Updated June 16, 2023

Best books to learn Derivatives

Derivatives are financial products that draw their value from underlying assets such as stocks, bonds, and other traditional securities. They are crucial for risk mitigation, etc. These top 10 derivative books can help readers of all levels of knowledge better understand derivatives. It can be a starting point for beginners and a reference tool for experts.

The top 10 derivative books are listed here to help you develop your career and gain the necessary information (the sequence is not as per ratings).

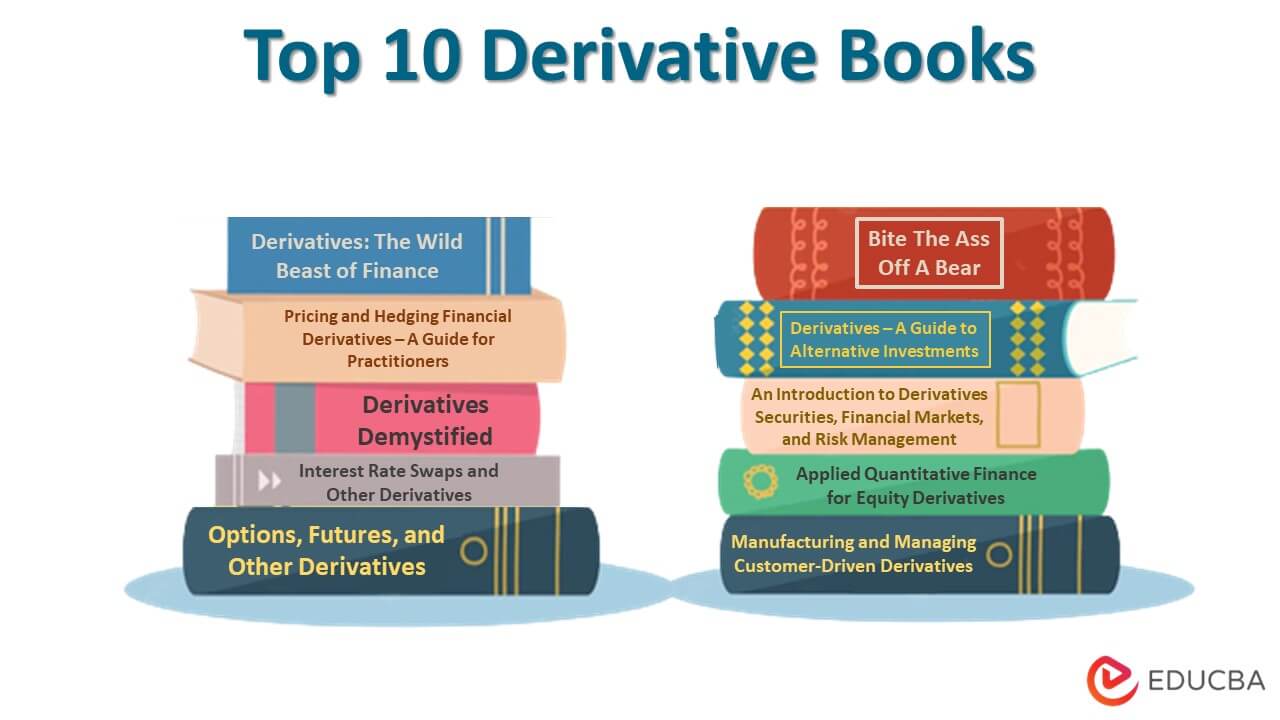

| # | Book | Author | Publishing Date | Rating |

| 1 | Derivatives: The Wild Beast of Finance | Alfred Steinherr | 2000 | Amazon: 3.6 Goodreads: 3.8 |

| 2 | Derivatives Demystified | Andrew M. Chisholm | 2010 | Amazon: 4.2 Goodreads: 3.81 |

| 3 | Derivatives – A Guide to Alternative Investments | David M. Weiss | 2014 | Amazon: 4.2 Goodreads: 3.8 |

| 4 | Interest Rate Swaps and Other Derivatives | Howard Corb | 2012 | Amazon: 4.6 Goodreads: 4.67 |

| 5 | Options, Futures, and Other Derivatives | John C. Hull | 2014 | Amazon: 4.6 Goodreads: 4.15 |

| 6 | Bite The Ass Off A Bear | Garth Friesen | 2017 | Amazon: 4.5 Goodreads: 4 |

| 7 | Pricing and Hedging Financial Derivatives – A Guide for Practitioners | Leonardo Marroni, Irene Perdomo | 2013 | Amazon: 3.8 Goodreads: 4.6 |

| 8 | An Introduction to Derivatives Securities, Financial Markets, and Risk Management | Robert Jarrow, Arkadev Chatterjea | 2013 | Amazon: 4.1 Goodreads: 4.33 |

| 9 | Applied Quantitative Finance for Equity Derivatives | Jherek Healy | 2021 | Amazon: 5 Goodreads: 5 |

| 10 | Manufacturing and Managing Customer-Driven Derivatives | Dong Qu | 2016 | Amazon: 5 Goodreads: 4 |

Let us discuss and outline each derivative book’s reviews and key points in detail.

Book #1: Derivatives: The Wild Beast of Finance

Author: Alfred Steinherr

Buy this book here.

Review:

The book explores the role of derivatives in the growth and diversification of national and world economies. The author makes numerous bold statements concerning the possible risk and dangers of the derivatives market in this book. However, the writing of this book makes understanding this challenging concept easier.

Key Points:

- The author discusses the profound effects of these financial instruments on the future of international banking while placing derivatives in a broad historical and economic framework.

- It lists well-known derivatives disasters like Barings and Orange County

- Steinherr has offered professionals, officials, and students a fun and enlightening canter through the derivatives world.

Book #2: Derivatives Demystified

Author: Andrew M. Chisholm

Buy this book here.

Review:

The derivative book is an instruction manual for everyone curious about trading in derivatives. The author attempts to explain the subject using a simple style. He uses basic language and mathematics. The book makes an effort to give the reader solid basics. Anyone participating in the investing market can use this book as a guide.

Key Points:

- The book demonstrates the use of each building block in diverse markets to address various risk management and trading issues.

- The new edition also provides a thorough background of derivatives, including information on their usage before the present credit crisis.

- The most distinctive feature of this book is its emphasis on case studies, examples, and real-world applications of various derivatives.

Book #3: Derivatives – A Guide to Alternative Investments

Author: David M. Weiss

Buy this book here.

Review:

The book is a compilation of the author’s 30-year brokerage industry experience. The author introduces readers to the ideas of derivatives. It follows a structured style to clarify fundamental ideas and lay the groundwork for more complicated concepts.

Key Points:

- The book methodically describes the structure, application, and significance of all goods that make up the derivatives universe.

- It presents the market participants, explains the mechanics of trade, and clarifies the functions of regulation and oversight for each product.

- You can quickly learn about the options of the market.

Book #4: Interest Rate Swaps and Other Derivatives

Author: Howard Corb

Buy this book here.

Review:

Corb’s book on derivatives is one of the few that blends academic rigor with real-world trading. The book acts as a textbook and essential reference for a wide variety of readers looking for a comprehensive understanding of these marketplaces. This book’s conversational approach is its most engaging feature. The book also appeals to readers who work in this industry, including professionals, investors, and students.

Key Points:

- The author thoroughly covers every type of derivative in the book

- It covers a wide range of items in this market area and includes illustrative examples and extensive applications

- It comprehensively introduces complex crafts and structures, developing an intuitive sense of the items and their application in the market.

Book #5: Options, Futures, and Other Derivatives

Author: John C. Hull

Buy this book here.

Review:

The book analyzes the theory-practice gap and provides a contemporary look at the industry. It offers a superb supplementary package of mathematical and sector examinations. It also helps you understand how the call option works and how to trade the put option.

Key Points:

- It assists both students and practitioners in keeping up with the quick pace of change in today’s derivatives markets.

- This book covers the Black-Scholes-Merton formulas, securitization, the overnight indexed swap, etc.

- It also includes modeling commodity prices and the valuation of commodity derivatives.

Book #6: Bite The Ass Off A Bear

Author: Garth Friesen

Buy this book here.

Review:

The primary goal of this book is to help traders and investors understand that working well with others will bring success rather than being driven by greed. Additionally, it lists all the rewards and hazards associated with trading in this challenging financial sector. Aspiring and experienced traders must have a strong work ethic, a can-do mentality, and a likable personality.

Key Points:

- It explains how to evaluate your suitability for trading life properly

- Learn about a market maker, a prop trader, and execution traders

- Understand the qualities hiring managers at hedge funds look for in a candidate

- Also, find out how to handle the asset management job interview process.

Book #7: Pricing and Hedging Financial Derivatives – A Guide for Practitioners

Author: Leonardo Marroni, Irene Perdomo

Buy this book here.

Review:

This guide for practitioners emphasizes giving readers practical methods for pricing and hedging derivatives. Additionally, it offers the expertise and understanding required for traders and financial experts to comprehend the specifics of this financial instrument. The book has real-world examples that cover everything from Monte Carlo techniques to commonly structured product payoffs and option payments with delta hedging.

Key Points:

- Outlines tried-and-true derivatives pricing and hedging methods for commodities, FX, fixed income, equities, multi-asset, and cross-assets

- Offers professional advice on the creation of structured products, along with a variety of practical examples

- All examples from the book are available in Excel on the companion website, along with the source code.

Book #8: An Introduction to Derivatives Securities, Financial Markets, and Risk Management

Author: Robert Jarrow, Arkadev Chatterjea

Buy this book here.

Review:

Any student who wants to study the complexities of derivatives should use this book. The revised and simplified second edition textbook is closely related to actual markets because of its economic orientation. The book structure makes it simple to comprehend this complex yet crucial subject.

Key Points:

- The book offers appropriate levels of mathematics, and the markets’ current state significantly impacts mathematics.

- The concepts and mathematics in the introductory text on derivatives and risk management are pretty understandable.

Book #9: Applied Quantitative Finance for Equity Derivatives

Author: Jherek Healy

Buy this book here.

Review:

The book includes currently used equity derivatives models. Generally speaking, books give readers abstract knowledge that may be challenging to use practically. This book educates readers unfamiliar with equity derivatives. These qualities make the book a top choice for students and professionals.

Key Points:

- The book addresses cash dividends for European, American, or exotic options.

- It explains the finite difference techniques for American options and exotics.

- It also includes non-parametric regression for American options in randomized simulations.

Book #10: Manufacturing and Managing Customer-Driven Derivatives

Author: Dong Qu

Buy this book here.

Review:

The book guides derivatives fund managers, traders, and students. It explains the latest concepts and provides a clear understanding of derivatives. It also illustrates its various perspectives and aspects. Additionally, you learn about structured derivatives.

Key Points:

- This derivative book explores the fundamentals of derivatives and their life cycle.

- Understand the baking process of complex derivatives

- Most importantly, the book discusses the complex topic of Customer-driven derivative products and their manufacturing process.