Updated July 6, 2023

What is Errors and Omission Insurance?

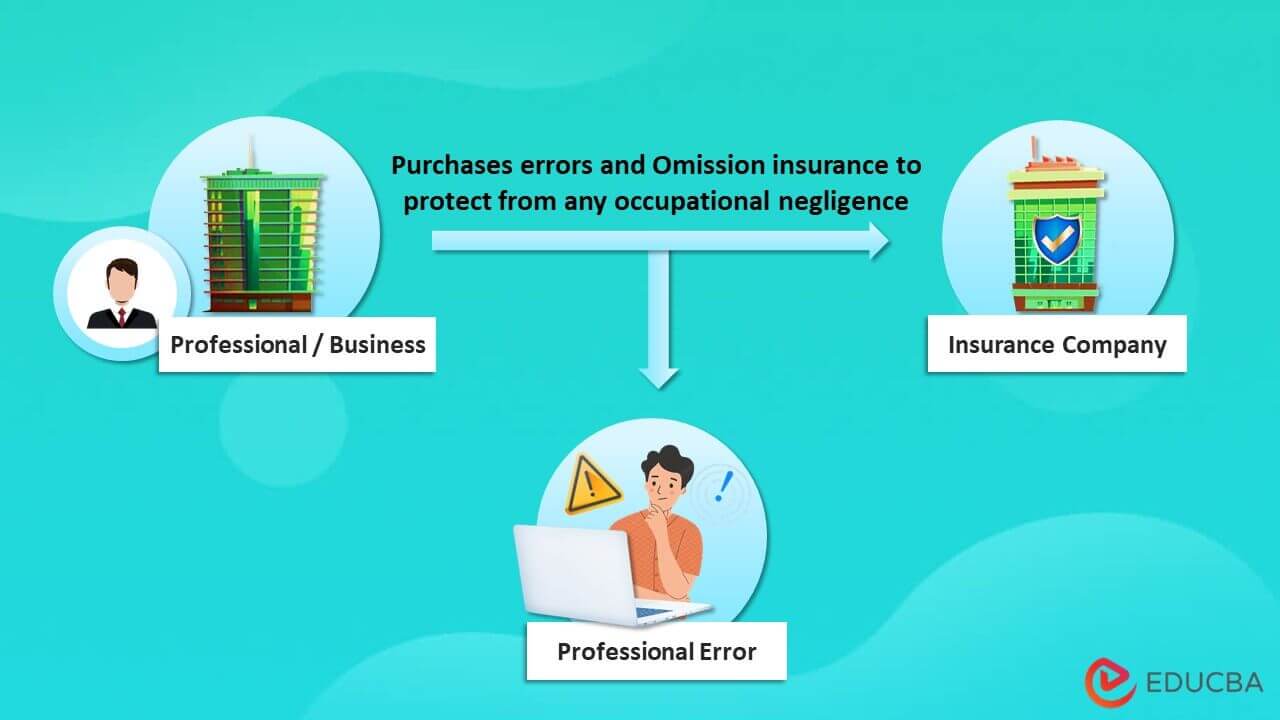

Errors and omission insurance (E&O) protects businesses and professionals against lawsuits claiming professional incompetence or negligence.

For example, Mr. Clark got a $15,000 roof installation. However, it had severe leaks after a winter storm because the base layer installation was incorrect. Mr. Clark registered a case against the contractor. As the contractor had E&O insurance, the contractor could claim the money to pay Mr. Clark.

Companies that provide services for a charge must purchase this policy. The law requires certain professionals, like doctors, surgeons, etc., to have this insurance. It covers the legal fees, such as defense costs, settlements, etc., associated with the lawsuit against companies. Additionally, it pays damages awarded by juries or arbitrators. It generally covers errors in judgment, calculation, interpreting facts, applying the law, and more.

Key Highlights

- Error and Omission Insurance shield businesses from client accusations regarding employee’s careless work/behavior.

- Individuals/businesses offering a service, including financial services, such as real estate agents, medical workers, etc., must buy this insurance.

- The standard coverage includes legal costs, accidental destruction, etc. It does not have any intentional or criminal acts by the firm.

- These insurance costs begin at around $500 annually, depending on the coverage type. It can also go up to $1000 per year.

Real-Life Examples

Example #1:

Global Travel, a travel agency, signed a contract with Qualpay, a payment solutions firm. According to the agreement, Global Travel would pay Qualpay periodical payments for their service.

In 2019, an employee from Global Travel stole around $1.1 million. It led to Global Travel’s inability to fulfill its contract with Qualpay. As a result, Qualpay raised a complaint, but as Global Travel had errors & omission insurance, they submitted an insurance claim.

Example #2:

In 2012, a US citizen, Robert Smith, got automobile insurance from Safeco. He went through Comegys consultancy agency. In 2013, while renewing the policy, he requested an upgrade, and his agent suggested a suitable option.

However, in 2015, after Robert died after encountering a motor accident, his wife found that the Comegys agent had not suggested the best policy. Therefore she filed a court case against the company. Nevertheless, they had E&O insurance.

Who Requires Errors and Omission Insurance?

- Every business in the field of service that charges clients for expert services must carry E&O insurance.

- It is for companies that work on contracts, such as hiring or working as contractors.

- Employees responsible for handling money and documents, writing reports, or making presentations for clients

- In addition, it is also for doctors, attorneys, architects, engineers, teachers, etc.

What is the Cost of Errors and Omission Insurance?

- The insurance cost depends on various factors, such as the company’s size, the type of business, and the geographical location. The insurance company also considers the claim history, net income, applicable coverages, deductibles, etc.

- The average costs for a policy range between $500 and $1,000 annually or around $30 to $80 per month. Typical coverage limits for this policy include $100,000 to $2 million or even more.

- It’s more expensive for commercial policies because they cover more risks. The higher the coverage limit, the higher the insurance premium one must pay

- It also differs for every profession. For instance, architects and engineers may have to pay the most ($1000+) as they work on expensive projects.

- While IT professionals, consultants, and real estate agents pay around $600 – $800, accountants and insurance professionals pay the least (around $500).

What Does it Cover?

- It covers legal costs incurred in case of a lawsuit due to an error in judgment and other mistakes that can lead to legal action against the company.

- The coverage includes any mistakes made by the insured regarding any legal and professional contract.

- The policy additionally protects from accidental destruction of property, invasion of privacy, and copyright infringement.

- It also covers any court-imposed fines or penalties.

What Does it Not Cover?

- This insurance does not cover losses from a cyber attack and for any intentional or criminal act

- The most common claim is when an individual or property suffers damage due to an error made by an employee/company. However, the E&O policy does not cover such claims.

- It also does not cover any employee grievances, theft, or false marketing

- The insurer won’t cover related lawsuits if the company violates the customer or employee copyright contracts.

Errors and Omission vs. Professional Liability Insurance

- E&O and professional insurance are interchangeable insurance terms

- The term that the insurer uses depends on the insured’s profession, as the type of negligence differs for every job

- Both the policies cover and do not cover the same situations

- Professional insurance is a policy term for architects, engineers, and consultants.

Features

- The premiums for E&O policies are mostly inexpensive, depending on the coverage, and therefore affordable to all service providers

- It provides high coverage amounts starting from $200,000 to $2 million

- It protects from various legal and financial claims, as its coverage ranges from court charges client reimbursement, and more

- Additionally, these insurance companies review and pass these claims quickly and efficiently.

Benefits

- It helps protect businesses’ assets, such as investments, properties, equipment, intellectual property rights, etc., against lawsuits

- Provides financial help to individuals and businesses in the event of an accidental mistake

- It gives a wide range of coverage on risks that can be beneficial for all kinds of professionals

- Having insurance brings peace to the insured in case of an unanticipated event.

Final Thoughts

E&O protects against potential legal liability for errors and omissions made by the insured during their professional duties. It is one of the most common types of insurance for small businesses. However, it protects businesses from financial losses that arise out of claims. It covers legal defense costs and reimburses for out-of-pocket expenses, such as repair costs.

Frequently Asked Questions(FAQs)

Q1. What are the typical claims under errors and omission insurance?

Answer: The common claims under E&O insurance are for errors in judgment, performance, contract compliance, and more. It also includes breach of warranty, fraud, employee/company negligence, etc.

Q2. What are the coverage exclusions of errors and omission insurance?

Answer: Coverage exclusions are situations where the policy does not cover losses. For instance, for the E&O insurance, the policy excludes any intentional negligence by the employees, a deliberate attempt at fraud, etc.

Q3. What is errors and omission insurance in real estate?

Answer: In the real estate industry, E&O insurance is helpful for agents. It can safeguard them from accidental errors during the sale or purchase of a property. It may include negligence in carrying out instructions from the client/representative, failure to provide information/providing incorrect information, calculating errors in commissions, taxes, or other charges, etc.

Q4. What are the limits of errors & omission policy?

Answer: E&O insurance has two kinds of limits: occurrence and aggregate. The occurrence limit is the total amount the insurer promises to pay for a single claim. In contrast, the aggregate limit is the amount the insurance provider will reimburse throughout the policy duration. For example, XYZ states they’ll pay $2,500 per claim and $250,000 for all claims combined.

Q5. How to determine errors & omission costs?

Answer: The costs for E&O insurance depend on the policy one takes and the risks one carries. For example, healthcare workers frequently pay more than copywriters. It generally evaluates the business industry, size, type, revenue, etc. It also considers coverage amount, claims history, etc.

Recommended Articles

This is a guide to errors and omission insurance. It explains its meaning, coverage, costs, examples, and more. To learn more, please read the following articles,