current Assets and Current Liabilities. Several elements come under each of these categories.

Current Assets

The components included under Current Assets are:

- Cash and cash equivalents: This refers to the money a company has on hand or in a bank account. It is easily accessible and comes into use to meet short-term financial obligations.

- Accounts receivable: This is the money that consumers owe a firm for products or services that have been supplied but have yet to be paid for. It is a short-term asset that represents money that the company expects to receive in the near future.

- Inventory: This refers to the goods a company has on hand and wants to sell to its customers. It can include raw materials, work-in-progress, and finished goods. Inventory is categorized as a current asset since it is expected to be turned into cash within a year.

- Short-term investments: The company has made these investments in securities or other financial instruments, which they can easily convert into cash within one year or less. Certificates of deposit, treasury, and money market funds are all examples of short-term investments.

- Prepaid expenses: These are expenses that a company has paid for in advance, for example, insurance premiums, rent, or subscriptions. They are considered current assets because the company will benefit from them within one year or less.

Current Liabilities

The components included under Current Liabilities are:

- Accounts payable: The amount of money owed by a corporation to its suppliers for products or services supplied but not yet paid for. It is a short-term obligation that indicates the money the company must pay in the near future.

- Short-term loans: These are loans that a company has taken out and is required to repay within one year or less. Lines of credit, trade credit, and commercial paper are all examples of short-term loans.

- Accrued expenditures: These are expenses incurred but not yet paid for by a corporation, such as salaries, taxes, and interest. They are classified as a liability since the corporation is legally obligated to pay them in the near future.

- Current portion of long-term debt: It is the portion of a company’s long-term debt (e.g., a mortgage or bond) that is due in a year or less. It is a current liability since it represents the money that the company is obligated to pay in the near future.

- Unearned revenue: This is payment received in advance for goods or services the company has yet to deliver. It is a liability because the company has a legal obligation to deliver the goods or services in the near future.

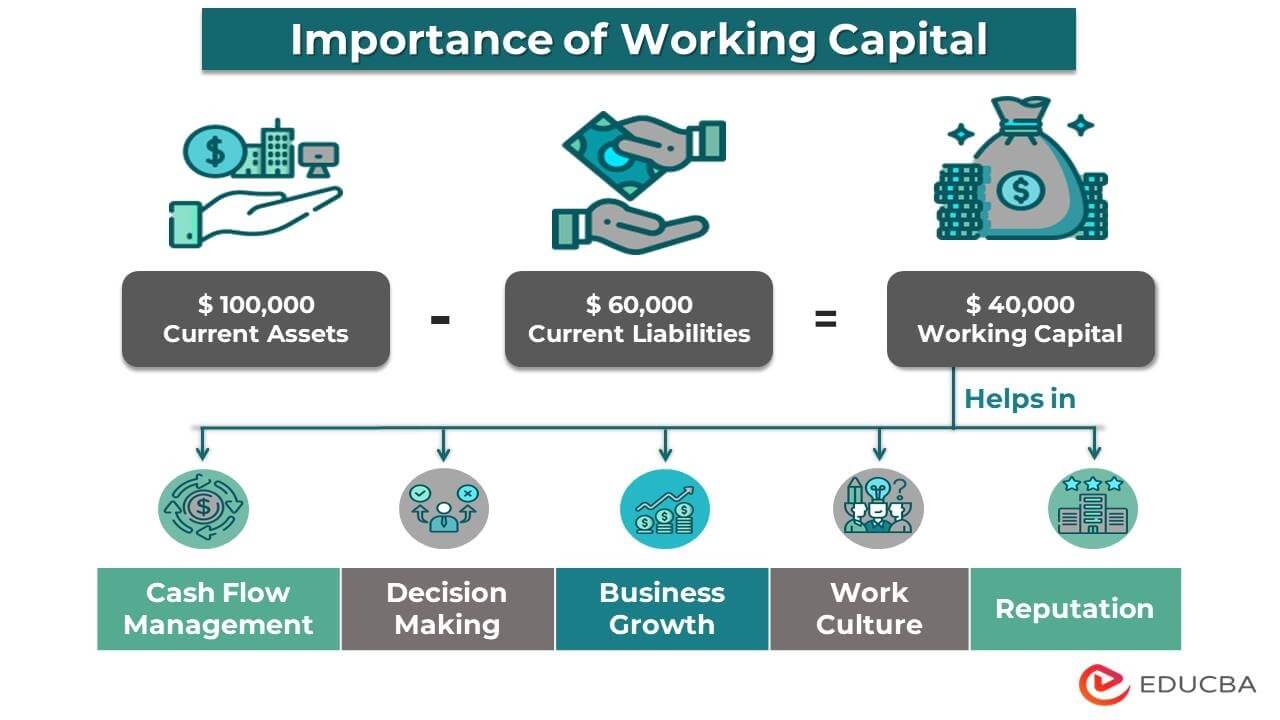

Importance of Working Capital

Below is the importance of working capital:

1. Liquidity Management

Working capital guarantees that a business has adequate cash on hand to meet its short-term financial responsibilities, e.g., paying suppliers, employees, rent, and other costs., The financial team of an enterprise would plan for their funds by analyzing the expenses payable or to be incurred in the near future.

2. Cash Flow Management

Efficient management of working capital can help companies manage their cash flows better, which is critical to their survival and growth. Inappropriately planned day-to-day expenses may result in enterprise liquidity issues.

3. Decision-Making

Managing working capital enables businesses to make informed decisions pertaining to investments, sales, production, and pricing. The finance team can handle the funds efficiently by analyzing the requirement of funds for daily operations.

4. Business Growth

Having enough working capital helps a business in its growth and expansion. Working capital can facilitate a business to invest in novel projects, extend its operations, and capitalize on emerging growth opportunities. Contrarily, a lack of working capital in a business can hinder growth efforts and limit its ability to compete in the market.

5. Value Addition

Proper management of working capital helps the business pay its outstanding debts on time, creating goodwill and adding value in the market.

6. Short-Term Profit

A business can invest extra working capital to create short-term profits rather than keeping a heavy amount of funds as working capital, which may not be necessary.

7. Builds Creditworthiness and Work Culture

Timely payment of salaries and other day-to-day expenses creates a good working environment, which motivates employees to work harder and strengthens the company’s culture. Furthermore, adequate working capital planning ensures timely payments to creditors, which improves the business’s creditworthiness and makes it easier to obtain funds when required.

8. Good Reputation

Maintaining a good reputation in the market due to timely payments and fulfilling commitments helps the business easily obtain contracts and generate more business. A business with a good reputation can act as a guarantor for other enterprises, which can help it secure more contracts and generate more profits.

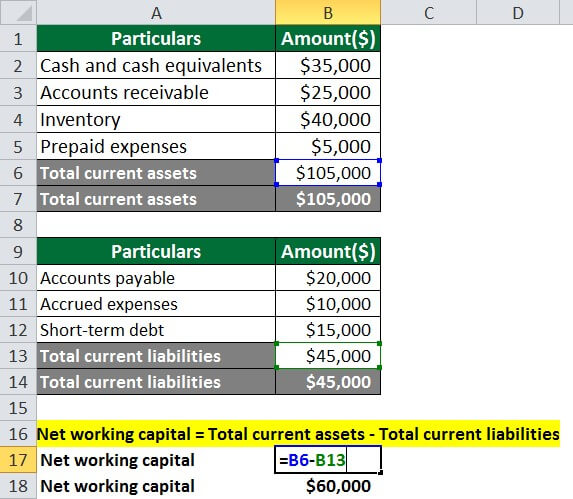

Working Capital Management Example

Oliver Corporation is a company in the electronics business. They have the following details for the current year. Based on these details, calculate the net working capital of Oliver Industries, and what does this mean for the company’s short-term financial health?

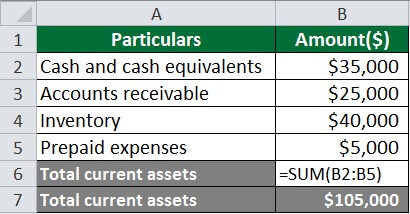

Current Assets

- Cash and cash equivalents: $35,000

- Accounts receivable: $25,000

- Inventory: $40,000

- Prepaid expenses: $5,000

- Total current assets: $105,000

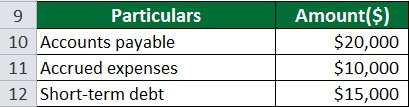

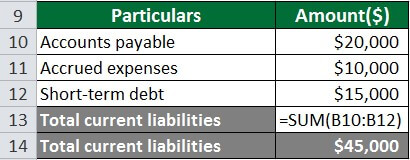

Current Liabilities

- Accounts payable: $20,000

- Accrued expenses: $10,000

- Short-term debt: $15,000

- Total current liabilities: $45,000

Solution:

Step 1: Calculate Current Assets

The current assets of Oliver Corporation are:

To calculate the total current assets, we add up these individual assets:

Total current assets = $35,000 + $25,000 + $40,000 + $5,000

Total current assets = $105,000

Step 2: Calculate Current Liabilities

The current liabilities of Oliver Corporation are:

To calculate the total current liabilities, we add up these individual liabilities:

Total current liabilities = $20,000 + $10,000 + $15,000

Total current liabilities = $45,000

Step 3: Calculate Net Working Capital

In order to calculate the net working capital, we must subtract the total current liabilities from the total current assets:

Net working capital = Total current assets – Total current liabilities

= $105,000 − $45,000

= $60,000

Step 4: Result Analysis

The net working capital of Oliver Corporation is $60,000. This means the company has enough short-term assets to cover its short-term liabilities, which is a positive sign for its financial health. This also means that Oliver Corporation can easily pay off its current obligations and still have enough current assets to operate its business effectively.

Conclusion

Working capital has significant importance in achieving organizational goals and enhancing the profitability of a business. It is essential to calculate the working capital regularly, whether it is on a monthly, quarterly, or yearly basis. However, it is usually preferred to calculate the working capital requirement and availability every quarter to make informed decisions accordingly. Further, spare funds should be invested in a manner that maximizes returns. By effectively managing working capital, a business can improve its liquidity, cash flow, decision-making, growth prospects, reputation, and creditworthiness.

Frequently Asked Questions (FAQs)

Q1. What are some common sources of working capital for businesses?

Answer: Cash reserves, lines of credit, accounts receivable financing, and factoring are a few of the common sources for working capital. Some businesses may also supplement their working capital by utilizing inventory financing or asset-based lending.

Q2. How to calculate the working capital?

Answer: One calculates the working capital by subtracting a company’s current liabilities from its current assets. Items like cash, inventory, and accounts receivable come under current assets, while accounts payable and short-term debt come under current liabilities.

Q3. How does a healthy working capital ratio benefit?

Answer: A healthy working capital ratio can provide various advantages to a business, such as better cash flow management, improved decision-making, increased financial stability, and much more.

Recommended Articles

The above article explains the importance of working capital. Here we discuss its meaning, formula, and components alongside an example. Here are some further articles to learn more: