Credit Card Terminals vs. Traditional Payment Methods

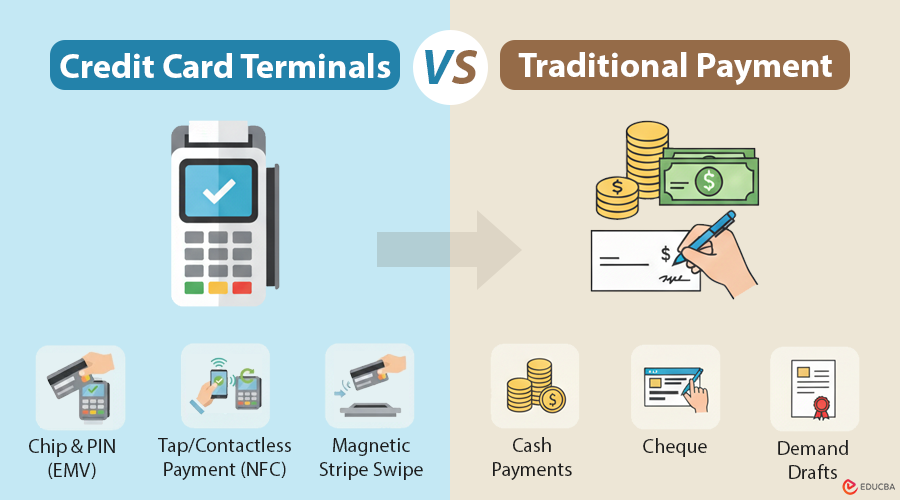

The way we pay for things is evolving rapidly in today’s tech-driven world. With a shift away from traditional payment options like cash and checks, credit card terminals vs. traditional payment methods have become a key comparison for businesses looking to modernize operations. In this article, we explore the differences between credit card terminals and traditional payment methods and why businesses should consider integrating them into their systems.

Understanding Credit Card Terminals

Credit card terminals are devices that enable businesses to accept card payments both in-store and on the go. These terminals offer several benefits in the credit card terminals vs. traditional payment methods debate:

- Basics: When a customer makes a card payment, the terminal reads the card’s information and verifies the transaction with the bank.

- Fast and secure: Transactions are quick, reducing wait times.

- Convenience: Customers find it easy to use, eliminating the need for carrying cash. Payment can be as simple as a tap or swipe.

Traditional Payment Methods Overview

When comparing credit card terminals vs. traditional payment methods, it is important to understand how cash and checks work.

1. Cash:

- Widely accepted and provides immediate payment.

- No processing fees, but it poses security risks and inconvenience for handling large sums.

2. Checks:

- Suitable for high-value transactions and easy to track.

- Safer for large sums but involves delayed processing and risk of bounced checks.

Comparing Credit Card Terminals vs. Traditional Payment Methods

When analyzing credit card terminals vs. traditional payment methods, several factors play a role:

| Factor | Credit Card Terminals | Traditional Payment Methods |

| Efficiency | Transactions are processed quickly, reducing customer wait times. | Cash is fast for small amounts, but handling change slows the process; checks require clearing and cause delays. |

| Security | Offers enhanced protection with secure, encrypted transactions. | Cash is prone to theft; checks can be fraudulent or bounce. |

| Customer Experience | Enables seamless, contactless transactions for greater convenience and satisfaction. | Handling cash or waiting for check clearance can be inconvenient for customers. |

| Economic Impact | May include fees, but often results in increased sales and higher customer spending. | Cash has no fees, but checks may bring hidden costs such as bounced-check fees. |

Businesses transitioning from traditional payment methods to electronic processing can acquire terminals from DCCSupply, Global Payments Direct, or Payment Depot, which offer entry-level and advanced systems with transparent fee structures and integration support for various point-of-sale environments.

The Benefits of Credit Card Machines for Businesses

In the context of credit card terminals vs. traditional payment methods, credit card machines provide several advantages:

- Increased sales: Accepting credit cards can encourage impulse buys, boosting revenue.

- Improved cash flow: Quick transaction processing ensures faster receipt of funds, maintaining healthy cash flow.

- Customer satisfaction: Multiple payment options enhance satisfaction and loyalty.

- Fast transactions: Quick service reduces checkout time, especially during peak hours.

- Adaptability: Various models cater to different business needs, offering scalability and flexibility.

This technology can provide a competitive advantage and align with consumer preferences.

Key Considerations When You Buy a Credit Card Machine

To make the right choice while evaluating credit card terminals vs. traditional payment methods, consider:

- Cost: Evaluate initial and ongoing fees, including transaction fees and maintenance costs.

- Compatibility: Ensure seamless integration with existing systems for efficient operation.

- Security features: Opt for machines with robust security measures, such as encryption.

- Tech support: Choose a provider offering reliable customer service for issue resolution.

- Custom needs: Consider your business requirements for tailored features.

Informed choices about credit card machines can enhance efficiency and customer satisfaction while aligning with business goals.

Transitioning from traditional payment methods to credit card terminals can significantly benefit businesses. To keep up with the changing payment landscape, businesses should:

- Assess current payment system efficiency and security.

- Explore credit card machine options that meet specific business needs.

- Engage reputable vendors for advanced payment systems.

By taking these steps, businesses can enhance payment processing and thrive in a cashless economy. For more information on transitioning, consult resources provided by industry experts or your client’s offerings.

Recommended Articles

We hope this article on credit card terminals vs. traditional payment methods helps you understand how modern payment solutions can improve efficiency, security, and customer satisfaction. Check out our related articles to explore more insights on payment technologies, business operations, and digital transaction trends.