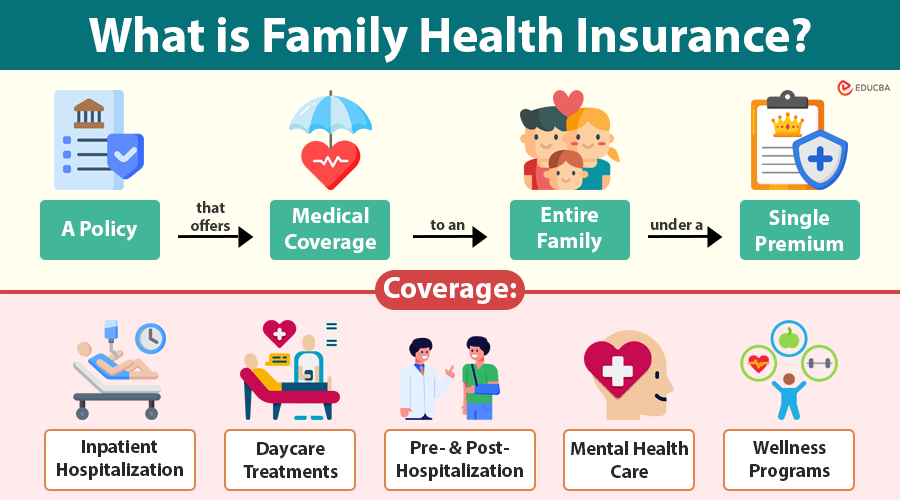

What is Family Health Insurance?

Family health insurance is a policy that offers medical coverage to an entire family under a single premium. In most cases, it covers the policyholder, spouse, and dependent children. Many plans also allow coverage for dependent parents or parents-in-law.

For example, imagine a family of four — parents and two kids — covered under a family health insurance floater plan of USD 100,000. Suppose one child needs surgery costing USD 20,000. In that case, the family can use that amount from the shared sum insured, with the remaining USD 80,000 still available for other family members during the policy year.

The global health insurance market is valued at USD 2.69 trillion in 2025 and is projected to reach USD 5.12 trillion by 2034, growing at a CAGR of 7.43% (2025–2034). In North America alone, the market surpassed USD 880 billion in 2024 and is projected to expand at a CAGR of 7.46% over the forecast period.

Table of Contents

- What is Family Health Insurance?

- Types of Family Health Insurance

- What Does Family Health Insurance Typically Cover?

- Why do Families Need Health Insurance?

- Global Market and Coverage Insights

- Key Benefits & Features

- How to Choose the Right Plan?

- Global Case Studies & Success Stories

- Future Trends in Family Health Insurance

- Common Exclusions to Watch

- The Role of Government Policies

- Steps to Maximize Your Family Policy

Types of Family Health Insurance

- Family floater plans: A single sum insured, which all members share. If one member falls ill, they can use the entire amount.

- Individual plans bundled: Each family member has an independent sum insured under the same contract.

- Hybrid models: Some plans combine a floater policy with individual benefits for greater flexibility.

What Does Family Health Insurance Typically Cover?

Family Health Insurance plans generally include a wide range of benefits to protect your entire family under a single policy. Typical coverage features are:

- Inpatient hospitalization: Covers expenses for hospital stays and related treatments.

- Daycare treatments: Takes care of procedures that do not require a 24-hour hospital stay, like cataract surgery.

- Pre- and post-hospitalization: Pays for tests and medications before admission and after discharge.

- Maternity and newborn benefits: Includes delivery costs, newborn care, and vaccinations.

- Emergency ambulance charges: Covers ambulance services for quick medical transport.

- Critical illness riders: Offers added protection for major illnesses such as cancer or heart disease.

- Preventive health check-ups: Encourages early diagnosis of diseases through annual screenings.

- OPD consultations: Covers outpatient visits to specialists or general practitioners.

- Mental health care: Provides counseling or psychiatric treatment, a growing necessity nowadays.

- Wellness programs: Supports a healthier lifestyle through diet plans, fitness programs, and stress management.

Why Families Need Health Insurance?

The World Bank states that approximately half of the world’s population lacks access to basic health services, thereby placing families at financial risk.

Key reasons families need health insurance include:

- Protecting savings: Without insurance, a single hospitalization can wipe out years of savings. For instance, the average cost of heart surgery in the U.S. can exceed $100,000.

- Inflation in healthcare: Global healthcare inflation averages 6–10% annually. This means costs double roughly every 7–8 years.

- Coverage for chronic conditions: Around 1 in 3 adults worldwide suffer from chronic diseases such as hypertension or diabetes.

- Child and maternity needs: Most plans support maternity and child vaccinations, which are crucial for young families.

- Peace of mind: Medical emergencies are stressful, but insurance helps you feel secure.

- Tax benefits: In many countries (like India, the U.S., or Germany), insurance premiums are tax-deductible.

- Access to quality care: With insurance, families can afford to go to better hospitals rather than low-cost facilities.

Global Market and Coverage Insights

The Family Floater Market

- Valued at $53.7 billion in 2024, projected to reach $94.5 billion by 2029 (CAGR 11.3%).

- Developed economies are seeing strong adoption, but emerging markets, such as India, Vietnam, and Nigeria, are experiencing the fastest growth.

Universal Health Coverage (UHC)

- WHO is UHC Index: 68 in 2021 (up from 45 in 2000).

- Countries with notable achievements:

- Vietnam: 93%+ insured

- Rwanda: >90% through community-based models

- India: Ayushman Bharat covers nearly 500 million people

- Germany/UK: near-universal coverage through public–private partnerships

However, over 2 billion people globally still lack comprehensive protection.

Key Benefits & Features

Expanded benefits families should prioritize:

- Restoration benefit: Many plans reinstate the sum insured if it is exhausted within a year, vital for larger families.

- No-claim bonus: Increases the sum insured annually if no claims are made.

- Cashless hospitalization: Partner networks handle payments directly, reducing out-of-pocket expenses.

- Pre-existing disease coverage: Modern policies often reduce waiting periods for pre-existing conditions.

- Maternity cover: Includes delivery, newborn vaccinations, and congenital conditions.

- Telemedicine: Following the pandemic, insurers are offering free virtual consultations.

- Mental health: Insurers are increasingly including counselling and psychiatric support to align with WHO guidelines.

- Second opinions: Critical illnesses, such as cancer, often come with free second opinions under family plans.

- Preventive wellness: Annual check-ups, diet consultations, and fitness discounts encourage a healthier family lifestyle.

How to Choose the Right Plan?

Choosing a family plan should not be rushed. A thorough checklist:

- Estimate the right sum insured: Ideally, enough to cover the most expensive treatment for at least two members in a year.

- Check co-payment clauses: Some plans require you to pay 10–30% of the bill — minimize these if possible.

- Analyze network hospitals: Select plans with hospitals near your residence for emergency care.

- Scrutinize exclusions: Insurers often exclude dental, cosmetic, and infertility treatments from coverage.

- Look for daycare treatments: Should cover 100+ daycare procedures.

- Compare claim settlement ratios: A ratio above 90% is a healthy benchmark.

- Evaluate premium hikes: Some policies raise premiums dramatically at renewals — check past patterns.

- Portability options: If moving to another city or country, can you transfer the policy?

- Customer support reviews: In a medical crisis, a responsive helpline can be the difference between approval and denial.

Global Case Studies & Success Stories

- Vietnam: Subsidized insurance, combined with local clinics, has driven coverage to over 93%.

- Rwanda: Community “mutuelles” help cover 90%+ of the population with sliding-scale premiums.

- Germany: Combines public and private players to achieve nearly 100% coverage.

- India: Ayushman Bharat provides cashless coverage in over 25,000 hospitals nationwide for ~500 million people.

- Thailand: Universal coverage since 2002, with a basic package plus voluntary top-ups.

These examples demonstrate that family health insurance, along with strong government backing, can drive universal access to healthcare.

Future Trends in Family Health Insurance

- AI-driven underwriting: Machine learning predicts risk better, offering customized pricing.

- Telehealth growth: Following the pandemic, more than 50% of family plans globally now include telehealth.

- Wearables integration: Fitbit and Apple Watch data help insurers reward healthy behavior.

- Climate health coverage: More insurers are adding vector-borne diseases caused by global warming.

- Cross-border benefits: As global migration increases, plans that cover treatments abroad are in high demand.

- Expanded mental health coverage: Plans now include everything from therapy to digital stress-relief programs.

Common Exclusions to Watch

While family plans are broad, they do have exclusions. Typical exclusions include:

- Cosmetic surgery

- Non-medically necessary dental work

- Injuries due to dangerous sports or adventure activities

- Self-inflicted injuries

- Drug/alcohol abuse-related treatments

- Infertility treatments (though this is changing in some countries).

Understanding these exclusions avoids unpleasant surprises during claims.

The Role of Government Policies

Family health insurance works best when supported by sound public policy. Governments worldwide help through:

- Subsidies for premiums (e.g., Ayushman Bharat, Vietnam social schemes)

- Public–private partnerships to expand the network of hospitals

- Tax deductions to encourage uptake

- Digital insurance frameworks to make buying and claiming easier.

These government initiatives create an ecosystem that fosters the growth of family health insurance, thereby reducing the population’s out-of-pocket expenses.

Steps to Maximize Your Family Policy

Here is a quick action checklist for readers:

- List your family’s health history and identify high-risk areas

- Choose an adequate sum insured

- Verify the hospital network and check its quality

- Check waiting periods for maternity and pre-existing conditions

- Go through the policy exclusions line by line

- Consider critical illness add-ons

- Track renewal timelines

- Educate your family about cashless claims

- Save insurer helpline numbers

- Review policies annually as your family grows

Final Thoughts

Family health insurance is more than a policy — it is your family’s financial and emotional safeguard. It helps you avoid catastrophic healthcare expenses, gain access to better care, and safeguard your financial well-being. As health risks evolve and healthcare inflation rises, a comprehensive family policy is an essential part of modern life.

Frequently Asked Questions (FAQs)

Q1. Can I add parents to my family health plan?

Answer: Yes, many family plans allow dependent parents, but premiums will be higher.

Q2. Are vaccinations covered?

Answer: Typically, for children, yes, under preventive care. Adult vaccines depend on policy terms.

Q3. Is mental health covered?

Answer: Increasingly yes — but check the policy for therapy session limits.

Q4. Can I port my policy to another insurer?

Answer: In most regions, yes, after a certain period (usually one year).

Q5. Do family plans cover COVID-19?

Answer: Yes, nearly all plans now cover COVID-19, subject to policy conditions.

Recommended Articles

We hope this guide on Family Health Insurance helps you make informed choices to protect your loved ones. Explore these recommended articles for deeper insights into health insurance plans, wellness benefits, and tips to maximize your family’s healthcare coverage.