Updated July 26, 2023

GDP Deflator Formula (Table of Contents)

What is GDP Deflator Formula?

The term “GDP deflator” refers to the index that helps determine price inflation or deflation in the economy. In other words, the GDP deflator measures the general price level of all the goods and services produced in an economy.

The formula for GDP deflator is very simple, and it can be derived by dividing the nominal GDP by the real GDP and then multiplying the result by 100. Nominal GDP captures the valuation of all goods and services at current prices, while real GDP is the valuation of the same at constant prices without the effect of inflation. Mathematical representation of the formula is:

Examples of GDP Deflator Formula (With Excel Template)

Let’s take an example to understand the calculation of the GDP Deflator in a better manner.

GDP Deflator Formula – Example #1

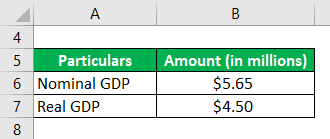

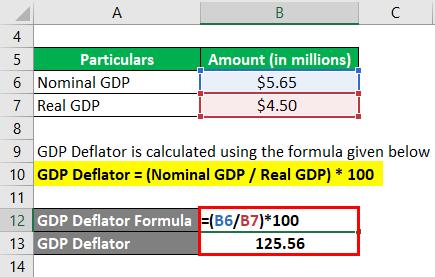

Let us take a simple example of an economy where the nominal GDP (valued at current prices) is $5.65 million and real GDP (valued at constant prices of the base year 2014) is $4.50 million during 2019. Calculate the GDP deflator for the economy.

Solution:

The formula to calculate GDP Deflator is as below:

GDP Deflator = (Nominal GDP / Real GDP) * 100

- GDP Deflator = $5.65 million / $4.50 million * 100

- GDP Deflator = 125.56

Therefore, the GDP deflator for the economy stood at 125.56 in 2019.

GDP Deflator Formula – Example #2

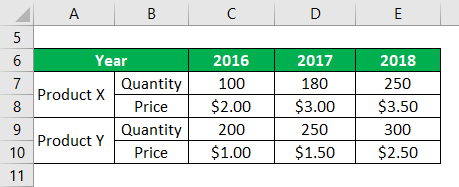

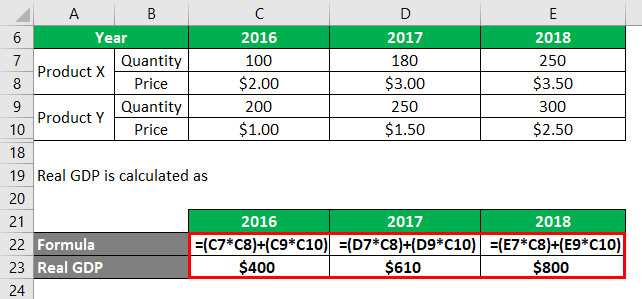

Let us take the example of some random items, namely product X and product Y. The following information about the production quantity and prices of the products for the last three years is available, where 2016 is to be treated as the base year. Calculate the GDP deflator for 2016, 2017, and 2018 based on the given information.

Solution:

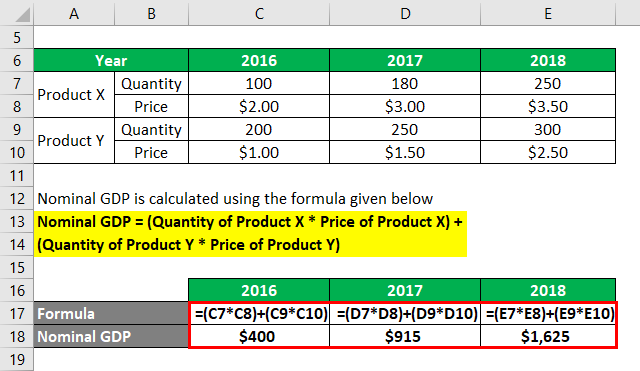

The formula to calculate Nominal GDP is as below:

Nominal GDP = (Quantity of Product X * Price of Product X) + (Quantity of Product Y * Price of Product Y)

For 2016

- Nominal GDP = (100 * $2.00) + (200 * $1.00)

- Nominal GDP = $400

For 2017

- Nominal GDP = (180 * $3.00) + (250 * $1.50)

- Nominal GDP = $915

For 2018

- Nominal GDP = (250 * $3.50) + (300 * $2.50)

- Nominal GDP = $1,625

Real GDP is calculated as

For 2016

- Real GDP = (100 * $2.00) + (200 * $1.00)

- Real GDP = $400

For 2017

- Real GDP = (180 * $2.00) + (250 * $1.00)

- Real GDP = $610

For 2018

- Real GDP = (250 * $2.00) + (300 * $1.00)

- Real GDP = $800

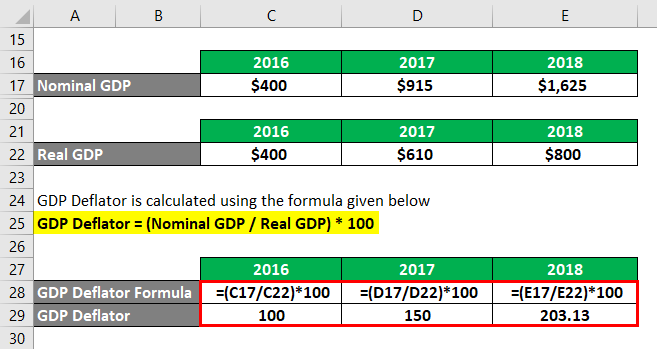

GDP Deflator = (Nominal GDP / Real GDP) * 100

For 2016

- GDP Deflator = ($400 / $400) * 100

- GDP Deflator = 100

For 2017

- GDP Deflator = ($915 / $610) * 100

- GDP Deflator = 150

For 2018

- GDP Deflator = ($1,625 / $800) * 100

- GDP Deflator = 203.13

Therefore, the GDP deflator for 2016, 2017, and 2018 stood at 100, 150, and 203.13, respectively. This indicates that compared to 2016, the price level increased by 50% in 2017 and 103.13% in 2018.

Explanation

The formula for the GDP deflator can be derived by using the following steps:

Step 1: Firstly, determine the nominal GDP of the subject economy. It is the product of all the goods and services produced in the economy and their current prices. The current price can either increase or decrease over a period of time based on inflation or deflation in the economy, respectively.

Step 2: Next, determine the real GDP of the economy, and it is the product of all the goods and services produced in the economy and their respective constant prices. The constant price is the price in the base year that does not change due to inflation or deflation.

Step 3: Finally, the formula for the GDP deflator can be calculated by dividing the nominal GDP (step 1) by the real GDP (step 2), and then the result is multiplied by 100, as shown below.

GDP Deflator = (Nominal GDP / Real GDP) * 100

Relevance and Uses of GDP Deflator Formula

The concept of GDP deflator is a very important economic metric as it helps capture the changes in the price level in an economy by measuring all the factors of the GDP. Although the GDP deflator is similar to other price indices, like Consumer Price Index (CPI) and Wholesale Price Index (WPI), the major difference between it and the other price indices is that it is not based on a fixed basket of goods and services. The GDP deflator is determined based on a dynamic basket that alters its composition based on the requirement of each case.

Further, the difference between a GDP deflator and a price index is usually small. However, governments prefer utilizing price indexes over GDP deflators for fiscal and monetary planning because even the smallest differences in inflation measures can alter the budget as they run into billions and trillions of dollars.

GDP Deflator Formula Calculator

You can use the following GDP Deflator Calculator

| Nominal GDP | |

| Real GDP | |

| GDP Deflator | |

| GDP Deflator = |

|

||||||||||

|

Recommended Articles

This is a guide to GDP Deflator Formula. Here we discuss How to Calculate GDP Deflator along with practical examples. We also provide a GDP Deflator Calculator with a downloadable Excel template. You may also look at the following articles to learn more –