Updated November 17, 2023

Difference Between Horizontal Integration vs Vertical Integration

Both horizontal integration and vertical integration are part of business strategies during any business’s expansion. Horizontal Integration means acquiring similar companies within the same sector and those associated with the same business activities. On the other hand, Vertical integration plays a crucial role in enhancing profitability and reducing the company’s cost. In this process, the company acquires different stages of production or functional segments of the production process. Hence, the profitability from other channels gets omitted, and the profit margin increases.

Let us study much more about Horizontal Integration vs Vertical Integration:

For example, a steel manufacturing company can generate power to reduce the cost arising from the power supply. Various forms of Vertical Integration exist, such as Forward integration and backward integration. An example of backward integration is When a Chinese Smartphone manufacturer opens a unit that manufactures a mobile chipset and supplies it to the smartphone unit. Thus in earlier cases, the Smartphone Company had to purchase a chipset from any other chipset manufacturing company, and the manufacturing costs bear a specific part of the profit the chipset manufacturer was enjoying.

Thus after in-house chipset manufacturing, the profit remains with the smartphone manufacturer. In the case of forwarding integration, we can take the example of the Indian Company Avanti Feeds, which cultivates Shrimp-feeds used for the feeding of processed shrimps. After successfully running the shrimp feeding business, the company has decided to enter the processed shrimp business. Thus process-shrimp business turned out to be very profitable, contributing to the margin healthily and the increase in Revenue.

Thus, these strategic business activities help the business increase market share and margins, decrease competition, and generate higher income with higher profitability. But in the case of vertical, the required expertise is vast rather than horizontal integration. In the case of Horizontal, the scope of the business remains the same, and only the market share and the participants increase big time. For example, the acquisition of Ranbaxy by Sun Pharmaceuticals within the Pharmaceutical space denotes erosion of competition, enhancing product portfolio, increasing customer base, etc. Again, these acquisitions increase the pharmaceutical companies’ market share and profitability. However, in the case of vertical integration, the business field spreads, and different business functions emerge.

For example, Google acquired Motorola Inc. because the Company Google wanted to make its mark in the Smartphone department in which it has yet to gain experience. Thus, instead of going through Greenfield expansion, it has acquired Motorola through Brownfield expansion. Greenfield expansion means setting up new manufacturing and servicing departments, whereas Brownfield expansion means expanding through mergers and acquisitions.

Another example of horizontal integration was Facebook Inc.’s acquisition of WhatsApp. Both are from the social media segment and to gain market share, Facebook acquired WhatsApp to remain competitive in the social media sector. Thus, this acquisition can be an example of Greenfield expansion as Whatsapp has its own setup and customer base; Facebook did not have a new setup.

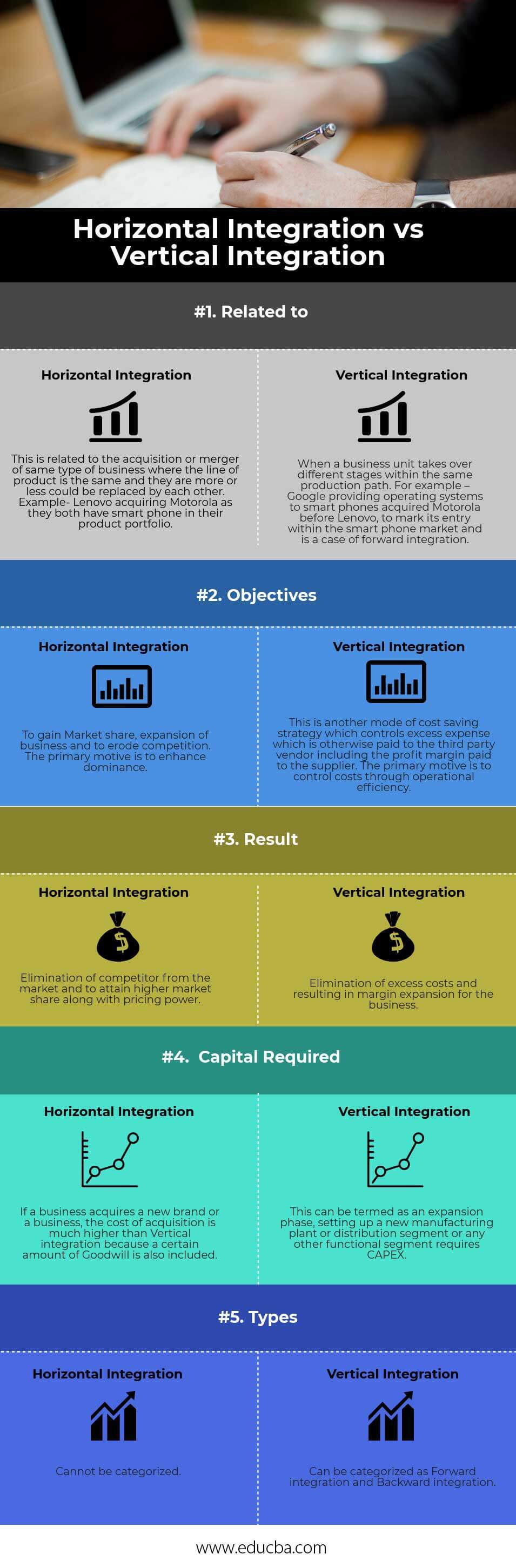

Horizontal Integration vs Vertical Integration Infographics

Below is the top 5 difference between Horizontal Integration vs Vertical Integration :

Key Differences Between Horizontal Integration vs Vertical Integration

Both horizontal integration and vertical integration are popular choices in the market; let us discuss some of the significant differences:

- Horizontal Integration generally emphasizes the market primarily on the Perfect condition market. In contrast, Vertical integration sees the Industry as a whole and concentrates on the different functional segments of the industry.

- After acquiring or merging a particular company, the business, to achieve self-sufficiency, needs to depend on various functional departments that ensure seamless operations. On the other hand, a self-sustaining business relies on multiple departments and can achieve this through vertical integration.

- The primary objective is to gain market share, remove competition, and gain pricing power in case of horizontal integration. On the other hand, vertical integration increases efficiency and expands margins by creating self-sufficiency through functional departments working together.

- The Capital required in the case of Horizontal integration is much more than Vertical integration, as the amount of goodwill is included within the deal. Vertical integration can split into two parts, viz. Forward integration and backward integration.

Horizontal Integration vs Vertical Integration Comparison Table

Below is the topmost Comparison between Horizontal Integration vs Vertical Integration.

| The basis Of Comparison |

Horizontal Integration |

Vertical Integration |

| Related to | This is related to the acquisition or merger of the same type of business where the line of products is the same, and they more or less could be replaced by each other. Example- Lenovo acquired Motorola as they have a smartphone in their product portfolio. | When a business unit takes over different stages within the same production path, for example – Google provides operating systems for smartphones, acquired Motorola before Lenovo to mark its entry within the smartphone market, and is a case of forwarding integration. |

| Objectives | To gain Market share, expand the business, and erode competition. The primary motive is to enhance dominance. | This is another cost-saving strategy that controls excess expense that is otherwise paid to the third-party vendor, including the profit margin paid to the supplier. The primary motive is to control costs through operational efficiency. |

| Result | Eliminating competitors from the market, attaining higher market share, and pricing power. | Elimination of excess costs and resulting in margin expansion for the business. |

| Capital required | If a business acquires a new brand or a business, the acquisition cost is much higher than Vertical integration because a certain amount of Goodwill is included. | This can be termed an expansion phase; setting up a new manufacturing plant, distribution segment, or any other functional segment requires CAPEX. |

| Types | It cannot be categorized. | It can be categorized as Forwarding integration and Backward integration. |

Conclusion

Both horizontal and vertical integration play an immense role in determining the future of a particular business. One helps improve operational efficiency, margins, and profitability; another helps attain higher market share and pricing power. Thus, a mix of horizontal and vertical integration is required in any kind of business.

Recommended Articles

This has guided the top difference between Horizontal Integration and Vertical Integration. Here, we also discuss the Horizontal and Vertical Integration key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –