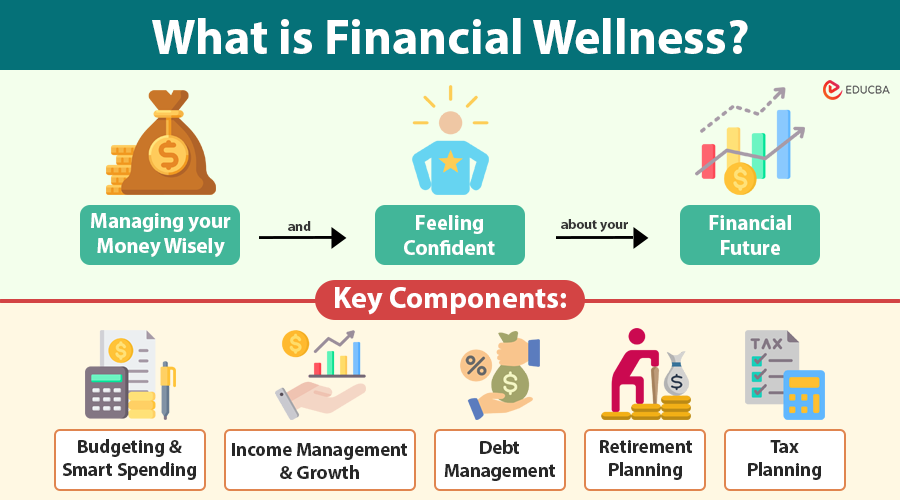

What is Financial Wellness?

Financial wellness means being in a healthy financial position where you can comfortably manage daily expenses, handle unexpected costs, and save for future goals without constant money stress.

For example, Emma pays her bills on time, has a small emergency fund, and saves each month for retirement. She can enjoy outings with friends without worrying about going into debt. This balance and confidence in her finances show that Emma has financial wellness.

Table of Contents

- What Is Financial Wellness?

- Why Financial Wellness Matters?

- Key Components of Financial Wellness

- Steps to Improve Your Financial Wellness

- Tools and Resources

- Common Financial Mistakes to Avoid

- Financial Wellness for Families

- Financial Wellness for Retirement Planning

Key Takeaways

- Financial wellness means managing money confidently to cover daily expenses, emergencies, and future goals without stress.

- Budgeting, smart spending, and tracking income are foundational to building financial stability.

- Saving consistently and reducing high-interest debt protects against financial setbacks and creates long-term security.

- Investing early, monitoring credit, and planning for retirement help grow wealth and ensure financial independence.

- Insurance, tax planning, and estate considerations safeguard your family and assets from unexpected events.

- Financial education and a positive money mindset empower better decisions and support lasting financial wellness.

Why Financial Wellness Matters?

Good financial health allows you to:

- Reduce stress and anxiety: Money problems are one of the leading causes of stress. Financial wellness helps you avoid constant worry about bills, debt, or emergencies.

- Improve physical and mental health: Less financial stress means better sleep, fewer health issues, and a more positive mindset.

- Achieve personal and family goals: With strong financial habits, you can-

- Buy a home

- Support your children’s education

- Travel or enjoy hobbies

- Build wealth for the next generation

- Be ready for emergencies: Unexpected events like car repairs, medical bills, or job loss become manageable when you have savings and insurance protection.

- Enjoy more freedom and stability: Financial wellness gives you the freedom to make choices, switch jobs, start a business, or retire comfortably without relying on credit or stressing about money.

Key Components of Financial Wellness

Several core components build financial wellness and work together to create a strong and stable financial life. Each one plays an important role in helping you manage money confidently and achieve long-term security.

1. Budgeting and Smart Spending

Budgeting helps you track income and expenses so you can make intentional financial decisions. Smart spending ensures your money goes toward needs, priorities, and goals, not impulsive purchases.

What it includes:

- Creating a monthly budget

- Identifying needs vs. wants

- Reducing unnecessary expenses

- Maintaining a positive cash flow.

2. Income Management and Growth

Increasing your earning potential strengthens financial stability and accelerates goal achievement.

What it includes:

- Developing career skills

- Negotiating your salary

- Starting side hustles or passive income

- Planning for long-term earning growth.

3. Debt Management

Managing debt wisely prevents interest costs from draining your income and allows financial progress.

What it includes:

- Paying bills on time

- Reducing high-interest balances (like credit cards)

- Choosing the right repayment strategy

- Avoiding excessive borrowing.

4. Saving for Short-Term and Long-Term Needs

Saving builds a financial cushion that protects you from unexpected issues and prepares you for future goals.

What it includes:

- Emergency savings

- Short-term goals (travel, home upgrades)

- Long-term goals (education, homeownership)

- Automating savings contributions.

5. Investing for Wealth Building

Investing helps your money grow and supports a secure future.

What it includes:

- Saving for retirement through accounts like 401(k)s and IRAs

- Diversifying investments (stocks, bonds, funds)

- Understanding risk vs. return

- Starting early to benefit from compound growth.

6. Credit Health and Monitoring

Good credit gives you access to better financial opportunities and lower interest rates.

What it includes:

- Maintaining a strong credit score

- Monitoring credit reports regularly

- Keeping credit card balances low

- Borrowing responsibly.

7. Retirement Planning

Preparing for retirement ensures you can enjoy life later without depending only on Social Security.

What it includes:

- Setting retirement savings goals

- Contributing consistently to retirement plans

- Taking advantage of employer 401(k) matches

- Reviewing plans as life changes.

8. Insurance and Financial Protection

Insurance protects your finances from large, unexpected costs that could derail your progress.

What it includes:

- Health, auto, home, and life insurance

- Disability coverage to protect income

- Understanding what each policy covers

- Choosing your coverage based on needs.

9. Tax Planning

Smart tax strategies help you keep more of your hard-earned money.

What it includes:

- Using tax-advantaged accounts (HSA, IRA, 401(k))

- Understanding common deductions and credits

- Planning for annual tax obligations

- Getting help from a tax professional if needed.

10. Financial Education and Mindset

Knowledge and a healthy money mindset empower you to make informed financial decisions.

What it includes:

- Learning about personal finance

- Building confidence in money management

- Reducing fear or stress around finances

- Focusing on progress, not perfection.

Steps to Improve Your Financial Wellness

Improving your financial health does not require big changes all at once. Small, consistent actions can completely transform your future. Here is a step-by-step plan designed specifically for U.S. households:

Step 1: Track Your Spending and Know Where Your Money Goes

Start by reviewing every dollar spent during the last 30 days.

This helps answer the key question: “Where is my money actually going?”

How to track:

- Use banking apps or budgeting apps (Mint, YNAB, EveryDollar)

- Sort expenses into Needs, Wants, and Waste

- Identify spending leaks, like subscriptions you do not use

Goal: Awareness → Control

Step 2: Build a Starter Emergency Fund

Start with $500–$1,000 as a quick safety shield.

Why?

- Covers urgent expenses like car repair or medical co-pay

- Prevents reliance on high-interest credit cards

Goal: 3–6 months of living expenses in a high-yield savings account (HYSA).

Step 3: Pay Down High-Interest Debt First

Debt can delay every financial goal.

Steps:

- List all debts → interest rates, balances, minimum payments

- Choose one strategy:

| Method | Benefit | Example Users |

| Avalanche (highest interest first) | Saves most money | Credit card users |

| Snowball (smallest balance first) | Boosts motivation | Beginners |

Also consider:

- Debt consolidation

- Negotiating lower interest rates

- Balance transfers (0% APR offers)

Goal: eliminate credit card balances with APRs above 20% first.

Step 4: Create a Realistic Budget That Fits Your Lifestyle

Choose a method you can stick to. Budgeting must be practical, not stressful.

Tips:

- Include fun spending to avoid burnout

- Review the budget monthly and adjust as income or priorities change

Remember: You control your money, not the other way around.

Step 5: Start Saving Consistently for the Future

Even little amounts grow over time.

Recommended approach:

- Automate savings right after payday

- Open multiple goal-based savings accounts:

- Emergency fund

- Travel fund

- Home purchase fund

- Holiday spending fund

Use separate accounts to avoid accidental spending.

Step 6: Begin or Increase Investing

Investing for a long time is more important than trying to pick the perfect moment.

Start with:

- 401(k): especially when your employer contributes too

→ Never leave free money behind

- Roth IRA: tax-free retirement income

- Index funds / ETFs for low-cost diversification

Tip: Even $50–$100 monthly can grow into thousands thanks to compound interest.

Step 7: Monitor and Improve Your Credit Score

Better credit = lower interest rates = big financial savings.

What to do:

- Pay all bills on time

- Keep credit utilization below 30%

- Check your free yearly credit reports for mistakes.

- Do not apply for too many new accounts at once

Goal: 700+ score for strong financial flexibility.

Step 8: Protect Yourself with the Right Insurance

Insurance prevents financial disasters from turning into lifelong debt.

Priority protection for U.S. residents:

- Health insurance (medical expenses can bankrupt anyone)

- Auto insurance (required in most states)

- Renters/Homeowners insurance (protects property + liability)

- Get life insurance if your family depends on your income.

This step supports financial stability + security.

Step 9: Plan for Taxes Early

Smart tax planning = more money in your pocket.

Actions:

- Maximize tax-advantaged accounts (401k, IRA, HSA)

- Track deductions (home office, childcare, EV credits, education)

- Consider a CPA if self-employed or earning multiple income streams

Goal: Minimize tax burden legally and efficiently

Step 10: Build Financial Knowledge and a Positive Mindset

Financial wellness also includes emotional well-being.

Strengthen your mindset:

- Consume financial education daily (books, podcasts, YouTube)

- Celebrate progress and small wins

- Talk openly about money with trusted people

- Avoid comparing your journey with others; everyone starts differently

Quick Checklist to Start

| Action | Time Required |

| Track spending for 30 days | 15 minutes/day |

| Set up automatic savings | 10 minutes |

| Review credit report | 5 minutes |

| Reduce one monthly expense | 10 minutes |

| Open a retirement account if you do not have one | 20 minutes |

| Pay $20 extra on high-interest debt | Immediate |

Tools and Resources for Financial Wellness

| Resource Type | Examples |

| Budgeting Apps | Mint, You Need A Budget (YNAB), EveryDollar |

| Free Credit Monitoring | Credit Karma, AnnualCreditReport.com |

| Investment Platforms | Vanguard, Fidelity, Schwab, Robinhood |

| Financial Counseling | National Foundation for Credit Counseling (NFCC) |

| Government Resources | Consumer Financial Protection Bureau (CFPB) |

Common Financial Mistakes to Avoid

Even with the best intentions, many people fall into financial traps that can slow progress and create long-term money stress. Understanding these common mistakes can help you make smarter decisions and stay on track toward financial wellness.

- Living without a budget: Not having a budget makes it easy to overspend, miss bills, and lose track of where your money goes. A budget helps you control your spending, stay organized, and reach your money goals more quickly.

- Relying too much on credit cards: Credit cards are easy to use, but high interest rates can make small purchases turn into costly debt. Many Americans end up paying interest each month when they do not pay their credit card balance in full.

- Ignoring an emergency fund: Unexpected expenses like car repairs, medical bills, or job loss can cause serious financial problems. Without emergency savings, people often turn to loans or credit cards, which can increase future financial pressure.

- Delaying retirement savings: Many people wait too long to start saving for retirement, believing they have plenty of time. However, the earlier you save, the more compound growth works in your favor, especially with 401(k) matching or tax-advantaged accounts.

- Overspending on lifestyle upgrades: As income rises, so does lifestyle spending. This is known as “lifestyle inflation.” It can prevent you from saving enough and building wealth, even if you earn more money.

- Not tracking subscriptions and recurring bills: Unused subscriptions and automatic payments can silently drain money each month. Canceling what you do not use can free up spending room for savings or essentials.

- Making only minimum payments on debt: Minimum payments seem manageable, but they extend the payoff timeline and cost thousands of dollars in extra interest, especially on credit card debt and personal loans.

- Avoiding conversations about money: Some people avoid discussing finances with partners or family, which can lead to misunderstandings, missed goals, or financial conflicts. Open communication supports shared financial wellness.

- Not having proper insurance: Skipping important insurance, such as health, auto, or renters coverage, can lead to significant risk if something goes wrong. Appropriate coverage protects both your finances and peace of mind.

- Failing to plan long-term: Without long-term planning, such as saving for a home, college, or retirement, people often struggle to manage major financial needs when they arise. A plan gives direction and purpose to your money decisions.

Financial Wellness for Families

Families face unique financial responsibilities, including raising children, managing household expenses, and planning for education. Here is how to strengthen your family’s financial wellness:

1. Budgeting as a Household

- Track combined household income and expenses

- Assign each family member a role in managing money

- Categorize expenses: needs (mortgage, groceries), wants (entertainment), and savings (college fund, emergency fund).

2. Emergency Fund for the Whole Family

- Aim for 3–6 months of combined living expenses

- Covers unexpected costs: car repairs, medical bills, or job loss

- Please keep it in a high-yield savings account for easy access.

4. College Savings

- Consider 529 college savings plans or Coverdell ESAs

- Take advantage of tax benefits and potential state incentives

- Automate contributions monthly to reduce stress.

5. Insurance and Protection

- Life insurance if your income supports dependents

- Health insurance for all family members

- Disability insurance to protect against income loss

- Homeowners or renters insurance to safeguard property.

6. Estate Planning

- Create a will and designate guardians for minor children

- Use trusts if necessary to protect assets

- Regularly review beneficiaries on insurance policies and retirement accounts.

Financial Wellness for Retirement Planning

Planning for retirement is crucial, especially as Social Security alone may not cover all expenses. A strong retirement strategy ensures financial independence later in life.

1. Set Retirement Goals

- Determine the age you want to retire

- Estimate expected monthly expenses

- Include healthcare costs, travel, hobbies, and emergencies.

2. Maximize Retirement Accounts

- 401(k): Contribute enough to get the full employer match; it is free money!

- IRA / Roth IRA: Tax-advantaged savings for retirement

- If you are over 50, consider adding extra contributions to your retirement accounts.

4. Diversify Investments

- Stocks, bonds, mutual funds, and ETFs reduce risk while growing wealth

- Update your portfolio regularly to keep it aligned with your goals and risk tolerance.

5. Healthcare and Long-Term Care Planning

- Estimate medical expenses in retirement

- Consider Medicare plans and supplemental insurance

- Plan for long-term care insurance if needed.

6. Withdrawal Strategy

- Learn about safe withdrawal rates (e.g., the 4% rule)

- Plan withdrawals to minimize taxes

- Consider tax-efficient accounts for withdrawals (Roth vs. traditional).

Final Thoughts

Financial wellness is the foundation for a secure, stress-free, and fulfilling life. By keeping track of spending, saving regularly, paying off debt, investing carefully, and planning, you can take control of your money and create long-term financial stability. Whether you are planning for your family, preparing for retirement, or improving your daily money habits, small, consistent actions can create lasting financial confidence and freedom. Prioritizing financial wellness today ensures peace of mind and a brighter financial future tomorrow.

Frequently Asked Questions (FAQs)

Q1. How do financial wellness and financial literacy differ?

Answer: Financial literacy is the knowledge and understanding of money management concepts, while financial wellness is the application of that knowledge to maintain a healthy financial life with confidence, stability, and peace of mind.

Q2. Can I achieve financial wellness on a low income?

Answer: Yes. Financial wellness means using your money wisely to make the most of what you have. Focus on budgeting, reducing debt, automating savings, and avoiding unnecessary expenses, even if the amounts are small.

Q3. How much emergency savings should I have?

Answer: Start with $500–$1,000 for small emergencies. Long-term, aim for 3–6 months of living expenses in a high-yield savings account.

Q4. Can financial wellness reduce stress and improve mental health?

Answer: Yes. Managing money proactively reduces anxiety, improves sleep, and allows you to focus on personal and family goals rather than worrying about bills or debt.

Q5. Are insurance and estate planning necessary for financial wellness?

Answer: Absolutely. They protect your assets and loved ones from unexpected events, ensuring long-term financial security.

Q6. Is financial wellness a one-time goal or an ongoing process?

Answer: Financial wellness is continuous. Life changes, goals evolve, and financial habits require consistent attention and adaptation.

Recommended Articles

We hope this article on financial wellness helped you understand how managing money wisely can reduce stress and build long-term security. Explore the articles below to learn more about budgeting, saving, investing, and planning for a financially healthy future.