Updated October 5, 2023

Part – 10

In our last tutorial, we understood the concept of WACC. Now, we will learn about the cost of equity.

Part 13 – Cost of Equity

Investors in a company’s equity require a rate of return appropriate to the risk they take in holding such equity. This cost reflects the uncertainty of cash flows associated with the stock, primarily the combination of its dividends and capital gains. The cost of equity is the discount rate applied to expected equity cash flows, which helps investors determine the price they are willing to pay for such cash flows. A higher discount rate (or cost of equity) will result in an issuing company receiving a lower price for its equity capital. Thus, it has less to invest in the assets that generate returns for all capital holders (debt and equity).

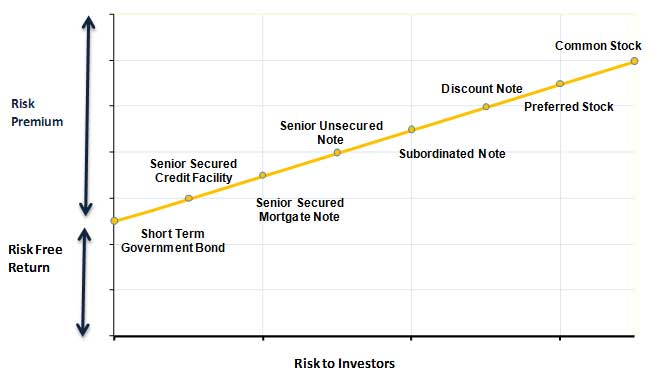

The cost of equity varies with the risk of an issue. As with debt, a higher risk will result in a higher cost associated with taking this risk. In general terms, it has been observed over time that the cost of equity is typically higher than the cost of debt. If a company goes bankrupt, equity holders only receive a return after debt holders get their payment. This is because debt holders have a prior claim on assets, reducing the residual claim of equity holders.

Conversely, if a company performs well, equity holders receive all the benefits of the upside, while debt holders receive only their contracted payments. The increased range of possible outcomes for equity holders, especially in companies with high debt levels, makes equity riskier. Therefore, an equity investor will demand a greater return than a debt holder.

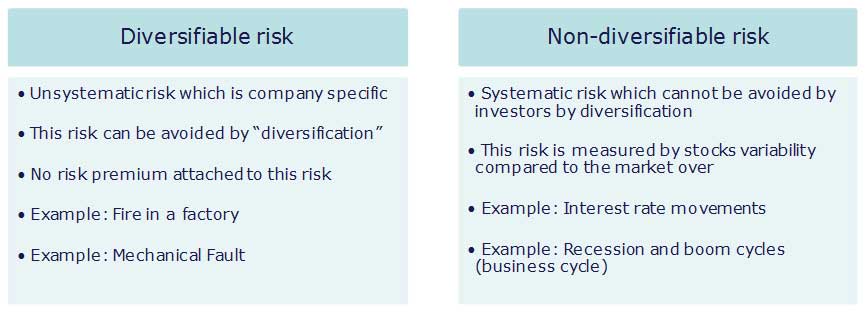

The risk of giving equity to an investor is composed of diversifiable and non-diversifiable risks. The former is a risk an investor can avoid by holding the given equity in a portfolio with other equities. The effect of diversification is that the diversifiable risks of various equities can offset each other. The risk remaining after the rest has been diversified away is non-diversifiable or systematic.

Investors cannot avoid systematic risk. Investors demand a return for such risk because one cannot avoid it through diversification. Thus, investors demand a return for the systematic risk associated with a stock (as measured by its variability compared to the market) over the return demanded on a risk-free investment. Beta measures the correlation between a specific stock’s volatility and the overall market’s volatility. Investors use beta as a multiplier to arrive at the premium over the risk-free rate of an equity investment as a measure of a company’s or portfolio’s systematic risk.