Updated July 31, 2023

Difference Between Equity vs Commodity

Equity shares price movement provides the base for most market-related activity. The confidence of the investors, lending, F & O movement, the growth of the company, competitiveness, etc., are decided by the equity price movement. In layman’s terms, equity means the common stock of the company. It is listed on the stock exchanges so that it can be easily traded in an authorized way.

Also, Equity shares provide ownership to the holders. Holding equity shares is important in the market as shareholders will directly take part in the management and strategic decision-making of the company. The commodity is a raw material or primary agricultural product capable of being bought and sold in the market. Generally, settlement by taking delivery is done by the traders with a day-to-day transaction exposure in that particular commodity. So they will hedge themselves by buying the commodity at forwarding rates for the specified date. In the end, they will take physical delivery for their daily requirements in the business. The second type of settlement in cash is a kind of speculation.

Commodity

Trading of the commodity takes place in 2 ways:

- By taking physical delivery

- By cash settlement

Any person who, based on their instinct of price movement in a specific direction in a given time frame, will enter into the transaction for the future specified date. The difference between the contract and actual prices will be settled in cash on the specified date. This is nothing but to manipulate the market based on the instinct of the price movement.

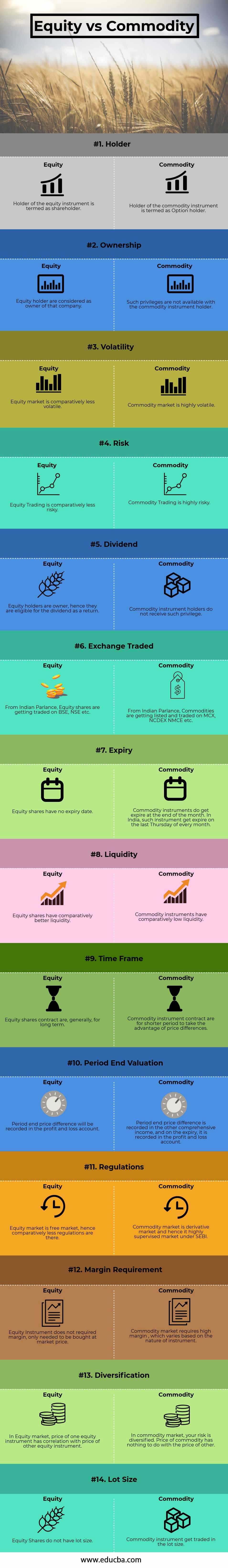

Head To Head Comparison Between Equity vs Commodity (Infographics)

Below is the top 14 difference between Equity vs Commodity

Key Differences Between Equity vs Commodity

Equity vs Commodity Card are popular choices in the market; let us discuss some of the major differences between Equity vs Commodity.

- Equity shares are generally listed and traded in stock exchanges like National Stock Exchange and Bombay Stock Exchange, etc. In contrast, Commodities are getting listed and traded on the stock exchanges like Multi Commodity Exchange, National Commodity and Derivatives Exchange, etc.

- Equity markets are less volatile as trades can be undertaken even in a single share, while commodity markets are highly volatile as trades are conducted in huge lot sizes.

- Equity contracts have no expiry dates, while commodity contracts always have a fixed expiry date on which settlement must take place.

- The equity market comparatively has a high amount of liquidity as compared to the commodity market, as investment happens in the lot size.

- Equity markets are less risky as they have low volatility, and the Commodity market is highly volatile because these are highly risky.

- Equity contracts require an investment of market price only, while commodity contracts require an investment of margin requirement, which keeps changing based on price changes.

- The holder of the equity instruments is the owner of the company. Hence it enjoys all the privileges like dividends, voting rights, etc. However, such privileges are not available to the holder of the commodity instruments.

Equity vs Commodity Comparison Table

Let’s look at the top 14 Comparisons between Equity vs Commodity.

| The Basis of Comparison | Equity | Commodity |

| Holder | The holder of the equity instrument is termed as a shareholder. | The holder of the commodity instrument is termed as the Option holder. |

| Ownership | The equity holder is like the owner of that company. | Such privileges are not available with the commodity instrument holder. |

| Volatility | The equity market is comparatively less volatile. | A commodity market is highly volatile. |

| Risk | Equity Trading is comparatively less risky, | Commodity Trading is highly risky. |

| Dividend | Equity holders are the owner. Hence they are eligible for the dividend as a return. | Commodity instrument holders do not receive such a privilege. |

| Exchange-Traded | From Indian Parlance, Equity shares are traded on BSE, NSE, etc. | From Indian Parlance, Commodities are listed and traded on MCX, NCDEX, NMCE, etc. |

| Expiry | Equity shares have no expiry date | Commodity instruments do get expire at the end of the month. In India, such an instrument expires on the last Thursday of every month. |

| Liquidity | Equity shares have comparatively better liquidity | Commodity instruments have comparatively low liquidity. |

| Time frame | Equity shares contract is, generally, for the long term. | A commodity instrument contract is for a shorter period to take advantage of price differences. |

| Period end valuation | The period-end price difference will be in the profit and loss account. | The period-end price difference is in the other comprehensive income; on the expiry, it is in the profit and loss account. |

| Regulations | The equity market is the free market. Hence comparatively fewer regulations are there. | A commodity market is a derivative market; hence, it is a highly supervised under SEBI. |

| Margin Requirement | Equity Instrument does not provide the required margin; they only need to be at market price. | The commodity market requires a high margin, which varies based on the nature of an instrument. |

| Diversification | In the Equity market, the price of one equity instrument correlates with the price of another equity instrument. | In the commodity market, your risk is diversified. The commodity’s price has nothing to do with the price of others. |

| Lot Size | Equity Shares do not have lot size. | Commodity instrument gets traded in the lot size. |

Conclusion

Equity vs commodity markets is highly different from each other. Equity vs commodity has its own specifications, features, and investment terms. From a market perspective, having a balanced view of investing is advisable. However, if a person does not have high exposure to the market and at the initial stage, one can start with equity markets and initiate his/her investment cycle.

Recommended Articles

This has been a guide to the top difference between Equity vs Commodity. Here we also discuss the Equity vs Commodity key differences with infographics and a comparison table. You may also have a look at the following articles to learn more.