Updated July 12, 2023

What is the Free Cash Flow to Firm Formula?

After deducting depreciation, taxes, and working capital, the amount of cash flow from operations available to the firm is known as Free Cash Flow to the Firm. It is one of many tools that are helpful to analyze company finances that measure the firm’s profitability after expenses and investments.

Free Cash Flow to the Firm indicates strength in the company’s finances. For analysts, while doing business valuation, FCFF is useful in Discounted Cash flow analysis, which determines the business’s intrinsic value. It describes the business’s profitability and indicates funds available with the firm even after deductions.

The Formula for Free Cash Flow to Firm

Below are the formulas to calculate Free Cash Flow for the Firm:

Where,

- NI: Net Income

- D&A: Depreciation and amortization

- I: Interest

- T: Tax Rate

Where,

- CFO: Cash Flow from Operations

- I: Interest

- T: Tax Rate

Where,

- EBIT: Earnings before Interest Tax

- T: Tax Rate

- D&A: Depreciation and Amortisation

While Calculating the Net change in working capital, Cash and short term obligations are not considered.

EBITDA: Earnings before Interest Tax Depreciation and Amortisation

Examples to Calculate Free Cash Flow to Firm

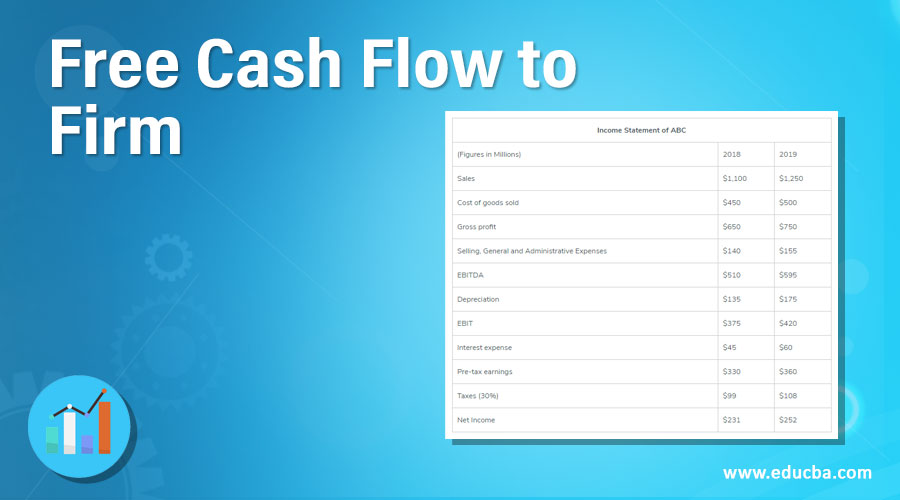

Following are details of Company ABC

| Income Statement of ABC | ||

| (Figures in Millions) | 2018 | 2019 |

| Sales | $1,100 | $1,250 |

| Cost of goods sold | $450 | $500 |

| Gross profit | $650 | $750 |

| Selling, General, and Administrative Expenses | $140 | $155 |

| EBITDA | $510 | $595 |

| Depreciation | $135 | $175 |

| EBIT | $375 | $420 |

| Interest expense | $45 | $60 |

| Pre-tax earnings | $330 | $360 |

| Taxes (30%) | $99 | $108 |

| Net Income | $231 | $252 |

| Balance Sheet of ABC | ||

| (Figures in Millions) | ||

| Assets | 2018 | 2019 |

| Cash | $40 | $60 |

| Accounts receivable | $70 | $110 |

| Inventory | $120 | $145 |

| Current assets | $230 | $315 |

| Fixed Assets | $1,400 | $1,600 |

| Accumulated depreciation | $460 | $500 |

| Total Assets | $1,170 | $1,415 |

| Liabilities | 2018 | 2019 |

| Accounts payable | $75 | $95 |

| Short-term debt | $60 | $80 |

| Current liabilities | $135 | $175 |

| Long term debt | $600 | $650 |

| Common stock | $200 | $200 |

| Retained earnings | $235 | $390 |

| Total Liabilities and Equity | $1,170 | $1,415 |

Now to Calculate Free Cash Flow to the Firm, we need,

EBIT = $420

EBITDA = $595

Net Income = $252

Depreciation and Amortisation = $175

Capital Expenditure = Fixed asset 2019 – Fixed asset 2018 = $200(Cash Outflow)

| Net Change in Working Capital | 2018 | 2019 | Change |

| Current Asset | |||

| Accounts receivable | $ 70 | $ 110 | $ -40 |

| Inventory | $ 120 | $ 145 | $ -25 |

| Current Liabilities | |||

| Accounts payable | $ 75 | $ 95 | $ 20 |

| Working Capital (Current Assets – Current Liabilities) | $ 115 | $ 160 | $ -45 |

Net Change in Working Capital = – $45(Cash Outflow)

Net Income Approach

FCFF = NI + D&A + (I * (1 – T)) – Capital Expenditure + Changes in Net Working Capital

- FCFF = $252 + $175 + ($60 * (1 – 30%)) – $200 – $45

- FCFF = $224 (mn)

EBIT Approach

FCFF = (EBIT * (1 – T)) + D&A – Capital Expenditure + Changes in Net Working Capital

- FCFF = ($420 * (1 – 30%)) + $175 – $200 – $45

- FCFF = $224 (mn)

FCFF = (EBITDA * (1 – T)) + (D&A * T) – Capital Expenditure + Changes in Net Working Capital

- FCFF = ($595 * (1 – 30%)) + ($175 * 30%) – $200 – $45

- FCFF = $224 (mn)

Evaluation Using FCFF

Free Cash Flow to the Firm indicates cash, which is available with the company for investors after payment of all debts, expenses, investment in current assets,s and investment in long-term assets. FCFF indicates the company’s growth and performance over the years. It is one of the most important tools in the calculation valuation of the stock. For investors, it is helpful to understand whether such stocks are overvalued or undervalued in terms of price.

A positive value of FCFF indicates a company can maintain cash even after expenses and investments. The negative value of FCFF indicates the company’s inability to generate enough revenue to match its operating costs and investment activities. Although negative FCFF can result from the company’s increase in investment for future growth, an investor should understand and study a company’s finances before making a judgment.

Importance and Uses of Free Cash Flow to Firm

- Difficult to Manipulate: Unlike other indicators like EPS(Earnings per share), Free Cash Flow to the Firm gives a much more accurate picture. Earnings can be manipulated with aggressive accounting practices like a high depreciation rate. But in FCFF, considering actual cash flows, this method is much more helpful in analysis.

- Indicators for Business: Business with positive FCFF indicates the sound financial health of the company, while negative FCFF indicates the company’s inability to generate higher revenues. FCFF also tells about the performance of business and investments.

- Indicator for Investor: Free Cash Flow to the Firm indicates the company’s performance and ability to manage its operations without a shortage of cash, which also means the company can pay dividends, reinvest money in capital assets targeting growth and eventually helpful in the growth of a business that will provide capital appreciation to investors. For an investor, FCFF can be quite helpful in understanding the company’s financial scenario.

FCFF vs FCFE

| Free Cash Flow to Firm | Free Cash Flow to Equity | |

| Definition | Cash flow is available to the firm and all investors after deducting expenses, tax, reinvestment, and debt payments. | Free Cash Flow to Equity indicates how much cash is left with the firm for equity shareholders after deductions of expenses, reinvestment, and debt payments. |

| Leverage | It is unlevered cash flow as it does not consider the effects of leverage. | FCFE is levered cash flow as it considers the effects of leverage by deducting interest payments to arrive at final calculations of cash flow |

| Usage | FCFF is used in the calculation of business valuations | FCFE is used in the Valuation of Equity holders. |

| Calculation | In the DCF model, the Weighted average cost of capital is used to calculate the capital structure. | The cost of Equity is used to understand free cash flow for equity. |

| All investors and management prefer FCFF as it helps maintain a better picture in case of high leverage. | Equity Investors and Analysts prefer FCFE as It provides a much more accurate picture of business in case of high leverage. |

Conclusion

Free Cash Flow to the Firm is the cash-generating ability of the firm even after deducting expenses, taxes, and income, indicating the firm’s financial health and growth prospects. Compared to EPS, FCFF is much more helpful as it can be difficult to manipulate as it only considers transactions involving actual cash outflow and inflow in business. Positive FCFF indicates the company’s ability to grow without external funding.

For investors looking for capital growth and income, FCFF can be helpful as companies with positive FCFF value either reinvest in capital assets targeting further growth or give dividends to shareholders.

Although a Negative value in FCFF is considered bad, an investor needs to dig deep and understand the company’s finances before making any judgment. The investor can analyze multiple years to understand whether a company is showing growth or is under stress.

Recommended Articles

This is a guide to Free Cash Flow to Firm Formula. Here we discuss the formulas and examples to calculate Free Cash Flow to Firm, importance, and uses. You can also go through our other related articles to learn more –